- within Technology topic(s)

- in United States

- with readers working within the Environment & Waste Management and Retail & Leisure industries

- within Wealth Management, Law Practice Management and Coronavirus (COVID-19) topic(s)

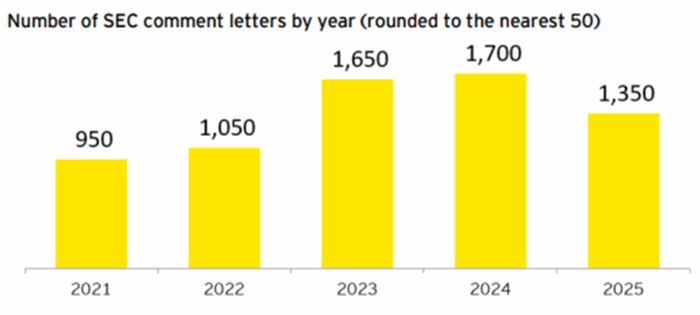

EY's recent SEC Reporting Update highlights 2025 trends in comment letters issued by the staff of the Securities and Exchange Commission (the "Staff") to registrants about disclosures in their periodic filings. The survey found that the volume of comment letters issued in the past year (ended June 30, 2025) declined, reversing the elevated volumes of comment letters issued in the prior two years.

The number of registrants that received comment letters also declined relative to last year. However, the distribution of the total number of comment letters on Form 10-K and 10-Q filings remained almost identical to 2024. Registrants with a public float of over $100 million received 53% of all comment letters (down from 54% in 2024), registrants with a public float between $75 million and $700 million received 25% of comment letters (no change from 2024), and registrants with a public float of less than $75 million received 22% of comment letters (up from 21% in 2024).

While traditional areas such as management's discussion and analysis (MD&A) and non-GAAP remain dominant, EY notes that the Staff is attuned to broader macroeconomic and technological developments. For example, registrants may see increased scrutiny of disclosures related to the impact of inflation, interest rate volatility, supply chain disruptions, and disclosures relating to cybersecurity, crypto assets, and artificial intelligence.

Key Focus Areas

MD&A. The Staff frequently requests more specific explanations of material period-to-period changes, asking registrants to identify and quantify the underlying drivers, including offsetting factors, for revenue, COGS, gross profit and operating expenses. Comments have focused on a need for more robust liquidity and capital resources discussions, including sources and uses of cash, trends and uncertainties (e.g., rate environment), and known trends impacting future results. Comments also have requested clearer treatment of critical accounting estimates and key metrics, with analysis that goes beyond boilerplate and aligns with Item 303 expectations.

Non-GAAP Financial Measures. Staff comments related to non-GAAP measures include comments relating to undue prominence (e.g., leading MD&A with non-GAAP, non-GAAP income statements); inappropriate reconciliations (i.e., starting from operating income for adjusted EBITDA, or reconciling margins to non-GAAP bases); forward-looking non-GAAP that are missing quantitative reconciliations; and misleading adjustments that exclude normal, recurring expenses.

Segment Reporting. Staff comments have focused on the identification of operating segments and the identification of the "Chief Operating Decision Maker," aggregation judgments, and completeness of required reportable-segment and entity-wide disclosures and related reconciliations under ASC 280. The Staff expects disclosure of significant segment expenses and a clear distinction drawn from "other segment items," challenging omissions or unclear categorizations. The Staff will cross-check public communications (earnings calls, website, investor presentations) for consistency with reported segments and will question inconsistencies.

Revenue Recognition. The Staff frequently comments on disaggregation of revenue under ASC 606, asking registrants to select categories that reflect how revenue is viewed internally and communicated externally, and to explain the linkage to segment disclosures. They probe identification and satisfaction of performance obligations, including judgments about timing (over time versus point in time) and the chosen measure of progress. They also remind registrants to separately present material product versus service revenues and related costs on the face of the income statement under Regulation S-X Rule 5-03(b).

Goodwill & Intangible Assets. The Staff will ask for more detail on impairment analyses, such as methods, key assumptions, sensitivity, and how reporting units are identified and assigned assets/liabilities/goodwill. Comments request disclosures about at-risk reporting units, the timing of impairment charges, and inclusion of relevant discussion in critical accounting estimates in MD&A. They also seek explanation of how useful lives of finite-lived intangibles were determined.

Emerging Trends. The Staff issued comment letters to registrants requesting expanded disclosure relating to new and emerging risks, including cybersecurity and crypto assets. For example, the Staff has requested additional information regarding registrants' disclosures about their cybersecurity risk management systems, in accordance with Item 106(c)(2)(i) of Regulation S-K. The Staff issued comments requesting registrants to enhance their risk factors disclosures to include the material effects that specific regulations and material pending regulations relating to crypto assets, crypto markets, and artificial intelligence may have on the business and business plans.

Looking Ahead

Registrants should proactively evaluate their filings for the issues most frequently raised by the Staff and consider whether additional context or clarity would enhance their disclosures. For additional details and analysis, read EY's SEC Reporting Update: Highlights of trends in 2025 SEC staff comment letters.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2025. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.