- within Insolvency/Bankruptcy/Re-Structuring and Law Department Performance topic(s)

This edition of the Automotive Industry Spotlight will focus on the current landscape of electric vehicle (EV) charging infrastructure.

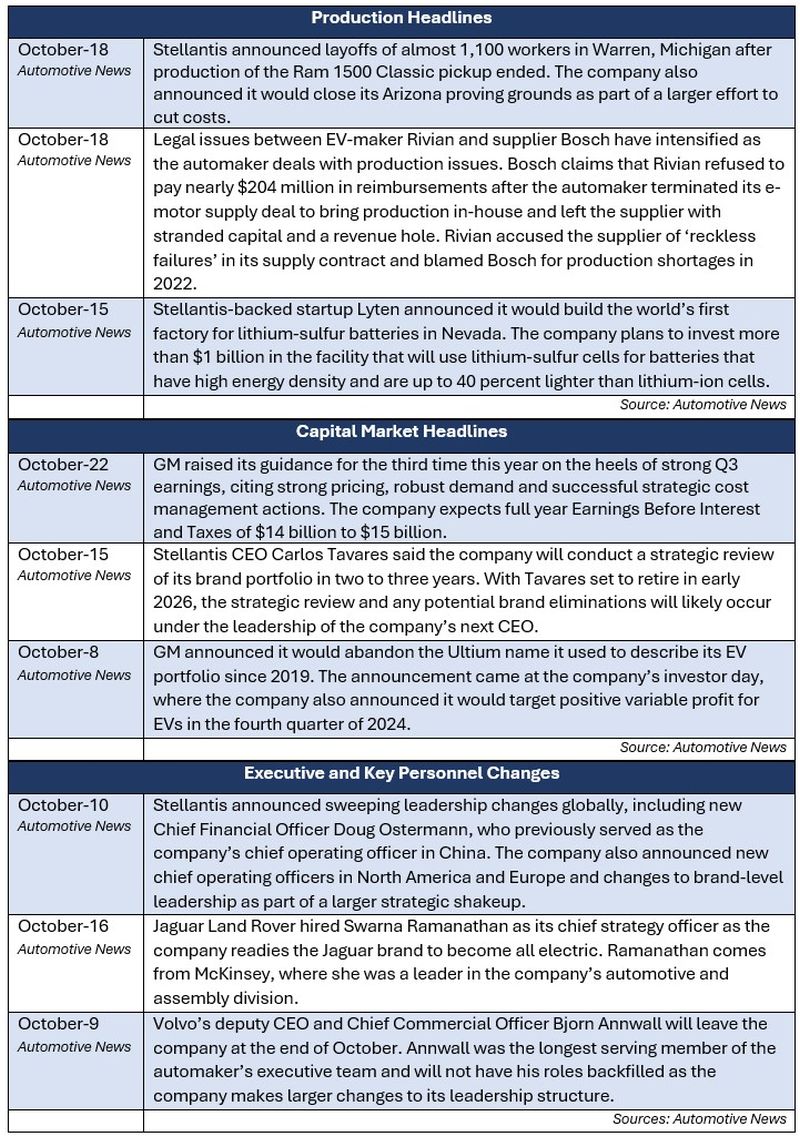

In industry news, the $204 million Rivian and Bosch dispute escalates as Rivian faces production issues. GM raises 2024 earnings guidance for the third time this year, citing strong pricing, robust demand and successful strategic cost management initiatives. Stellantis announces sweeping leadership changes globally, including new COOs across North America and Europe amidst broader changes to its leadership structure.

In regulatory news, BMW announces a recall of 700,000 vehicles in China related to a coolant pump defect, which could result in potential fire risk. The National Highway Traffic Safety Administration (NHTSA) launches an investigation into Tesla's full self-driving software due to four reports of collisions linked to the software. Honda announces a recall of 1.7 million North American vehicles, citing steering difficulties resulting from an improperly produced steering gearbox.

Industry Focus: EV Charging Infrastructure in the U.S.

As excitement around EVs cools, one thing is clear: the lack of robust public charging infrastructure continues to be a major barrier to mass adoption. Consumers still hesitate to make the switch, citing the infamous "range anxiety"1 — the fear that they won't be able to find an operable charging station before their battery runs out. In addition, consumers dread the prospect of having to wait thirty minutes or more for their vehicle to charge. For years, automakers and government agencies have been pushing forward initiatives to change that, but lots of roads will need to be covered to meet larger EV charging goals.

Government programs, like the Bipartisan Infrastructure Law, have funneled billions into EV infrastructure. Automakers are continuing their own investments into solutions for the problem as well, partnering with charging networks to make EVs more convenient. Still, the current state of charging infrastructure suggests we're far from the goal of making charging stations as ubiquitous as gas stations. Stakeholders across the EV supply chain anxiously await the results from the 2024 U.S. presidential election, which could result in very different outcomes for the broader EV market.

The Road to 500,000 Charging Ports

The Bipartisan Infrastructure Law, passed in 2021, allocated $7.5 billion to help states build the infrastructure needed to reduce range anxiety and push EV adoption. Of that, $5 billion was set aside for the National Electric Vehicle Infrastructure (NEVI) plan. NEVI aims to establish EV charging stations every 50 miles along major U.S. highways, with a target of 500,000 chargers by 2030.2

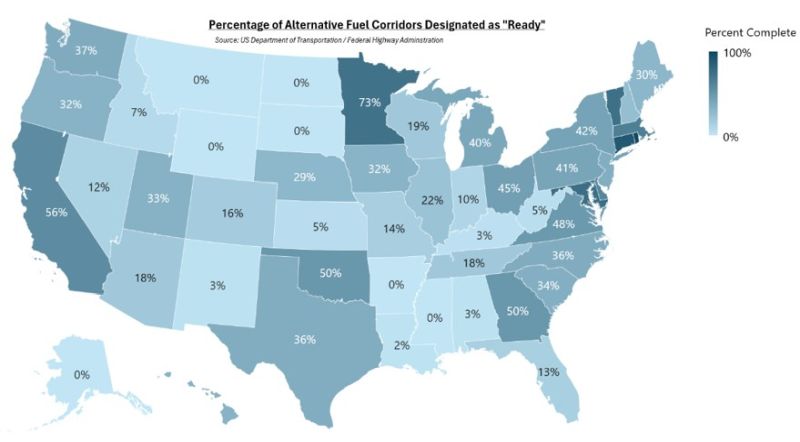

The most recent data from the U.S. Department of Energy reports that there are only about 67,000 public charging stations nationwide, which house approximately 187,000 chargers.3 However, only about 79,000 public chargers are active across the US.3 In order to meet the goal of 500,000 public charging ports by 2030, the number of EV chargers would need to increase at a compounded annual growth rate of nearly 36 percent between now and 2030; the average annual growth rate between 2014 and 2023 was 22.4 percent.3 Furthermore, the Bipartisan Infrastructure Law allocates responsibility to the states for building out EV infrastructure, and most states are falling behind on their respective targets. The following map illustrates the progress states have made toward their share of establishing the alternative fuel corridor on interstate highways.

Even with billions in federal funding and original equipment manufacturer (OEM) investment, there are regulatory and logistical hurdles that make building out charging infrastructure a slow, often frustrating process. Installing a public charger involves navigating a maze of permits, approvals and zoning laws, and delays are common. Additionally, states are inconsistent in how they prioritize EV infrastructure, leading to disparities in progress. Some states, particularly those in the Midwest and South, lag more EV-friendly states like California.

Policymakers are trying to address some of these issues. For instance, the Department of Energy recently announced a conditional $1.05 billion loan guarantee for EVgo, an EV charging infrastructure company, to deploy 7,500 charging ports across 1,100 U.S. charging station locations.4 This move aims to accelerate the installation of charging infrastructure, including fast charging technology, but OEMs and other private stakeholders continue with their own initiatives.

OEMs and Charging Providers

While government programs and incentives will provide a meaningful impact to EV charging infrastructure over time, OEMs and other stakeholders will need a faster solution to hopefully aid in reversing sluggish EV demand. Several major OEMs have struck deals to improve EV charging access. For example, last year Ford announced a partnership with Tesla, giving Ford EVs access to Tesla's extensive supercharger network.5 Additionally, GM has teamed up with Pilot Company — the interstate travel and fuel center operator — to install up to 2,000 high-power fast chargers along U.S. highways in plans for a coast-to-coast EV charging network.6

The addition of new charging ports and stations will continue to be positive momentum for broader EV adoption, which should benefit the OEMs by way of increased EV sales over time. Acknowledging this, the need for standardized charging technology has also been identified as a key area for development. As a result, most of the major OEMs and third-party charging infrastructure providers have made the commitment to adopt the North American Charging Standard (NACS) inlet on their future production of EVs and charging ports.7 Prior to this commitment, there had been a variety of charging inlets on the market, which furthered the issue of range anxiety as compatibility with chargers was not standard. Collaboration among OEMs and third-party charging infrastructure providers should continue over the next several years of infrastructure build up and all stakeholders, including consumers, should realize benefits from increased standardization and accessibility in EV charging infrastructure.

2024 Presidential Election: A Potential Sea of Change

With the 2024 U.S. presidential election coming soon, stakeholders across the automotive industry are anxiously awaiting the results to react to potentially significant policy changes. Automakers and suppliers alike have delayed key EV investment decisions until after the results of the election are finalized.8 Our previous coverage on the topic noted that a Harris/Walz administration would likely continue the Biden administration's rules on vehicle emissions, which are estimated to require electric vehicles representing between 30 percent and 56 percent of vehicle sales by 2030-2032.9 Meanwhile, a Trump/Vance administration would likely significantly change emission guidelines, resulting in less pressure on automakers to ramp up EV production and reduce production of internal combustion engine (ICE) vehicles. Furthermore, former President Trump has indicated he sees a much smaller market in the near- to mid- term future for EVs due to the losses most OEMs are incurring on EVs and battery range issues.10

The momentum behind EVs and supporting infrastructure could change drastically depending on the outcome of the presidential election. The large-scale buildout of a national charging network would reliably continue under a Harris/Walz administration, and OEMs and others in the EV supply chain would potentially receive continued increased levels of support to grow their own charging network, which would allow further progress towards scale and profitability in the EV market. Conversely, a Trump/Vance administration would potentially put the federal funds allocated to a national charging network at risk, which may lead OEMs to rethink their EV production goals — particularly when considering OEMs lose approximately $6,000 on each EV sold.11

Sources

1. EY Mobility Consumer Index shows US less likely to purchase an EV than last year. https://www.ey.com/en_us/newsroom/2024/09/us-consumers-less-likely-to-purchase-an-ev-than-last-year

2. US Department of Transportation / Federal Highway Administration. https://highways.dot.gov/newsroom/biden-harris-administration-celebrates-opening-nations-first-nevi-funded-ev-charging

3. Sherwood News: The biggest barrier to the mass adoption of electric vehicles is charging them. https://sherwood.news/tech/ev-chargers-2030-infrastructure-goals-struggle/

4. Department of Energy / Loan Programs Office. https://www.energy.gov/lpo/articles/lpo-announces-conditional-commitment-evgo-deploy-nationwide-ev-fast-charging-network

5. Ford: Customers can now charge on Tesla Superchargers in U.S., Canada. https://media.ford.com/content/fordmedia/fna/us/en/news/2024/02/29/ford-customers-can-now-charge-on-tesla-superchargers-in-u-s---ca.html

6. Automotive World: Pilot Travel Centers LLC, General Motors, and EVgo make convenient, accessible charging a reality with opening of first stations in coast-to-cost EV charging network. https://www.automotiveworld.com/news-releases/pilot-travel-centers-llc-general-motors-and-evgo-make-convenient-accessible-charging-a-reality-with-opening-of-first-stations-in-coast-to-coast-ev-charging-network/

7. The International Council on Clean Transportation: Public EV charging in the United States is about to get a whole lot easier. https://theicct.org/public-ev-charging-in-the-us-get-easier-feb24/

8. Automotive News: Toss-up election leads companies to delay investment decisions until after November. https://www.autonews.com/mobility-report/presidential-election-outcome-weighs-industrys-ev-plans

9. Automotive News: EPA eases ramp-up for vehicle emissions rule to address industry concerns. https://www.autonews.com/regulation-safety/epa-finalizes-auto-tailpipe-rule-slower-ev-pace-amid-criticism

10. Reuters: Trump says he may end EV tax credit; is open to naming Elon Musk as an adviser. https://www.reuters.com/world/us/trump-says-he-would-consider-ending-7500-electric-vehicle-credit-2024-08-19/

11. Automotive News: Automakers lose about $6,000 on every EV they sell. https://www.autonews.com/mobility-report/every-ev-leads-6000-losses-automakers-bcg-says

Additional October insights are included below.

Industry Update

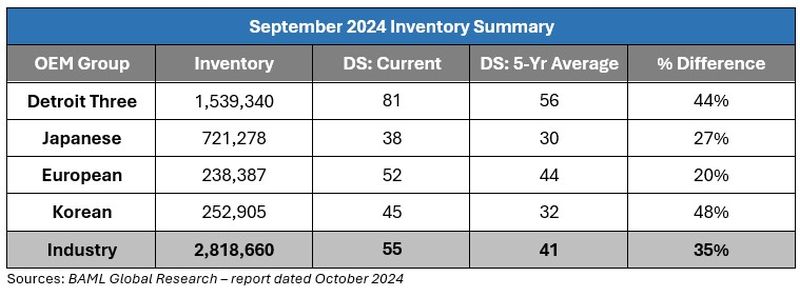

September inventory levels ended at 2.819 million units, a 119,000-unit increase from August. Days' supply closed at 55, approximately 35 percent above the five-year average. GM, plus 11,000 units, and Ford, plus 57,000 units, led the way for domestic increases while Stellantis saw a 7,000-unit decrease.

Regulatory Landscape

BMW Recall: BMW announced it would recall nearly 700,000 cars in China due to fire risk from a coolant pump defect. The recall follows a steep drop in deliveries for the German automaker in China, which is its largest market by revenue; in the third quarter of 2024, BMW saw its shipments of BMW and Mini brand cars drop 30 percent.1

Tesla Self-Driving NHTSA Probe: Tesla's full self-driving software is again under NHTSA investigation after four reports of collisions were linked to the software, including one resulting in a fatality. In all four instances, the vehicle entered areas with reduced roadway visibility.2

Honda Recall: Honda of North America is recalling nearly 1.7 million vehicles due to an improperly produced steering gearbox that swells while driving, causing friction and difficulty steering. The recall affects nearly a dozen different models. The company expects that only 1 percent of all vehicles will actually have the fault.3

Regulatory News Source

1. Automotive News: BMW recalls almost 700,000 cars in China due to Fire Risk. https://www.autonews.com/china/bmw-recalls-almost-700000-cars-china-fire-risk

2. Automotive News: Tesla Full Self-Driving Software under US Investigation After Fatal Crash. https://www.autonews.com/regulation-safety/tesla-probed-nhtsa-full-self-driving-collisions

3. Automotive News: Honda Recalls Nearly 1.7M Vehicles in the US for Steering Wheel Jam. https://www.autonews.com/regulation-safety/honda-recalls-millions-vehicles-steering-problem

31 October 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.