- within Energy and Natural Resources topic(s)

- in United States

- with readers working within the Property industries

- within Insolvency/Bankruptcy/Re-Structuring topic(s)

Welcome to Edition 35 of P2N0 covering the drive to avoid, reduce and remove greenhouse gas (GHG) emissions to progress to net-zero GHG emissions (NZE).

P2N0 covers significant news items globally, reporting on them in short form, focusing on policy settings and legal and project developments and trends. This Edition 35 covers news items arising during the period August 1 to August 31, 2025.

P2N0 does not cover news items about climate change, M&A activity, or news items that are negative.

After consultation, we are to move to a quarterly cadence for P2N0, with the first quarterly P2N0 to cover September, October and November 2025. In addition to the Quarterly P2N0, we will provide weekly coverage of the most significant issues and new items – Weekly P2N0. Finally, once a month we will publish a standalone article in our Current State of Play series.

Access previous editions of P2N0 at bakerbotts.com.

HEADLINES FROM AUGUST 1 TO AUGUST 31, 2025

New cadence:

As noted above, we are moving to quarterly cadence for P2N0, with the first quarterly P2N0 to cover September, October and November 2025. During December 2025 we will publish a COP-30 Special Edition.

In addition to the Quarterly P2N0, we will provide weekly coverage of the most significant issues and new items of each week covered in more detail. The Weekly P2N0 coverage will commence in October 2025 and will be limited to five pages in length.

Finally, once a month we will publish standalone articles, entitled Current State of Play.

The first Current State of Play will be published during the week beginning September 22, 2025, and will cover Article 6 of the Paris Agreement, by considering Carbon Capture and Storage1 (CCS) and Carbon Dioxide Removal2 (CDR) in the context of Article 6 and carbon credits and carbon offsets generally. Both CCS and CDR are required to address climate change, together with other means of decarbonization and achieving the energy transition3 .

As currently planned, Current State of Play publications will cover Climate Risk Disclosure, Digital Infrastructure, and Hydrogen, the Difficult to Decarbonize Sectors.

Opening observations:

As has been the case since first covering progress to net zero over five years ago, the month of August has been a quieter month for news and publications as folk in the Northern Hemisphere take their summer vacations and legislators enjoy summer recessions.

Throughout August 2025, a number of themes continued, as follows:

- Continued analysis of the implications of the increased demand

for electrical energy and water for data centres (and

"bit barns") driven by the continued

development of AI, including:

- The immediate impact of increased electrical demand on the cost of electrical energy and the need to augment and to expand transmission networks; and

- The procurement of natural gas and nuclear electrical energy

capacity by hyper-scalers to ensure that they have sufficient

electrical energy capacity available in the near to medium

term.

The procurement of natural gas and nuclear electrical energy capacity to provide secure electrical energy supply for data centres is a theme globally. For example, in the UK, developers of three data centres in the south of England are seeking gas supplies and connections for this purpose, and in the US, power utilities are planning to spend up to USD 212 billion this year, with 25% of that spend estimated to relate to increased demand from data centers (or bit barns).

It is clear that there is no shortage of capital available for the development of digital infrastructure, increasingly supported by a strong second market in the form of infrastructure securitization. One of the upcoming standalone articles will be dedicated to infrastructure securitization.

This month, the author has read two new terms – bit barns (for data centres) and Goldilocks power source (natural gas as the fuel for electrical energy capacity to power data centres).

- Continued development of thinking, and development and tabling

of initiatives to address the need for critical materials, metals

and minerals (CM3) across the defence

sector and more broadly in the context of national security.

By way of a reminder:- CM3 are: 1. Bauxite, High Purity Alumina, and Aluminium; 2. Antimony; 3. Beryllium; 4. Bismuth; 5. Cobalt; 6. Copper; 7. Gallium; 8. Germanium; 9. Graphite; 10. Indium; 11. Lithium; 12. Magnesium; 13. Manganese; 14. Nickel; 15. Niobium; 16. Platinum metals; 17. Rare Earths Elements (REEs); 18. Silicon and Silicon metals; 19. Tantalum; 20. Titanium and Titanium metal; 21. Tungsten; 22. Uranium; and, 23. Vanadium; and

- REEs are: 1. Cerium (Ce); 2. Dysprosium (Dy);

3. Erbium (Er); 4. Europium (Eu); 5. Gadolinium (Gd); 6. Holmium

(Ho); 7. Lanthanum (La); 8. Lutetium (Lu); 9. Neodymium (Nd); 10.

Praseodymium (Pr); 11. Promethium (Pm); 12. Samarium (Sm); 13.

Scandium (Sc); 14. Terbium (Tb); 15. Thulium (Tm); 16. Ytterbium

(Yb); and 17. Yttrium (Y).

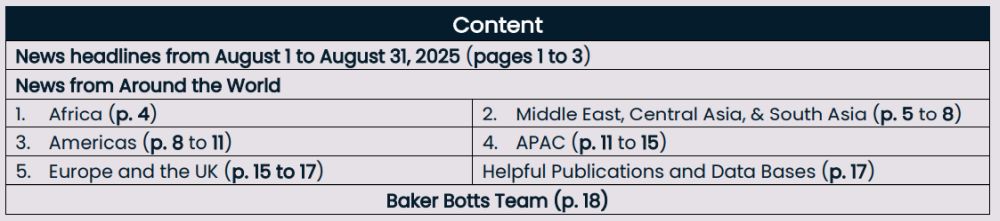

In the context of data centres and AI the good folk at the US Geological Survey (USGS) published Key Minerals in Data Centers. The table below provides a summary:

In addition to demand for CM3 and REEs for data centers themselves, the USGS reports that by 2028, data centers could consume 12% of electrical energy in the US.

- Continued development of the framework to allow the operationalisation of Article 6 of the Paris Agreement;

- Continued communication of "ambitious efforts" of parties to the Paris Agreement to increase their commitments to avoid, reduce and remove GHG emissions for the purposes of achieving their nationally determined contributions;

- Renewed focus on a price on carbon and renewed rigour in analysing the role of CCS in avoiding GHG emissions as the Northern Lights Project commenced injection of CO2;

- Continued mixed news on the development of clean and renewable hydrogen production capacity and projects to transport and to use clean and renewable hydrogen globally. One of the key themes that has emerged is that China and the European Union are leading the world in the development of hydrogen production and transportation capacity and the development of the demand side for hydrogen; and

- Continued withdrawal from initiatives: Edition

34 of P2N0 noted

that corporations and other organisations were withdrawing from

global initiatives.

For example, a number of:

- corporations have withdrawn from participation in the Science Based Targets Initiative (SBTI), marking a lack of alignment between those corporations and the climate disclosure reporting assessment and reporting frameworks that are continuing to be developed; and

- banks have withdrawn from the Net-Zero Banking Alliance

(NZBA), which was established at COP26 in Glasgow

in 2021 as part of the Glasgow Financial Alliance for Net Zero

(GFANZ). The key objective for the Alliance was aligning

bank activities with achieving net-zero GHG emissions by 2050

(Net-Zero 2050).

On August 27, 2025, it was reported widely that the NZBA had paused operations and is to hold a vote by the end of September 2025 to determine whether to continue working as an alliance or to change its basis of operation.

- First BESS in West Africa: On August

14, 2025, it was reported widely that the first battery

energy storage system (BESS) had commenced operation on

Senegal.

As reported, the Walo BESS is connected to the transmission system of the Senelec, the transmission system operator (TSO) of Senegal. While the scale of the Walo BESS is not at the same level as in countries like Australia, it provides recognition of the acceptance of BESS as a means of providing transmission grid stabilisation.

On August 18, 2025, the good folk at the Visual Capitalist, published Visualising Africa's Battery Storage Pipeline. The publication provides a broad and clear perspective on the "game-changing" outcomes that BESS will achieve, critically in the context of remote grids. Click through, it is worth it!

- Catching up on reading: During August

2025, ahead of speaking engagements, the author caught up

on carbon finance and carbon market reading. In the context of

Africa, the following publications are recommended:

- Climate Finance Capacity Building Handbook published on August 20, 2025, by the Republic of Kenya, The National Treasury and Economic Planning;

- Carbon Market Framework published in July 2025 by the Malawi Government, Ministry of Natural Resources and Climate Change, Environmental Affairs Department; and

- Carbon Finance Playbook, Demystifying the capital

raising process for Nature-based Carbon Projects in Emerging

Markets published by USAID, an older

publication, but one that provides a sound foundation.

- India and Japan JCM: On August 29, 2025, it was announced that India and Japan had signed a Memorandum of Cooperation in respect of the Joint Credit Mechanism4 to begin to cooperate to credit carbon credits through the development of decarbonization projects. (The Memorandum of Cooperation had been signed by August 5, 2025, but was not announced until August 29, 2025.)

- Oman announces incentives for Green Hydrogen

projects: On August 13 and 14,

2025, Hydrom announced that the third bidding round

for the development of green hydrogen projects in the Sultanate of

Oman would include incentives. Key incentives include:

- A 90% reduction in land lease fees during the development stage, with potential additional relief during the Front-End Engineering Design (FEED) phase;

- Substantial reductions in base royalties during the early years of production; and

- Corporate tax exemptions of up to 10 years.

As might be expected, and as announced, the incentives:

"Together ... are designed to support early-stage project economics, improve internal rates of return, and accelerate progress towards Final Investment Decisions".

- Itochu and Larsen & Toubro sign joint development agreement: On August 13, 2025, it was reported widely that Itochu and Larsen & Toubro had signed a joint development agreement to provide a framework to determine the feasibility of the development of the 300,000 metric tonnes a year Green Ammonia production facility at Kandla, in the Indian State of Gujarat.

- Green Ammonia for fertiliser use: Edition 34

of P2N0 reported that

towards the end of July 2025, the results of the

first auction for 75,000 metric tonnes a year of

Green Ammonia (under the National Green

Hydrogen Mission and undertaken by the Solar

Energy Corporation of India Limited (SECI)) were

announced.

SECI is working with the MNRE and the Department of Fertilizers.

During August 2025, the following auction outcomes were reported:- ACME to supply Paradeep Phosphates Limited with 75,000 metric tonnes of NH3 a year at 55.75 rupees per kg (or USD 641 per metric tonne) under a 10-year term contract;

- NTPC Renewable Energy to supply Krishana Phoschem Limited with 70,000 metric tonnes of NH3 a year at 51.80 rupees per kg (or at USD 591 per metric tonne) under a 10-year term contract;

- Oriana Power to supply Madhya Bharat Agro Projects Limited with 60,000 metric tonnes a year at 52.25 rupees per kg (or at USD 596 per metric tonne) under a 10-year term contract;

- SCC Infrastructure to supply Madhya Bharat Agro Projects Limited with 70,000 metric tonnes a year at 53.55 rupees per kg (or at USD 596 per metric tonne) under a 10-year term contract;

- Onix Renewable to supply Gujarat Narmada Valley Fertilisers & Chemicals with 50,000 metric tonnes of NH3 a year at 52.50 rupees per kg (or at USD 596 per metric tonne) under a 10-year term contract;

- Jakson Green Private Limited to supply Coromandel International Limited in Kakinada, Andhra Pradesh with 85,000 metric tonnes of NH3 a year at 50.75 rupees kg (or at USD 579 per metric tonne) under a 10-year term contract;

- ACME to supply Coromandel International with 50,00 metric tonnes of NH3 a year at 52 rupees per kg (or at USD 593 per metric tonne), under a 10-year term contract; and

- Suryam International to supply Madras

Fertilisers Limited with 4,000 tonnes

NH3 a year at 50 rupees per kg (or at

USD 567 per metric tonne).

As announced by SECI, this is the first of a number of auctions to match supply with demand. For further detail about green hydrogen and green ammonia projects see the SECI site.

Comment: The most telling feature of the auction process is the price – remaining at below USD 0.68 a kg (or USD 680 a tonne). In contrast the European Hydrogen Bank action process has seen prices at the €1 a kg price point. In this context, it is important to note that the prices are for fertilizer use, not for energy use.

- Towards Near-Zero Emissions Steel: Modelling-Based

Policy Insights for Major Producers was published during

August 2025 (with support from WRI India, s-curve

economics, Cambridge Econometrics and University of Exeter).

As has been noted previously in P2N0, iron and steel production (together with cement production) is going to continue as the main stay of economic development in countries with continuing population growth and increasing urbanisation. In this context, the publication provides "up-to-the-minute" thinking about the policy settings that may be deployed to avoid, reduce and remove GHG emissions arising from the production of iron and steel. The publication is excellent and well-worth a read for those working in the sector, and the iron and steel value chain more generally. - KSA renewable electrical energy editorial:

During July 2025 there was considerable coverage

of the development of renewable electrical energy capacity and the

increase in the production capacity for green hydrogen and

ammonia.

As this news settled during August 2025, several key points emerged:- As well as being blessed with some of the world's best hydrocarbon resources, the Kingdom of Saudi Arabia (KSA) is blessed with some of the world's best renewable energy resources, solar and wind, critically radiant heat;

- The cost of renewable electrical energy generation in KSA is the lowest in the world, and it makes sense to develop renewable electrical energy to provide electrical energy rather than to use hydrocarbons;

- The policy settings of the KSA recognise this, with the National Renewable Energy Program providing for the development of renewable electrical energy projects with a view to renewable electrical energy providing 50% of the electrical energy demand by 2030;

- To achieve the 2030 renewable electrical energy demand target, it is estimated that 130 GW of renewable electrical energy capacity need to be developed. At the moment, KSA has around 55 GW of renewable electrical energy capacity being developed.

By way of reminder: During July 2025, the following news items provided the basis and the focus for this analysis:

- KSA to develop Neom 2.0: On July 28, 2025, hydrogeninsight (at https://www.hydrogeninsight.com, under Saudi Arabia's second green hydrogen and ammonia plant will be nearly twice the size of 2.2 GW Neom project) reported that Técnicas Reunidas and Sinopec have been engaged to design the Yanbu hydrogen production hub.

- KSA developing renewable energy and hydrogen

exports: On July 21, 2025, it was

reported widely that the KSA had signed a number of agreements to

establish the India-Middle East – Europe Economic

Corridor.

As reported, the agreements include a Joint Development Agreement between ACWA Power and EnBW providing a framework for the development of a hydrogen production hub in Yanbu, on the Red Sea Coast. In addition, ACWA Power signed a Memorandum of Understanding with Edison, TotalEnergies, Zhero Europe and EnBW under which there will be an assessment of the feasibility of exporting renewable energy from KSA to Europe. - KSA awards concessions for 15 GW of photovoltaic and

wind projects: On July 13, 2025, it was reported widely

that KSA had signed agreements for the development of seven new

renewable energy projects. The agreements were signed under the

National Renewable Energy Program, administered by the

Ministry of Energy.

The agreements signed by ACWA Power in consortium with Badeel (owned by PIF) and Aramco Power (owned by Saudi Aramco).

As reported, the seven projects, with a total capacity of 15,000 MW, will cost USD 8.3 billion to develop.

They are:

- five solar energy projects: Afif 1 – 2,000 MW; Afif 2 – 2,000 MW; Humaij – 3,000 MW; Bisha – 3,000 MW: Khulis – 2,000 MW; and

- two wind energy projects: Starah – 2,000

MW; and Shaqra – 1,000 MW.

This continues the Ministry of Energy's investment under the National Renewable Energy Program. To the end of 2024, 10 renewable energy projects had been developed, with 6,150 MW of photovoltaic solar and 400 MW of wind.

- Tracking Renewables Progress in the KSA: With renewable projects progressing rapidly in Saudi Arabia, the Kin Abdullah Petroleum Studies and Research Center has developed a KSA Renewables Tracker which shows solar and wind energy projects under development or tender and operation stages. Renewable Vision has also developed a visual representation of renewable energy projects in Saudi Arabia, which can be accessed here.

- Tracking Data Centers in the KSA: Along with

renewable projects, data center projects are also progressing

rapidly in Saudi Arabia. Renewable Vision has

developed a Saudi Data Center Tracker that details each

data center project in Saudi Arabia. Currently, it shows 24 live

sites (~620 MW), 11 builds underway (~380 MW) and a further 13 in

the pipeline (~600 MW), with Riyadh alone set to capture 55 % of

near‑term capacity. If all announced projects are developed,

Saudi data center demand would be around 1.6 GW by 2030.

- Google USD 9 billion investment: On August 28, 2025, it was reported widely that Google is developing a new campus near Richmond, Chesterfield County, Virginia, and is expanding existing capacity elsewhere. As reported, Google is to invest USD 9 billion on the new campus and the expansion of capacity in Loudoun County and Prince William County.

- CM3 from tailings: On

August 21, 2025, it was reported widely that

Colorado School of Mines had published a paper in

Science, that assesses the potential to derive

CM3 and REEs from

tailings. For those familiar with the mining of certain metals and

minerals, the mining process results in tailings, hitherto regarded

as residue and waste. It has long been accepted that tailings

contain metals and minerals that were not mined as part of the

primary mining operations.

Edition 32 of P2N0 reported on the cooperation of by the US Geological Survey, Geoscience Australia, and Geologic Survey of Canada to collate data and information. It is good to see that the data and information collated is being put to good use. The headline takeaway from the Colorado School of Mines is that secondary mining operations, i.e., mining tailings, could derive sufficient CM3 and REEs to match demand in the US for all but two CM3, platinum and palladium. As ever, the issue is cost of production, not demand!

- Meta and Entergy agree on gas-fired power solution: On August 21, 2025, it was reported widely that Meta is to develop a USD 10 billion data center in the US State of Louisiana with the electrical energy to be supplied by Entergy using 2.25 GW of electrical energy generated from the new build gas-fired power generation.

- Google to develop SMR in Tennessee: On August 18, 2025, it was reported widely that Google, working with Kairos Power and the Tennessee Valley Authority (TVA), is to develop a small modular reactor in Oak Ridge, Tennessee, to generate up to 50 MW of nuclear energy to be supplied to power Google's cloud hosting, cloud storage and AI tools in Tennessee and Alabama. As reported, under a power purchase agreement, TVA will purchase electrical energy from Kairos Power, and that electrical energy will be supplied to Google.

- Applied Digital to develop 280 MW data center: On August 18, 2025, it was reported widely that Applied Digital is to commence the development of its 280 MW AI data center near Harwood, North Dakota, in September 2025. As reported, the USD 3 billion project will evolve into "an epicenter for the development of AI" in Cass Country, North Dakota.

- Glencore seek funding support for Argentina copper projects: On August 18, 2025, it was reported widely that Glencore plc had applied for the inclusion of two copper projects in the Argentinian investment incentive program (Rigi). Gary Nagle, CEO of Glencore stated that the Rigi framework provides a "key catalyst to attract major foreign investment to the country".

- Equinix to develop nuclear capacity to power AI data

centers: On August 14, 2025, The Register

(at https://www.theregister.com,

under Equinix signs deals for nukes and fuel cells to

power its AI bit bins) reported that Equinix is partnering with

Oklo and Radiant Industries to

provide a framework for the development of nuclear energy

capacity.

Oklo and Radiant Industries are part of the US Department of Energy (DOE) Nuclear Reactor Pilot Program. In addition, The Register reports that Equinix has signed a letter of intent with ULC Energy for up to 250 MW and Stellaria for up to 500 MW of nuclear energy under power purchase agreements.

[Note: On September 2, 2025, it was reported widely that the project was to undertake a review following a judicial decision impacting the development of the project.] - EIA predicts that US electrical energy use will reach record levels in 2025 and 2026: On August 13, 2025, the estimates of the Energy Information Association (EIA), contained in its short-term energy outlook, were reported widely. In 2025, electrical energy demand will increase to 4,186 TWh (4.186 billion kWh), and in 2026 to 4,284 TWh (4,284 billion kWh). The EIA finds that the increase in demand for electrical energy is a function of increased demand from AI and cryptocurrency capacity development and increased use of electrical energy for heating and transport.

- Federal US Government proposed USD 1 billion in funding

for CM3: On August 13, 2025,

the US Department of Energy (DOE) announced (at

energy.gov, under Energy Department Announces Actions to Secure

American Critical Minerals and Materials Supply Chain) its

intention to offer funding opportunities, worth nearly USD

1 billion, "to advance and scale mining, processing,

and manufacturing technology across stages of the critical minerals

and materials supply chain".

Key components of the funding plan include:- USD $500 million allocated to the Office of Manufacturing and Energy Supply Chains (MESC) to advance battery materials processing, manufacturing, and recycling projects. This will support scaling up U.S. capabilities in producing key battery minerals;

- USD $250 million toward transforming industrial sites, including coal plants and waste facilities, to produce mineral byproducts and enable byproduct recovery;

- USD $135 million dedicated to strengthening rare earth element supply chains, particularly by demonstrating commercial feasibility of recovering rare earths from mining waste and tailings;

- USD $50 million aimed at refining and alloying critical materials such as gallium, germanium, and silicon carbide, crucial for semiconductors and rare earth magnets; and

- Funding through, Advanced Research Projects Agency-Energy (ARPA-E)'s, RECOVER program to extract minerals from industrial wastewater and other waste streams, promoting innovative recycling methods.

- Panasonic reaches a higher register: On August 10, 2025, it was reported widely that Panasonic had opened the largest battery manufacturing facility in the world, in De Soto, in the US State of Kansas. The USD 4.2 billion facility will produce batteries for EVs and for business and residential use.

- OXI closing in on DACs operation: On

August 8, 2025, it was reported widely that

Occidental's direct air capture

(DAC) two train Stratos Facility,

in Ector County, Texas, is progressing towards

operation. As reported, the two trains, in combination, have the

capacity to remove annually 500,000 metric tonnes

of CO2 from the climate system.

The CEO of Occidental, Vicki Hollub, noted that: "The timing is perfect as there is growing momentum behind direct air capture to generate meaningful value from enhanced oil recovery, or EOR, in carbon dioxide removal credits".

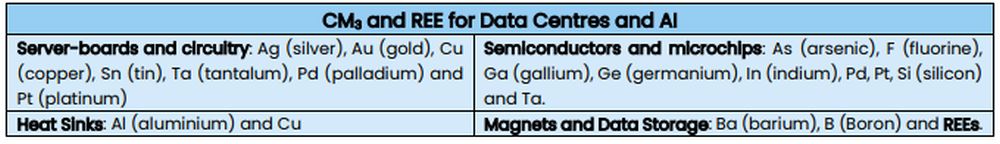

By way of reminder: Edition 34 of P2N0 (under 45Q Tax Credit for CCS)reported that: On July 4, 2025, the final form of modifications to the 45Q tax credit passed into law.

In summary, the position is now as follows:

The key change from the Inflation Reduction Act is to provide for a 45Q Tax Credit for CO2 used to achieve EOR. The extension of the 45Q Tax Credit for CO2 may result in investment in EOR to allow capture of CO2 to use in EOR.

In support of these CCS initiatives, The Primacy Certainty Bill (PCB) has been introduced. The PCB is intended to facilitate the development and deployment of CCS, among other things, providing for state primacy, i.e., state regulation of Class IV wells and the amendment of the Safe Drinking Water Act. - US States considering how to ring-fence regular folk from increased electrical energy prices: On August 10, 2025, 2KUTV (at kutv.com, under Utah among states reviewing data center power impact on household bills) reported that a number of US States are considering how they might insulate regular households and businesses from the impact of increased electrical energy prices arising from increased electrical demand, principally from data centers.

- PJM Interconnection paying high prices for electrical energy: On August 6, 2025, Inside Climate News (at https://insideclimatenews.org, under Why Prices Are Soaring in the Country's Largest Grid Region, Explained in 5 Charts) reported that PJN Interconnection is experiencing high prices in its auction process, which matches electricity demand across its grid with supply. These elevated prices were driven by a combination of hot weather and increasing electricity demand, primarily from energyintensive data centers.

- Curbing demand for electrical energy demand:

On August 4, 2025, it was reported widely that

Google had agreed with Michigan

Power and Tennessee Power Authority to

manage demand for electrical energy at data centers by managing

demand for electrical energy across grids.

Comment: As will be apparent from news items in this Edition 35 of P2N0 and other news items, demand for electrical energy from data centres is outstripping the rate at which new electrical energy capacity is being developed and deployed, leading to a need for demand management (to avoid load shedding) and upward pressure on electrical energy prices.

- Fermi America and Hyundai Engineering and Construction (HEC) sign MOU: On August 1, 2025, Interesting Engineering (at https://interestingengineering.com under Nuclear-powered grid to fuel AI data centers in landmark Texas HyperGrid project) reported that Fermi America and HEC had signed a memorandum of understanding (MOU) to provide a framework for them to work together on planning, FEED and the EPC for a nuclear power plant development as part of the plans of Fermi America to develop its HyperGrid campus in Amarillo, Texas.

- Georgia Power proposes 10 GW expansion: On

August 1, 2025, AJC (at https://www.ajc.com, under Georgia Power's massive data center expansion

includes a lot of gas) reported that Georgia

Power intends to expand its generation capacity by

10 GW, including to supply power to data centres.

The intended expansion is proposed in two phases.

- The first phase involves the addition of 2 GW by 2027, including BESS and increased natural gasfired capacity; and

- The second phase involves the development of

8 GW between 2028 and

2031, at a cost of USD 15

billion, including gas-fired generation capacity –

Plant Bowen, near Cartersville, Plant McIntosh

near the Georgia-South Carolina border, and

Plant Wansley, near Newnan, BESS

and photovoltaic solar capacity.

- From HFO to HVO: One of the key issues for data centres is security of electrical energy supply, and diesel fuel gensets remain key. On August 27, 2025, The Business Times (at https://www.businesstimes.com, under Microsoft, and Rolls-Royce Power Systems push treated vegetable oils to green Singapore's data centres) reported that Microsoft and Rolls-Royce were promoting the adoption of hydrotreated vegetable oil (HVO) as a sustainable fuel to displace diesel as a back-up fuel. It will be interesting to follow this initiative.

- China to accelerate the roll-out and roll-up of its

carbon market: On August 26, 2025, it was

reported widely that China by 2030 will have "a transparent,

standardized and internationally aligned voluntary carbon

market". It is understood that this policy setting is endorsed

by both the Chinese Communist Party and the State Council.

By way of reminder: China started its national carbon market in July 2021, with the market applying to the electrical energy sector, with aluminium, cement and iron and steel industries to be subject to the market during 2025. The Chinese national carbon market currently operates primarily on an intensitybased allocation system, distributing emissions allowances based on output and emissions efficiency, rather than imposing an absolute emissions cap. A move to an absolute emissions cap scheme is likely. - POSCO to develop Green Steel Project at Port

Hedland: During August 2025 it was

reported widely that POSCO had obtained

environmental approval for the development of a Direct

Reduced Iron (DRI) iron and steel production facility in

Port Hedland in the Pilbara Region of Western Australia. The

DRI facility will produce hot briquetted

iron (HBI) along with iron ore pellets.

The Pilbara region of Western Australia continues to provide iron ore for export. A recent discovery valued at USD 6 trillion illustrates that the role of the Pilbara region is not going to lessen. In addition, the Pilbara region has world class radiative heat sources, and as such is able to produce and to supply green electrical energy to produce green hydrogen. - Gentari and Gamuda looking good: On

August 25, 2025, it was reported widely that

Gentari (the green limb of PETRONAS) and

Gamuda are to develop jointly 1.5 GW photovoltaic

solar and BESS capacity under Malaysia's Corporate

Renewable Energy Supply Scheme (CRESS).

In a joint statement, Gentari and Gamuda noted:

"As ... critical facilities for cloud computing, AI and digital services, hyperscale DCs ... are projected to require 5GW of reliable power by 2035". - On August 24, 2025, The Straits Times (at https://www.straitstimes.com, under World's largest facility to help remove CO2 from the ocean to begin operations in S'pore in 2026) reported that the Equatic1 demonstration plan in Tuas, a cooperative initiative between the Public Utilities Board (PUB) and Equatic, is to commence operation of its "ocean-based carbon removal technology" demonstration plant during 2023. As reported, the technology derives dissolved CO2 from seawater, with the CO2 removed then stored. The "decarbonated" seawater is then discharged back into the ocean, and (the theory is), is that "decarbonated" seawater is then able to absorb CO2.

- 3 GW of renewable energy projects in Sarawak: On August 20, 2025, it was reported widely that Blueleaf and Chemsain had signed a memorandum of understanding (MoU) to provide a framework for the development of up to 3 GW of renewable electrical energy projects across the Malaysian State of Sarawak.

- Singapore continues GHG emission progress: On August 19, 2025, the Republic of Singapore and Kingdom of Thailand signed an Implementation Agreement to provide a framework for Singapore to acquire carbon credits from Thailand. This is Singapore's first Article 6 agreement with another ASEAN nation.

- Australia launches BBI: On August 20, 2025, it was reported widely that the Federal Australia Government had launched, officially, its AUD 500 million Battery Breakthrough Initiative (BBI). The launch was marked by the Australian Renewable Energy Agency (ARENA) opening the application process for funding under the BBI. The BBI is intended to boost investment, and as such, capacity, in battery manufacturing.

- Green light for green H2 and NH3 project: On August 18, 2025, hydrogeninsight (at www.hydrogen.com, under Second-largest in China State-owned firm to build giant 2.2GW green hydrogen-to-ammonia project) reported that China Energy Investment Corporation had been given the green light to develop a 2.2 GW green hydrogen-to-ammonia project. As reported, the project will cost around USD 1.8 billion to develop and will produce up to 1.35 million metric tonnes of green hydrogen a year.

- Indonesia up in lights: On August 11, 2025, it was reported widely that Indonesia plans to develop and to deploy 80 GW of renewable electrical energy capacity across 80,000 villages. The development and deployment of the 80 GW of remote (off-grid) photovoltaic solar capacity will be accompanied by the development of 20 GW of centralised (on-grid) PV capacity.

- Sarawak steps up to transition: On

August 11, 2025, it was reported widely that

Sarawak had published its Sarawak Energy Transition Policy

(SET-P). The SET-P sets-up seven

strategic structures: 1. Clean Hydrogen;

2. CCS and CCUS; 3. Energy

Efficiency; 4. Low Carbon Mobility;

5. Natural Gas; 6. Alternative Energy; and 7.

Renewable electrical energy. The publication is excellent and is

well worth a read for those developing policy settings, and those

implementing them.

Comment: The SET-P takes the thinking in the IEA and IRENA roadmaps, and places it firmly in the context of Sarawak, and its decarbonisation and economic development context.

Roadmap IEA Seven strategic structures of the IEA Roadmap are: - Energy efficiency

- Behavioral change

- Electrification

- Renewables

- Hydrogen and hydrogen-based fuels

- Bioenergy and land use change

- Carbon capture, utilization, and storage (CCUS)

IRENA Six strategic structures of the World Energy Transitions Outlook (WETO) are:

- Energy conservation and efficiency

- Renewables (power and direct uses)

- Electrification of end use (direct)

- Hydrogen and its derivatives

- Carbon capture and storage (CCS), and CCUS in industry

- Bioenergy with CCS and other carbon removal measures

- National Energy Administration (NEA) announced 8 green ammonia / methanol projects: On August 11, 2025, it was reported widely that the China NEA had granted priority project status to eight "green liquid projects", with these projects entitled to seek funding support for the development cost of the projects. Each project is required to achieve production (at high and stable levels) by 2027.

- Biggest BESS comes on-line: During the first

week of August 2025 the nameplate 850 MW

Waratah Super Battery "came on-line", providing

350 MW / 700 MWh of capacity now, and at its full nameplate

capacity of 850 MW / 1700 MWh by the end of 2025. The world's

Biggest BESS will provide integrity and stabilisation services

under the System Integrity Protection Scheme

(SIPS). Not only is the Waratah Super Battery the Biggest

BESS, its scale and functionality is world scale in the context of

providing integrity and stabilisation services.

Comment: Since the end of 2017, when the State of South Australia procured the supply of 100 MW of BESS from Tesla, Australia has led the world in the development of BESS capacity and its deployment across the national grid to allow the continued development and deployment of photovoltaic solar and wind capacity.

- Australia roof-top solar "sky's the

limit": On August 7, 2025, the good

folk at Renew Economy (at https://reneweconomy.com.au

under Australia leads the world on rooftop solar, now it

needs to catch up with how to manage it) reported that by 2050,

Australia is expected to have 55 GW of roof top solar by 2035, and

would have 115 GW of installed rooftop solar

capacity by 2050, providing up to 100 TWh of

distributed electrical energy supply. This means that the national

grid will have periods of time during which electrical energy will

flow upstream from that distributed electrical energy

capacity

How to address the changed and ever-changing dynamics is addressed in five reports (under Navigating to the Future Grid). The reports are well-worth a read.

On August 13, 2025, the good folk at onestepoffthegrid (at https://onestepoffthegrid.com.au, under Home battery installs near 30,000 as rebate delivers six-months of uptake in six weeks) reported that 28,000 photovoltaic energy storage systems had been installed in six weeks since the Australian Federal Government launched the Cheaper Home Batteries Rebate. - China continues to break records:

- On August 21, 2025, it was reported widely that CO2 emissions in China has reduced during the first six months of 2025 (H1) by up to 3% from the generation of electrical energy; and

- During the first week of August 2025, it was

reported widely that during H1 of

2025, China had installed a further 268

GW of photovoltaic solar (212 GW) and wind (56 GW)

electrical energy capacity (taking the capacity for photovoltaic

solar and wind to close to 1,650 GW of installed capacity).

By way of comparison, in the first six months of 2025, China:

- generated more than 500 TWh of electrical energy from photovoltaic solar sources, broadly stated a little more than the demand for electrical energy in Japan; and

- installed more photovoltaic solar capacity (of 212 GW) than the

US has installed to date.

Taken with other renewable energy capacity, China has nearly 2,200 GW (or 2.2 TW) of renewable electrical energy.

- Northern Lights are all green: On

August 25, 2025, it was reported widely that the

Northern Lights Project had injected its first CO2

to effect storage permanently. For Equinor, Shell

and TotalEnergies, this marks the successful

development of Phase 1 of the Northern

Lights Project as part of the Long Ship

Project backed by the Government of Norway.

As reported, the CO2, captured at the Heidelberg Minerals cement plant, in Breivik, Norway, transported to the Northern Lights Project consolidation and storage facilities Øygarden, Norway, and then sent out 100 km for injection 2,600 metres below the sea-floor of the Norwegian sector of the North Sea.

The injection of CO2 marks the start of Phase 1 of the Northern Lights Project, under which 1.5 million metric tonnes of CO2 will be injected each year. As noted previously, one of the privileges of working in the decarbonization and energy transition sector is that one gets to watch the development of projects from acorn to oak.

- No showstoppers to H2 pipeline from North Africa to

Europe: On August 18, 2025,

hydrogeninsight (at https://www.hydrogeninsight.com,

under "No showstopper identified" / Five gas

pipeline operators complete study on 3,400 hydrogen corridor)

reported that five transmission service operators (TSOs),

Eurstream (Slovakia), Net4Gas

(Czechia), OGE (Germany), Snam

(Italy) and TAG (Austria) had concluded that there

are no showstoppers to the development of the SunsHyde

Corridor.

As reported, the conclusion is that the SunsHyde Corridor can be developed by 2030, with capacity of 450 GWh a day (or 5 million metric tonnes a year). The SunsHyde Corridor will comprise 85% repurposed pipeline systems.

- Fallout from Second EHB Auction: During

August 2025, some of the successful bidders for

funding support under the second auction undertaken by the

European Hydrogen Bank have not taken up the

funding support on offer. These are:

- Deutsche ReGas' 210MW H2-Hub Lubmin in Germany;

- Zeevonk's 560 MW electrolyser in the Netherlands led by CIP and Vattenfall; and

- Catalina's 500 MW project in Spain developed by CIP and

Enagás Renovable.

Project developers seeking subsidies from the European Hydrogen Bank must begin hydrogen production within five years of signing their grant agreements, effectively setting most project completion deadlines around 2030.

The European Commission confirmed that unclaimed funds from the second auction will be reassigned to reserve projects narrowly missed selection during the process.

By way of reminder, on May 20, 2025, the European Union announced the results of the second auction for RFNBO Hydrogen in the Results of the IF 24 RFNBO Hydrogen Auction. The second auction was seeking to procure RFNBO Hydrogen in a general category and in a maritime category. As announced, 61 bids were received from 10 different European Economic Area (EEA) countries amounting to 6.3 GW of electrolyser capacity, with a total bid value of €4.48 billion in the general category and €399 million in the maritime category.

- 100 more Data Centres projected in the UK: On

August 15, 2025, The BBC (at https://www.bbc.com, under Data Centres to be expanded

across UK as concerns mount) reported that the estimated 477 data centres in the UK is to increase by around 100 in the near to near to medium term, i.e., within the next five years. Among the data centres identified are a £10 billion AI data centre in Blyth, near Newcastle upon Tyne (to be developed by Blackstone Group), four data centres planned by Microsoft, with two in the Leeds area, one in Newport, Wales, and one in Acton, Greater London. Google is developing a £740 million in Hertfordshire. - Governor of Svalbard plans SMR: On August 14, 2025, World Nuclear News (at https://www.worldnuclear-news.org, underPlans for SMW on Svalbard progress) reported that the Governor of Svalbard is considering the development of a small modular reactor (SMR) to keep on the northern lights. The SMR being proposed is the Longyearbyen project.

- Switzerland to lift ban on new nuclear power capacity: On August 14, 2025, it was reported widely that Switzerland's Federal Council had introduced draft legislation to lift the ban on the development of nuclear energy capacity.

- EU plans to invest USD 30 billion on data center developments: On August 12, 2025, energyreporters (at https://www.energy-reporters.com, under "They're Building Data Fortresses For AI"; EU unveils $30 Billion Plan For Gigawatt Centers Housing 100,000 GPUs Each To Rival US And China) reported that the European Union plans to invest up to USD 30 billion "in a groundbreaking initiative to construct a network of high-capacity AI date centers". This investment is intended to maintain (some may say to catch-up) parity with the US and China.

- EC publishes guidance document on Deforestation

Regulation: On August 12, 2025, the

European Commission (EC) published a Guidance Document for Regulation (EU) 2023/1115 on

DeforestationFree Products.

This non-binding guidance aims:- to avoid that the listed products Europeans buy, use, and consume contribute to deforestation and forest degradation in the European Union (EU) and globally;

- to reduce carbon emissions caused by EU consumption and production of the relevant commodities by at least 32 million metric tonnes a year; and

- to address all deforestation driven by agricultural expansion

to produce the commodities in the scope of the regulation, as well

as forest degradation.

The guidance clarifies key definitions such as "placing on the market" and "making available on the market," and elaborates on due diligence obligations including traceability, risk assessment, and mitigation measures.

- Germany continues to accelerate renewable sources: On August 7, 2025, it was reported widely that on August 6, 2025, the Federal German Government had released draft laws for debate in the Federal Parliament, including to accelerate the rate of development and deployment ofgeothermal energy production and offshore wind field capacity.

- Germany continues to develop Carbon Dioxide Storage Law: On August 6, 2025, the Federal German Government approved draft amendments to the Carbon Dioxide Storage Law. As understood, the draft amendment will allow Germany to use CCS and CCUS for the purposes of achieving its GHG emission avoidance, reduction, and removal targets, and to provide for the development and use of pipelines to allow the transportation of CO2. In effect, the Carbon Dioxide Storage Law supports the large-scale commercialization of CCS and CCUS in Germany.

- Germany offshore wind field tender becalmed: On August 6, 2025, it was reported widely that the most recent bid-round for the award of offshore wind field concessions had not attracted any bids. Industry bodies, including the German Offshore Wind Energy Association (BWO) and WindEurope, expressed concerns, attributing the lack of participation to the auction's negative bidding model that exposed developers to financial risks without guaranteed revenue.

- Over 50% of electrical energy in UK renewable: In late July 2025, the UK Government (Department for Energy Security & Net Zero) announced that during 2024, over 50% of the UK's electrical generation came from renewable sources for the first time. For more detail, see Digest of UK Energy Statistics (DUKES) 2025 at https://www.gov.uk).

HELPFUL PUBLICATIONS AND DATA BASES

In addition to publications covered by this edition of P2N0, the most noteworthy publications read by the author during August 2025 are:

- From pilots to practice: Methanol and ammonia shipping

fuels: During August 2025, the good folk

at the Global Maritime Forum published From pilots to practice: Methanol

and ammonia shipping fuels.

The publication is excellent, providing a clear-sighted perspective on the progress made to date across the ammonia and methanol supply chains, and the fact that the pace of progress needs to increase to ensure that supply matches demand by 2030. As with many aspects of progress to net zero, the ammonia and methanol value chains have bottlenecks and pinch points. - State of the art: CCS Technologies 2025: During July 2025, the good folk at the Global CCS Institute published State of the art: CCS Technologies 2025. The publication is worth a read, providing a punchy summary of CCS technologies.

Footnotes

1 Carbon Capture and Storage involves the capture of CO2 that would otherwise be emitted to the climate system and the storage of that CO2 (sequestration) permanently and securely in a geological formation. This avoids the emission of CO2 into the climate system. Carbon Capture and Use involves the capture of CO2 that would otherwise be emitted to the climate system, and the use of it for an industrial use, including to produce products that do not store CO2 permanently.

2 Carbon Dioxide Removal involves the removal of CO2 that is already in the climate system (from the climate system) and the storage of the CO2 in a more stable form of carbon, which is not permanent. This removes CO2 emissions already in the climate system.

3 Each Current State of Play will address key and current risk. For example, one of the key risks of CDR is the risk of loss of the substance in which the CO2 removed is stored and the ongoing impact of that loss. To address this risk, a draft standard, Addressing nonpermanence / reversal has been released by the UNFCCC. The key proposal in the draft standard is that each project that may be subject to a reversal in sequestration must contribute to a Reversal Risk Buffer Pool a percentage of their emissions units (carbon credits) under Article 6.4, which carbon credits are cancelled if a reversal occurs.

4 The Joint Credit Mechanism is a bilateral carbon market mechanism involving Japan and a host country. It seeks to facilitate transfer of low carbon technologies and implementation of mitigation actions that enables developing countries to achieve sustainable development. As of August 2025, a JCM partnership document has been signed with 31 countries.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]