- within Energy and Natural Resources, Tax and International Law topic(s)

- with readers working within the Media & Information and Oil & Gas industries

Electric vehicles (EVs) and charging stations found their legal ground with the amendment made in the Turkish Electricity Market Act No. 6446 (Act) in December 2021. In the article1 we have previously published regarding the stated amendment, we conveyed the headlines of the Act, namely that the definitions related to charging stations were added, and the concept of "charging service" was regulated. The Energy Market Regulatory Authority (EMRA), Turkish Energy Regulatory Agency, was given three months to prepare the secondary regulations. EMRA published the draft Charging Service Regulation (Draft Regulation) in this context and shared it for public consultation. We evaluated the Draft Regulation from the perspectives of economics, administrative law, and energy law and conveyed our amendment proposals to EMRA and shared our views on the subject2. The Charging Service Regulation, which EMRA finalized by evaluating the opinions, came into force recently. This article aims to inform you regarding the Charging Service Regulation.

A Reminder of the Draft Regulation and our Suggestions of Amendments...

When we examined the Draft Regulation, we had focused on the following points; restriction of the freedom of price determination of the operators, creation of barriers to entry to the market, imposing restrictions on business models that operators can adopt, uncertain regulations, failure to fully comply with the principle of administering the law, intervention in the investment preferences of the operators, requirement of permission in case of expansion of the stations, vague and subjective concepts such as "reasonable profit", determination of pricing only in kW/h unit, the possibility of adversely affecting the development of the electricity charging service market due to reasons such as the insufficiently regulated relationship between charging stations and electricity distribution companies and the grid company3.

At this point, we had addressed that the role of a regulatory agency that oversees economic efficiency is to identify and remove artificial barriers which block market entry. Furthermore, we also remind that market interventions should be limited to the situations where structural market failures occur. Even in those cases, the interventions should not be more than what is necessary to eliminate these failures (the risk of over-regulation). The regulator should compare the expected economic benefit from the regulations with direct and indirect costs that may arise from them[4]. We want to declare proudly that within the framework of our opinions for the Draft Regulation; EMRA has taken into account our amendment proposals regarding "eliminating deficiencies in license applications", "finalization period of license applications", "license fee", "expanding and narrowing the charging network" and "additional pricing option for the costumers who do not leave the station after charging has ended".

System Established with the Charging Service Regulation

Under the Charging Service Regulation, rules and procedures regarding the charging services through the establishment and operation of charging units and stations connected to the charging network for electric vehicles are determined. The regulation covers issues related to establishing the charging network, licensing of the charging network operators and regulation of their activities, the rights and obligations of the charging network operators, charging station operators, and end-users. In this context, it is worth noting that private charging stations that do not operate commercially and charging units that users set up for their own needs are exempted.

The basis of the system established by the regulation is that "charging network operators" build their charging networks based on the license received from EMRA. However, license holder legal entities operating in the electricity market with regulated tariffs are prohibited from obtaining a charging network operator license and thus providing charging services. However, in the formation of on-street charging points, it can be argued that distribution companies' involvement in charging services may provide a positive externality considering that they are already responsible for street lighting.

As per the Regulation, it is clear that the regulation does not agree with this. On the other hand, charging station operators do not need to obtain a license from EMRA. They can offer charging services with the certificates they will receive from charging network operators. Essentially, we believe that what is meant by "certificate" in the Regulation is a contract between the charging network operators and the charging station operator. Only one charging service network operator can issue a certificate for each charging station. Still, the charging station operator will be able to provide charging services at more than one charging station with a certificate obtained from the charging network operator. In addition, we would like to emphasize that one of the important provisions brought by the regulation is to enable the establishment of an electricity generation facility based on renewable energy sources (like solar or wind) to meet the charging station's electricity need and establish an electricity storage facility integrated into the charging station.

Obligations of Charging Network Operators

The main obligations of the charging network operators determined in the Regulation are as follows:

- To obtain a license from EMRA

- To establish a charging network consisting of at least fifty charging units and charging stations in at least five different province of Turkey within six months from the effective date of the license.

However, under the Regulation, charging network operators must ensure that the charging units in the charging network meet the following conditions:

- At least five percent of it is a DC 50 kW and above charging unit,

- At least fifty percent of the charging units on highways and state roads, which are under the responsibility of the General Directorate of Highways, must be DC 50 kW and above charging units,

- In the case of AC, at least one of them must be a Type-2 charging socket defined in the TS EN 62196-2 standard (AC powered charging units can be put into service by equipping them with a vehicle connector),

- In the case of DC, at least one of the power charging units must be equipped with a combined charging system (Combo-2) defined in the TS EN 62196-3 standard,

- Communication protocols used in communication with charging networks and electric vehicles must be compatible with each other.

In addition, EMRA may impose commercial and technical obligations and special conditions on charging network operators, including establishing a certain number of charging stations in certain locations. In this case, appropriation can be made upon the licensee's request. This obligation is legally unclear and has a nature that may adversely affect the decision of new investors to enter the market5.

The obligation to provide "continuous, high quality and uninterrupted charging service" in the Regulation reminds us of the electricity supply obligation of distribution companies. There are two points worth noting here. The first one is that the service provider offered at the charging station is considered the charging network operator. Accordingly, it should be stated that concerning this assumption of the Regulation (considering that charging station operators operate on behalf of the charging network operators, it can be predicted that they would not assume the capital risk associated with the establishment of charging stations), charging station operators do not have an active function. All active charging stations are operated by the companies expected to be charging network operators.

Moreover, no provision in the Regulation prevents all charging stations from being operated by charging network operators themself, unlike the gas stations in Turkey. The second point is that the Regulation defines a charging service as a universal service. It makes the responsibilities of charging network operators ambiguous. To illustrate, who will be responsible for service interruption in the event of a power outage? In our opinion, electricity supply, or other words, an uninterrupted and high-quality supply of electricity in accordance with the relevant legislation, is actually the responsibility of the distribution companies.

Other Obligations of Charging Network Operators

Other obligations of the charging network operators, other than those mentioned above, are as follows:

- To provide charging service continuously and uninterruptedly, except for justifiable reasons and force majeure (charging stations, which are open to using in the parking lots of workplaces such as hotels, restaurants, shopping centers, may offer charging service limited to the working hours of the workplace they are connected to)

- Safety of life and property at the charging station,

- To provide charging services to customers of equal status without discrimination,

- To determine, announce and apply the charging service price in accordance with the relevant legislation,

- Not to demand a separate fee under any name other than the price calculated based on the charging service price,

- Establishing the necessary management, inspection, and registration system to ensure interoperability of charging stations,

- To take information security measures.

Determination of Charging Service Price

Per the Electricity Market Law, the price of the charging service will be freely determined as per the rules and procedures prepared by EMRA. Accordingly, the following parameters are taken into account in determining the charging service price;

- investment and operating costs for establishing a charging station and establishing a charging network,

- power purchase costs and other relevant costs,

- legal obligations such as taxes, funds, etc.

- a reasonable profit.

Although the legislator states that the price of the charging service can be determined freely, it is obvious that some criteria should be taken into consideration while determining the price. When determining the relevant procedures and principles, these criteria should be taken into account by both the charging service providers and EMRA. When we look at the ambiguity of the criteria referred above, EMRA has a wide discretion over the prices of the charging service, for example there is no strong objective and well-respected way of determining "reasonable profit".

As per the Regulation, the "amortizations" are added to the Law's parameters to be considered while determining the price of the charging service. Moreover, Regulation allows applying different service prices for different types and power charging units. However, the charging service price should be applied in terms of the price of the unit energy (TL/kWh) transferred to the electric vehicle. It is alleged that the rationale behind this rule is to make the price of the charging service as simple as possible in a way that the consumer can easily understand.

Additionally, the Regulation prohibits charging a separate fee for the charging service applied, other than the price calculated based on the charging service price, under any connection, transaction initiation and charging equipment usage fee. However, additional charges may be applied to customers who do not leave the charging station when he or she completes charging. The charging network operator informs the customer that the charging service has been completed. In this regard, although the Regulation stipulates the condition of informing the customer about the completion of the charging service by the charging network operator, we believe that it is the charging station operator who should be liable for notifying the customer.

Besides, the charging network operator is obliged to inform EMRA about the determination method of the charging service price and its updates. In other words, in accordance with the Regulation, charging service fees will be determined by the charging network operators, not by the charging station operators. However, determining retail prices for economic efficiency and rate of return is closely related to fixed and variable costs and utilization rates. In this respect, we would like to address that as per competition law charging station operator should determine the charging service price itself rather than the charging network operator.

On the other hand, under the Regulation, the charging service price can't be 25% more than the lowest charging service price applied by the charging network operator to its loyalty agreement customers.

Finally, the charging network operator must simultaneously announce the charging service prices on its website, digital channels, and charging stations. EMRA will establish a platform that provides live data of charging stations so that all existing charging stations can be viewed in real-time. The geographical locations of public charging stations, the number of charging units, their power and types, the number and types of sockets, their availability, payment method, and charging service prices will be included on this platform. Although it seems that the stated platform will display prices transparently in favor of the consumer at first glance, it is evaluated that such transparent prices may bring along oligopolistic pricing and, as a result, may damage price competition and cause a single oligopolistic price applied in the market6.

Conclusion

With state aid and subsidies, the number of electric vehicles in various parts of the world is increasing faster than expected. However, it is foreseen that there may be difficulties in constructing the infrastructure to meet this increase7. It is important to establish a market structure in which businesses can invest in this context. Rather than setting boundaries for businesses, encouraging pathways to set targets may be more effective in EV charging infrastructure. Considering the intensity of R&D studies on EV and charging services in the world, it is seen that the technology and business models related to the subject are developing and changing very rapidly8. Therefore, leaving the development to the investors without choosing a technology or model may accelerate the development of the charging service market and may support "innovation". In a market where competition is encouraged, the concept of reasonable profit may create an entry barrier for investors.

Likewise, the fact that loyalty contracts are regulated in the Regulation has a restrictive aspect on the applicable business models9. In an arrangement based on competition to spread charging services, such promotion and loyalty practices, which are part of the business model, should be left open to development as an element of competition instead of the regulations.

On the other hand, imposing minimum investment obligations on operators makes sense only in cases where the free-market mechanism may not provide sufficient investment motivation. These obligations are the only way to deliver the service to non-profitable points. However, when such regulations are implemented in markets that can automatically become competitive in certain geographies, such as the charging services market for electric vehicles, there will be no significant benefit from them. Less investment will be attracted to the market due to increased entry costs. In this context, the regulations should have been designed not to create artificial barriers to entry into the charging services market. The relevant minimum obligations should have been limited to regions where a self-competitive structure would not occur.

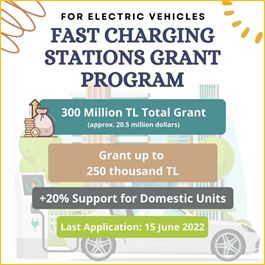

Although we find the charging station structure introduced by the Regulation to be more intrusive than it should be in the free market, the Regulation's entry into force is an extremely important and positive development for investors considering that it makes it easier for prospective investors to analyze their risks. We are also happy to inform you that the recently announced "Fast Charging Stations for Electric Vehicles Grant Program," with a budget of approximately $20.5 million, was initiated by the Ministry of Industry and Technology to encourage fast-charging station investment is promising. With the incentive, it is envisaged to establish fast-charging stations at 1560 points in 81 provinces.10 Grant applications can be made at sarjdestek.sanayi.gov.tr until 15 June 2022. Investors can be supported up to 250 thousand Turkish liras (about 17 thousand dollars) per station and up to 312.5 thousand Turkish liras (about 21.25 thousand dollars) for domestic units with a plus 20 percent support. We also believe that tax incentives should be introduced to secure supply, zero-carbon targets, and domestic investments. We will continue to share the compliance process of the charging stations that are already in operation and the implementation of the Regulation.

Footnotes

1. ARDIYOK S. ve KIL I. F., Elektrikli Araç Sarj Istasyonlari Mevzuatina Kavustu!, https://www.rekabetregulasyon.com/elektrikli-arac-sarj-istasyonlari-mevzuatina-kavustu/ , Last Access: 18.04.2022.

2. ARDIYOK, S., KÖKSAL, E., KIL, I.F., SERTER Y.S. (2022), Sarj Hizmeti Yönetmelik Taslaginin Iktisadi ve Hukuki Degerlendirilmesi, Baseak CORE Papers No:15, 2022, https://www.baseak.com/en/insights/alerts/2022/february/25/baseak-core-papers-15 , Last Access: 18.04.2022.

3. Ibid.

4. Ibid. p.6.

5. Ibid, p.17.

6. Ibid, p.13.

7. NICHOLAS, M., HALL, D. ve LUTSEY, N. (2019). Quantifying the Electric Vehicle Charging. The International Council on Clean Transportation. p.19.

8. Why the automotive future is electric, https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/why-the-automotive-future-is-electric, Last Access: 19.04.2022; New technology to speed up charging electric cars, sciencedaily.com/releases/2022/03/220321091916.htm, Last Access: 19.04.2022

9. ARDIYOK, S., KÖKSAL, E., KIL, I.F., SERTER Y.S. (2022), Sarj Hizmeti Yönetmelik Taslaginin Iktisadi ve Hukuki Degerlendirilmesi, Baseak CORE Papers No:15, 2022, https://www.baseak.com/en/insights/alerts/2022/february/25/baseak-core-papers-15 , p. 12-13, Last Access: 18.04.2022.

10. https://www.sanayi.gov.tr/medya/haber/elektrikli-araclar-icin-hizli-sarj-istasyonlari-hibe-programi2 , Last Access: 20.04.2022.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.