- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Advertising & Public Relations and Law Firm industries

- within Transport and Strategy topic(s)

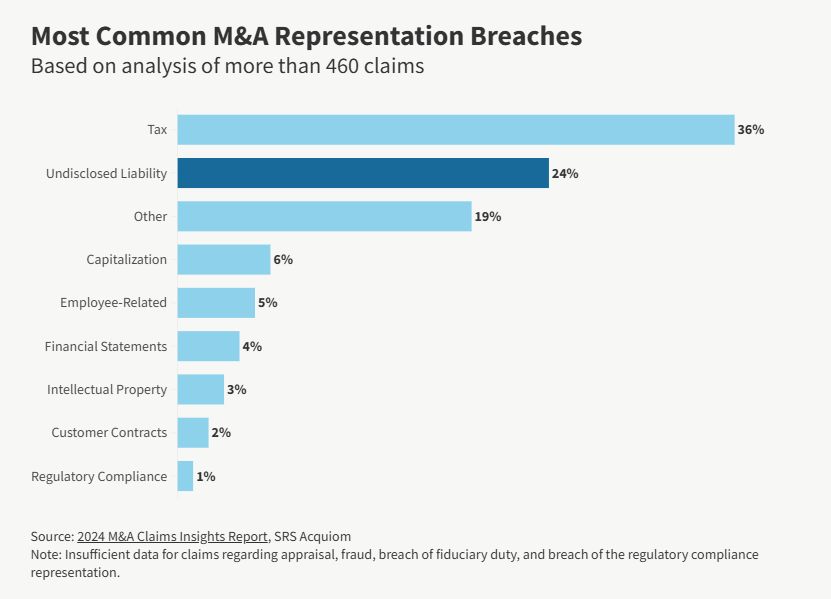

Undisclosed liability claims in M&A have more than doubled since 2022. They now account for 24% of all breach of representations and warranties (R&W) indemnification claims and are one of the most significant post-closing risks in M&A deals, according to SRS Acquiom's "2024 M&A Claims Insights Report."1

Although the cause of the surge in undisclosed liability claims is subject to conjecture, Ruth Mackey, a director at SRS Acquiom, suggests that market conditions over the past two years may be driving a rise in "buyer's remorse" and a corresponding increase in R&W indemnification claims. According to Mackey, "in line with the market trend of hunkering down and trying to hold on to more cash, buyers seem to be pursuing claims the parties may not have identified in due diligence or claims that buyers may not have previously cared to pursue."

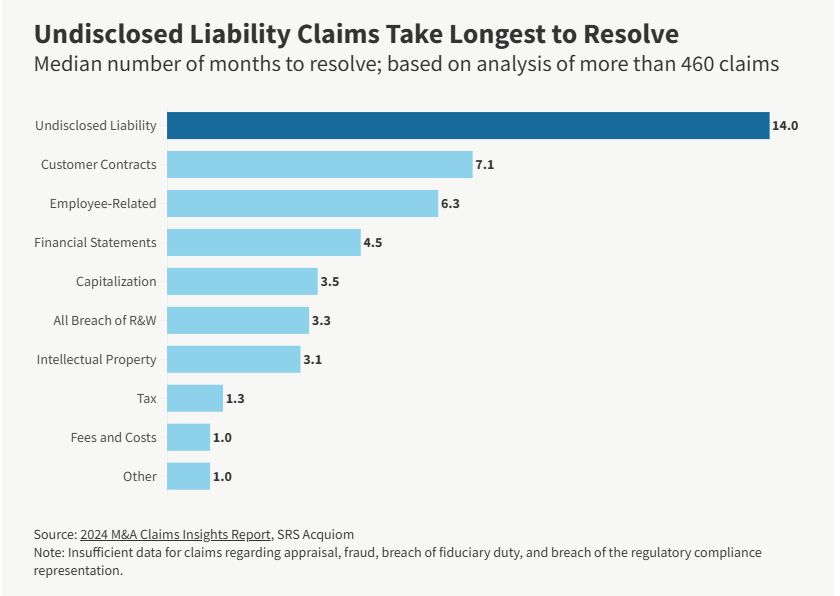

Undisclosed liability claims are often paired with claims regarding breaches of other representations. Aon's "2024 Transaction Solutions Global Claims Study" indicates undisclosed liability claims tend to have lesser individual severity than other types of claims since specific breached representations typically govern the underlying issues, making the undisclosed liabilities representation a secondary claim rather than the primary basis for recovery. But with a median resolution time of 14 months — longer than any other type of M&A claim — undisclosed liability claims still trigger complex, costly, and resource-intensive resolution processes that can strain deal relationships and consume substantial management attention.

The longer resolution time for undisclosed liability claims likely stems from their nature. Unlike disputes over specific issues, claims with respect to undisclosed liabilities that are not otherwise subject to coverage by another representation may come as a greater surprise to a seller and trigger stronger resistance, leading to costlier and more protracted negotiations.

How NUL Representations Shape Risk Allocation

At the center of these disputes is the "no undisclosed liabilities" (NUL) representation (also called the "absence of liabilities" representation), whereby a target company — or its seller(s) — affirms that it has no liabilities or obligations of any kind, except those set forth on its balance sheet or otherwise identified (subject to certain negotiated qualifications).

The scope of a NUL representation can dramatically shift the risk of otherwise undisclosed or unknown liabilities between parties. Buyers typically seek broad coverage with minimal qualifications or exceptions, while sellers push for narrower terms with multiple carve-outs.

A buyer-friendly NUL representation might simply state:

The Target has no Liabilities other than (a) Liabilities specifically accrued for or reserved against in the Latest Balance Sheet and (b) as set forth on Section [X] of the Disclosure Schedule.

This straightforward language gives buyers maximum protection, allowing claims for any undisclosed liabilities that existed at closing but weren't captured in the balance sheet or disclosure schedule.

Sellers, however, often negotiate for more protective language. For example:

The Target has no liabilities that would have been required to be reflected or reserved against in a consolidated balance sheet of the Target prepared in accordance with generally accepted accounting principles, other than (a) liabilities reflected or reserved against in the Latest Balance Sheet, (b) liabilities incurred in the Ordinary Course of Business since the date of the Latest Balance Sheet, (c) liabilities that would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect, (d) executory obligations under Contracts, (e) liabilities as set forth in the Disclosure Schedule, and (f) liabilities incurred in connection with the transactions contemplated by this Agreement.

These additional qualifications significantly limit the seller's exposure. Buyers can pursue claims only for liabilities that fall outside the listed exceptions (a) through (f), and, in particular, the "Material Adverse Effect" qualifier sets a very high bar. This approach significantly reduces the seller's exposure and limits the buyer's potential claims, effectively shifting some of the risk of undisclosed or unknown liabilities back to the buyer unless such undisclosed or unknown liabilities "fit" into the narrowed scope of liabilities subject to the NUL representation.

Buyers typically succeed in obtaining a protective NUL representation. SRS Acquiom's "2025 M&A Deal Terms Study" notes that 97% of 2024 M&A deals included in the study contain a NUL representation, with 19% of such NUL representations drafted in a way that favors the seller and 81% of such NUL representations drafted in a way that favors the buyer.

How Buyers and Sellers Can Manage the Risk

The surge in undisclosed liability claims — and their lengthy resolution times — demands careful attention from both sides of M&A transactions. For buyers, securing a broad NUL representation is crucial in protecting against hidden liabilities that might surface after closing. Sellers must balance limiting their exposure against addressing legitimate buyer concerns, all while avoiding terms that could trigger prolonged disputes.

Successful risk management begins with careful negotiation. Buyers should minimize exceptions to NUL representations while ensuring clear paths to R&W indemnification. Sellers, in turn, need to identify appropriate carve-outs that limit their exposure and don't invite disputes. Both parties must carefully consider how each qualification affects the overall allocation of risk.

Due diligence serves as the second line of defense. Both parties should focus on uncovering potential liabilities before signing, with special attention to areas not covered by other representations. Targeted questions about specific liability concerns often reveal issues that might otherwise surface as post-closing disputes.

Finally, post-closing monitoring provides crucial protection. This means establishing clear integration plans with specific monitoring responsibilities, regularly reviewing the target company's financial and operational condition, and addressing potential issues early — before they escalate into formal claims. When issues do arise, early identification and intervention can prevent them from becoming prolonged legal battles.

Looking Ahead

The dramatic rise in undisclosed liability claims signals a new era in M&A risk management. As these disputes grow more common and take longer to resolve, careful negotiation of NUL representations becomes increasingly critical. Success requires a nuanced approach that considers transaction specifics, industry dynamics, and each party's risk tolerance. By treating NUL representations as vital risk-allocation tools, parties can better navigate today's complex M&A landscape and minimize the likelihood of costly, protracted disputes.

Footnote

1. The report is based on data collected from more than 460 breach of seller R&W claims (excluding "fees and costs" claims) for deals with fully released escrows between Q3 2022 and Q2 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.