On April 4, 2016, the Internal Revenue Service (IRS) and US Department of the Treasury (Treasury)—without advance warning—released proposed regulations under section 385 (the Proposed Regulations) that will, if finalized in their current form, have dramatic implications for US corporate tax planning and compliance. Certain aspects of the rules when finalized are intended to apply retroactively to corporate debt issued in specified circumstances on or after April 4, 2016. US government officials have indicated they intend to finalize the Proposed Regulations as early as the end of August, and many large corporate taxpayers are acting now, rather than waiting, to evaluate the Proposed Regulations' potential effects on their existing and future US tax planning strategies and compliance regimes.

The Proposed Regulations impact the US federal tax treatment of many cross-border intercompany loans among affiliated members of a multi-national enterprise (MNE), as well as loans between US corporations under common ownership not filing a consolidated return and loans between members of brother-sister US consolidated return groups. However, the Proposed Regulations generally do not affect loans between members of a single consolidated return group (the Proposed Regulations treat the members of a consolidated group as a single taxpayer).

In broad terms, where applicable, the Proposed Regulations (1) impose new documentation and information requirements for intercompany debt which, if not complied with, will automatically result in the purported debt instrument being characterized as stock for federal income tax purposes; (2) authorize the IRS to characterize a debt instrument as in part debt, and in part stock under certain circumstances (an example is provided focused on expected ability to pay); and (3) mandate recharacterization of an instrument otherwise qualifying as debt for federal income tax purposes as stock if issued in a distribution or certain other circumstances specified in the Proposed Regulations (targeting, among other things, note distributions, exchanges of related party stock for debt instruments, and similar debt-funded distributions or other transactions often used in cross-border tax planning to optimize the capitalization of a US member of a MNE, manage the global effective tax rate (via US interest deductions) or mitigate potential withholding taxes associated with repatriation). Certain exceptions are provided for small non-publicly traded groups, groups without significant amounts of proscribed intercompany debt (i.e., less than $50 million), and certain routine distributions (e.g., distributions of current year earnings and profits), but these exceptions are narrowly drawn. Therefore, if the Proposed Regulations are finalized, they will significantly impact the tax planning of virtually every publicly-traded MNE and many privately held enterprises as well.

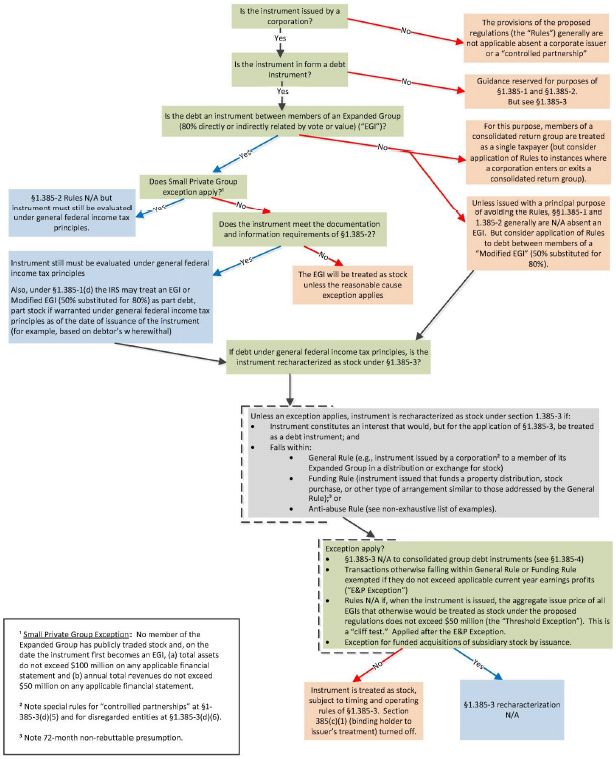

Following is an overview of the most significant rules in the Proposed Regulations. A flow chart on page 7 illustrates the basic application of these rules.

Section 1.385-2 Documentation and Information Requirements

In General. Section 1.385-2 of the Proposed Regulations sets forth minimum (necessary, but not sufficient) documentation and information requirements for an Expanded Group Instrument or "EGI" (generally a debt instrument (applicable instrument) between parties directly or indirectly at least 80 percent related by vote or value) to be respected as debt for federal income tax purposes, failing which the Proposed Regulations mandate the EGI will be treated as stock. Excepted from the application of the rules is the case of an EGI where no member of the Expanded Group has publicly traded stock and, on the date the instrument first becomes an EGI, (1) total assets do not exceed $100 million on any applicable financial statement and (2) annual total revenues do not exceed $50 million on any applicable financial statement. In addition, the provisions of section 1.385-2 do not extend to instruments not cast in the form of debt, such as sale-repurchase agreements (repos), leases treated as debt and preferred equity certificates.

Section 1.385-2 is proposed to be effective in respect of applicable instruments issued (or deemed issued) after the regulations are finalized (the General Effective Date). Thus, debt instruments issued before the General Effective Date are grandfathered, but such grandfathered instruments can become subject to the final regulations if they are significantly modified and deemed reissued under section 1001 after the General Effective Date.

The Proposed Regulations mandate the timely preparation and maintenance of the following documentation and information:

- Written documentation evidencing an unconditional and legally binding obligation to pay a sum certain on demand or at one or more fixed dates.

- Written documentation establishing that the holder has the rights of a creditor to enforce the obligation.

- Written documentation (e.g., cash flow projections, business forecasts, asset appraisals, determination of financial ratios) containing information establishing the issuer's financial position supported a reasonable expectation that the issuer intended to, and would be able to, meet its obligations pursuant to the terms of the applicable instrument.

- If an issuer made any payment of interest or principal with respect to the EGI and such payment is claimed to support the treatment of the EGI as indebtedness under general federal tax principles, documentation must include written evidence of such payment.

- If the issuer did not make a payment of interest or principal that was due and payable under the terms and conditions of the EGI, or if any other event of default or similar event has occurred, there must be written documentation evidencing the holder's reasonable exercise of the diligence and judgment of a creditor (e.g., documentation of the holder's efforts to assert its rights under the terms of the EGI or any documentation detailing the holder's decision to refrain from pursuing any actions to enforce payment).

The Proposed Regulations contain detailed rules as to what constitutes "timely" preparation and specify the records required to be maintained and period for which they must be maintained.

In the case of revolving credit and similar agreements, the documentation requirement may be satisfied by relevant enabling documents such as board of directors' resolutions, credit agreements, security agreements, as well as any relevant documentation executed with respect to an initial principal balance or increase in the principal balance of the EGI. If an EGI is issued pursuant to a cash pooling arrangement or internal banking service that involves cash sweeps, set-off facilities or similar features, the EGI satisfies the documentation requirements only if the material documentation governing the ongoing operations of the cash pooling arrangement or internal banking service—including any agreements with entities that are not members of the expanded group—conforms to the requirements of section 1.385-2 and contains the relevant legal rights and responsibilities of the parties to the arrangements in conducting the operation of the cash pooling arrangement or internal banking service.

Section 1.385-2 Operating Rules. The operating rules under section 1.385-2 include a "reasonable cause" exception (with reference to the principles set forth in the regulations under section 6724), for instances where the taxpayer is able to establish that a failure to satisfy the documentation and information requirements of section 1.385-2 is due to reasonable cause. In such cases, the Proposed Regulations provide that "appropriate modifications may be made" in determining whether the requirements of this section have been satisfied.

The operating rules also (1) address the application of section 1.385-2 to an applicable instrument becoming or ceasing to be an EGI, including in the case of an applicable instrument ceasing to be between members of a consolidated return group, (2) specify that an EGI issued by a disregarded entity (DRE) that is treated as equity under section 1.385-2 will be treated as an equity interest in the DRE (converting it to a partnership) for federal tax purposes rather than stock in the DRE's owner and (3) provide that a "controlled partnership" is treated as a member of an expanded group if one or more members of the expanded group own, directly or indirectly, 80 percent of the interests in partnership capital or profits of the controlled partnership and specify that an EGI issued by a controlled partnership that is recharacterized as stock under section 1.385-2 is treated as an equity interest in the controlled partnership.

Finally, section 1.385-2(d) provides that taxpayers may not make affirmative use of the rules of section 1.385-2 to reduce federal tax liability and section 1.385-2(e) provides that if an applicable instrument that is not an EGI is issued with a principal purpose of avoiding the purposes of the section, the applicable instrument will be treated as an EGI subject to the section.

Bifurcation of Debt between Modified Expanded Group Members: Section 1.385-1(d)

Section 1.385-1(d) provides that the IRS may treat an EGI between members of a "Modified Expanded Group" (an Expanded Group but substituting 50 percent for 80 percent as the relationship threshold) as in part indebtedness and in part stock "to the extent that an analysis, as of the issuance of the EGI, of the relevant facts and circumstances concerning the EGI (taking into account any application of section 1.385-2) under general federal tax principles results in a determination that the EGI is properly treated for federal tax purposes as indebtedness in part and stock in part." The sole example provided involves a case where the IRS's analysis supports a reasonable expectation that, as of the issuance of the EGI, only a portion of the principal amount of an EGI will be repaid. The issuer of an EGI, the holder of an EGI, and any other person relying on the characterization of an EGI as indebtedness for federal tax purposes would continue to be bound by the issuer's initial characterization (i.e., no affirmative use of bifurcation by taxpayers is permitted).

The debt bifurcation provision applies to all corporate instruments issued in form as debt, without exception, effective as of the General Effective Date but, for purposes of sections 1.385-3 and 1.385-4, as of the accelerated effective date provided for in those sections (see discussion below). Like the provisions of section 1.385-2, this bifurcated debt provision does not extend to instruments not issued in the form of debt.

Debt Recharacterization Rules of Section 1.385-3

Subject to certain exceptions discussed below, section 1.385-3 provides rules for recasting debt instruments as stock when the instruments are issued in certain transactions. The term "debt instrument" is defined as an interest that would, but for the application of section 1.385-3, be treated as debt under general federal income tax principles (and, unlike section 1.385-1(d) and section 1.385-2, section 1.385-3 can apply to repos, leases treated as debt, preferred equity certificates and other instruments that in substance, but not form, constitute debt for federal tax purposes).

Recasts under General Rule. Under the "General Rule" in section 1.385-3(b)(2)), debt instruments issued under the following circumstances will be recast as stock: (1) debt issued by a corporation to a related corporate shareholder as a distribution, (2) certain debt issued by a corporation in exchange for stock of an affiliate (for example, a share repurchase for a note or a purchase of affiliate shares for a note in what otherwise would be a section 304 transaction) and (3) certain debt issued as part of an internal asset reorganization (e.g., a cross chain transfer of assets in exchange for a note distributed to parent company in a "D" reorganization).

The Proposed Regulations are aimed at effectively overturning the result in Kraft Foods Co. v. Commissioner, 232 F.2d 118 (2d Cir. 1956), a case in which the Second Circuit Court of Appeals determined that debentures issued by a corporate subsidiary to its sole corporate shareholder as a dividend should be respected as indebtedness for federal income tax purposes. In the preamble to the Proposed Regulations, the IRS and the Treasury note that the factors in cases like Kraft, "including the parent-subsidiary relationship, the fact that no new capital is introduced in connection with a distribution of debentures, and the typical lack of a substantial non-tax business purpose," support the conclusion that "the issuance of a debt instrument in a distribution is a transaction that frequently has minimal or nonexistent non-tax effects . . . allowing the related parties to obtain significant federal tax benefits at little or no cost." The IRS and Treasury have determined that in such cases it is appropriate to treat a debt instrument as stock.

Under the "Funding Rule" in section 1.385-3(b)(3), the provisions of section 1.385-3 also apply to any debt instrument that is a "principal purpose debt instrument"—a debt instrument "to the extent it is issued by a corporation (funded member) to a member of the funded member's expanded group in exchange for property with a principal purpose of funding [certain specified types of a] distribution or acquisition" (paralleling the transactions addressed by the General Rule). The reference to "to the extent" signifies that the treatment of an instrument can be bifurcated under the recharacterization rules of section 1.385-3 as well as under section 1.385-1(d). For example, if a corporation with no earnings and profits borrows $100 from an affiliate and then distributes $80 of cash to its parent corporation, $80 of the loan will be recast as stock and $20 of the loan will continue to be treated as debt. No further rules are provided for how to treat the bifurcated instrument (e.g., how to allocate future interest and principal payments between the stock and debt portions of the instrument).

Under a non-rebuttable per se rule, a debt instrument is treated as issued with a principal purpose of funding a proscribed distribution or acquisition if it is issued by the funded member during the 72 month period beginning 36 months before the date of the distribution or acquisition, and ending 36 months after the date of the distribution or acquisition. This per se rule is subject to a very narrow "ordinary course exception" for a debt instrument that arises in the issuer's trade or business in connection with the purchase of property or the receipt of services, as well certain other narrow exceptions (that also apply to the General Rule and which are described below). There is currently no general exception for cash sweeps or similar arrangements, although the government is willing to further consider whether some exceptions for these arrangements would be appropriate.

Recasts under Anti-Abuse Rule. Finally, under an anti-abuse rule set forth in section 1.385-3(b)(4), a debt instrument is treated as stock if it is issued with a principal purpose of avoiding the application of section 1.385-3 or section 1.385-4 (not otherwise discussed in this article, section 1.385-4 provides rules for applying section 1.385-3 to consolidated groups when an interest ceases to be a consolidated group debt instrument or becomes a consolidated group debt instrument). In addition, an interest that is not a debt instrument (for example, a contract to which section 483 applies or a non-periodic swap payment) is treated as stock if issued with a principal purpose of avoiding the application of the rules. The anti-avoidance rule may apply, for example, if a debt instrument is issued to, and later acquired from, a person who is not a member of the issuer's Expanded Group with a principal purpose of avoiding the application of the rules. A number of additional examples are provided.

Exceptions to Application of Section 1.385-3

Section 1.385-3(c) contains a number of important exceptions:

- Exception for Current Earnings and Profits. Section 1.385-3(c) provides that, for purposes of the application of the General Rule (section 1.385-2(b)(2)) and the Funding Rule (section 1.385-2(b)(3)) to a member of an Expanded Group with respect to a taxable year, the aggregate amount of any distributions or acquisitions that are described in the General Rule or the Funding Rule are reduced by an amount equal to the member's current year earnings and profits. This reduction is applied to the transactions based on the order in which the distributions and acquisitions occur. It is not clear from the preamble why the exception is provided solely for distributions from current (as opposed to current and accumulated earnings and profits), but the government has since stated that the exception is intended only to protect ordinary course distributions and not all dividend distributions.

- Threshold Exception. A debt instrument is not treated as stock under section 1.385-3 if, immediately after the debt instrument is issued, the aggregate adjusted issue price of debt instruments held by members of the Expanded Group otherwise caught by the rules does not exceed $50 million. Once this threshold is exceeded, the Threshold Exception will not apply to any debt instrument issued by members of the Expanded Group for so long as any debt instrument that previously was treated as indebtedness solely because of the Threshold Exception remains outstanding.

- Exception for Funded Acquisitions of Subsidiary Stock by Issuance. An acquisition of Expanded Group stock will not be treated as described in the Funding Rule if the acquisition results from a transfer of property by a funded member (the transferor) to an Expanded Group member (the issuer) in exchange for stock of the issuer, provided that, for the 36-month period immediately following the issuance, the transferor holds, directly or indirectly, more than 50 percent of the total combined voting power of all classes of stock of the issuer entitled to vote and more than 50 percent of the total value of the stock of the issuer.

Section 1.385-3 Operating Rules

Section 1.385-3(d) sets forth various operating rules for the application of the section, including rules addressing excepted debt that that then ceases to qualify for an exception and debt treated as stock which then ceases to be between members of an Expanded Group. A comprehensive discussion of these rules is beyond the scope of this article. A few highlights are as follows:

- Treatment of Partnerships. A controlled partnership is treated as an aggregate of its partners. Thus, for example, when a corporation that is a member of an Expanded Group becomes a partner in a partnership that is a controlled partnership with respect to that Expanded Group, the corporation is treated as acquiring its proportionate share of the controlled partnership's assets. In addition, each Expanded Group partner in a controlled partnership is treated as issuing its proportionate share (based on its share of partnership profits) of any debt instrument issued by the controlled partnership. To the extent that this application of the aggregate approach causes a debt instrument issued by a controlled partnership to be recharacterized under section 1.385-3(b), then the holder of the recharacterized debt instrument is treated as holding stock in the Expanded Group partners. The controlled partnership rules do not provide guidance regarding all the collateral recasts that result from the aggregate approach, the additional recasts that will be required when the recharacterized debt is later repaid, or any implications under the existing partnership rules (e.g., under section 752).

- Treatment of Disregarded Entities. If a debt instrument of a disregarded entity is treated as stock under section 1.385-3, the debt instrument is treated as stock in the entity's owner rather than as an equity interest in the entity, which prevents the disregarded entity from becoming a partnership with two equity owners. (This is the opposite of the rule in section 1.385-2, which (as described above) causes a disregarded entity that issues debt without sufficient documentation to become a partnership when the debt is recharacterized as stock.)

- No Affirmative Use. The rules of section 1.385-3 and section 1.385-4 do not apply to the extent a person enters into a transaction that otherwise would be subject to the rules with a principal purpose of reducing the federal tax liability of any member of the Expanded Group that includes the issuer and the holder of the debt instrument by disregarding the treatment of the debt instrument that would occur without regard to this section. (Some have referred to this as "the government always wins rule," and they have expressed the view that the existence of this rule (among others) makes the Proposed Regulations especially vulnerable to a validity challenge.)

Section 1.385-3 Effective Date

Section 1.385-3 applies to any debt instrument issued on or after April 4, 2016, and to any debt instrument treated as issued before that date as a result of an entity classification election made under section 301.7701-3 that is filed on or after this date. For purposes of the principal purpose test set forth in section 1.385-3(b)(3)(iv), a distribution or acquisition described in the Funding Rule that occurs before April 4 (other than a distribution or acquisition that is treated as occurring before that date as a result of an entity classification election made under section 301.7701-3 that is filed on or after that date) is not taken into account. Once again, care should be exercised to ensure that grandfathered debt instruments issued before April 4, 2016 do not inadvertently become subject to the rules through a significant modification occurring after April 4, 2016.

For instruments that otherwise would be treated as stock pursuant to section 1.385-3 prior to issuance of the section 385 regulations in final form, the debt instrument is treated as indebtedness until the date that is 90 days after the date of publication in the Federal Register of the Treasury decision adopting the rule as a final regulation. To the extent that the debt instrument is held by a member of the issuer's Expanded Group on the date that is 90 days after the date of publication in the Federal Register of the Treasury decision adopting the rule as a final regulation, the debt instrument is deemed to be exchanged for stock on that date. Although this 90 day rule provides flexibility to unwind debt instruments issued after April 4, 2016, close attention should be paid to both the transaction in which the instrument was issued and the unwind transaction, because such transactions may still be subject to the Funding Rule.

Conclusion

The Proposed Regulations are an ambitious undertaking. Satisfaction of what historically have been factors to take into account as part of a debt-equity analysis will become necessary (but not sufficient) conditions for treatment of an instrument as debt for federal tax purposes if the Proposed Regulations are finalized. The IRS is also given license to bifurcate an instrument into part debt and part stock on audit. Moreover, an instrument qualifying as debt, both under general federal income tax principles and the provisions of section 1.385-1 and section 1.385-2, can still be automatically recharacterized as stock under section 1.385-3 if the debt is issued in certain contexts. Particularly troubling is the vague and uncertain reach of section 1.385-3, covering as it does not only easily discernible fact patterns like the distribution of debentures in Kraft Foods, but also highly ambiguous and complex scenarios such as those addressed by the Funding Rule (particularly under the 72 month per se rule). The routine recharacterization of intercompany debt as stock under these rules can trigger, among many other surprising and adverse consequences, a de-consolidation of a subsidiary, a break in section 368(c) control, disqualification of a REIT, inadvertent hook stock, section 304 transactions and subpart F income, to name only a few examples. It also, of course, would create a proliferation of cross-border hybrid instruments (since the instrument in question may satisfy normal conventions for debt characterization). Moreover, it remains to be seen whether (and how) states will implement the rules once finalized (keeping in mind that members of a consolidated return group may file separate state tax returns). Consequently, taxpayers are well-advised to take stock (no pun intended) of their intercompany debt regimes.

Government officials have expressed an active interest in receiving comments on the Proposed Regulations as quickly as possible. Given the scope and complexity of these new rules, it can be anticipated that extensive comments will be forthcoming.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]