- in United States

- within Law Practice Management, Tax and Law Department Performance topic(s)

Summary for Founders:

- Define "confidential information" clearly so key materials like pitch decks, pricing and customer data are actually covered.

- Use the right NDA structure because unilateral and mutual NDAs protect founders differently.

- Lock down "permitted use" so the other side can only use your information to evaluate the specific deal.

- Set realistic time limits and scope so protection does not expire before the information becomes valuable.

- Treat the NDA as an ongoing system using version control, disclosure tracking and separate IP ownership terms when joint work is expected.

Why NDAs Fail When Founders Need Them Most

As a founder, you probably reach for a nondisclosure agreement ("NDA") early. It feels like the responsible move before you start sharing details about your product, technology or strategy with an outside third party that you deem trustworthy. Once it is signed, there is a natural sense of relief that the risk is handled.

That relief may be misplaced because an NDA does not freeze risk at signing. Confidential information keeps moving after the ink dries, whether through pitch meetings, diligence calls, internal reviews or follow-up conversations. If the agreement was drafted loosely or applied without attention to how information will actually be shared, it may fail at the exact moment it is tested.

This article breaks down the most common NDA mistakes founders make, explains how those mistakes quietly shift risk and shows how to recognize and avoid them before confidential information leaves your control

Common NDA Mistakes

The mistakes below are the ones we see most often when NDAs are reviewed during fundraising, diligence or disputes. Each one shows how small drafting and process decisions can quietly shift risk long before a founder realizes the agreement is being tested.

strongMistake 1: Treating "Confidential Information" as Obvious Instead of Defining It

Founders may assume that what counts as confidential is obvious. Trade secrets, proprietary technology and sensitive product details feel self-explanatory. Once an NDA is signed, it is easy to believe those categories are automatically protected.

That assumption is where problems begin. Many NDAs rely on broad or generic definitions that leave room for disagreement later. This issue often arises when confidentiality and trade secret provisions are drafted without alignment to how information is actually shared.

What feels clearly confidential to you may not fall within the scope of protection once the language of the agreement is applied.

This gap usually does not matter at the moment information is shared. It matters later, when questions arise about use, disclosure or breach. At that point, the NDA is interpreted based on its definitions, not on what either party assumed at the time.

Early conversations are where this risk is highest. You may share meaningful company information in pitch meetings or exploratory discussions before a deal structure exists. If the NDA does not clearly cover those disclosures, the information may sit outside the protection you expect.

Avoiding this mistake requires treating the definition of confidential information as a drafting decision, not boilerplate. A strong NDA specifies what categories of information are covered and how shared materials are treated, instead of relying solely on general labels. That clarity reduces ambiguity when the agreement is later tested.

Below are common examples of information founders routinely share early, often without confirming whether the NDA actually protects them:

- Investor pitch decks with market strategy

- Customer lists and early traction metrics

- Pricing models and revenue projections

- Prototype demos or mockups

- Hiring plans and team structures

- Member negotiations or distribution strategies

What Founders Assume Is Covered vs. How NDAs Actually Treat It

| What Founders Assume Is Covered | How NDAs Actually Treat It |

| "Our pitch deck is covered" | Pitch decks often mix public information with proprietary material that may not fit the NDA's definition of confidential information |

| "Customer lists are sensitive" | Customer lists are clearly protected only if the NDA clearly identifies them as confidential |

| "Pricing models are unique" | Financial models are often excluded or disputed unless the agreement specifically includes them |

| "Hiring plans are internal" | Organizational and staffing details may not be protected without explicit coverage |

| "Member talks are private" | Negotiation discussions often fall outside coverage unless expressly included in the NDA |

strongMistake 2: Signing the Wrong Type of NDA for the Relationship

Founders rarely sign the wrong NDA because they are careless. More often, they sign it because the conversation is already moving and momentum feels more important than a pause.

- An investor wants to review materials

- A potential partner wants to "take a look"

- A large company sends over its standard form

In each of these moments, the pressure is the same. Move forward quickly or risk slowing the deal.

However, the NDA that gets signed may reflect the other party's expectations, not how information will actually flow. When that happens, you may become the primary disclosing party under terms that were never designed to protect you.

The structure of the NDA matters because it determines who owes confidentiality obligations and to whom. Choosing the wrong structure can leave you sharing sensitive information without reciprocal protections.

Unilateral NDA

A unilateral NDA places confidentiality obligations on only one party. The disclosing party shares confidential information and the receiving party agrees to protect it. These agreements are common in large company templates and early investor outreach, where the recipient wants flexibility to evaluate without committing to confidentiality for its own information.

For founders, the risk is structural. When you are the only party bound by confidentiality obligations, your disclosures may be protected narrowly while the recipient retains broad freedom to use what it learns.

Mutual NDA

A mutual NDA reflects a relationship where confidential information flows in both directions. Both parties agree to protect information shared during the discussion. This structure better matches exploratory collaborations, joint development conversations and member-level discussions.

Mutual does not automatically mean safe. Scope, definitions and use restrictions still matter. But the structure itself creates a more balanced starting point, where confidentiality obligations are not one-sided by default.

strongMistake 3: Ignoring the Clauses That Control How Information Can Be Used

Choosing the right type of NDA is only the starting point. What actually governs risk is what the agreement allows the other party to do after confidential information is shared.

Most NDAs work through specific permissions and restrictions that define how information may be used, who may access it and what happens once the discussion moves forward. Those details are easy to overlook because nothing appears to go wrong at the time of signing.

Problems surface later, after information has already moved. At that point, the receiving party relies on what the agreement permits, not on what you assumed it restricted. When use boundaries are unclear or incomplete, confidential information can be applied in ways that feel unfair but still comply with the written terms.

This is how NDAs fail without anyone acting in bad faith. The agreement does not break. It performs exactly as drafted, just not as you expected.

Key Clauses That Quietly Shape Real-World Risk

Once information is disclosed, risk is controlled almost entirely by a small set of clauses that determine how that information may be handled. These provisions rarely draw attention during signing, but they are the ones that matter most when questions arise later.

- Definition of confidential information

This clause sets the outer boundary of protection. If the definition is narrow or generic, entire categories of trade secrets, proprietary processes or sensitive data may fall outside coverage from the start.

- Permitted use restrictions

This provision governs what the receiving party is actually allowed to do with the information. When permitted use is defined broadly, information shared for evaluation can later be applied in other business contexts without triggering a breach.

- Disclosure limitations

This clause controls how far information can travel inside the receiving organization. Without clear limits, confidential information may circulate well beyond the individuals involved in the discussion.

- Nonsolicitation scope

When included, nonsolicitation provisions address whether exposure to confidential information can be used to recruit employees, contractors or advisors involved in the relationship.

- Remedies for breach

This section determines what leverage exists if the agreement is violated. Weak or unclear remedies can limit practical enforcement, even when a breach is clear.

strongMistake 4: Letting Time Limits and Scope Work Against You

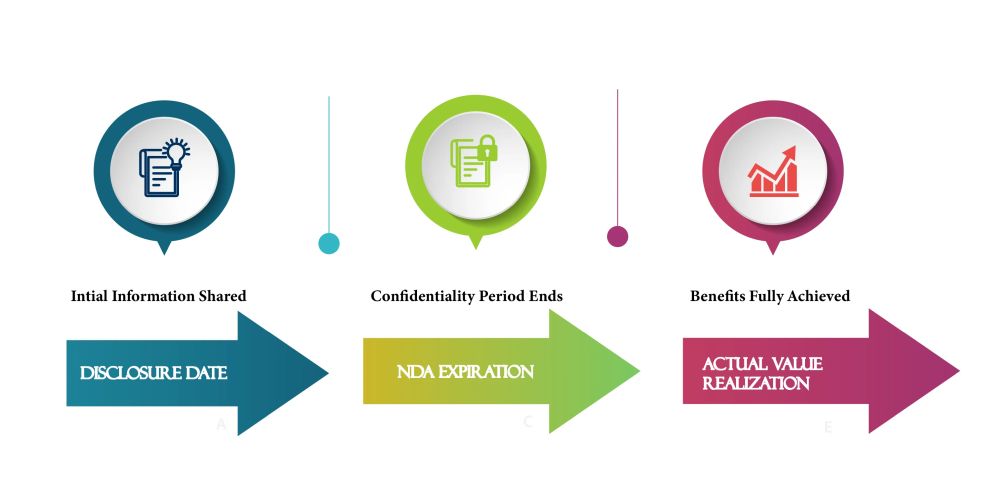

Time limits and scope decide whether an NDA protects anything at all when it matters most. Even when confidentiality obligations exist on paper, they can quietly expire before the information becomes valuable.

Early disclosures happen at the beginning of a relationship. Competitive value, market traction and commercial leverage often emerge much later. When an NDA's confidentiality period ends in between, the agreement may stop providing protection at the moment it is most needed.

Courts pay close attention to both duration and scope. An NDA that attempts to protect everything indefinitely may be treated as unreasonable and enforced narrowly. An NDA with a short or rigid term may expire while proprietary information is still commercially sensitive. In either case, leverage is lost not through misconduct but because the agreement no longer supports enforcement.

Different types of information require different treatment. Some information loses sensitivity quickly. Other information, particularly trade secrets, remains protectable only if secrecy is actively maintained. When time limits are too short or scope is poorly matched to what was disclosed, trade secret protection can erode even if an NDA technically existed.

A well-drafted NDA aligns duration and scope with the nature of the information and the expected timeline of the relationship. That alignment strengthens enforceability and supports protection of intellectual property without relying on overbroad terms that courts may disregard.

strongMistake 5: Treating the NDA as a One-Time Document Instead of a Process

You may treat an NDA and confidentiality agreements as one-time paperwork. The agreement is signed, filed away and forgotten. In practice, confidentiality rarely works that cleanly. Information continues to move, relationships evolve and disclosures expand long after the initial signature.

This is where problems begin. As conversations turn into collaborations, pilots or formal agreements, NDA risk often breaks down in predictable ways:

- Teams rely on outdated NDAs with narrower definitions or weaker use restrictions

- Different versions of NDAs circulate across employees with no clear ownership

- Disclosure permissions expand informally without updating the governing agreement

- No clear record exists showing which NDA applied to which disclosure

Inconsistent NDAs across a team create diligence risk. During fundraising or an acquisition, investors often ask how confidential information was shared and which agreements governed those disclosures. If different employees relied on different NDAs or if no one can identify which version applied, credibility suffers and deals slow down.

Disclosure tracking matters for the same reason. Maintaining a simple record of what confidential information was shared, with whom and under which agreement helps document compliance and reduce disputes later. Without that record, founders are left reconstructing events after the fact, usually when leverage is already limited.

A well-run NDA is not just a document. It functions as part of an information management practice that supports the protection of intellectual property, trade secrets and other confidential information as the company grows. Treating NDAs as living agreements, supported by version control and disclosure tracking, reduces friction in diligence and helps avoid questions after information has already left the room.

strongMistake 6: Assuming NDAs Fix Ownership Problems

Up to this point, every mistake has focused on confidentiality failing quietly. Ownership failures are different. They surface late, cost more and are much harder to unwind.

NDAs protect secrecy, not control. They restrict disclosure and use, but they do not determine who owns what is created, improved or derived once collaboration begins. When founders rely on an NDA alone during joint work, ownership questions often remain unresolved until the stakes are high.

This is one of the costliest NDA mistakes because it usually appears after value has already been created. A founder may share proprietary information or trade secrets under an NDA, collaborate on development and only later discover that ownership of improvements, inventions or patentable material was never addressed.

At that point, confidentiality is no longer the problem. Control is.

Courts do not infer ownership from silence. If a separate agreement does not clearly assign intellectual property rights, joint development can result in shared or disputed ownership, even when both parties believed the NDA was sufficient.

To understand why this happens, it helps to be clear about what NDAs are designed to do and what they are not.

What NDAs Cover and What They Leave Unresolved

| NDAs Do | NDAs Do Not |

| Limit disclosure of confidential information | Assign intellectual property ownership |

| Control permitted use of shared information | Grant patent or invention rights |

| Create confidentiality obligations | Resolve joint development ownership issues |

Where Legal Counsel Fits into NDA Risk Management

At Crowley Law LLC, we help our clients manage NDA risk at a systems level. Our role as legal counselor focuses on aligning confidentiality obligations with how founders operate in practice.

That includes helping our clients to:

- Identify unclear language that weakens confidentiality obligations or creates ambiguity in enforcement, especially where definitions do not match real-world use

- Align NDA terms with actual workflows so obligations reflect how confidential information is disclosed, stored, accessed and shared

- Draft NDAs by relationship type, such as investor, vendor or collaborator, so the agreement reflects how information moves in that commercial context

- Address ownership issues outside the NDA when joint work is expected, rather than assuming confidentiality resolves control of intellectual property

- Identify hidden risk in joint development and multi-party discussions where multiple participants may later claim rights despite shared assumptions about confidentiality

These steps allow founders to address confidentiality risk early, before disclosures expand, leverage shifts or value is created under unclear assumptions.

FAQs

| FAQ | Answer |

| What makes a nondisclosure agreement ("NDA") ineffective rather than invalid? | Most NDAs are not invalid as contracts. They are ineffective because its definitions, use restrictions, time limits and scope do not match how information is actually shared. An NDA can be legally enforceable and still fail to protect confidential information when it is vague, overbroad or disconnected from real disclosure practices. |

| What are common NDA loopholes founders miss? | Most NDA loopholes come from what the agreement does not

clearly address. Common examples include:

" Internal disclosure provisions that allow information to circulate broadly within the recipient " Permitted use clauses that allow information to be applied beyond a narrow evaluation purpose " Definitions of confidential information that exclude entire categories of sensitive data " Silence around how information may be used after discussions end |

| What are practical red flags in an NDA? | Red flags are often subtle and easy to miss when momentum is

high. They include:

" Generic definitions of confidential information with no categories or examples " Use restrictions tied to broad business purposes rather than a specific transaction " Short confidentiality terms that expire while information remains commercially sensitive " NDAs that assume confidentiality alone resolves ownership or control issues |

| What does a "bad" NDA look like in practice? | A bad NDA is often a standard form that appears reasonable, but does not fit the relationship. It may be mutual when disclosures are one-sided, narrowly drafted when information will be shared broadly or silent on how information may be used after disclosure. Problems usually surface later, during diligence or disputes, not at signing. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.