- within Corporate/Commercial Law and Insurance topic(s)

In Dealmaker's Digest, read the top 10 latest developments in global transactions. We offer insights into M&A activity across industries and borders. To receive our M&A thought leadership, please join our mailing list.

Key Takeaways

- U.S. outbound deal value jumped to over $80 billion in July; the highest monthly value in over 3 years was driven by megadeals in the software and pharmaceutical sectors.

- Aggregate global deal value in July increased another 6% and exceeded $480 billion, while monthly deal count dropped 13%.

- Acquisitions in the software and transportation sectors led U.S. M&A activity in July.

- Earnouts: A market snapshot of this key M&A mechanism.

Global M&A Activity Update

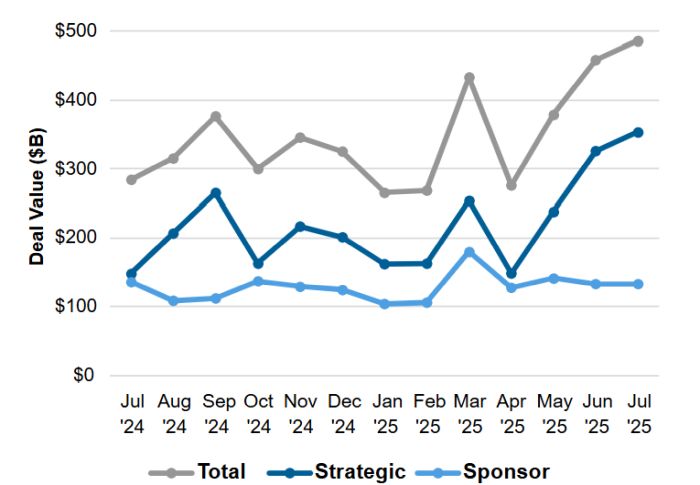

1 Deal Value Trends

Aggregate global monthly deal value1 in July exceeded $480 billion, an increase of 6% from June and 71% year-over-year. Union Pacific's $71 billion proposed acquisition of Norfolk Southern drove the highest monthly deal value in more than three years.

Transactions involving strategic buyers in July exceeded $350 billion and continued Q2's upswing in activity. Strategic buyer deal value was up 8% month-over-month and 139% year-over-year.

Financial, or sponsor, buyer transactions held steady in July, down by just $100 million. Year-over-year, sponsor buyer deal value also held steady (-2%).

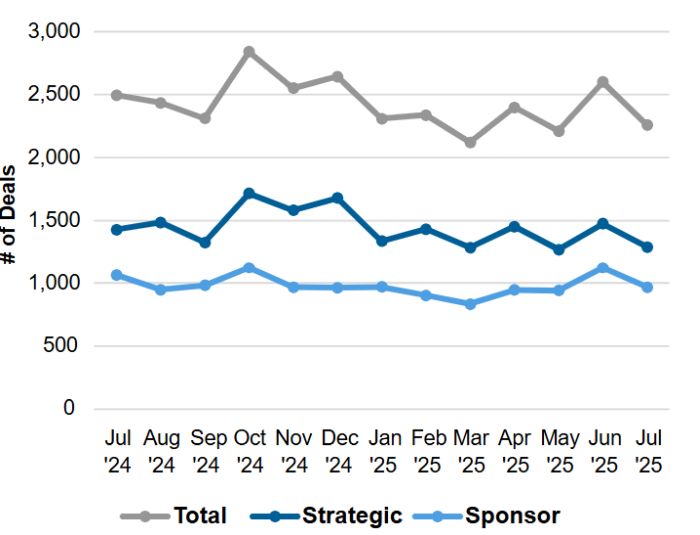

2. Deal Count Trends

Despite the upswing in monthly value, global deal count declined 13% in July and regressed toward the trailing twelve-month average (~2300 deals). Year-over-year, deal count dropped 10%.

Strategic buyer deal count in July also declined 13% month-over-month and 10% year-over-year.

Sponsor buyer deal count fell 14% from June and 9% year-over-year.

Active M&A Industries (U.S. Targets)

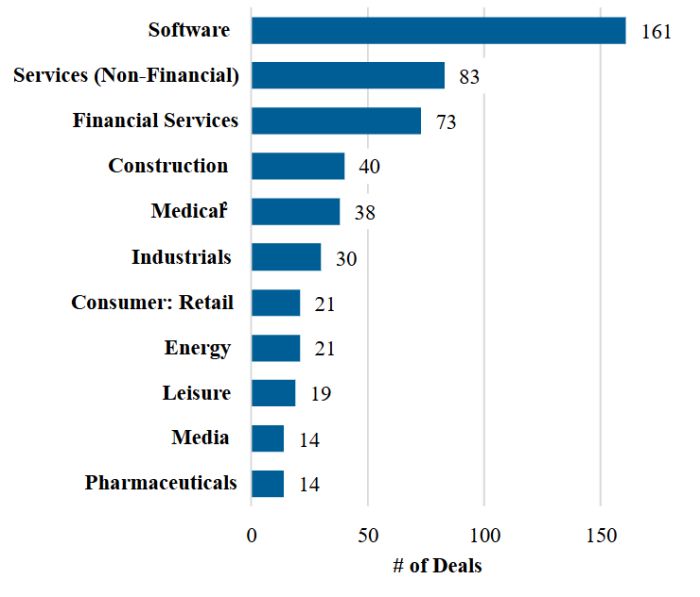

3 By Deal Count

- The software industry remained at the top for U.S. M&A activity by deal count in July, continuing its streak as the leading industry by volume.

- Services industries remained active, rounding out the top three sectors in July by deal count.

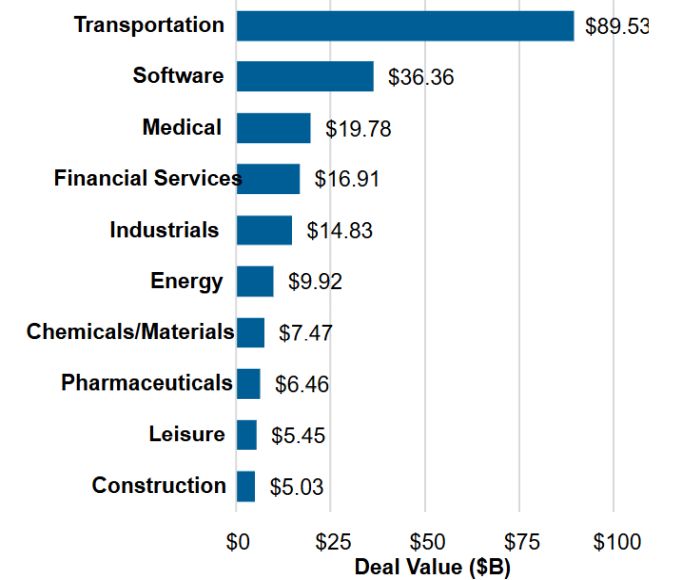

4 By Deal Value

- The transportation sector topped the charts by deal value in July, driven by Union Pacific's $71 billion announced merger with Norfolk Southern.

- The software industry was pushed to second place for most active sector by deal value in July, followed by the medical sector.

5 Global Blockbuster Deals

Largest Transportation Deal

- Union Pacific agreed to acquire Norfolk Southern in a stock and cash transactions with an equity value of approximately $71 billion.

Largest Software Deal

- Palo Alto Networks agreed to acquire CyberArk in a stock and cash transaction with an equity value of approximately $25 billion.

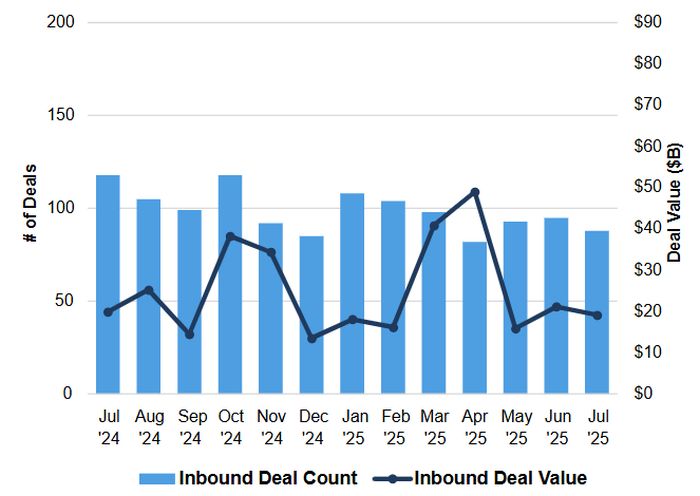

6 Inbound U.S. M&A Activity

- By deal value, inbound U.S. activity in July declined 10% from June. Year-over-year, inbound deal value held roughly steady (-4%).

- By deal count, acquisitions of U.S. targets by non-U.S. acquirers declined 7% in July. Year-over-year, inbound deal count decreased 25%, likely the result of continuing political uncertainty regarding foreign investment.

- UK- and Canada-based acquirers undertook the largest number of inbound transactions in July, with 15 and 12 deals, respectively. India trailed behind with 7 deals.

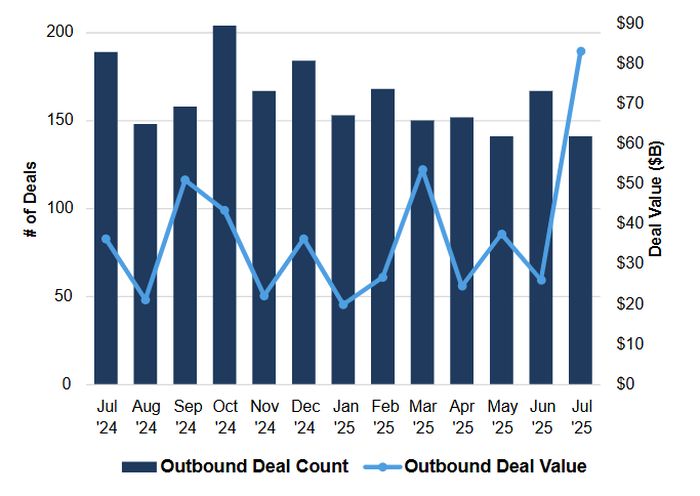

7 Outbound U.S. M&A Activity

- By deal value, acquisitions of ex-U.S. targets by U.S. buyers in July skyrocketed 219% from June to approximately $83 billion, the highest recorded in over 3 years. Megadeals in the software and pharmaceutical sectors drove the increase. Year-over-year, outbound deal value was up 129%.

- Despite the boom in deal value (caused by outsized blockbusters), outbound deal count decreased 16% from June to July. Year-over-year, outbound deal count declined 25%.

- U.S. acquirers predominantly looked to targets in the UK in July, with 29 transactions. Canada took second place with 15 transactions, and Australia took third with 9 deals.

Market Snapshot: Earnouts

Whether bridging stubborn valuation gaps, unlocking deals that might otherwise stall, or assuring founders they can participate in future upside, earnouts have become a defining feature of M&A in recent years. Key earnout market insights are highlighted below.

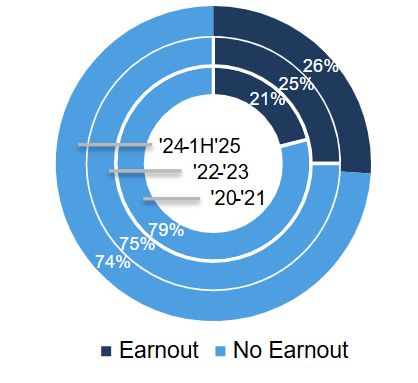

8 Earnout Usage

- Earnouts have gained prominence as a flexible solution to valuation uncertainty, especially in sectors facing rapid change or limited comps. They allow parties to bridge pricing gaps by tying a portion of the purchase price to the achievement of post-closing milestones, aligning incentives and enabling deals in challenging environments.

- In private-target North American deals (other than life sciences transactions)3 in which Ropes & Gray advised over the last 18 months, more than one-quarter included a milestone payment or other earnout mechanic.

- The noticeable post-2020 uptick (when 21% of comparable deals utilized an earnout) illustrates the extent to which parties have leveraged this mechanism to enable deals amid unsteady economic markets.

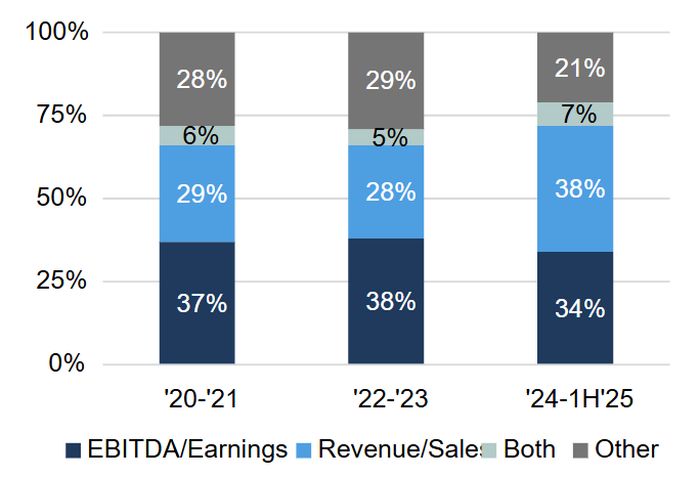

9 Basis for Earnout

- Sales or revenue-based metrics have been the most frequently utilized earnout triggers over the past 18 months, followed by EBITDA or other earnings-based targets.

- Other triggers that we observe include deal-specific objectives, such as high-multiple exits, closing of add-on acquisitions or technology-focused metrics (e.g., subscription counts).

Standard of Operation for Businesses Subject to Earnout

- Where earnouts are utilized, covenants and other guardrails regarding the standard of operation during the earnout period are often heavily negotiated.

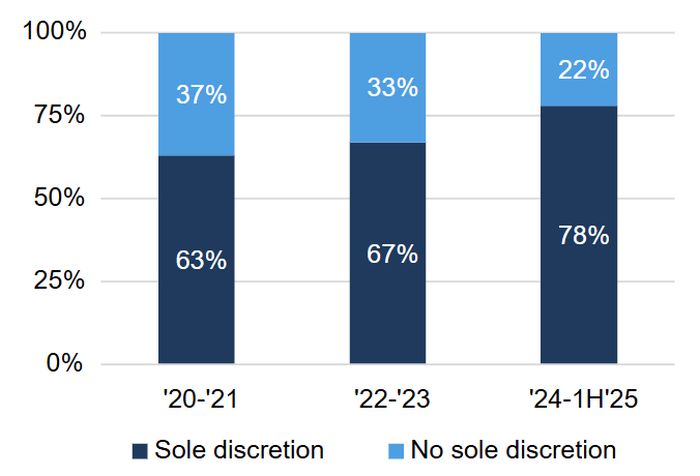

- We have observed an increasing percentage of deals providing buyers with sole discretion to operate post-closing, often coupled with deal-specific or measurable obligations in lieu of "ordinary course" covenants. This trend continues from earlier years.

Footnotes

1. Unless otherwise noted, charts compiled using Mergermarket data for July 2025 as of August 5, 2025. Aggregate deal values by dollar amount are calculated from the subset of deals with disclosed values.

2. Medical industry classification principally includes medical devices/technology/services, excluding biotech and pharmaceutical deals.

3. Transactions in the life sciences sector have been excluded to better represent the prevalence of earnouts and related standards across all industries. Life sciences transactions have traditionally utilized earnouts or CVRs at higher rates and incorporate tailored milestone events (such as regulatory approvals or commercial viability standards); recent data suggests the use of earnouts and CVRs outside of life sciences is increasing.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.