Form 8938 to be Attached to 2011 Income Tax Returns due this year

The Foreign Account Tax Compliance Act ("FATCA") became law almost two years ago. Some of its provisions became effective upon enactment, but a few key provisions were phased in. One of the delayed provisions that is effective for returns due in 2012 requires individuals to report annually their interests in foreign financial accounts and foreign financial assets. This new filing requirement under FATCA is in addition to the information reports that U.S. persons already file with various federal agencies, including the Internal Revenue Service, in order to disclose foreign accounts and assets. Beginning with 2011 income tax returns, however, individuals owning foreign accounts or financial assets will be required to include new IRS Form 8938, "Statement of Specified Foreign Financial Assets" with their annual income tax returns--likely requiring many more U.S. persons to come forward and disclose their offshore dealings.

Who Must File Form 8938?

A "specified individual" (generally, a U.S. citizen or resident alien) who has an interest in one or more foreign accounts or financial assets must file Form 8938 if the aggregate fair market value of those foreign assets exceeds either $50,000 on the last day of the taxable year or $75,000 at any time during the year. These filing thresholds double for married individuals filing joint income tax returns ($100,000 on the last day of the year or $150,000 during the year). Higher filing thresholds apply to individuals residing outside the United States.

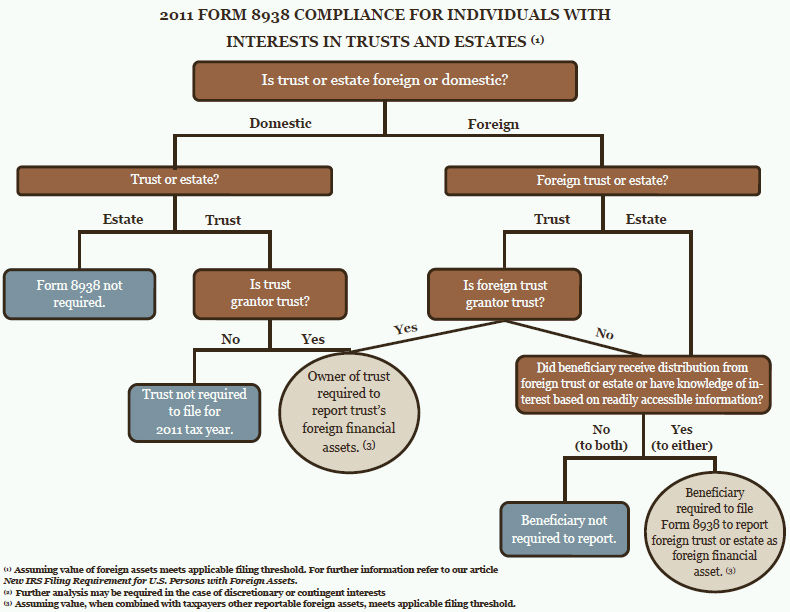

Currently there are two look-through rules applicable to individuals. First, the owner of a disregarded entity (such as a single-member limited liability company) is treated as having an interest in foreign financial assets owned by the entity for purposes of the Form 8938 filing requirement. Similarly, the grantor of a grantor trust is treated as owning the foreign financial assets of the trust.

Beginning with 2012 tax returns, closely held domestic partnerships and corporations which earn predominately investment income will also be subject to Form 8938 filing requirements. Some domestic nongrantor trusts will also be required to file.

What Information Needs To Be Reported On Form 8938?

The year's highest value of accounts in foreign financial institutions, along with identifying information about the account, must be reported on the new Form 8938. Taxpayers with foreign accounts already report this information on their annual Report of Foreign Bank and Financial Accounts ("FBAR"). But in addition to the information customarily reported on the FBAR, the new form requires the account owner to summarize the foreign-source interest, dividends or other income reported on the tax return, as well as on which tax return schedule the income appears.

The criteria for a Form 8938 filing requirement go far beyond the FBAR, however. Besides foreign accounts, individuals must also report other "foreign financial assets." This term includes any interest in stocks, other securities, and other financial instruments issued by non-U.S. persons (unless held in an account at a financial institution). Interests in foreign entities such as foreign partnerships, corporations, and limited liability companies are also considered to be foreign financial assets. A U.S. beneficiary's interest in a foreign estate or foreign trust is considered to be a foreign financial asset if the U.S. person knows (or has reason to know) of the existence of the interest. If the person receives a distribution from the trust or estate, he or she is deemed to have knowledge.

The value of foreign financial accounts for purposes of determining the applicable threshold may be relatively easy to determine. However, that may not be the case for other types of foreign assets. Regulations provide that the U.S. person may determine the fair market value of such assets based on information publicly available from reliable sources, or from other verifiable sources. Perhaps as a concession that reliable valuation may not be available for certain foreign assets, the regulations specifically state that third party appraisals are not required in order to obtain a reportable value.

Special rules provide for reporting the value of interests in foreign trusts, estates, pension plans, and deferred compensation plans. The maximum value of a beneficiary's interest in a foreign trust is the sum of the fair market value of his or her trust distributions for the year, plus the value of that person's right as a beneficiary to receive mandatory distributions from the trust. The maximum value of an interest in a foreign estate, pension plan, or deferred compensation plan is the fair market value of the person's beneficial interest in such estate's or plan's assets determined as of the last day of the taxable year. If such information is unavailable, the maximum value to be reported is the distribution received during the taxable year.1

Are There Any Exceptions To Reporting? What About Duplicative Filings?

As mentioned in the introductory paragraph, U.S. persons are already required to file periodic reports with the IRS and the Treasury Department to disclose required information regarding foreign assets and accounts. The new regulations provide that individuals who file certain enumerated forms do not have to again disclose the assets on Form 8938. They do, however, need to file Form 8938 and identify which of the other forms they are also filing.

It is important to note, however, that Form 8938 does not replace the FBAR. U.S. persons with financial interests in, or signature authority over, foreign accounts will still need to file the annual FBAR (due on June 30 of each year).

What Are The Penalties For Failure To File?

Failure to file Form 8938 or to provide the required information carries a penalty of $10,000 per failure. This penalty structure is consistent with penalties for not filing existing information returns for foreign assets. However, there are additional negative consequences for failure to comply.

There is currently in place a penalty equal to 20% of underpaid income tax resulting from negligence, substantial understatement of tax, and certain valuation misstatements. This penalty now is increased to 40% if the understated tax is attributable to a transaction involving an undisclosed foreign financial asset.

Further, the IRS generally has 3 years from the date of filing of an income tax return to audit your return and assess additional tax. This statute of limitations is extended to 6 years if an income tax return omits more than $5,000 of income attributable to a foreign financial asset, even if the asset is not required to be reported on Form 8938 (due to dollar threshold or the exception for duplicate filings).

We Are Here To Help

The new regulations provide welcome guidance for complying with the new Form 8938 filing requirement under FATCA. Of course, applying these regulations to real life situations may be challenging, particularly with hard-to-value assets such as beneficial interests in trusts and closely-held foreign entities.

Our firm has decades of depth of experience and a robust practice in international compliance matters and is thus uniquely qualified to assist clients in the evaluation of their specific situations and a determination of the appropriate filing requirements. We typically work alongside clients' income tax return preparers to ensure adherence with foreign compliance rules, including the new laws in place under FATCA.

Footnote

1. Please refer to "Form 8938 Compliance for Trusts and Estates" chart which accompanies this article for a schematic of filing requirements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.