Overview

In our report we continue to look at the progress that smaller biotech companies have made in their reporting on environmental, social and governance (ESG) matters building on our prior research. This year saw a significant increase in all areas of reporting as companies seem to be responding to pressures from investors and other stakeholders to increase the quantity and quality of information that they disclose.

In 2023, we reviewed the disclosure practices of 74 biotech companies (see Appendix) with market capitalizations ranging from $1 billion to $10 billion as of June 30, 2023, which represented a substantial increase in the number of companies that we reviewed in 2021 (50) and 2022 (48). Sixteen of the 74 companies were also included in the list of companies that we previously reviewed. The companies that we considered to have provided ESG disclosure (see "Methodology – Defining ESG Disclosure") are referred to as the "disclosing companies" in this report.

Highlights for 2023

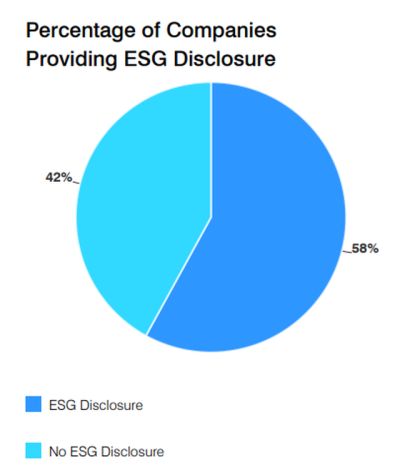

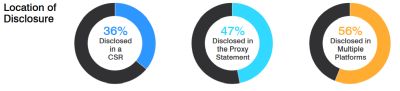

- Although the percentage of companies disclosing ESG information was roughly the same (60% in 2022 vs. 58% in 2023), the percentage of companies providing ESG disclosure in voluntary, standalone reports (CSRs) more than doubled from 17% in 2022 to 36% in 2023.

- With the increased use of CSRs, there was a corresponding increase in the breadth and depth of ESG disclosure, with most topics showing significant increases in the percentage of disclosing companies providing disclosure.

- The most common topics discussed were environmental/ sustainability, human capital resources, community engagement and business ethics.

- The topics of access to medicine, cybersecurity and community engagement showed the biggest increases in the percentage of companies disclosing compared to 2022.

- 77% of disclosing companies provided quantitative metrics, including employee demographic information (gender and race/ethnicity), employee attrition and engagement, corporate donations, tons of recycled waste and drug recalls.

Steady Progress Toward Greater ESG Disclosure

When we published our first report, Biotech's ESG Crossroads, our research from data gathered in 2021 revealed that relatively few companies had reported any ESG data at that time. Of the 50 U.S. biotech companies with market capitalizations ranging from $1.3 billion to $4.6 billion, just 30% of the subject companies publicly disclosed ESG information as a unified set of risks and opportunities under an umbrella term such as "ESG," "sustainability" or "corporate social responsibility." Furthermore, only nine (18%) and five (10%) of the companies had provided disclosure in their proxy statements and CSRs, respectively, with three companies providing disclosure in both documents.

When we examined the same group of companies in our follow-up report in 2022, The Evolution of ESG Disclosure for Biotech Companies, we noticed significant progress, with 60% of such companies providing ESG disclosure, primarily in their proxy statements. Although only eight companies had produced CSRs, as we noted in that report, the breadth and depth of such disclosures indicated progress and the achievement of reporting goals expressed in the prior report.

In 2023 we expanded the scope of our review to include more companies with a higher market capitalization, and we saw a substantial increase in the number of companies providing detailed ESG disclosure in CSRs. Although the percentage of companies reporting ESG information was relatively consistent with 2022 (58% versus 60%), the percentage using CSRs, which typically include the most detailed ESG information and generally employ quantitative metrics guided by third-party reporting standards, more than doubled, with 36% of companies reviewed disclosing in CSRs in 2023 versus 17% in 2022.

Perhaps because of more companies providing disclosures in CSRs, the percentage of companies disclosing in proxy statements declined from 54% in 2022 to 47% in 2023, including three companies that only briefly mentioned board oversight of ESG. When disclosing companies provided their ESG disclosure in their proxy statements, the disclosure was generally brief and qualitative. The average disclosure consisted of a few paragraphs describing ESG initiatives at a high level, usually broken into separate subsections for discrete ESG topics such as "environment" or "community impact."

Twenty-four or 56% of the disclosing companies provided disclosure in more than one platform, typically in a CSR and proxy statement.

To view the full article, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.