In 2017, the federal gift and estate tax exemption was $5.49 million1. The Tax Cuts and Jobs Act of 2017 doubled the gift and estate tax exemption amount to $11.18 million in 2018, and that amount has been adjusted for inflation every year and has steadily increased.

However, the Tax Cuts and Jobs Act of 2017 has a "sunset" provision, meaning the higher gift and estate tax exemption expires in 2025. That will result in a decrease in the gift and estate tax exemption to $5,000,000 in 2026, which will be adjusted for inflation going back to 2018, and is predicted to be slightly above $7,000,000. Congress would have to pass new legislation for the gift and estate tax exemption to not expire and to avoid the decrease in the exemption. The gift and estate tax exemption is $13,610,000 in 2024 and will be $13,990,000 in 2025.

On November 26, 2019, the IRS released regulations clarifying that completed gifts made between 2018 and 2025 will have the benefit of the higher exemption even if the taxpayer dies in a year when the exemption is lower than when the gifts were made. This provides taxpayers with gifting and estate planning opportunities using the higher exemption before it sunsets in 2026. However, the planning needs to start now. Taxpayers cannot wait until the end of 2025 to start making gifts. Gifts often include assets that require a qualified appraisal that meets IRS requirements and can take a substantial amount of time to complete. Plus, with many taxpayers making gifts at the higher exemption many qualified appraisers are likely to be backlogged and may not have time to complete the qualified appraisal before the December 31, 2025 deadline.

If nothing happens, something happens (you snooze, you lose!)

If Congress takes no action and the gift and estate tax exemption sunsets to the predicted $7,000,000 plus amount, taxpayers who die after December 31, 2025, with a federally taxable estate, and who did not make gifts in excess of $7,000,000 before the sunset, will have lost the benefit of the increased exemption. The longer you wait the more difficult it will be to effectively plan and make gifts before the federal gift and estate tax exemption sunsets in 2026.

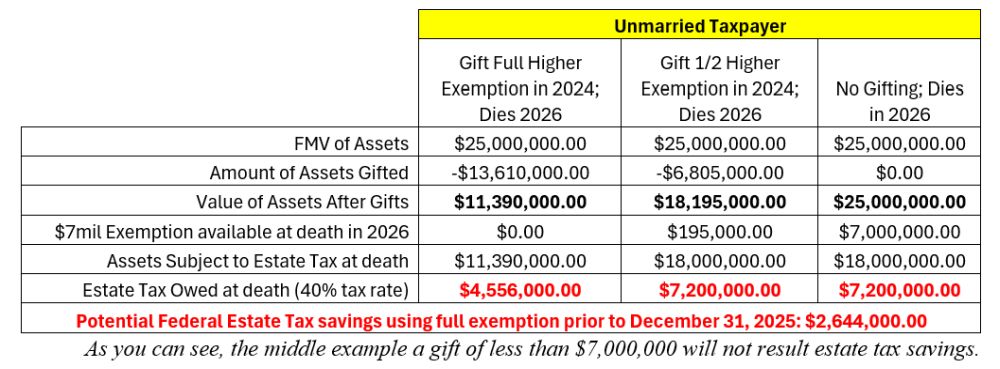

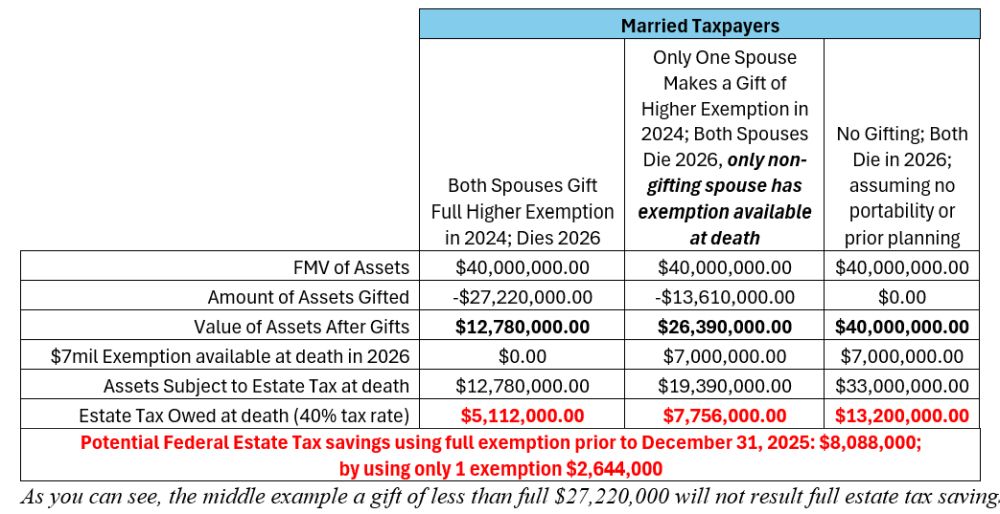

We have provided examples at the end of this piece illustrating how the looming decrease of the gift and estate tax exemption could impact single and married taxpayers.

How can I make gifts to use my higher exemption?

The focus prior to the sunset is making gifts that use the higher exemption. Those gifts can be made in a variety of ways. You aren't required to just cut large checks for your children. For example, you could make gifts to an irrevocable trust for the benefit of your spouse (such as a Spousal Lifetime Access Trust "SLAT") or your children and grandchildren. Your estate planning attorney can assist in you determining the best way to make those gifts in a manner that will accomplish your goals.

Who does this really affect?

Taxpayers with assets projected to be above the $7,000,000 plus exemption in 2026 should consider gifting options before the sunset. Taxpayers who are unlikely to have a taxable estate after the sunset probably do not need to worry about the exemption sunsetting, i.e., a single individual with less than $7,000,000 in assets and a married couple with less than $14,000,000 in combined assets. However, assets may appreciate during your life or you may receive an inheritance that would cause your estate to be subject to federal estate tax at your death. It is important to meet with your advisor and attorney to analyze your estate and if gifting prior to December 31, 2025, would benefit your estate.

What should I do?

There are many issues to consider when evaluating the goals for your estate and the best way to accomplish those goals. While the estate tax is not scheduled to sunset for over a year, 2026 will be here before we know it. Evaluating your estate plan, determining if and how gifts should be made to take advantage of the current higher gift and estate tax exemption, and potentially obtaining a qualified appraisal will take time. To discuss your options, please contact one of our attorneys in our Trusts and Estates Practice Group as soon as possible to schedule an appointment.

Below are examples illustrating how the looming decrease of the gift and estate tax exemption could impact single and married taxpayers:

Unmarried Taxpayer Potential Federal Estate Tax Outcomes

Tom Taxpayer is unmarried, his assets are valued at $25,000,000, he has made no prior reportable gifts, and he dies in 2026 when the exemption is $7,000,000. The below chart illustrates the Federal Estate Tax outcome in three scenarios: (1) Tom makes a gift of the full exemption in 2024 of $13,610,000, (2) Tom makes a gift of half of his exemption in 2024, and (3) Tom makes no gifts during his lifetime.

Married Taxpayers Potential Federal Estate Tax Outcomes

Tom Taxpayer is married, their combined assets are valued at $40,000,000, neither Taxpayer has made a prior reportable gift, and both die in 2026 when the exemption is $7,000,000. The below chart illustrates the Federal Estate Tax outcome in three scenarios: (1) The Taxpayers both make gifts of the full exemption in 2024, (2) only one spouse makes a gift of the Taxpayer's full exemption in 2024, and (3) neither Taxpayer makes a reportable gift during their lifetime.

Footnote

1 There are several states that have a state level estate tax. This article only addresses federal estate tax.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]