- within Food, Drugs, Healthcare and Life Sciences topic(s)

On August 25, 2022, the U.S. Securities and Exchange Commission (SEC) adopted the pay versus performance disclosure requirements that the agency was directed to promulgate by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act).1

The new pay versus performance disclosure requirements specified in new paragraph (v) of Item 402 of Regulation S-K will become effective 30 days following publication of the adopting release in the Federal Register.

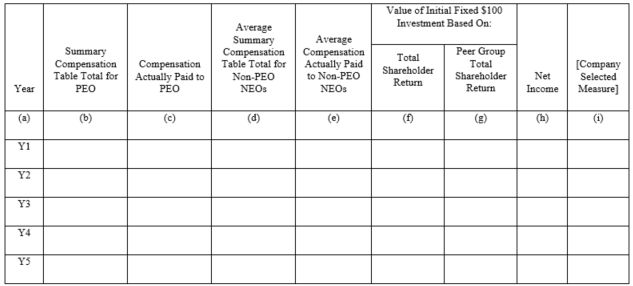

Item 402(v) of Regulation S-K will require that companies provide a new table disclosing specified executive compensation and financial performance measures for the company's five most recently completed fiscal years. This table will include, for the principal executive officer (PEO) and, as an average, for the other named executive officers (NEOs), the Summary Compensation Table measure of total compensation and a measure reflecting "executive compensation actually paid," as specified by the rule. The financial performance measures to be included in the table are:

- Cumulative total shareholder return (TSR) for the company;

- TSR for the company's self-selected peer group;

- The company's net income; and

- A financial performance measure chosen by the company and specific to the company that, in the company's assessment, represents the most important financial performance measure the company uses to link compensation actually paid to the company's NEOs to company performance for the most recently completed fiscal year.

In addition, Item 402(v) requires a clear description of the relationships between each of the financial performance measures included in the table and the executive compensation actually paid to its PEO and, on average, to its other NEOs over the company's five most recently completed fiscal years. The company will be required to also include a description of the relationship between the company's TSR and its peer group TSR.

Item 402(v) also requires a list of three to seven financial performance measures that the company determines are its most important measures. Companies are permitted, but not required, to include non-financial measures in the list if they considered such measures to be among their three to seven "most important" measures.

Key Takeaways for Public Companies

- Subject to certain exceptions, public companies will need to comply with the new pay versus performance disclosure requirements in proxy and information statements that are required to include Item 402 executive compensation disclosure for fiscal years ending on or after December 16, 2022, therefore, calendar year-end companies will need to include the new disclosures in the proxy statements filed during the 2023 proxy season.

- New paragraph (v) of Item 402 of Regulation S-K mandates a new executive compensation table, along with additional narrative disclosure; however, this new disclosure is not required to be included in a company's Compensation Discussion and Analysis (CD&A) disclosure.

- Public companies will need to begin reporting a new measure of compensation called "executive compensation actually paid," which is the amount of total compensation reported in the Summary Compensation Table adjusted for certain amounts related to pension benefits and equity awards.

- The SEC expanded the required disclosure beyond the original 2015 proposal to include additional measures of company performance.

Background

On April 29, 2015, the SEC proposed rules to implement Section 953(a) of the Dodd-Frank Act, which were subject to a 60-day comment period that ended on July 6, 2015.2 The SEC proposed to add new paragraph (v) to Item 402 of Regulation S-K, which would require a company to provide a clear description of (1) the relationship between executive compensation actually paid to the company's NEOs and the cumulative TSR of the company, and (2) the relationship between the company's TSR and the TSR of a peer group chosen by the company, over each of the company's five most recently completed fiscal years. The SEC proposed that the disclosure would be required in a new table to be included in a company's executive compensation disclosure.

In January 2022, the SEC reopened the comment period for the pay versus performance rule proposal.3 In the reopening release, the SEC solicited comment on whether it should require disclosure of three other measures of performance in addition to TSR: (i) pre-tax net income; (ii) net income, and (iii) a measure specific to a particular company, chosen by the company. In addition to potentially including the company-selected measure in the proposed table, the SEC asked whether it should separately require companies to provide a list of the five most important performance measures used by the company to link compensation actually paid during the fiscal year to company performance, over the time horizon of the disclosure, in order of importance, and if the company considers fewer than five performance measures when it links compensation actually paid during the fiscal year to company performance, the company would be required to disclose only the number of measures it actually considers.

New Item 402(v) of Regulation S-K

The amendments adopted by the SEC add new paragraph (v) to Item 402 of Regulation S-K, which requires companies to describe the relationship between the executive compensation actually paid by the company and the financial performance of the company over the time horizon of the disclosure. Item 402(v) of Regulation S-K requires disclosure of the cumulative TSR of the company (substantially as defined in Item 201(e) of Regulation S-K), the TSR of the company's peer group, the company's net income, and a measure chosen by the company and specific to the company (Company-Selected Measure) as the measures of financial performance. The final rules require that the information be presented in a tabular form as specified in the rule.

Location of the Disclosure

As proposed, the SEC adopted a requirement to include the new Item 402(v) of Regulation S-K disclosure in any proxy or information statement for which disclosure under Item 402 of Regulation S-K is required. Placing the pay-versus-performance information in proxy statements and information statements provides shareholders with the pay-versus-performance disclosure (along with all other executive compensation disclosures called for by Item 402 of Regulation S-K) in circumstances in which shareholder action is to be taken with regard to an election of directors or executive compensation. The SEC does not require the pay-versus-performance disclosure in other filings where disclosure under Item 402 of Regulation S-K is required, such as in registration statements filed under the Securities Act of 1933, as amended (Securities Act).

Form of the Disclosure

The relevant information must be presented in the following tabular format, subject to certain exceptions for smaller reporting companies:

In addition, companies are required to use the information in the above table to provide clear descriptions of the relationships between compensation actually paid and three measures of financial performance, as follows: describe the relationship between (a) the executive compensation actually paid to the company's PEO and (b) the average of the executive compensation actually paid to the company's remaining NEOs to (i) the cumulative TSR of the company, (ii) the net income of the company, and (iii) the company's Company-Selected Measure, in each case over the company's five most recently completed fiscal years. Companies that do not use any financial performance measures to link executive compensation actually paid to company performance, or that only use measures already required to be disclosed in the table, would not be required to disclose a Company-Selected Measure or its relationship to executive compensation actually paid.

Companies are also required to provide a "clear" description of the relationship between the company's TSR and the TSR of a peer group chosen by the company, also over the company's five most recently completed fiscal years. Companies will have flexibility as to the format in which to present the descriptions of these relationships, whether graphical, narrative, or a combination of the two. Companies will also have flexibility to decide whether to group any of these relationship disclosures together when presenting their clear description disclosure, but any combined description of multiple relationships must be "clear." Smaller reporting companies will only be required to present such clear descriptions with respect to the measures they are required to include in the table and for their three, rather than five, most recently completed fiscal years.

The SEC notes that companies will have the flexibility to decide whether to group any of these relationship disclosures together when presenting this information, but any combined description of multiple relationships must be clear.

Companies also will be required to provide an unranked list of the most important financial performance measures used by the company to link executive compensation actually paid to the company's NEOs during the last fiscal year to company performance. While companies may include non-financial performance measures in this list, they must select the Company-Selected Measure from the financial performance measures included in this list, and it must be the financial performance measure that, in the company's assessment, represents the most important performance measure (that is not otherwise required to be disclosed in the table) used by the company to link compensation actually paid to the company's NEOs, for the most recently completed fiscal year, to company performance.

Supplemental Disclosure

Item 402(v) permits companies to voluntarily provide supplemental measures of compensation or financial performance (in the table or in other disclosure), and other supplemental disclosures, so long as any such measure or disclosure is clearly identified as supplemental, not misleading, and not presented with greater prominence than the required disclosure.

Determination of Executive Compensation Actually Paid

For purposes of Item 402(v), the definition of "executive compensation actually paid" for a fiscal year is, generally, total compensation as reported in the Summary Compensation Table for that year (i) less the change in the actuarial present value of pension benefits, (ii) less the grant-date fair value of any stock and option awards granted during that year, (iii) plus the pension service cost for the year and, in the case of any plan amendments (or initiations), the associated prior service cost (or less any associated credit), and (iv) plus the change in fair value of outstanding and unvested stock and option awards during that year (or as of the vesting date or the date the company determines the award will not vest, if within the year) as well as the fair value of new stock and option awards granted during that year as of the end of the year (or as of the vesting date or the date the company determines the award will not vest, if within the year). Adjustments (i) and (iii) with respect to pension plans do not apply to smaller reporting companies, because they are not otherwise required to disclose executive compensation related to pension plans.

Determination of Company Cumulative TSR and Peer Group TSR

Under Item 402(v) of Regulation S-K, a company will be required to disclose the cumulative TSR of the company, which is to be computed in accordance with the requirements set forth in Item 201(e) of Regulation S-K. Item 201(e) of Regulation S-K sets forth the specific disclosure requirements for the company's stock performance graph, which is required to be included in the annual report to security holders provided for by Rules 14a-3 and 240.14c-3 under the Securities Exchange Act of 1934, as amended (Exchange Act). Item 201(e) provides that cumulative TSR is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the company's share price at the end and the beginning of the measurement period, by the share price at the beginning of the measurement period.

The final rules require a company to disclose weighted peer group TSR (weighted according to the respective companies' stock market capitalization at the beginning of each period for which a return is indicated), using either the same peer group used for purposes of Item 201(e) of Regulation S-K or a peer group used in the CD&A for purposes of disclosing a company's compensation benchmarking practices. If the peer group is not a published industry or line-of-business index, the identity of the companies composing the group must be disclosed in a footnote. A company that has previously disclosed the composition of the companies in its peer group in prior filings with the SEC would be permitted to comply with this requirement by incorporation by reference to those filings. Consistent with the approach specified in Item 201(e) of Regulation S-K, if a company changes the peer group used in its pay-versus-performance disclosure from the one used in the previous fiscal year, it will be required to include tabular disclosure of peer group TSR for that new peer group (for all years in the table), but must explain, in a footnote, the reason for the change, and compare the company's TSR to that of both the old and the new group.

Data Tagging

The final rules require companies to separately tag each value disclosed in the table, block-text tag the footnote and relationship disclosure, and tag specific data points (such as quantitative amounts) within the footnote disclosures, all in Inline XBRL.

Applicability of the New Disclosure Requirements

The final rules apply to all reporting companies except foreign private issuers, registered investment companies, and emerging growth companies (EGCs). As proposed, business development companies are treated in the same manner as companies other than registered investment companies and, therefore, are subject to the disclosure requirement of new Item 402(v) of Regulation S-K.

Smaller reporting companies are required to provide disclosure under Item 402(v) of Regulation S-K, but the disclosure is scaled for those companies, consistent with the existing scaled executive compensation disclosure requirements applicable to smaller reporting companies. Specifically, smaller reporting companies would:

- Only be required to present three, instead of five, fiscal years of disclosure under new Item 402(v) of Regulation S-K;

- Not be required to disclose amounts related to pensions for purposes of disclosing executive compensation actually paid;

- Not be required to present peer group TSR;

- Be permitted to provide two years of data, instead of three, in the first applicable filing after the rules became effective; and

- Be required to provide disclosure in the prescribed table in Inline XBRL format beginning in the third filing in which the smaller reporting company provides pay-versus-performance disclosure.

Compliance Dates

The new pay versus performance disclosure requirements will become effective 30 days following publication of the adopting release in the Federal Register. Companies (other than emerging growth companies, registered investment companies, or foreign private issuers, which are all exempt from the rule) will need to comply with these disclosure requirements in proxy and information statements that are required to include Item 402 executive compensation disclosure for fiscal years ending on or after December 16, 2022.

Companies (except for smaller reporting companies) will be required to provide the information for three years in the first proxy or information statement in which they provide the disclosure, adding another year of disclosure in each of the two subsequent annual proxy filings that require the Item 402(v) disclosure. Both company TSR and peer group TSR must be calculated based on a fixed investment of one hundred dollars at the measurement point.

Smaller reporting companies will initially be required to provide the information for two years, adding an additional year of disclosure in the subsequent annual proxy or information statement that requires this disclosure. In addition, a smaller reporting company will only be required to tag the information using Inline XBRL data beginning in the third filing in which it provides pay versus performance disclosure, instead of the first.

Footnotes

1. Release No. 34-95607, Pay Versus Performance (Aug. 25, 2022), available at https://www.sec.gov/rules/final/2022/34-95607.pdf.

2. Release No. 34-74835, Pay Versus Performance (Apr. 29, 2015), available at: https://www.sec.gov/rules/proposed/2015/34-74835.pdf.

3. Release No. 34-94074, Reopening of Comment Period for Pay Versus Performance R (Jan. 27, 2022), available at: https://www.sec.gov/rules/proposed/2022/34-94074.pdf.

Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

© Morrison & Foerster LLP. All rights reserved