- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Media & Information and Retail & Leisure industries

Key Takeaways:

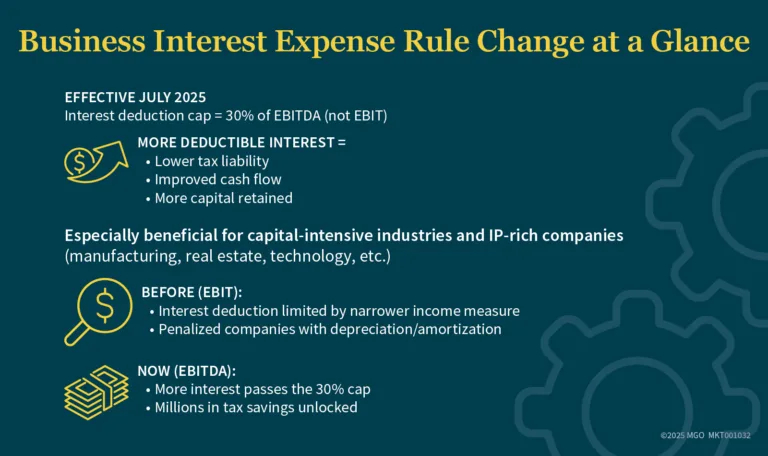

- New EBITDA-based deduction rules may reduce your company's taxable income significantly.

- Capital-intensive and IP-driven businesses stand to benefit the most from this tax change.

- Your tax strategy may need updates to maximize savings and follow new interest deduction rules.

If your business carries significant debt and works in a capital-intensive or intellectual property (IP)-heavy industry, a long-anticipated tax law change could substantially lower your federal tax bill. The shift — part of recent legislation — reintroduces a more favorable formula for deducting business interest, allowing many mid-market companies to benefit — especially those in manufacturing, telecom, life sciences, and tech.

Background

As of July 2025, businesses can now calculate interest deductions using 30% of EBITDA (earnings before interest, taxes, depreciation, and amortization), rather than EBIT. This adjustment expands the deduction cap and directly benefits companies with heavy equipment investments or large intangible asset portfolios. The change could translate into millions in annual savings — freeing up cash flow for reinvestment, hiring, or expansion.

What's Changed — And Why It Matters to You

Before this change, companies could only deduct interest up to 30% of EBIT — a narrower measure of income. This penalized firms with large depreciation and amortization expenses, reducing their ability to fully deduct interest on debt.

Now, with EBITDA back in the calculation, more of your interest expense is deductible. This especially benefits companies:

- Investing in equipment or facilities (high depreciation)

- Relying on patents, software, or brand value (high amortization)

- Backed by private equity or using debt to scale operations

While large companies drive headlines, middle-market firms with aggressive growth plans or recent capital investments are equally poised to benefit — if they act quickly.

How This Impacts Your Tax Strategy

If you're a CFO or tax executive, this isn't just a policy footnote — it's a planning opportunity. Here's what you should assess right now:

1. Model Your EBITDA Versus Interest Exposure

Review your financials and calculate interest as a percentage of EBITDA. Even if you were under the earlier EBIT-based cap, rising interest rates may have brought you closer to the limit. With EBITDA, you could have new room to deduct more.

2. Re-Evaluate Capitalization and Asset Strategy

High depreciation and amortization are now helpful again. Consider whether capital expenditures or amortized IP assets (like patents or software licenses) can be timed or structured to further boost EBITDA.

3. Evaluate Foreign Income Impacts

Not all changes are favorable. The law also requires exclusion of certain foreign income and includes capitalized interest in deciding whether you're over the cap. These nuances may reduce the benefit for some companies.

Which Industries Should Pay Close Attention?

This shift disproportionately benefits sectors where depreciation or amortization drives EBITDA higher, such as:

Manufacturing and Distribution

Heavy equipment investments often drive large depreciation. This change lets you deduct more interest related to equipment purchases, expansions, or upgrades. Explore our manufacturing solutions »

Life Sciences and Biotech

Drug and device companies with large IP portfolios now have more headroom to deduct interest — especially helpful if your company is scaling or recently completed an acquisition.

Technology

Amortizing intangibles like proprietary software and brand assets could boost EBITDA, giving you a wider deduction window — vital if your company used debt to fund growth.

Telecommunications

With substantial infrastructure depreciation, this rule is especially impactful. Businesses can now recapture deductions lost under EBIT rules.

What You Should Do Next

This is the time to:

- Re-model your tax position using EBITDA-based caps

- Reassess financing strategies considering increased deductibility

- Analyze carryforwards and future-year tax projections

- Revisit capitalization policies and M&A financing structures

Even if your interest expense is well below the cap today, this law creates a more favorable environment for future borrowing and investment.

How MGO Can Help

At MGO, we help mid-market companies translate complex tax changes into clear business advantages. Our tax professionals work with clients in manufacturing, life sciences, technology, cannabis, and other fast-evolving industries to build strategies that align with your capital structure and growth goals.

We go beyond compliance — helping you improve interest deductibility, forecast future liabilities, and stay ahead of shifting regulations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.