- within Family and Matrimonial topic(s)

- in United Kingdom

- with readers working within the Advertising & Public Relations and Securities & Investment industries

- within Family and Matrimonial, Criminal Law and Strategy topic(s)

Key Takeaways:

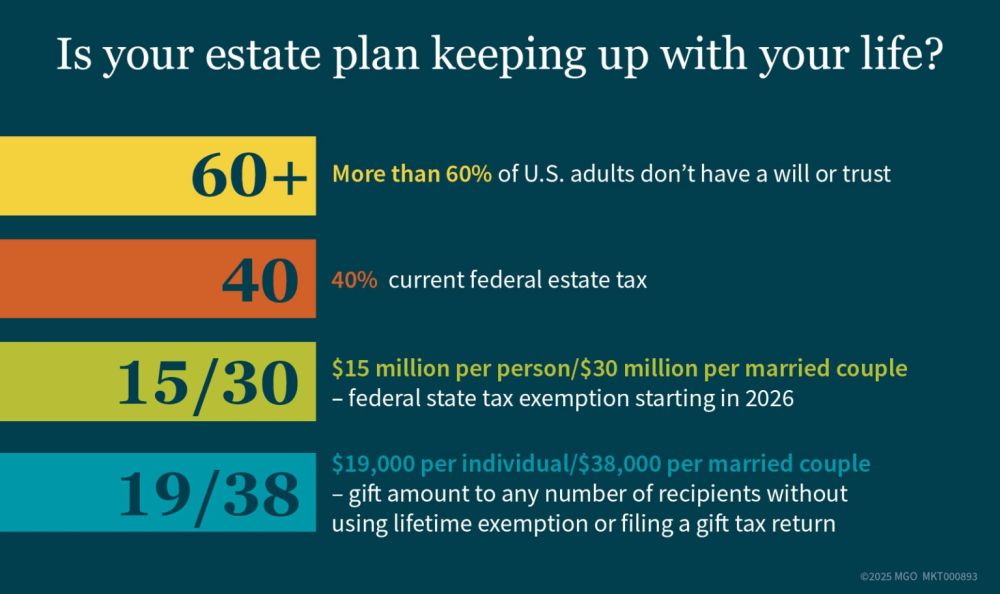

- Most Americans lack an up-to-date estate plan, leaving inheritances at risk of delays, disputes, and unintended distributions.

- Wills and trusts help clarify intentions, avoid probate, and protect beneficiaries.

- Review and update estate plans regularly — especially after major life events — to reflect changes in family structure, assets, and federal and state laws.

—

The U.S. is on the precipice of the largest generational transfer of wealth in history. Baby Boomers account for 51.8% of the country's total wealth, and over the next two decades (through 2045) an estimated $68-84 trillion will transfer to their spouses, descendants, trusts, and family foundations.

This massive shift will affect millions of families, yet too many are unprepared — both those who will pass on wealth and those who will inherit it. Despite rising awareness of the importance of estate planning, an estimated two-thirds of Americans don't have any estate planning documents (wills, living trusts, healthcare directive, durable power of attorney, etc.), and won't bother until a medical diagnosis or the death of a family member compels them. And those who do prepare estate planning documents typically either: (1) fail to update them on a regular basis, or (2) don't place their assets in the trust's name — subjecting those assets to probate and court proceedings.

One recent development adds even more urgency to the need for estate planning conversations. The newly enacted One Big Beautiful Bill Act (OBBBA) permanently raises the federal estate tax exemption to $15 million per person or $30 million for married couples (with proper planning) starting in 2026. This increase shields more wealth from the 40% federal estate tax and creates new planning opportunities for high-net-worth families.

With more flexibility under the new exemption levels, now is the time to take a look at your estate plan. A thoughtful and regularly updated estate plan is essential for families looking to preserve and pass on wealth. Here's what that entails:

Start With the Fundamentals: Wills and Trusts

A will outlines how you want your assets distributed after your death and names guardians for minor children (if applicable). Without one, the state's intestacy laws take over — which can delay the process and distribute assets in ways you may not have intended.

Certain trust structures take it a step further by allowing assets to bypass probate. This saves time, reduces legal and administrative fees, and helps maintain privacy. Trusts also offer greater control over how and when beneficiaries receive assets. This is particularly important for families with minor beneficiaries, blended families, or those with concerns about their heirs' financial readiness.

Creating these documents is only the beginning. One common breakdown in estate plans comes from mismatched asset titling. For example, a trust may be established to hold real estate or investment accounts. But, if the assets are still titled in the individual's name, they may fall outside the scope of the trust — requiring them to go through probate like any other asset.

After establishing a trust, review every asset — including bank accounts, brokerage accounts, and real property, to ensure correct titling and beneficiary designations.

Revisit and Refresh as Life Changes

Estate planning is not a one-time task. Documents drafted years ago may no longer reflect your current family structure, financial picture, or wishes.

Too often, we see wills and trusts that were never updated after:

- Marriage, divorce, or remarriage

- Birth or adoption of children or grandchildren

- Total disability of a beneficiary

- Death of a named trustee or beneficiary

- Significant changes in wealth or business ownership

Additionally, federal and state laws are constantly evolving — and these changes can have profound effects on your estate plan. Schedule time for a full estate plan review every three to five years, or after major life events.

Leverage Gifting to Reduce Estate Size

Structured gifting can be a powerful yet simple way to reduce the taxable value of an estate, especially for families with closely held business interests.

In 2025, individuals can gift up to $19,000 annually to any number of recipients without using their lifetime exemption or filing a gift tax return. Married couples can gift $38,000 per recipient.

For high-net-worth families, these amounts may not be significant enough to matter on a year-to-year basis. However, when multiplied over several recipients over a decade or more, the total can be substantial.

For example, if a couple gifted $76,000 annually to an adult child and their spouse, that's $760,000 over a decade. That amount is removed from the estate and potentially sheltered from the 40% estate tax.

This strategy can also include gifting fractional shares of a closely-held business to heirs over time. Doing so gradually helps prepare the next generation for future ownership while reducing the size of the taxable estate.

Be sure to work with your advisors to properly execute and document these gifts to avoid triggering unwanted tax consequences or disrupting business control.

Prepare the Next Generation for What's Coming

An estimated 15% of Americans will receive an inheritance in the next 10 years, yet most lack the financial knowledge to handle the responsibility. Often, beneficiaries are unaware of the size of the estate or the decedent's intention — and the disconnect can create confusion, resentment, or financial missteps after a family member's death. Most family members are under the misbelief that they will be taxed upon the receipt of an inheritance.

Open communication about inheritance plans, values, and responsibilities reduces these risks. Consider involving heirs in estate planning conversations, educating them about trusts and business succession plans, and giving them opportunities to participate (with guidance) in philanthropic or investment decisions.

Address Complex Assets Like Family Businesses

Families with significant business holdings should pay special attention to succession planning and ownership transfer structures. Options may include:

- Establishing a family limited partnership (FLP)

- Using grantor-retained annuity trusts (GRATs)

- Gifting non-voting or minority business interests gradually

- Consider having a formal buy-sell agreement

These strategies require coordination between estate planning attorneys and tax advisors to align the legal structure with business operations, tax liabilities, cash flow needs, and long-term ownership goals.

How MGO Can Help

Wealth transfer doesn't happen automatically. Without planning, estates of any size can become a source of friction, tax exposure, or missed opportunity.

At MGO, we help individuals and families develop tailored estate strategies that reflect your values, protect your assets, and align with evolving tax laws.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.