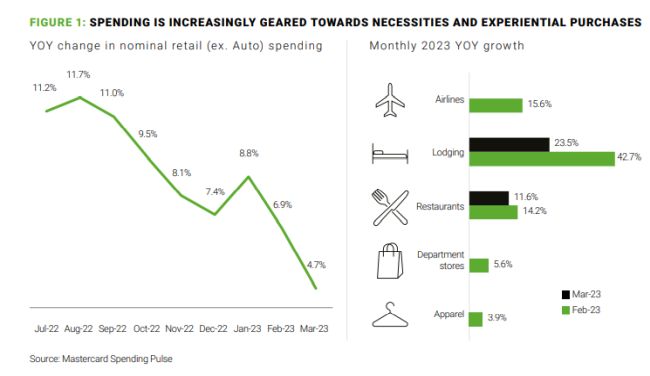

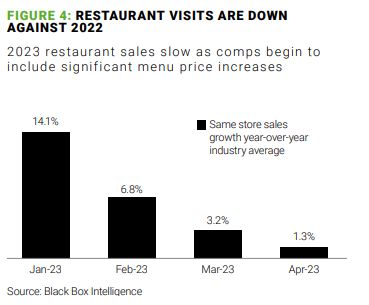

So far in 2023, U.S. consumer spending on experiences has outpaced consumption of hard goods. Travel spending reached record numbers and restaurant companies posted almost universally positive same-store sales in the first quarter.

The story was different in the retail sector, which signaled stalling demand. We saw major companies such as Walmart and Costco continue to flag significant pull backs on discretionary spending and stronger allocation to essentials within hard goods. A 7.5% drop in China's exports in May 2023 suggests global demand for goods has indeed been chilling. And many retail executives are already forecasting sharp consumer cutbacks in apparel and footwear for the 2023 U.S. holiday season.

Rather than chalking up the growing trend to prioritized services spending to consumers making up for lost time post-lockdown, we attribute recent spending patterns to a lasting shift towards an experiential mindset. This evolution has been in progress for a while now and will continue to persist through a period of tightened spending.

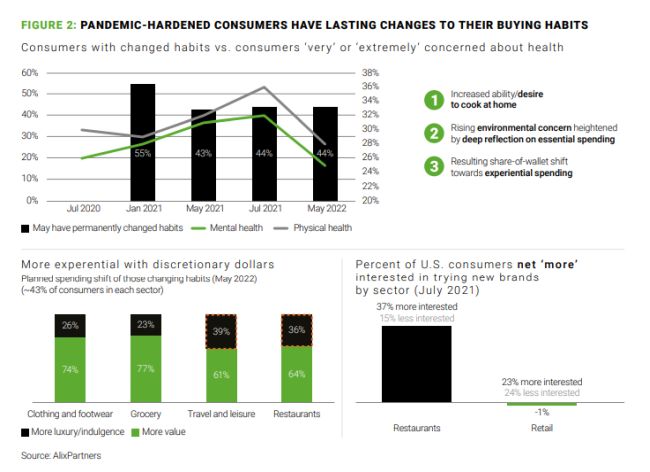

We initially flagged the concept in the back half of 2021 in our Changing Consumer Priorities Study, writing that "the intentional consumer does not necessarily spend less – but is much more deliberate about how and where to spend. For example, the same consumer may decide to splurge on a bauble, a delicacy, or an experience but cut back on buying a product they deem unessential or bad for the environment." At the time, 30% of those reporting on pandemic-induced changes to spending said that they had reduced consumption for reasons of sustainability postpandemic, and 67% said the pandemic made them more conscious of the environment.

Amid steep supply shortages and record splurges on goods, our research showed that consumers were seeking more luxury and indulgence in restaurants, travel, and leisure occasions post-pandemic, and to a degree not seen in prior retail and consumer products trends. Additionally, consumers suggested they were significantly more open to engaging with unfamiliar restaurant brands than with retail. This sentiment combined with a digitally savvy shopper who had upped their online shopping and ordering skill set during the pandemic created a robust recipe for much more intentionality in spending with less impulsiveness in purchasing habits.

Our ongoing consumer research tracks a rethinking of discretionary spending from the extended lockdowns of COVID-19 to the current day. In May 2022, nearly 1 in 2 consumers continued to tell us the pandemic likely drove permanent impacts to their buying habits, unchanged from a year prior.

We believe this shifting of consumer wallet share has been creating disproportionately more restaurant dollars to spend despite financial headwinds: credit card balances hitting record levels, a widening consumer base reporting living paycheck-paycheck, eroding U.S. consumer buying power and continuous looming macroeconomic clouds in H1 2023.

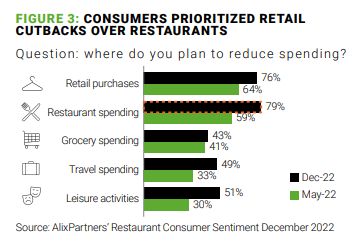

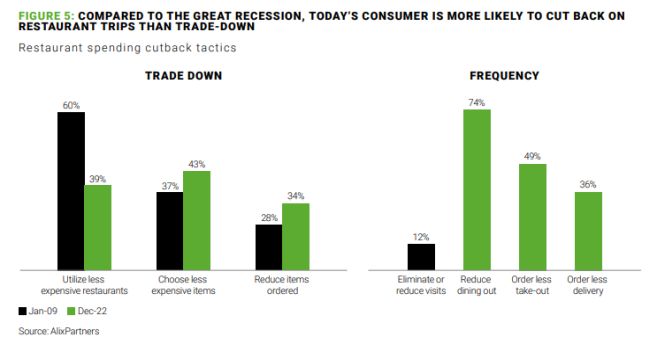

In the next economic phase, consumers will likely continue to lean in further to their pandemic-hardened consumer mindset. We anticipate a continued preference for more intentional spending — meaningful travel and dining experiences — over mindless consumption of goods. We expect that consumers will continue to prioritize experiential purchases, cutting back on retail before restaurants, and eating out less rather than simply trading down, as they did in prior recessions.

This has ramifications for how the restaurant industry looks at talent. The National Restaurant Association's 2022 DEI restaurant study found that while 64% of enterprises "strongly agree" that their company offers career pathways to employees, only 35% of former employees say their company provided good long-term opportunities. Female, Hispanic, and Black employees tend to rate their companies poorer than white and male employees, and more than a third of current employees are already looking for other jobs. Of those who left the industry, only 16% expect to return to restaurants or food service. That's a huge problem if the industry is to capitalize on the hunger for experiential spending with exceptional service.

The lasting impact of the pandemic shows in the new consumer profile. They have a greater awareness of health and sustainability (figure 2), and a drive to make their spending count. This is supported by 15 years of AlixPartners research, as we will discuss.

THE END OF THE SPENDING SPREE

Although we see potentially more experiential dollars now comprising wallet-share, restaurant operators will need to be cautious. Our research suggests consumers have been tightening their spending for the past year and have been feeling mounting financial pressures. Nearly all U.S. consumers are now reporting discretionary spending cuts, per a CNBC survey.

In May 2022, respondents to AlixPartners' Restaurant Consumer Sentiment survey suggested they would cut back on retail spending first before restaurants, in keeping with pandemic-influenced changes in behavior. Travel and leisure were the least likely to see cutbacks of the areas surveyed. Consumers indicated they would continue to be more intentional about their discretionary spending, and they made good on their word: the 2022 holiday season saw a slowing of retail growth, and gains for cheaper private-label grocery brands like Kirkland Select, while restaurant performance has shown greater resilience. In first half of 2023, we saw the retail environment continue to erode, with 92% of middle-income Americans surveyed by CNBC in June 2023 reporting cuts to their spending, starting with clothing.

Despite largely positive Q1 2023 sales across the U.S. restaurant industry, cracks are emerging across restaurant sector spending as sector comp sales have been on a downward trend since January. In December 2022, consumers suggested that they planned to significantly increase cut backs on restaurants to reign in discretionary spending amid ongoing inflation. And CNBC's June report continues to suggest restaurants will be the secondary cut behind discretionary retail. Since earnings reported retail cutbacks have mirrored consumer intentions, consumer changes in restaurant spending will likely continue to accelerate and show greater impacts across the industry as 2023 progresses.

However, our research suggests this tightening in combination with a more intentional and experiential consumer will likely drive a different approach to restaurant spending than in previous recessionary periods.

Consumer sentiment suggests strong guest interest in prioritizing restaurant dollars against meaningful dinein experiences, even if they end up spending more per occasion but eating out less frequently. In May 2022, almost 1 in 2 (41%) of consumers suggested they enjoyed cooking more or learning how to cook more easily at home as a result of the pandemic. Drilling down further into restaurant spending, we are predicting a shift in recessionary behaviors such that consumers don't simply trade-down to cheaper dining options, as our data shows they did following the Global Financial Crisis, but rather opt to reduce the number of visits to restaurants in order to prioritize a higher quality, more engaging meal out.

Reducing the number of dine-out occasions and cutting back on take-out remain the top two tactics consumers plan to use today (for 74% and 49% of consumers surveyed, respectively). Gen Z and younger Millennials suggest they are more likely to reduce delivery and take-out, while older consumers are more likely to reduce dine-out occasions.

The shift in how consumers determine when and where to spend money on dining means that the headwinds and tailwinds in each sector during a recessionary environment will likely be less defined than in the past. Within each sector, from quick-service to full-service, there will likely be a nuanced shift in spending creating both headwinds and opportunities for brands across the industry.

A MEAL TO REMEMBER: WHY CONSUMERS ARE LIKELY TO BEHAVE DIFFERENTLY THIS DOWNTURN

A reduction in guest visits means that the industry will be pushed to further differentiate against the convenience and experience spectrum. Guests will be much more discerning with the value equation. Brands that are potentially caught in the middle trying to be everything to all consumers by attempting to grow and execute across all channels without a clear vision of their customer may run a heightened risk of falling flat against their objectives. In parallel, legacy tactics traditionally used in downturns will be less effective to engage customers during sluggish periods, but new, significant opportunities to grow dining share are likely to develop.

Thus, despite recessionary headwinds, many companies will still need to go full-throttle on their growth and transformation agendas to keep relevancy with the more experiential consumer but may need to do so more economically. As off-premise business potentially swings back away from third party delivery as consumers avoid fees, some concepts will find themselves needing to make accelerated investments in pick-up channels. Many operators will also need to better identify their target consumer, differentiating the "guest of tomorrow" from the "guest of yesterday." Millennial-oriented concepts may be particularly vulnerable to new-found disruption.

As dining patterns drift further due to rising financial strain on the more experiential consumer, brands will likely need to become nimble in operations to quickly ramp up or ramp down in response to potentially more extreme ends of demand in peak and slow periods. Just as brands pivoted during COVID to accommodate off-premise and outdoor dining, online ordering and safety protocols, companies may need to right-size operating hours, seating expansion and augment staffing schedules to grow sales during high demand day-parts and lean in to reducing expenses in newly exposed valleys. Additionally, concepts may need to proactively recession-proof menus to ensure strong margin across a wider set of offerings, cheaper proteins, and small plates to offer a more varied price point.

CASUAL DINING BRANDS

will need to continue shifting away from the pandemic mindset of competing with fast casual (e.g., off-premise, etc.) to differentiating against fast casual on experience; optimization and growth of the offpremise channels cannot come at the cost of delivering a consistent, fulfilling in-restaurant experience. Consumer sentiment suggests strong guest interest in prioritizing meaningful dine-in experiences, even if it means spending more per occasion but less frequently. Continued focus on profitable traffic and strong service experience will be the differentiators here.

FAST CASUAL BRANDS

will need to remain cautious, as many concepts are caught in the no man's land of convenience and experience. Some fast casual concepts may be particularly challenged due to rising check growth and increased ancillary charges over the past couple years. Rising tipping fatigue will likely drive increased consumer scrutiny over service-level and cost value of occasion, particularly for dine-in. And as third-party delivery cools off and off-premise channels swing back towards pick-up concepts need to be positioned to compete with the speed of drive-thru. Additionally, many fast casuals have expanded on the backs of Millennials, and discretionary spending shifts due to macroenvironmental pressures, climbing home ownership, and family life changes will continue to disrupt the dining behaviors of this generation. Some brands may need to better evaluate offering to satisfy changing dynamics or further diversify their core target customer base.

QUICK SERVICE RESTAURANTS

should likely benefit from macro-environmental headwinds, but the trade-down shift may be less pronounced and companies will need to invest in the right areas. Operators will need to focus on generating profitable traffic; while value-positioning can be a bellwether of growth for limited-service concepts during recessionary times, it is important that these campaigns don't come at the significant impact of restaurant-level margin. Additionally, value positioning should not come at the detriment of a newly re-engaged higher income consumer—some brands cannot lose sight of premium opportunities. The pandemic engaged higher-income consumers with QSRs due to off-premise efficiency; as recessionary pressures mount and delivery declines, these guests may be well positioned to increase engagement with QSR and will seek offerings to rival fast-casual competition.

At the forefront at delivering against these changes, will be the strength of the labor force. The industry will need to be nimble in the face of rising labor disruption and committed to transforming historical approaches to career management in the industry to up-skillings if they are to compete with adjacent sectors to attract top talent.

HOW BEING FRONT-FOOTED ON DE&I ACTIVATION COULD UNLOCK POTENTIAL

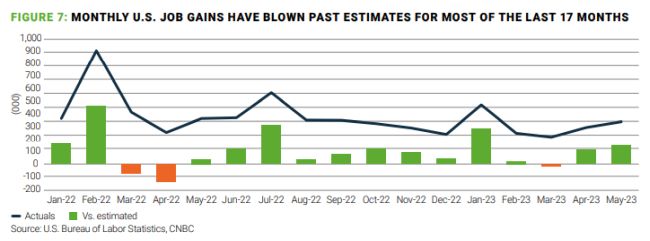

For much of the past year, U.S. economists' eyes have been glued to the monthly jobs report, looking for signs as to whether the country will dip into a recession or not; thus far, the labor market has held up with unexpected strength despite looming macroeconomic headwinds, likely preventing the U.S. from crossing recessionary thresholds as money is consistently being earned and spent.

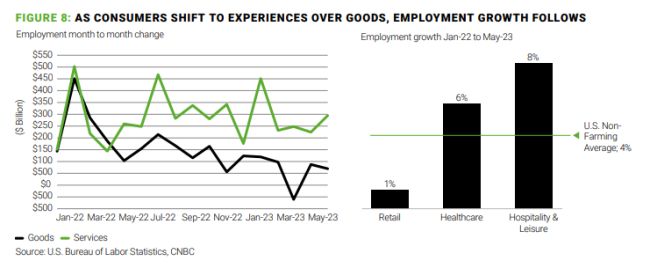

Beyond its status as an economic barometer, job creation may signal the rising importance of the restaurant industry in the context of greater GDP. While there have been some shifts in those participating in the workforce and a large section of the population moving into retirement and freeing up jobs, many of the job creation areas in the past year have been centered in service-oriented industries such as healthcare, hospitality, and leisure. As discretionary spending shifts from hard goods to services, dollars spent on dining arguably provide greater support to domestic employment, compared to dollars spent on apparel, where the bulk of labor costs remain overseas.

We are at a pivotal, disruptive point. Following decades of offshoring and automation and what is likely to come down the pipeline with digitization and artificial intelligence, there is strong potential with experiential consumer dynamic shifts for hospitality to continue to move center-stage in importance to the U.S. labor force. But 40% of hospitality jobs remain unfilled.

The restaurant industry will have to transform to meet this nascent goal; a sector that has historically positioned itself to target a transient or entry-level labor force will need to shift to a center of robust career development willing to embrace labor disruption, from minimum wage pressures to unionization. The evolution of the industry will require further investment in diversity, equity, and inclusion (DE&I) by leading concepts. Currently, there is a large gap between what restaurant companies are investing in DE&I and awareness among store-level employees about such policies, suggesting many brands may not be effectively signifying their ostensible commitment to DE&I.

Workforce management will be critical regardless of where companies fall on the speed versus experience spectrum. The next generation of employees will need a heightened skill set to work more broadly across operations and to leverage AI, technology, robot kitchens, and other innovations on the horizon while also delivering against customer experience. While the shift to the more experiential consumer may be the beacon the industry needs to further commit to ESG goals, it's ultimately less about wooing the consumer, and more about attracting top talent that can then feed the consumer experience.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.