Investors typically require fund managers to commit some of their own money to their funds to ensure that managers' interests are aligned with the interests of investors. But how much do managers need to commit?

The fund manager's contribution has to be meaningful, but the definition of meaningful can vary depending on circumstances. Managers raising their first fund may contribute less than 1%, which is usually a significant amount for a manager that is just getting started. Those who have raised a number of successful funds will usually have to contribute more, ensuring that they have a meaningful stake in the fund relative to their financial circumstances.

The amount is not only determined by investors, however. Fund managers with successful track records often want to commit more to their own funds, and have the means to do so.

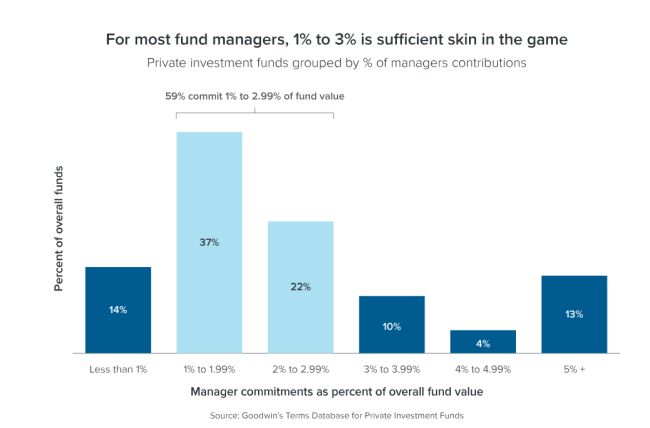

Analysis of Goodwin's Terms Database for Private Investment Funds indicates that, in a majority of cases (59%), the fund manager's contribution represents 1% to 2.99% of a fund's aggregate commitments. But 14% of managers contribute less than 1% — and 13% of managers contribute 5% or more.

These findings are based on data from a variety of fund types — including private equity, real estate, venture capital, infrastructure, and credit funds; the findings are similar, with only slight variations, when the different fund types are considered separately.

The database includes amounts committed to funds by management teams, not commitments made by affiliates of the fund manager's group, so it is of particular interest when the fund does not have a large institution backing the sponsor.

This is the first in a regular series of data-backed insights published by the Goodwin Private Investment Funds, Secondaries, and Fund Finance practices.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.