On August 25, 2022, the US Securities and Exchange Commission (SEC) finally adopted a "pay versus performance" rule in accordance with a Dodd-Frank Wall Street Reform and Consumer Protection Act (DoddFrank Act) mandate that requires SEC-reporting companies to disclose in a clear manner the relationship between executive compensation actually paid and the financial performance of the company.1 As adopted, the rule generally requires disclosure of five years of pay versus performance data in proxy and information statements in which executive compensation information is required to be included pursuant to Item 402 of SEC Regulation S-K. The new pay versus performance disclosures must be included in proxy and information statements that are required to include such compensation information for fiscal years ending on or after December 16, 2022. Thus, the new rule will generally apply for the upcoming 2023 proxy season.

Background

The Dodd-Frank Act added Section 14(i) to the US Securities Exchange Act of 1934, as amended (Exchange Act), directing the SEC to adopt a pay versus performance rule in proxy and information statements in which executive compensation information is required to be included pursuant to Item 402 of Regulation S-K. The SEC originally proposed the pay versus performance rule in 2015 (2015 Proposal), proposing new subsection (v) to Item 402 of Regulation S-K to require a new compensation table, showing the relationship between compensation actually paid to named executive officers (NEOs) and a company's performance, with performance measured both by the company's total shareholder return (TSR) and peer group TSR, as well as a description of the relationship of pay to performance. Earlier this year, the SEC reopened the comment period on the 2015 Proposal (as opposed to re-proposing its pay versus performance rule) and requested comments on additional disclosures that were not contemplated in the 2015 Proposal.

Requirements of Pay Versus Performance Rule

As adopted, new Item 402(v) of Regulation S-K requires:

- a new pay versus performance table,

- a clear description of the relationship between the compensation actually paid to the principal executive officer (PEO) and to the other NEOs (Remaining NEOs) and the company's performance across each of the measures included in the pay versus performance table, which may be presented as a narrative, a graph or a combination of the two, and

- a tabular list of the most important financial performance measures that the company uses to link NEO compensation to company performance.

Companies have flexibility as to the exact placement of the pay versus performance disclosures within the proxy or information statement, although these must appear with, and in the same format as, the rest of the executive compensation disclosures required to be provided by Item 402 of Regulation S-K. The disclosures may, but need not, be part of the Compensation Discussion and Analysis (CD&A).

Pay Versus Performance Table.The pay versus performance table must disclose the compensation paid to the PEO and the average compensation paid to the Remaining NEOs as compared to four performance measures. The performance measures required to be included are:

- company TSR,

- peer group TSR,

- net income, and

- a company-selected financial performance measure (Company-Selected Measure).

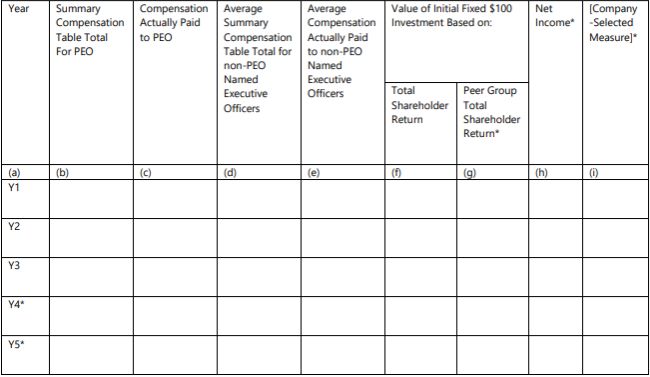

The new table must contain data for five years, except that smaller reporting companies (SRCs) are permitted to provide three years of data. The table is required to be in the following format, with the column titled "Company-Selected Measure" replaced with the name of the financial performance measure chosen by the company:

Pay Versus Performance

*Denotes disclosures not required for SRCs.

Description of Pay Versus Performance Relationship. The required tabular disclosure must be accompanied by a clear description of the relationship between

- both executive compensation actually paid to the PEO and the

average compensation actually paid to the Remaining NEOs, and each

of the following:

- company TSR,

- company net income, and

- the Company-Selected Measure; and

- company TSR,

- the Company's TSR and the peer group TSR.

If a company elects to provide any additional measures in the table, each additional measure must be accompanied by a clear description of the relationship between such compensation actually paid and the additional measure over the company's five fiscal years displayed in the table. The descriptions can be provided in narrative or graphic form, or a combination of both. For example, the adopting release indicates that the relationship could be expressed as a graph providing executive compensation actually paid and change in financial performance measure(s) on parallel axes and plotting compensation and the measure(s) over the required time period. Companies are permitted to group the descriptions, but any combined description of multiple relationships must be clear.

Companies may supplement the required disclosure with additional pay versus performance measures or descriptions (in the table or elsewhere). However, any such supplemental disclosure must be clearly identified as supplemental, not be misleading and not be presented more prominently than the required disclosure.

Tabular List. Additionally, companies (other than SRCs) must provide an unranked list of the three to seven most important financial performance measures used to link executive compensation actually paid to NEOs during the last fiscal year with the company's performance. Alternatively, companies may elect to include one tabular list for the PEO and one list for the Remaining NEOs, or provide lists for each NEO, setting out the applicable three to seven financial performance measures used to link the relevant individual's compensation with company performance. Companies are permitted to include non-financial measures in the list if they consider such measures to be among their three to seven most important measures. If a company uses fewer than three measures to link NEOs' compensation to company performance, only measures actually used must be included.

Additional Information on Pay Versus Performance Rule

Companies Covered. The pay versus performance rule applies to all SEC-reporting companies, except:

- foreign private issuers,

- registered investment companies, and

- emerging growth companies

Business development companies (a category of closed-end investment company) and SRCs are subject to the rule, although the disclosure requirements for SRCs are scaled.

Filings Covered. As previously noted, pay versus performance disclosure is required in proxy and information statements that are required to contain executive compensation disclosure pursuant to Item 402 of Regulation S-K. The pay versus performance information will not be deemed to be incorporated by reference into any filing under the US Securities Act of 1933, as amended, or the Exchange Act unless the company specifically incorporates it.

Executives Covered. The pay versus performance table must separately provide compensation information for the PEO, on an annual basis, for each of the past five fiscal years (three in the case of SRCs). If more than one person has served as PEO in any year, data for each PEO must be reported in separate columns.

In addition, the table must provide average (i.e., mean) compensation, on an annual basis, for the Remaining NEOs for such years. The Remaining NEOs whose compensation amounts are included in the averages reported for a given year must be individually identified by a footnote. The footnote will allow investors to consider the average compensation reported with changes in composition of the Remaining NEOs.

Pay Covered. The elements of the compensation actually paid category reflects that information contained in the Summary Compensation Table is distinct from the compensation paid to an NEO in a given year. Under Item 402(v)(2) of Regulation S-K, compensation actually paid to each individual is comprised of total compensation disclosed in the Summary Compensation Table modified to adjust the amounts included for pension benefits, equity awards and above-market or preferential earnings on deferred compensation that is not tax qualified, each as described below.

For each year included in the pay versus performance table, companies will be required to deduct from the Summary Compensation Table total the aggregate change in the actuarial present value of all defined benefit and actuarial pension plans, and add back the aggregate of: (i) actuarially determined service cost for services rendered by the NEO during the applicable year (service cost); and (ii) the entire cost of benefits granted in a plan amendment (or initiation) during the covered fiscal year that are attributed by the benefit formula to services rendered in periods prior to the plan amendment or initiation (prior service cost), in each case, calculated in accordance with US generally accepted accounting principles (GAAP). The change in actuarial present value would be deducted only if the value is positive. The scaled disclosure requirements do not require SRCs to make this pension adjustment.

The 2015 Proposal had proposed to treat equity awards as actually paid in the fiscal year in which such awards became vested. However, comments to the 2015 Proposal noted that such timing could create a perceived misalignment between pay and performance since such awards would be viewed as actually paid only in the year of vesting rather than actually paid in each fiscal year over the life of the award between the date of grant and the date of vesting. For example, where an award vests over a three-year period and the company's financial performance is positive in the first two years and negative in the third, reporting the full value of the award only in the vesting year may give investors the misleading impression that the executive was not rewarded for positive performance in years one and two and was rewarded despite negative performance in year three. To address these concerns, Item 402(v) of Regulation S-K, as adopted, generally requires that equity awards first be reported as compensation actually paid in the fiscal year during which the award is granted based on the fair value as of the last day of the year, and then, in each subsequent year, changes in the fair value of the award as of the last day of the fiscal year will be reported until a final fair value is reported for the fiscal year in which vesting occurs (i.e., the date that all applicable vesting conditions have been satisfied) determined as of the date of vesting. For any awards that are subject to performance conditions, the change in fair value is calculated based on the probable outcome of such conditions as of the last day of the fiscal year.

Specifically, to calculate compensation actually paid for equity awards for each year included in the pay versus performance table, companies need to deduct the equity award amounts shown in the Summary Compensation Table from total compensation and then add or subtract the following amounts, as applicable:

- the year-end fair value of any equity awards granted in the

covered fiscal year that are outstanding and unvested as of the end

of the covered fiscal year;

- the amount of change as of the end of the covered fiscal year

(from the end of the prior fiscal year) in fair value of any awards

granted in prior years that are outstanding and unvested as of the

end of the covered fiscal year;

- for awards that are granted and vest in the same covered fiscal

year, the fair value as of the vesting date;

- for awards granted in prior years that vest in the covered

fiscal year, the amount equal to the change in fair value as of the

vesting date (from the end of the prior fiscal year);

- for awards granted in prior years that are determined to fail

to meet the applicable vesting conditions during the covered fiscal

year, a deduction for the amount equal to the fair value at the end

of the prior fiscal year; and

- the dollar value of any dividends or other earnings paid on

stock or option awards in the covered fiscal year prior to the

vesting date that are not otherwise reflected in the fair value of

such award or included in any other component of total compensation

for the covered fiscal year

Vesting date valuation assumptions have to be disclosed by footnote if they are materially different from those disclosed as of the grant date.

Additionally, compensation actually paid must include above-market or preferential earnings on deferred compensation that is not tax qualified. Such amounts may be viewed to approximate the value that would be set aside currently by the company to satisfy its obligations in the future. Such amounts of deferred compensation that are not tax qualified must be included whether or not such amounts are vested and whether or not such amounts are actually paid during such year. According to the SEC, "excluding those amounts until their eventual payout would make the amount 'actually paid' contingent on an NEO's choice to withdraw or take a distribution from their account. . ." The SEC does not believe such treatment would accurately represent compensation "actually paid."

The pay versus performance table also must disclose, in an accompanying footnote, the amounts of compensation deducted from, and added to, the Summary Compensation Table total compensation in determining compensation actually paid to the PEO and Remaining NEOs.

Finally, any one-time payment, such as a signing or severance bonus, must be included in compensation actually paid. While such amounts may not be reflective of what an executive typically receives in a year, they are amounts that were actually paid in that year.

To view the full article click here

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

[View Source]