- within Corporate/Commercial Law topic(s)

Corporation v LLC—this is often the first question entrepreneurs face when deciding on a business structure. Each option has its unique advantages and challenges. Let's quickly break it down:

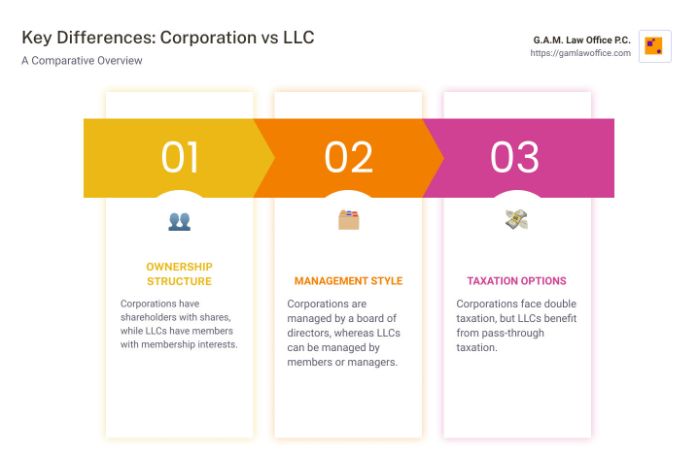

- Ownership: Corporations issue shares to shareholders, while LLCs have members who own membership interests.

- Management: Corporations are run by directors and officers, and LLCs can choose member or manager management.

- Taxes: Corporations typically face double taxation, whereas LLCs benefit from pass-through taxation.

Choosing the right legal structure for your business is crucial. It can affect everything from daily operations to taxes and personal liability.

Businesses thrive on strong foundations, much like a building needs solid groundwork. The decision between a corporation and an LLC is such a foundation. It not only sets the legal tone of your business but also impacts growth and security.Understanding this choice will enable you to stack the business odds in your favor.

Corporation v LLC: Key Differences

When it comes to choosing between acorporation and an LLC, it's all about understanding how they differ in ownership, management, and taxation. These differences can significantly impact your business's future.

Ownership Structure

In a corporation, ownership is all aboutshares and shareholders. Shareholders invest in the business by purchasing shares, and their ownership percentage is based on the number of shares they hold. This setup makes it easier to transfer ownership, attract investors, and potentially go public.

By contrast, an LLC is owned by itsmembers, who hold membership interests. There's no limit on the number of members, and these can include individuals, other LLCs, and even corporations. This flexible ownership structure allows LLCs to tailor profit-sharing arrangements to fit their needs.

Management Flexibility

The management of a corporation involves aboard of directorsand corporate officers. The board makes major decisions and appoints officers to handle day-to-day operations. This structure provides a clear hierarchy and is ideal for businesses planning to expand or attract investors.

An LLC, however, offers moreflexibility. It can be managed by its members (member-managed) or by appointed managers (manager-managed). This allows business owners to choose the management style that best suits their needs. Theoperating agreementin an LLC outlines how the company is run, including management roles and responsibilities, offering a customized approach to governance.

Taxation Options

Taxation is a major consideration when deciding between a corporation and an LLC. Corporations facedouble taxation: the business pays taxes on its profits, and shareholders pay taxes on dividends. However, corporations can deduct business expenses, including salaries and benefits, which can help offset the tax burden.

On the other hand, LLCs enjoypass-through taxationby default. This means the business income passes through to the members' personal tax returns, avoiding the double taxation seen in corporations. LLCs also have the option to be taxed as a corporation if that is more beneficial.

Understanding these key differences inownership, management, and taxationcan help you make an informed decision about whether a corporation or an LLC is the right fit for your business.

Advantages of Choosing a Corporation

When deciding between acorporation and an LLC, understand the unique advantages a corporation offers. Let's explore some of the key benefits:perpetual existence, capital raising, and legal stability.

Perpetual Existence

One of the standout features of a corporation is itsperpetual existence. Unlike an LLC, which may dissolve if a member leaves or passes away, a corporation continues to exist independently of its owners. This means the business can endure beyond the lifespans of its shareholders, providing continuity and stability. For example, companies like Microsoft and Coca-Cola have thrived for decades, thanks to their enduring corporate structure.

Capital Raising

Corporations have a significant edge when it comes toraising capital. They can issue shares of stock to attract investors, making it easier to gather funds for expansion and growth. This ability to raise funds is particularly valuable for businesses looking to scale quickly or enter new markets. Additionally, the structure of a corporation is often more appealing to venture capitalists and other professional investors who prefer the clear ownership delineation and governance that comes with shares.

Legal Stability

The legal stability of a corporation is another critical advantage. Corporations have been a part of U.S. business law for centuries, resulting in a well-established legal framework. This maturity means there are countless precedents and legal guidelines that provide clarity and predictability for corporations. The extensive history of corporate law offers a robust foundation for resolving disputes and ensures a consistent application of regulations across different jurisdictions.

Choosing a corporation can offer these distinct advantages, making it an attractive option for businesses seeking longevity, easy access to capital, and a stable legal environment.

Advantages of Choosing an LLC

When evaluating whether to choose an LLC over a corporation, it's important to consider the unique benefits that an LLC offers. Let's explore the key advantages: ease of formation, tax flexibility, and minimal formalities.

Ease of Formation

Starting an LLC is notably simpler compared to forming a corporation. The process typically involves less paperwork and fewer steps. Most states require just the filing of articles of organization with the Secretary of State. Some states even allow this to be done online, making it a quick and straightforward process. In contrast, forming a corporation involves more complex tasks like creating bylaws and issuing stock certificates.

An LLC is also governed by an operating agreement, which, while not mandatory, is a good practice. This document outlines the roles and responsibilities of members, allowing for a custom approach to managing the business.

Tax Flexibility

One of the standout features of an LLC is its tax flexibility. Unlike corporations, which face double taxation, LLCs are not considered separate tax entities by the IRS. This allows the profits and losses to pass through directly to the members, who report them on their personal tax returns.

LLC members can choose how they want to be taxed, whether as a sole proprietorship, partnership, or even as a corporation. This flexibility can result in significant tax savings and allows business owners to select the most advantageous tax structure for their specific situation.

Minimal Formalities

LLCs are favored for their minimal formalities. They do not require a board of directors, annual meetings, or extensive record-keeping, which are standard for corporations. This simplicity can save time and reduce administrative burdens, allowing owners to focus more on running their business rather than managing formalities.

Moreover, LLCs offer more flexibility in management. They can be member-managed or manager-managed, providing options for how the business is run. This can be particularly beneficial for small businesses where the owners are closely involved in day-to-day operations.

Choosing an LLC can provide these distinct advantages, making it an appealing option for entrepreneurs seeking a straightforward, flexible, and tax-efficient business structure.

Frequently Asked Questions aboutCorporation v LLC

What is the difference between an LLC and a corporation?

The primary difference between an LLC and a corporation lies in their ownership and management structure. LLCs are owned by members, who hold membership interests in the company. This can be a single person or multiple individuals, including other businesses. On the other hand, corporations are owned by shareholders, who hold stock in the company. This distinction influences how each entity is managed and taxed.

In terms of management, LLCs offer flexibility. They can be managed directly by their members or by appointed managers. Corporations, however, require a more structured approach with a board of directors overseeing the company's operations, and officers handling daily management tasks.

Is it better to form an LLC or corporation?

Deciding between forming an LLC or a corporation depends on several factors, including taxes and legal protection.

LLCs provide tax flexibility. They allow profits and losses to pass through to members, who report them on their personal tax returns, avoiding the double taxation faced by corporations. This can lead to potential tax savings, especially for small businesses or those with fewer owners.

Corporations, however, offer strong legal protection and can be more appealing if you're looking to raise capital. Their structure, with shareholders and a board of directors, can be attractive to investors. Corporations can also choose to be taxed as an S corporation to avoid double taxation, although this comes with restrictions.

What is the main advantage of a corporation over an LLC?

One of the main advantages of choosing a corporation over an LLC is perpetual existence. Corporations continue to exist even if the ownership changes or shareholders leave. This stability can be crucial for businesses planning long-term growth or those aiming to go public.

Additionally, corporations have an edge in capital raising. They can issue stocks to attract investors, providing a straightforward way to gather funds for expansion. This ability to raise capital is a significant advantage for businesses looking to grow or enter new markets.

Choosing between an LLC and a corporation requires weighing these differences in ownership, management, taxes, legal protection, and growth potential. Each structure offers unique benefits, and the best choice depends on the specific needs and goals of your business.

Conclusion

Choosing between a Corporation and an LLC is a critical decision for any business. At G.A.M. Law Office P.C., we understand the complexities involved in this choice and offer custom legal counsel to help you make the best decision for your business.

Our Approach:

We focus on providing strategic advice and transparent communication to safeguard your interests and foster growth. Whether you're an entrepreneur launching a startup or an established business looking to restructure, our team is here to guide you.

Why Choose Us?

- Custom Legal Counsel: We work closely with you to understand your unique needs and goals. This allows us to recommend the most suitable business structure and draft internal governing documents that align with your vision.

- Expertise in Business Law: With our specialization in business, trademark, and copyright law, we offer comprehensive legal solutions that go beyond business formation. Our expertise ensures that your business is not only legally sound but also strategically positioned for success.

- Focus on Growth: We aim to help you steer the legal landscape so you can focus on growing your business. From selecting the right entity to ensuring corporate compliance, we provide support every step of the way.

Get Started Today:

If you're considering forming a corporation or an LLC, or if you have questions about which structure is right for you, don't hesitate to reach out to us. Our New York City-based team is ready to provide the legal solutions you need to thrive.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.