Wages paid to U.S. citizens and residents by a U.S. person are generally subject to federal withholding, subject to certain exceptions. Wages paid to non-resident aliens are generally subject to reporting requirements and payments for services performed in the United States are generally subject to withholding, unless an exemption applies - for example, the common tax-treaty exemption for teachers, students, and researchers.

Tax withholding obligations may be impacted by tax residency, as well as income sourcing rules. And taxpayers seeking to apply a treaty exemption are generally required to file a Form 8233.

Section 3402 Withholding-"Wages" Paid to "Employees"

As a general rule, under the Internal Revenue Code, employers must withhold federal income tax as well as social security tax from the wages they pay to employees. In addition, employers generally must pay social security and unemployment taxes on behalf of their employees. These taxes are known collectively as 'employment taxes.

More specifically, § 3402(a)(1) requires that "every employer" who makes a payment of "wages" must deduct and withhold tax at the source in accordance with detailed regulations and withholding tables (based upon graduated rates). The term "wages" is defined broadly in § 3401(a) as "all remuneration ... for services performed by an employee for his employer," subject to a number of specific exceptions.

Payments for services performed by a nonresident alien employee within the United States are generally classified as wages and subject to wage withholding. This does not apply, however, with respect to services performed by nonresident alien employees who are entitled to a federal income tax exemption or an income tax treaty exemption.

Notably, the regulations under § 3401(a)(6) provide an exemption from wage withholding with respect to payments for services performed in the United States that are exempt from federal income tax under an income tax treaty.

Section 1441 Withholding

In addition to these withholding requirements under § 3402, § 1411 also imposes a separate and distinct withholding regime. Section 1441(a) of the Code provides that except as otherwise provided in section 1441(c) of the Code, all persons having control, receipt, custody, disposal, or payment of any of the items specified in § 1441(b) of the Code (to the extent that any of such items constitutes gross income from sources within the United States) to any nonresident alien individual shall deduct and withhold an amount equal to 30 percent of such payment. The items specified in section 1441(b) include "salaries [and] wages."

Much as with § 3402, however, § 1.1441-4(b)(iv) of the Treasury Regulations provides that withholding is not required from salaries, wages, remuneration, or any other compensation for personal services of a nonresident alien individual if such compensation is, or will be, exempt from the income tax imposed by Chapter 1 of the Code by reason of a provision of the Internal Revenue Code or tax convention to which the United States is a party.

Thus, while Code §§ 1441 and 3402 generally require that a payor of compensation for personal services withhold federal taxes on that payment, withholding is not required if the income is exempt under a U.S. income tax treaty.1 To claim the exemption, a nonresident alien individual must submit Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, to his withholding agent certifying that the income is exempt from tax under a U.S. treaty provision. Form 8233 must also set forth the conditions necessary for the exemption and representations that they have been met. A separate Form 8233 must be filed for each taxable year.

Tax Treaties

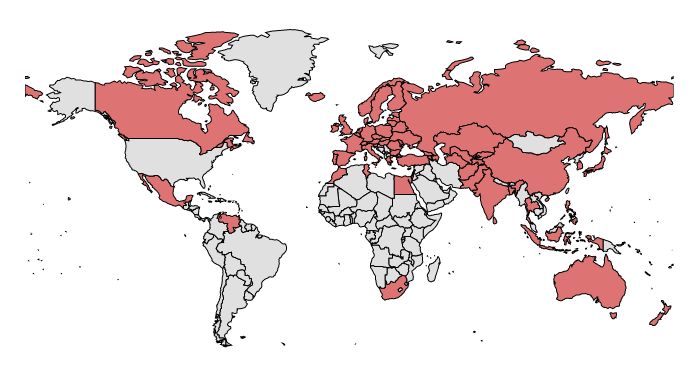

Withholding obligations may be impacted by an applicable tax treaty. Our Freeman Law interactive tax treaty map provides a link to tax treaty materials for each U.S. treaty partner:

To view the map please click here.

Withholding obligations can create significant tax and penalty exposure and may be impacted by tax treaties and other considerations. Tax withholding obligations may be impacted by tax residency, as well as income sourcing rules. A failure to withhold on payments to a non-resident alien may result in penalties and liability for the tax itself. For example, a person responsible for withholding, accounting for, or depositing or paying employment taxes, and willfully fail to do so, can be held liable for a penalty equal to the full amount of the unpaid trust fund tax, plus interest (so-called Trust Fund Recovery Penalty liability). The IRS interprets the scope of a "responsible person" for this purpose broadly, and it can reach a withholding agent, an officer of a corporation, a partner, a sole proprietor, or an employee of any form of business. A trustee or agent with authority over the funds of the business can also be held responsible for the penalty. Other penalties, such as penalties for failures to file a Form 1042 or 1042-S may apply as well.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.