- in United States

- with readers working within the Banking & Credit and Retail & Leisure industries

- within Litigation and Mediation & Arbitration topic(s)

On September 23, 2021, the U.S. Securities and Exchange Commission charged a quantitative analyst for "a scheme to violate the federal securities laws by using material nonpublic information to secretly trade ahead of (i.e., front-run) large securities trades entered by his employers, two large registered investment advisers."

Quantitative and systematic managers will immediately focus on this case, for obvious reasons. However, the actual nature of the alleged wrongdoing is not especially high-tech. According to the SEC complaint, the analyst, who worked for two large asset managers during this period, tracked client orders in his employer's order and execution management systems and then allegedly, on about 3,000 occasions, manually executed trades—in the same names and in the same direction as his employer's trades—away from his employer in an account in his wife's name (which account was not disclosed to his employers). In other words, the SEC claimed that he would "front-run" large client orders, capture for himself the benefit of the price movements caused by the large client orders, and hide his activities from his employers' compliance officers.

The SEC alleges this activity constituted an illegal misuse of his employers' material, nonpublic information and a concealment of illegal activity, constituting violations of Section 17(a) of the Securities Act of 1933, Section 10(b) of the Securities Exchange Act of 1934, Rules 10b-5, 10b5-1 and 10b5-2 thereunder, Section 17(j) of the Investment Company Act of 1940, and Rules 17j-1(b)(1) and (3) and 17j-1(d) thereunder. In addition, the U.S. Attorney's Office for the Southern District of New York today instituted a criminal action against Polevikov arising from the same alleged activities.

What is notable about this action from a technology and systems point of view is the sophistication of the SEC's support for its allegations. The SEC, among other things, has marshalled the following evidence:

- Internet usage records (i.e., Internet protocol (IP) data) showing that the analyst's wife's broker account was repeatedly accessed from the analyst's employer's domain during the workday at times when the analyst was physically present in the employer's offices. The complaint cites IP data from as early as February 2011.

- Statistical analyses concluding that (i) over a five year

period beginning in 2014, the analyst used his wife's account

to place 3,111 short-term equity trades, 92.4 percent of which

overlapped with trades by his employer, and (ii) that

approximately:

- 99.4 percent of the overlapping trades were in the same direction as the trades by the employer.

- 88 percent of those overlapping trades occurred within 90 minutes of the client trade orders being created in the order management system (OMS).

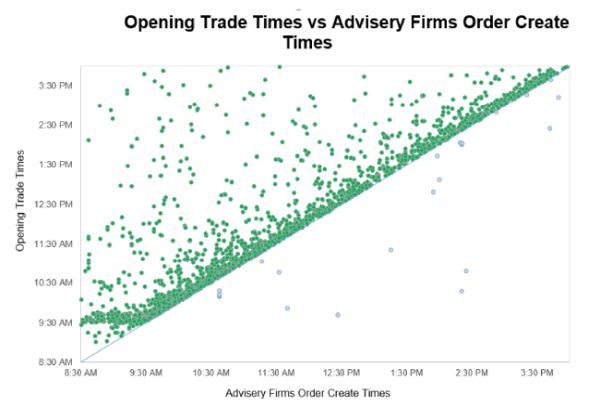

The complaint included a graphical representation of the SEC's analysis:

It is worth noting that the SEC did not appear to target the investment adviser for any failure to enforce its policies and procedures. Instead, the SEC focused on the analyst's failure to report his wife's account and to comply with his employers' preclearance and holding disclosure requirements.

The key lesson from this action for private fund managers and other advisers is an evolutionary one. The SEC has long employed experienced and educated technical and scientific personnel to sift through data and spot alleged wrongdoing, and has called those individuals and units out in press releases and other public statements.

However, this action represents the next step in this effort. The SEC's statistical and algorithmic efforts continue to increase in sophistication and effectiveness, and are taking more of a center-stage role in enforcement actions. The use of objective data to paint, in the complaint itself, a picture combining circumstantial and direct evidence hammers this point home. And the use of IP access logs (and, presumably, other electronic logs on physical access) that are a decade old sends a separate message on the durability of electronic evidence.

The SEC also has long cooperated with law enforcement, but a side-by-side review of the press releases from the U.S. Attorney's office and from the SEC makes it clear not just that the SEC enforcement attorneys and the federal prosecutors are coordinating, but that the SEC investigators actively collaborated with the FBI in preparing for this multipronged action.

As a result, what could be seen as an otherwise unremarkable front-running case may actually be an example of the seemingly inexorable increase in technical sophistication, investigative resources and interagency cooperation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.