- within Wealth Management, Antitrust/Competition Law and Tax topic(s)

- in United Kingdom

- with readers working within the Banking & Credit industries

Introduction

In 2024, plaintiffs filed 36 securities class action lawsuits against non-U.S. issuers, up by three from the 33 filings in 2023. Although this number indicates an uptick in non-U.S. issuer filings, it remains significantly lower than the high of 88 filings in 2020.1

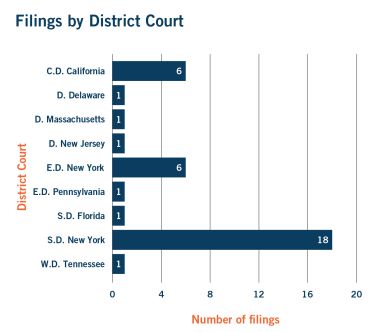

- As was the case in 2023, 2022, and 2021, the Second Circuit unsurprisingly continues to be the jurisdiction of choice for plaintiffs bringing securities claims against non-U.S. issuers. In 2024, plaintiffs favored the Second Circuit by an even larger margin, filing 67% of non-U.S. issuer class actions in the Second Circuit (24 of 36), as compared with last year's 45% (15 of 33). A majority of these lawsuits (18 of 24) were filed in the Southern District of New York ("S.D.N.Y."), with the six remaining Second Circuit lawsuits filed in the Eastern District of New York ("E.D.N.Y."). Roughly 17% of the 36 lawsuits were filed in the Ninth Circuit (6), followed by three in the Third Circuit. Only one case was filed in each of the First, Sixth and Eleventh Circuits.

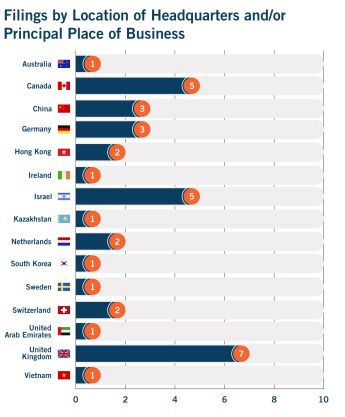

- Unlike the past three years, most non-U.S. issuer lawsuits were no longer against companies with headquarters and/or principal places of business in China. Of the 36 non-U.S. issuer lawsuits filed in 2024, seven were against companies headquartered in the United Kingdom, followed by a tie for second between companies based in Canada (5) and Israel (5), and a tie for third between companies based in China (3) and Germany (3).

- Pomerantz LLP claimed the top spot with the most first-in-court filings against non-U.S. issuers in 2024 (10), followed by Bronstein, Gewirtz & Grossman, LLC (7), usurping the Rosen Law Firm, P.A. (6). The Rosen Law Firm made 11 first-in-court filings in 2023 and held the lead for most first-in-court filings from 2018 through 2021. The Rosen Law Firm was appointed lead counsel in the most cases in 2024 (4), followed by Robbins Geller Rudman & Dowd LLP (3).

- The fourth quarter of 2024 proved the most active for securities class action filings against non-U.S. issuers, with 13 cases filed. Combining Q4 filings with those in Q3, the second half of 2024 yielded most of the 2024 filings, totaling 23 out of 36.

- Although the 36 lawsuits spanned 16 different industries, the largest number of filings involved the automobile industry (6), followed by the biotechnology and drugs industry (5) and software and programming industry (5).

An examination of the types of cases filed in 2024 reveals the following substantive trends:

- Four of the 36 cases were filed against electric vehicle ("EV") companies, with three of those companies specializing in designing and manufacturing EVs, and one in developing an electric takeoff and landing jet.

- Four cases were filed against biotechnology or pharmaceutical companies, concerning a COVID-19 vaccine, medical treatments made through the use of umbilical cords, and artificial-intelligence assisted drug recovery therapy.

- Two cases also involved companies that use artificial intelligence ("AI").

- Eleven cases involved allegations of overstated growth and revenues. These cases spanned industries, including AI, advanced vehicle technology, automobiles, semiconductors, software and programming, banking, aerospace communication, oil and gas, and retail.

In 2024, courts rendered 22 decisions on motions to dismiss securities class actions against non-U.S. issuers filed in 2023 and 2022.

- Six of those 22 decisions resulted in partial dismissals, as compared with only two partial dismissals in 2023, allowing portions of the claims to proceed to discovery.

- Out of those 22 decisions, one motion to dismiss was denied in its entirety, allowing all claims to proceed. Last year, no court denied a motion to dismiss a securities class action against a non-U.S. issuer in its entirety.

- Seven of those 22 decisions were dispositive, meaning they resulted in the closure of the case with no motion for reconsideration or pending appeal.

- Fifteen of those 22 decisions (68%) resulted in complete dismissal of all claims, 10 without prejudice and five with prejudice.

- Three of those 22 motion to dismiss decisions are pending appeal.

- Of those 22 decisions, 17 held that the plaintiffs had failed to allege, at least in part, an actionable misstatement or omission and seven determined that the plaintiffs had failed to allege, at least in part, a strong inference of scienter. Six courts relied on both independent reasons together to conclude that plaintiffs had failed to state a claim for relief.

Non-U.S. Companies Remain Targets for Securities Fraud Litigation

In 2024, the number of securities class actions against non-U.S. issuers increased in proportion to a subtle increase in overall securities class action filings, which grew from 213 cases in 2023 to 222 total filings in 2024. In 2024, 36 class actions were filed against non-U.S. issuers, as compared with 33 in 2023 and 34 in 2022.2

This survey provides an overview of securities lawsuits against non-U.S. issuers in 2024. First, we analyze the number of cases filed, including trends relating to location filed, the types of companies that plaintiffs targeted, and the nature of the underlying claims. Next, we analyze key decisions rendered on motions to dismiss in 2024 and their impact on the legal landscape of these types of suits. Finally, we outline issues and best practices that non-U.S. issuers should consider implementing to mitigate the risk of such lawsuits.

Filing Trends

In 2024, the percentage of securities class actions filed against non-U.S. issuers remained relatively stable. Approximately 16% of securities class actions (36 in total) were filed against non-U.S. issuers, as in 2023, when just under 16% of securities class actions targeted non-U.S. issuers. Like years past, certain filing trends emerged:

- The Second Circuit, particularly the S.D.N.Y., continued to see

the most activity in 2024. With 18 filings in the S.D.N.Y., it was

the preferred court for 50% of plaintiffs alleging securities

violations against non-U.S. issuers. This share indicates an

increase in S.D.N.Y. filings, up from about 36% in 2023. After

the

Second Circuit, the Ninth (6) and Third (3) Circuits had the highest numbers of suits filed against non-U.S. issuers. Only one case was filed in each of the First, Sixth and Eleventh Circuits. - Most suits were filed against companies headquartered in the

United Kingdom (7), followed by companies based in Canada and

Israel (5 each), and China and Germany (3 each).

- Of the seven suits filed against companies based in the United

Kingdom, two were filed in the S.D.N.Y., with the remainder in the

District of New Jersey ("D.N.J."), the District of

Massachusetts ("D. Mass."), the Western District of

Tennessee ("W.D. Tenn."), the Southern District of

California ("S.D. Cal.") and the District of Delaware

("D. Del.").

- Of the five suits filed against Canadian companies, four were filed in the S.D.N.Y and one was filed in the Central District of California ("C.D. Cal.").

- Of the five suits filed against companies headquartered in Israel, all of them were filed in the S.D.N.Y.

- Of the three cases filed against Chinese companies, one was filed in the S.D.N.Y, one in the E.D.N.Y and one in the C.D. Cal.

- Of the three suits filed against German companies, one was filed in the S.D.N.Y., one in the E.D.N.Y. and one in the Southern District of Florida ("S.D. Fla.").

- The non-U.S. issuer class actions span various industries, with the largest portions involving: (i) the automobile industry (6)—two of which were filed against Israeli companies, and the remaining four targeted companies in Canada, Vietnam, China and the Netherlands; and a tie for second between (ii) the biotechnology and drugs industry (5)—with two suits filed against companies headquartered in the United Kingdom, and the others involving companies in Germany, Hong Kong and Israel; and (iii) the software and programming industry (5)— where each suit was filed against companies based in different countries.

Substantive Trends

Misrepresentations and/or Omissions Relating to Business Prospects, Financial Projections, and Adverse Information in the EV Sector

In 2024, four cases targeted EV companies, alleging that these non-U.S. issuers overstated business prospects, provided misleading financial information and failed to disclose material adverse information.

First, plaintiffs filed suit in the S.D.N.Y. against the Lion Electric Company ("Lion"), a manufacturer and designer of all-electric trucks and buses incorporated and headquartered in Quebec, Canada.3 The amended complaint alleges that the Canadian company grossly inflated its production and sales forecasts to secure a merger with Northern Genesis, a Delaware company formed for the purpose of effectuating a strategic transaction for its stockholders.4 As a consequence of the Lion and Northern Genesis merger, Lion would become a SEC-registered company listed on the New York Stock Exchange.5 The plaintiffs claim that the projections in the proxy used to solicit Northern Genesis' approval of the merger were based on unrealistic sales assumptions and that Lion's value was materially below the per-share merger consideration.6 The plaintiffs allege that the difference between the proxy's projections and the company's annual reports filed in 2022, 2023 and 2024 illustrate the proxy's artificially inflated projections.7 The amended complaint contends that, following these annual reports, the market corrected its valuation of Lion, and Lion's shares fell from a peak of US$20.44 in 2021 to a low of $0.71 in 2024.8

In addition, plaintiffs filed suit in the E.D.N.Y. against two EV companies—VinFast Auto Ltd. ("VinFast"), a Vietnamese company, and Li Auto, Inc. ("Li Auto"), a Chinese company—after each company allegedly overstated its business capabilities and failed to meet delivery targets, leading to revised estimates and strategic missteps.

The complaint against VinFast alleges that the Vietnamese company lacked sufficient capital to execute its growth strategy and overstated the strength of its business model and operational capabilities, including its financial prospects following a merger with Black Spade, a "cross-border" investment company.9 Unable to meet its 2023 delivery targets, the complaint alleges that VinFast delivered only 34,855 EVs, below its 40,000-50,000 projection.10 After Barrons published an article detailing VinFast's failure to meet its 2023 sales target, the complaint alleges that VinFast's ordinary share price declined sharply by 84.78%.11

Similar to VinFast's alleged overstatements, the complaint against Li Auto alleges that the Chinese EV company overstated the demand for its vehicles and the efficacy of its operating strategy when launching Li MEGA—Li Auto's first battery-powered EV model.12 The plaintiffs contend that Li Auto revised its delivery estimates due to lower-than-expected order intake, and mis-timed the operating strategy for Li MEGA, planning as if it had reached a scaling phase while it was still in the validation phase.13 Just as VinFast found it difficult to reach its delivery targets, so too did Li Auto, revising its vehicle deliveries for the first quarter of 2024 to between 76,000 and 78,000 vehicles, compared to its target of between 100,000 and 103,000 vehicles.14 On March 21, 2024, Li Auto issued a press release acknowledging that its operating strategy for Li MEGA was "mis-paced" and revising its delivery estimates.15 On this news, Li Auto's share price fell US$2.55 per share, or 7.48%, closing at US$31.53 per share in 2024.16

Finally, plaintiffs filed suit in the S.D.N.Y. against Lilium N.V. ("Lilium"), a start-up electric aviation company incorporated in the Netherlands and headquartered in Germany.17 The complaint alleges that the company overstated its fundraising progress and failed to disclose imminent insolvency while developing its EV takeoff and landing jet.18 In 2024, Lilium disclosed that "funding for the company [was] not feasible" and stated that the company would be "obligated to file for insolvency."19 Following this news, Lilium's stock price fell 15.5%, and 36.97% the following day.20

Together, these cases highlight a new trend of increased scrutiny directed towards non-U.S. issuers in the EV sector and, specifically, their financial and manufacturing projections.

Misrepresentations and/or Omissions Relating to Business Prospects, Financial Projections, and Adverse Information in the Biotechnology and Pharmaceutical Sectors

Five non-U.S. issuers in the biotechnology and pharmaceutical sectors face securities litigation for allegedly making false or misleading statements or omissions concerning the companies' financial condition, business practices or risk disclosures.

Of these five biotechnology and pharmaceutical companies, three face litigation in the S.D.N.Y. In Ladewig v. BioNTech SE, the amended complaint alleges that BioNTech, a biotechnology company organized and headquartered in Germany, made materially false and misleading statements regarding revenue projections for its COVID-19 vaccine, dubbed Comirnaty, which was developed in conjunction with Pfizer.21 The amended complaint alleges that BioNTech misrepresented the vaccine revenues as ongoing rather than temporary, concealing a decline in demand and guiding investors to expect an additional €5 billion in 2023 vaccine revenue.22 The emergence of the Omicron variant rendered Comirnaty obsolete, according to the amended complaint, leading to significant inventory write-offs and a market capitalization drop of over US$1 billion dollars.23 On BioNTech's press release in 2023 announcing its inventory write-offs, BioNTech's share price fell by 6.38%.24

Another biotechnology company, Global Cord Blood Corporation ("GCBC"), also faces suit in the S.D.N.Y.25 GCBC, which is incorporated in the Cayman Islands and headquartered in Hong Kong, processes and stores umbilical cord blood for expectant parents to use in future medical treatments.26 In In re: Global Cord Blood Corporation Securities Litigation, the plaintiffs allege that GCBC misled investors by failing to disclose its fraudulent misappropriation of funds to companies controlled by the individual defendant Yuen Kam ("Kam").27 Kam is the founder, chairman, controlling shareholder, and CEO of Golden Meditech Holdings Limited ("Golden Meditech"), a company incorporated in the Cayman Islands and based in Hong Kong.28 Prior to the class period, Golden Meditech was the controlling shareholder of GCBC.29

The amended complaint alleges that Kam secretly controlled GCBC through its directors and officers.30 Specifically, the amended complaint alleges that GCBC created a sham transaction to acquire Cellenkos, Inc. ("Cellenkos"), a small drug development company incorporated in Delaware and based in Texas, with no revenue and no regulatory product approvals.31 GCBC allegedly agreed to acquire Cellenkos for an inflated price of US$664 million to cover up the misappropriation of at least US$606 million of GCBC's funds from 2015 to 2022 to Golden Meditech and its subsidiaries.32 However, GCBC's majority shareholder during the class period, Blue Ocean, prevented the transaction from closing by opposing it in the Cayman Islands Grand Court, where details of the sham transaction emerged.33 Upon that news, GCBC's share price dropped by 9.1%, falling from US$2.20 per share to US$0.22.34

A third company in the biotechnology and pharmaceutical industry, Taro Pharmaceutical Industries Ltd. ("Taro"), also faces suit in the S.D.N.Y.35 Taro is an Israeli research-based pharmaceutical manufacturer headquartered in New York.36 According to the complaint, Taro failed to disclose material information necessary for stockholders to properly assess Taro's merger with Sun Pharma, the largest pharmaceutical company in India.37 Specifically, the complaint alleges that the proxy statement soliciting shareholder approval for the merger included incomplete and misleading information about Taro's valuation. The proxy allegedly:

- overstated Taro's cost of capital at 10-12% annually;

- discounted Taro's future EBITDA by 45% due to past performance issues that were no longer relevant; and

- incorrectly stated that Taro's privatization would not result in any company savings, despite the elimination of SEC reporting requirements.38

Accordingly, the complaint alleges that the misrepresentations contained in the proxy "deprived [plaintiffs] of their right to cast an informed vote."39

The two remaining complaints against non-U.S. issuers in the pharmaceutical and biotechnology sector were filed by the Rosen Law Firm in the C.D. Cal. and Bronstein, Gewirtz & Grossman LLC, with the Rosen Law Firm as lead counsel, in the D.N.J. The California complaint alleges that AstraZeneca PLC ("AstraZeneca"), a pharmaceutical company based in the United Kingdom, understated its legal risks by failing to disclose insurance fraud and the detention of its president of operations in China.40 The New Jersey-amended complaint alleges that Exscientia p.l.c. ("Exscientia"), a biotechnology company based in the United Kingdom that uses AI to aid the drug recovery process, provided incomplete and misleading risk disclosures regarding the loss of its executives and failed to disclose executive misconduct, including sexual harassment and inappropriate relationships.41 Both cases against AstraZeneca and Exscientia focus on alleged misconduct by corporate executives.

To view the full article click here

Footnotes

1. Unless otherwise noted, the figures in this white paper are based on information reported by the Securities Class Action Clearinghouse in collaboration with Cornerstone Research, Stanford Univ., Securities Class Action Clearinghouse: Filings Database, Securities Class Action Clearinghouse (last visited February 20, 2025). A company is considered a "non-U.S. issuer" if the company is headquartered and/ or has a principal place of business outside of the United States. To the extent a company is listed as having both a non-U.S. headquarters/ principal place of business and a U.S. headquarters/principal place of business, that filing was also included as against a non-U.S. issuer.

2. The number of total filings is based on our review of the Stanford Clearinghouse database for filings made in 2024. The number of non-U.S. issuer filings is based on those filings against issuers with headquarters outside of the U.S. See Stanford Law School, Securities Class Action Clearinghouse: Filings Database, (2025); Cornerstone Research, Securities Class Action Filings: 2023 Year in Review, at 1 (2025); Dechert LLP, 2023 Developments in the U.S. Securities Fraud Class Actions Against Non-U.S. Issuers, at 1 (2025); Dechert LLP, 2022 Developments in the U.S. Securities Fraud Class Actions Against Non-U.S. Issuers, at 2 (2025).

3. Bouchard-A v. The Lion Elec. Co., No. 24-cv-2155, ECF No. 47, ¶¶ 3, 18 (S.D.N.Y.).

4. Id. at ¶¶ 3, 25.

5. Id. at ¶ 26.

6. Id. at ¶ 5.

7. Id. at ¶¶ 76-79.

8. Id. at ¶ 73.

9. Comeau. v. VinFast Auto Ltd., No. 24-cv-2750, ECF No. 1, ¶¶ 3, 9 (E.D.N.Y.).

10. Id. at ¶ 12.

11. Id. at ¶¶ 12-13.

12. Banurs v. Li Auto Inc., No. 24-cv-3470, ECF No. 1, ¶¶ 3, 4 (E.D.N.Y).

13. Id. at ¶¶ 4-5.

14. Id. at ¶ 5.

15. Id. at ¶ 28.

16. Id. at ¶ 29.

17. Kloster v. Lilium N.V., No. 24-cv-81428, ECF No. 1, ¶¶ 2, 14 (S.D.N.Y.) (transferred to the S.D. Fla. on November 15, 2024 with Plaintiffs' consent).

18. Id. at ¶ 7.

19. Id. at ¶¶ 5, 29.

20. Id. at ¶¶ 6, 30.

21. Ladewig v. BioNTech SE, No. 24-cv-337, ECF No. 40, ¶¶ 2, 24, 30.

22. Id. at ¶ 3, 8.

23. Id. at ¶¶ 13, 15, 17.

24. Id. at ¶¶ 15-16.

25. In re: Glob. Cord Blood Corp. Sec. Litig., No. 24-cv-3071, ECF No. 60, ¶ 2 (S.D.N.Y.).

26. Id. at ¶¶ 2, 17.

27. Id. at ¶¶ 2-4.

28. Id. at ¶¶ 18, 21.

29. Id. at ¶ 18.

30. Id. at ¶¶ 3, 7.

31. Id. at ¶ 5.

32. Id. at ¶ 7.

33. Id. at ¶ 8.

34. Id. at ¶¶ 8, 82.

35. Mitchell v. Taro Pharm. Indus. Ltd., et al., No. 24-cv-6818, ECF No. 1, ¶¶ 5, 11 (S.D.N.Y.).

36. Id. at ¶ 11

37. Id. at ¶¶ 5, 24.

38. Id. at ¶ 27.

39. Id. at ¶ 42.

40. Saleh v. AstraZeneca PLC, No. 24-cv-11021, ECF No. 1, ¶¶ 7, 33 (C.D. Cal.).

41. In Re Exscientia p.l.c. Sec. Litig., No. 24-cv-5692, ECF No. 17, ¶¶ 2, 98-101 (D.N.J.).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.