- with readers working within the Oil & Gas and Property industries

- within Wealth Management, Environment and Consumer Protection topic(s)

INTRODUCTION

The European Commission's Omnibus package, published on February 26, 2025 (the Omnibus Package or the Package), proposes to simplify the EU's sustainability laws. At the same time, it has generated significant uncertainty for both companies in-scope of the Corporate Sustainability Due Diligence Directive (the CS3D), and those within their value chain, as they grapple with how the Package's proposals will develop during the EU's legislative process.

While there is broad support for simplification of sustainability regulation, views among Member States and the Council of the EU (the Council) are diverging as to how that should be shaped.

In this article, we focus on the CS3D and address the ten questions most relevant to companies. We explore whether the Omnibus Package will indeed change diligence obligations and provide guidance on how companies within scope can continue their preparations.

The questions we explore in this bulletin are:

| 1. How do the CS3D and the Omnibus Package relate? | 6. How might the proposals enhance or detract from harmonization of laws across certain Member States? |

| 2. What are the proposed big picture changes? | 7. Do the proposed changes sufficiently clarify the CS3D's transition plan requirements? |

| 3. Do the Omnibus Package proposals have legal effect, and what are the timings for their adoption? | 8. How might the rules on liability under the CS3D change? |

| 4. Would due diligence requirements really be simplified? | 9. How does the Package seek to better align the CS3D with the CSRD? |

| 5. How do the proposals aim to reduce stakeholder engagement requirements? | 10. Should I change how I should prepare for the CS3D? |

1. How do the CS3D and the Omnibus Package relate?

The CS3D entered into force on July 25, 2024 with the aim of fostering sustainable and responsible corporate behavior throughout global value chains. To do so, the CS3D substantially amplifies the environmental and human rights due diligence responsibilities for companies operating within the EU. It achieves this through a trifecta of proactive requirements, imposing penalties and establishing a civil liability regime for non-compliance. As per current rules, Member States are to transpose the CS3D by July 2026, and the framework would start applying from July 2027. See our earlier publication on the CS3D for further background.

However, the CS3D's introduction was marred by significant political controversy. The CS3D's extensive due diligence obligations ignited considerable debate and political lobbying. Businesses expressed concerns about its broad scope and the substantial costs and resources required for compliance. Contrastingly, NGOs advocated for more robust accountability measures. Given its global implications, the CS3D also triggered political discussions between the EU and its major trade partners.

Citing trade tensions and growing geopolitical pressure, the increase in energy prices for EU firms and concerns about the competitive positioning of EU companies, the EU is now seeking to simplify its sustainability legal regime. The Draghi report on EU competitiveness1 accelerated the belief that the deregulation of not just large EU companies, but also of small- and medium-sized enterprises, is required to foster economic growth.

The Omnibus Package, published on February 26, 2025, is the result. It proposes to simplify the EU's sustainability laws, including the CS3D. However, while there is broad support for the need to streamline the regulatory framework, there remain contrasting views on how to achieve this. Such differing perspectives highlight the complexity that the EU will face in upcoming legislative discussions.

2. What are the proposed big picture changes?

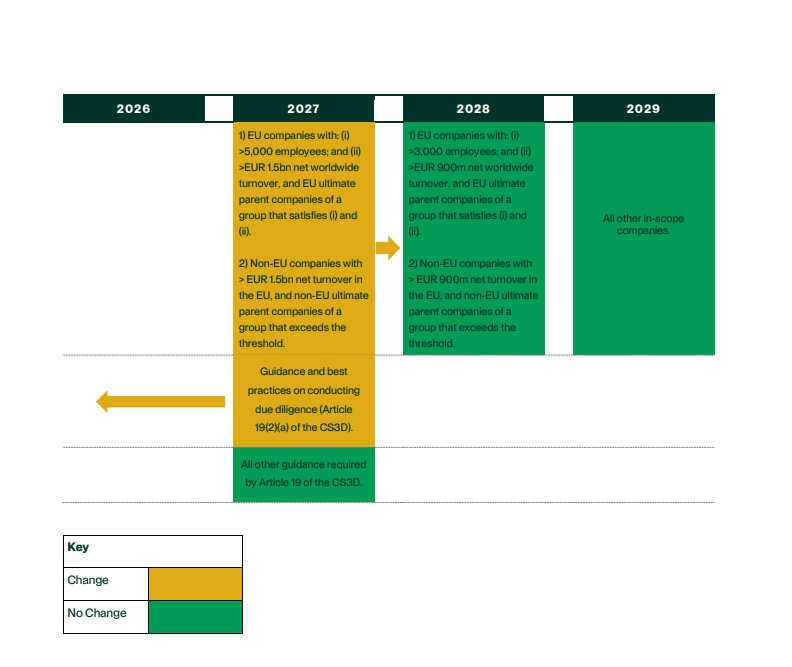

To give companies more time to prepare, the Omnibus Package proposes delaying CS3D application for the first in-scope companies from July 2027 to July 2028.

EU companies with more than 5,000 employees and with a net worldwide turnover of more than EUR 1.5bn, as well as non-EU companies with a net turnover in the EU of more than EUR 1.5bn, were due to fall within scope from July 2027. However, under the proposal, they would only fall in scope from July 2028, along with the other companies already in scope by then (i.e. EU companies with more than 3,000 employees on average and which generated a net worldwide turnover of more than EUR 900m in the last financial year, and non-EU companies which generated a net turnover of more than EUR 900m in the EU).

As CS3D application for the first in-scope companies would be delayed by one year, the deadline for Member States to transpose the CS3D into national law would also be delayed by one year (from July 26, 2026 to July 26, 2027).

Nevertheless, to give companies more time to learn from best practice, the Package would advance the Commission's guidelines on best practices for conducting due diligence under the CS3D by six months to July 26, 2026 (from January 26, 2027).

3. Do the Omnibus Package proposals have legal effect, and what are the timings for their adoption?

The Package does not have legal effect in and of itself. It will first need to be considered and adopted by the European Parliament and the Council. This process, detailed in the flowchart in our CRSD Omnibus article here, involves the bodies working together to finalize and adopt the legislative text. It is therefore possible that changes (potentially significant) could occur before an agreed version of the proposals is passed into EU law.

While typically the procedure to amend a directive takes about 19 months according to the European Parliament's statistics, the Commission has asked the European Parliament and the Council to "treat this omnibus package with priority, in particular the proposal postponing certain disclosure requirements under the CSRD and the transposition deadline under CS3D". As such, the European Parliament has already scheduled a first vote for April 1 before the Committee on Legal Affairs.

Overall, we anticipate more fulsome negotiations will be needed regarding the substantive changes to the CS3D, particularly in the European Parliament. Using the original 2024 CS3D discussions as context, negotiations could take over a year and Member States will then need to transpose the finalized text before it takes effect.

4. Would due diligence requirements really be simplified?

Companies are still required under the CS3D and the Package to map the operations of both direct and indirect business partners in their chain of activities to identify general areas where adverse impacts are most likely to occur and to be most severe.

Nevertheless, to reduce the burden on smaller companies, the Package would limit the information that in-scope companies can seek from direct business partners with fewer than 500 employees. The Package proposes that the information requested from these business partners should, in principle, not exceed the information specified in new voluntary sustainability reporting standards (the "Voluntary Standards") that the Commission intends to introduce swiftly through a Delegated Act for companies not subject to the CSRD. Nevertheless, where additional information is necessary (e.g., there is an indication of likely adverse impacts or the Voluntary Standards do not cover relevant adverse impacts) and that information cannot otherwise reasonably be obtained, the in-scope company may seek information from their direct business partners with fewer than 500 employees.

The Package proposes that in-depth assessments of areas where adverse impacts are most likely and most severe would be required only for a company's own operations, subsidiaries and direct business partners. Diligence would only need to be performed on indirect business partners in circumstances where: (i) companies have "plausible information" that suggests that an adverse impact at the level of the indirect business partner may arise; and (ii) where the indirect nature of the relationship is the result of an artificial arrangement pointing to circumvention.

While this, in theory, limits the diligence required, the Commission's Staff Working Document nevertheless states that "plausible information" includes "information of an objective character that allows the company to conclude that there is a reasonable likelihood that the information is true".2 Both the Staff Working Document and the explanatory memorandum further note that this could include instances where a company has received a complaint, or is in the possession of certain information which can include credible media or NGO reports. The Package's current wording arguably introduces greater uncertainty and raises the question as to whether companies could be held accountable for their constructive knowledge of plausible information related to their indirect business partners. This ambiguity may lead to an indirect obligation for companies to actively monitor media and other reports more rigorously than they currently do. It is therefore important that the forthcoming due diligence guidance includes clear definitions and guidance on the meaning of "plausible information".

The Package does not however amend the requirement for companies to update their due diligence measures if significant changes occur. The proposals would also require such updates if there are reasonable grounds to believe that existing measures are no longer adequate or effective as opposed to the current wording of when companies believe that new risks of adverse impacts may arise. We therefore question whether this proposed amendment in fact relieves companies from needing to ensure that their due diligence measures respond to new risks (as failing to do so could be perceived as no longer effective or adequate).

Footnotes

1 https://commission.europa.eu/topics/eu-competitiveness/draghi-report_en

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.