- within Criminal Law, Government, Public Sector and Tax topic(s)

Automakers, high-tech software companies, and electronics companies are increasingly facing similar challenges as vehicles become computers on wheels. For example, the global chip shortage is delaying the production of phones, laptops, and vehicles alike. Unsurprisingly, these similarities are also extending to how the automotive sector is being targeted by non-producing entities (NPEs) for patent infringement law suits.

Software and electronics companies were historically some of the largest targets for patent infringement law suits, including those brought by NPEs. Typically, companies engage in patent infringement suits, or patent wars, to capture market share by excluding rivals from the market. However, for developing markets, such as the electric and autonomous vehicle (E/AV) market, the high cost of patent litigation makes patent wars counterproductive. This is why some leading E/AV makers are attempting to lure competitors to the market by intentionally not enforcing their patents, anticipating that this will spur market growth and consequently increase demand for their products. It is possible that these companies expected to revert to patent wars within the decade since they continue to build their patent portfolios and the E/AV market is rapidly developing, which creates the high stakes that justify patent litigation.

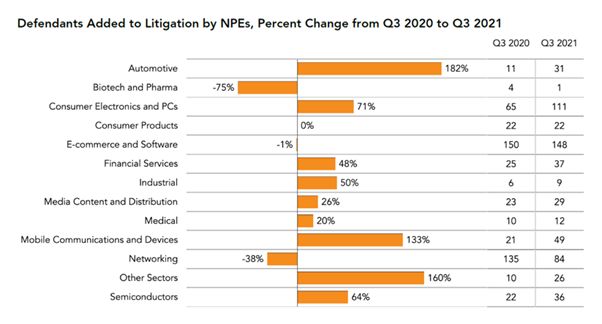

High-tech software and electronics companies, on the other hand, are familiar targets of NPEs and have significant experience defending against patent law suits. According to a report released by RPX Corp. on October 12, 2021 ("Report"), NPEs had their busiest third quarter since 2016, adding 595 defendants to litigation. Out of the 13 sectors in the chart below, the e-commerce and software, consumer electronics and PCs, mobile communications and devices, and semiconductors sectors constituted 57% of all defendants added to litigation by NPEs in 2014. In 2019 and 2020, those sectors continued to comprise the majority with 1,260 (59%) defendants added and 1,242 (53%) defendants added, respectively.

As vehicles become increasingly computerized, NPEs are targeting the automotive industry. Indeed, the Report notes a "marked increase" in NPE litigation hitting certain industries, with the automotive sector having the largest percentage increase from Q3 2020 to Q3 2021 at 182%. In Q3 2021, an NPE launched a new campaign against an automobile company regarding vehicle services that use "GPS and cellular systems to provide emergency services." There were also existing campaigns with new litigation, including an NPE targeting automotive GPS navigation and another NPE targeting in-vehicle infotainment systems. Some existing campaigns even pivoted to encompass automotive technology this quarter; for example, a private equity-backed NPE added automobile companies and parts suppliers to litigation over USB media ports.

As illustrated in the chart below, the automotive sector had around half the number of defendants added in Q3 2020 relative to the mobile communications and devices sector and the semiconductors sector. Notably, however, a year later the automotive sector almost had the same amount of defendants added as the semiconductors sector and is fast approaching the number of defendants added in the mobile communications and devices sector.

Table 1: Defendants Added to Litigation by NPEs, (RPS Rational Patent, "Q3 in Review", page 7, available here)

The e-commerce and software sector and the consumer electronics and PCs sector had the most defendants added in Q3 2021. But if the current trends continue, the automotive sector is on track to surpass the semiconductors sector and begin to catch up to the other electronic-type sectors.

It is unclear what effect the striking increase in NPE litigation will have on the automotive industry. Electronic companies were already waging patent wars on each other when NPEs started targeting them, unlike automotive companies which were avoiding patent litigation while the E/AV market developed. Although the automotive industry may wish to continue to avoid such litigation, the NPEs appear to have a different agenda and are poised to apply their assets and experiences to the automotive sector.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.