- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United States

- with readers working within the Pharmaceuticals & BioTech industries

- within Insolvency/Bankruptcy/Re-Structuring, Criminal Law and Law Practice Management topic(s)

|

The swell that may not break Where biosimilars stand now A record-breaking patent cliff is on the horizon, but headwinds may shrink the anticipated "wave" to a ripple. While past launches were a smash hit, recent ones are a wake-up call. |

Why the water's so choppy What's holding biosimilars back? There are three main culprits holding things back: policy uncertainty from the Inflation Reduction Act (IRA), tricky reimbursement economics, and PBMs acting as gatekeepers. All this limits adoption and makes the business case a tough sell. |

Navigating today's currents Strategic moves for a new reality Reform efforts to streamline biosimilar development and review are gaining traction, yet their timelines and impacts remain uncertain. Developers need disciplined strategies in target selection, provider economics, and channel tactics to succeed. |

Is the $200B patent cliff a wave or just a lot of foam?

Investors often describe the coming Loss-ofExclusivity (LoE) cycle for biologics as a massive "biosimilar wave". Sure, nearly $200 billion in branded products are set to lose exclusivity by 2036,1 but pricing pressures and adoption hurdles could shrink that 'wave' down to a "ripple".

To adapt to this new reality, stakeholders must refine their biosimilar strategy. Success now depends on precision, not momentum.

Many mega-blockbusters will face biosimilar competition in the next decade

Some biosimilar launches have succeeded; others have stumbled. Why?

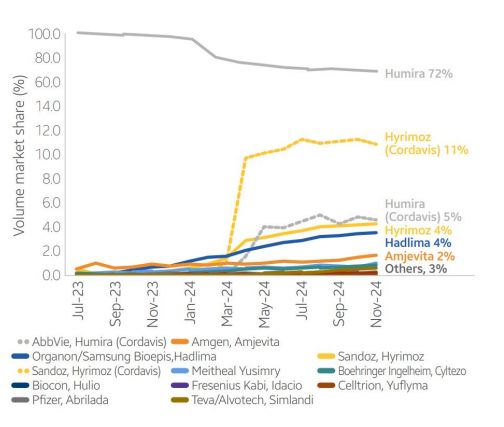

Oncology and supportive care biosimilars that 1 launched in 2018-2019 crushed it, grabbing 75- 90%1 of the market share. But recent launches of patient-administered biosimilars? Not so much. Humira biosimilars, for example, had a slow start in 2023. And four different Lantus biosimilars have only managed to capture 6% of the market. Why? The IRA's insulin caps and Sanofi's pricing strategy got in the way.1

The bottom line is that the market and regulatory uncertainty mean everyone needs to rethink their strategy.

Humira (adalimumab) volume market share1

The three hurdles you need to clear

Biosimilars face three main headwinds that, if not addressed, could hinder their growth

On the policy front, the IRA made picking a target a whole lot harder

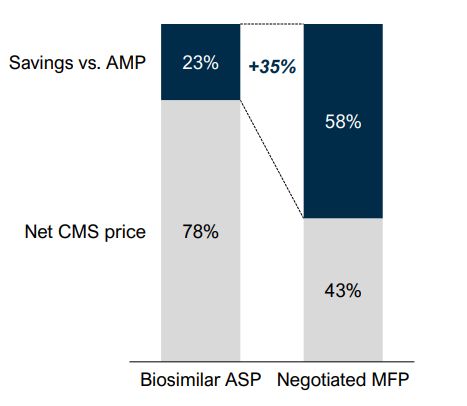

Developing a biosimilar typically takes 7-8 years and can cost anywhere from $100-250 million.1 The problem? The IRA allows CMS to negotiate prices on top-spending biologics after 11 years, starting with 10 products in 2026 and expanding to 200 by 2036.

MFPs may be set 40–75% (~58% average) below a drug's AMP, depending on its time on market.2 Since biosimilars typically offer only 15–30% (~23% average) ASP discounts,3 an MFP could lower the reference product's price enough for Part D plans to prefer it over biosimilars, reducing their market potential.

This uncertainty makes it difficult to identify viable targets and justify long-term R&D investments.

Reimbursement challenges create 'underwater' Part B economics that keep clinics loyal to originators

Provider-administered biosimilars are reimbursed under Medicare Part B at the drug's ASP + 6%, temporarily increased to ASP + 8% through 2027 under the IRA.1 But PBMs and insurer rebates can drive down the reference drug's price, leaving specialists "underwater", meaning they're paying more for the biosimilar than they're getting back from Medicare.

Potential reforms include linking reimbursement to providers' acquisition cost + 8% or excluding rebates from the ASP calculation.

Until this margin gap is fixed, clinics will favor reference products, limiting biosimilars in outpatient care.

Over 40 medical societies, known as the "Underwater Biosimilar Coalition," are urging Congress and CMS to reform reimbursement2

PBMs are limiting access (and you're not invited)

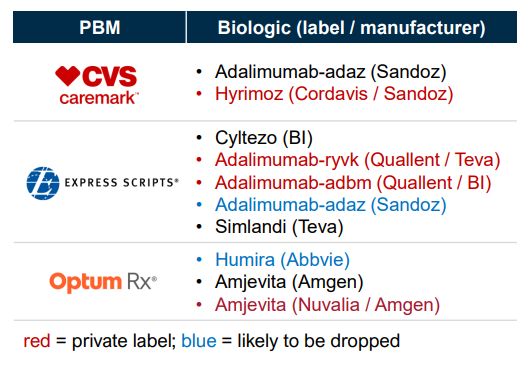

For the 2025 plan year, nearly all Humira biosimilars (8+) from non-PBM affiliated manufacturers were excluded from the standard formularies of CVS Caremark, Express Scripts, and Optum Rx,1 the Big 3 PBMs that process nearly 80% of US Rx claims. Why? Each of them is pushing their own private-label biosimilar: Cordavis (CVS), Quallent (Cigna / Express Scripts), and Nuvaila (United / Optum Rx).2

This "private-label lock-out" effect discourages anyone without a PBM affiliation from even trying to develop a biosimilar, leading to a market that's more consolidated and less competitive.

2025 formulary offerings for Humira and its biosimilars by the Big 3 PBMs

Policy momentum is building, but don't hold your breath

There's a lot of talk in D.C. about fixing this. The FDA is even trying to streamline biosimilar development by waiving some clinical trials to cut time and cost.1

There's also the bipartisan Biosimilar Red Tape Elimination Act, which would make all FDAapproved biosimilars interchangeable automatically. But it hasn't even been scheduled for a vote yet.2

Despite clear momentum, the timeline for any real change is still very much up in the air and could drag on indefinitely.

Three "winning" plays to navigate the situation

Pick your battles and your biologics

To win, don't just watch the patent clock. Your focus should be on biologics where you have either:

- A strong legal position with the resources to withstand the 'patent dance'

- A commercial sweet spot with a clear advantage to secure favorable formulary positioning in the commercial payer space

Make provider economics a priority

To ease that "underwater" feeling, offer options such as cost guarantees, buyand-bill support, or pass-through discounts to close the reimbursement gap.

Engage PBMs early or target alternative channels

Either engage early with PBMs for exclusive formulary agreements or bypass them entirely by targeting channels such as direct-to-employer plans and 340B programs.

The bottom line

The opportunity is real, but demands a focused strategy

The opportunity for biosimilars is real, but without near-term policy fixes, that big wave could end up being a ripple.

The companies that will win aren't just the ones who get in the water first. They'll be the ones who master target selection, launch economics, and channel tactics with precision. It's no longer about catching the wave—it's about navigating it with a damn good strategy.

Footnotea

1. IQVIA Institute Report (2025); A&M analysis of patent expiries

1.Sources: Samsung Bioepis Q1 2025 US Biosimilar Market Report

1. Blackstone and Joseph. Am Health Drug Benefits (2013);

2. Cubanski et al. KKF (2021);

3. Pharma's Almanac (2025)

1. CMS.gov (2022);

2. Infusion Providers Alliance (2024)

1. Reuters (2024);

2. Congress.gov (2023)

Originally Published 9 September 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.