When management equity holders leave a private equity-backed company on good terms, if their equity is subject to repurchase, such equity holders typically sell their equity back to the company at "fair market value."[1] But who decides what that value actually is? The method for making this determination is established at the time of the private equity ("PE") sponsor's initial investment in the company, though the actual valuation occurs when the equity holder departs.

PE sponsors typically take one of three approaches:

- The company's board sets the value on its own (with, in certain circumstances, a right for the applicable member of management to dispute);

- An independent appraiser is hired to set the value; or

- The method varies based on the person's role, equity size, and circumstances

Getting this decision right matters because the chosen approach affects future costs, efficiency, relationship preservation, and potential dispute risk — all factors that can impact the deal's economics and future PE sponsor–management equity holder relationships.

Board Determination Dominates

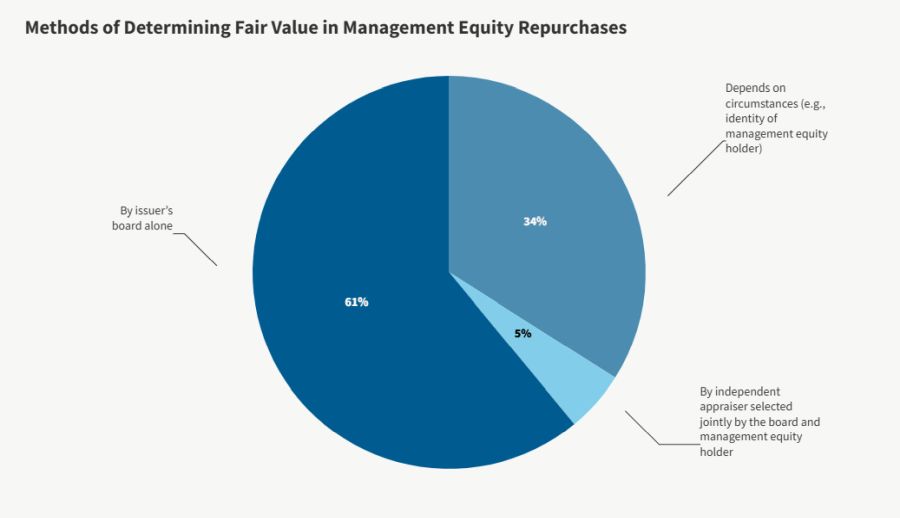

According to a poll of M&A partners in Goodwin's Private Equity practice, fair market value is determined solely by the portfolio company's board of directors in 61% of cases. Outside experts are used in only 5% of cases. Finally, about one-third of cases fall into a flexible category in which the approach varies based on circumstances like the management equity holder's role, equity stake, and relationship with the sponsor.

Why Boards Often Decide

Board determination offers three key advantages for PE sponsors. First, it delivers speed and cost efficiency because board members typically have access to sophisticated internal valuation models maintained by PE sponsors, eliminating the time and expense of engaging outside experts.

Second, boards can ensure methodological consistency across transactions, using the same methodology that determined the original valuation, "strike price," or "participation threshold" of the applicable equity the company is repurchasing. This consistency ensures growth is measured appropriately over time.

Third, companies retain full control over the process while still preserving the option to consult experts on their own terms when beneficial, rather than as a mandatory requirement.

When Independent Experts Add Value

Certain situations call for independent expertise. When a good faith determination requires specialized knowledge the board lacks (i.e., the valuation complexity demands professional expertise beyond internal capabilities), engaging an expert becomes necessary (or preferred) rather than optional.

Independent experts provide credibility benefits as their independence and adherence to market valuation practices offer boards greater protection from potential disputes. When stakes are high or relationships sensitive, external validation proves valuable.

Expert involvement also reflects negotiation dynamics. Significant management equity holders may use their leverage to negotiate for determinations made through bilateral processes or by independent experts, making expert involvement as much about relationship management as anything else.

When the Approach Depends on Circumstances

At the time these repurchase terms are negotiated, the varying levels of leverage that different stakeholders bring to the table may impact the outcome. While senior executives or founders with substantial equity stakes, strong sponsor relationships, or critical ongoing roles may strive for independent appraisals or hybrid processes that combine board discretion with expert validation, smaller stakeholders may simply accept board-determined valuations without additional process rights. While there is no one-size-fits-all approach, the overall determination is a negotiated point that merits a balance of the relevant objectives and circumstances.

The Bottom Line

The most appropriate approach for determining fair market value depends on the specific circumstances and relative leverage of the parties involved. PE sponsors scale their approach based on situational dynamics; while most favor board determination for its efficiency, they adapt when technical complexity, relationship considerations, or stakeholder leverage suggests alternative methods will better serve their objectives.

For more details on how PE sponsors use repurchase rights in respect of management incentive and rollover equity to achieve various equity management and risk mitigation goals, read our article "Trends in Equity Repurchasing in PE: Rollover vs. Incentive Equity."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.