- within Corporate/Commercial Law topic(s)

- in United States

- within Antitrust/Competition Law, Employment and HR and Technology topic(s)

If Sinosure—or one of its aggressive U.S.-based collection agents—is coming after you, stop everything and speak to experienced counsel immediately.

We've seen firsthand how quickly these matters escalate—and how devastating they can be for companies that delay. Sinosure is not your typical collections agency. It's a Chinese state-owned export insurance company with deep resources, sweeping authority, and global legal reach.

If you're not careful, you could:

- Pay twice what you owe — once to your supplier, and again to Sinosure

- Lose your intellectual property — including trademarks Sinosure can freeze through Chinese authorities

- Have shipments blocked by Chinese customs — cutting off access to critical inventory or product lines

- Be blacklisted from doing business in China — including credit blacklisting that affects future sourcing

The stakes are higher than you think.

What Is Sinosure and Why Should You Care?

Sinosure (China Export & Credit Insurance Corporation) was originally created to protect Chinese exporters when foreign buyers defaulted. The most common trigger for Sinosure involvement is when a company becomes late on payments to its Chinese factory or supplier. When payment delays occur, Chinese manufacturers can file claims with Sinosure to recover their losses—a process that transfers collection responsibility from your original supplier to this government-backed entity.

That original mission has evolved into something far more aggressive. Today, when a Chinese manufacturer claims you owe money, Sinosure can reimburse them immediately—and then comes after you directly with the full backing of the Chinese government.

This means your dispute is no longer a simple business disagreement with your supplier. You're now facing a Chinese government debt collector with:

- Global coordination capabilities

- A network of experienced U.S.-based law firms and collection agents

- Unlimited resources and patience

- A mandate to aggressively pursue collection from American companies

Remember: Sinosure is a Chinese government agency, trained and mandated to do what's best for the Chinese economy—and what's best for China is to aggressively collect from American companies, whether the full amount is truly owed or not.

Why Sinosure Debt Collection Is More Than a Manufacturer Dispute

We've successfully represented more than 100 companies against Sinosure and dealt with all the major U.S.-based firms they currently employ:

- Brown & Joseph (Angela Keane)

- The Leviton Law Firm (Don Leviton)

- USA Debt Recovery Solutions (Arthur Tretiakov)

- Creditors Adjustment Bureau/The Law Offices of Kenneth J. Freed (various attorneys)

They each have their strengths and weaknesses, and their own way of trying to collect on money allegedly owed to Sinosure, but they are all tough, relentless, and unyielding—because the Chinese government would have it no other way.

But our lawyers know how Sinosure and its debt collectors and law firms operate, what they look for in a target, and—most importantly—how to shut them down when it's still possible to do so.

Here's how Sinosure typically operates: They start by demanding you immediately confirm how much you owe, with threats to sue if you don't respond quickly.

The first thing we do is step in and make it clear to Sinosure that any lawsuit will be met with a rigorous, aggressive defense they won't want to test. This buys you crucial time, during which we plot a strategy tailored to your specific situation.

A shockingly high percentage of the time, our clients end up

paying Sinosure nothing, never get sued, never lose any assets, and

continue buying their products from China.

(We'd love to give you a percentage, but we have no desire

to rile Sinosure when doing so doesn't help a client.)

But we also hear a very different story from companies that come to us too late.

Many feel they had no choice but to pay Sinosure everything it demanded—which was often more than the original debt. Some had assets seized, or were permanently cut off from sourcing in China. Others reached out after settling directly with their supplier, only to find that Sinosure was still pursuing them for the same money.

And sometimes, it's the reverse: companies pay Sinosure first, only to face a second claim from the supplier.

How We Help Companies Defeat Sinosure Claims

The results speak for themselves: A remarkably high percentage of our clients end up paying Sinosure nothing, never get sued, never lose assets, and continue buying from China. (We'd love to share exact percentages, but discretion serves our clients better than statistics.)

Electronics Company – $2.3M Sinosure Claim

An Electronics manufacturer was facing a Sinosure demand. Through early intervention and strategic positioning, we helped them avoid any payment while ensuring Sinosure couldn't impact their operations. Final Result: $0 paid. No lawsuit. No future problems.

Flooring Company – $3.0M Sinosure Claim

Flooring company threatened by Sinosure after refusing to pay

for defective products. We protected their Chinese assets

(trademarks and receivables), preserved their sourcing

relationships, and presented compelling product quality defect

evidence to Sinosure.

Result: $0 paid. No lawsuit. No future

problems.

Tech Hardware Startup – $480K Sinosure Claim

Tech hardware company was at risk of losing its China trademarks

and of its entire China and Malaysia supply chain being cut off. .

We immediately protected its trademarks and took additional (cannot

be disclosed) actions to render the alleged debt strategically

irrelevant.

Result: $0 paid. No lawsuit. No future

problems.

Handling Sinosure Yourself Does NOT Work

We've seen too many companies make the same costly missteps when facing Sinosure—and the consequences are almost always worse than they expected. If you remember nothing else from this post, remember this: Sinosure is not a typical creditor, and treating it like one can be a disaster.

The Most Common Sinosure Mistakes Our Lawyers See

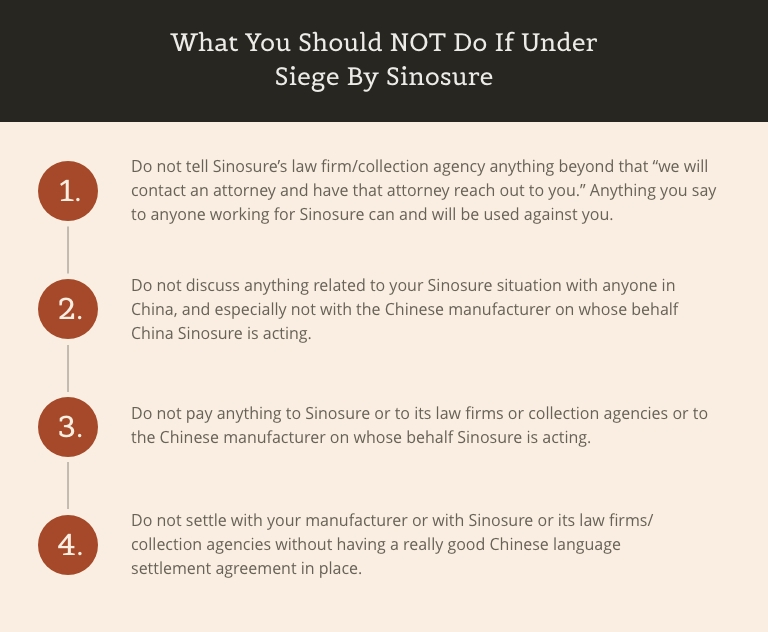

Here are the three most common—and dangerous—mistakes companies make:

Sinosure Mistake #1: Trying to Settle Directly with the Supplier

Many companies assume that if they settle privately with their Chinese manufacturer, the matter is resolved. But if the supplier has already been reimbursed by Sinosure—and they often have—you're now dealing with a government-backed insurer, not a private vendor. That means you could end up paying twice: once to your supplier, and again to Sinosure.

Sinosure Mistake #2: "Explaining the Situation" to Collection Agents

Sinosure's U.S.-based lawyers and debt collection agents may present themselves as simply gathering information, but even a single careless phrase in an email or phone call can be twisted into an admission of liability. That gives them enormous leverage—and significantly weakens your ability to fight back later. These attorneys and agents are almost certainly compensated based on how much they recover, which means they're not interested in your side of the story. They want one thing: money from you.

Sinosure Mistake #3: Settling, But Not Settling

Even if you're open to settling, doing it the wrong way can be worse than doing nothing. A valid settlement in this context must include:

- A bilingual written agreement governed by Chinese law

- Sealed with the Chinese party's official company chop

- Comprehensive releases from all relevant parties

Without those key elements, your "settlement" could be worthless—and leave you exposed to further claims.

What Your Should Do with Sinosure Instead

We understand how confusing and high-pressure these situations can be.

That's why we're always very direct with Sinosure victims about what we can do for them and how we charge them to do it.

If the amount at issue is small, the debt is clearly valid, and you can afford to pay it, it may not make financial sense to hire us—and we'll tell you that. But if you're facing a demand of $100,000 or more, and you either can't or don't want to pay it—or even if you're simply considering settlement with your supplier or Sinosure—you need to speak with experienced legal counsel who understands how Sinosure works. Either contact your regular legal team and have them reach out to us, or get in touch with us directly.

In most cases, we help clients:

- Avoid paying anything at all

- Protect their IP and receivables

- Continue sourcing from China without retaliation

We've even succeeded in cases where millions were allegedly owed. That kind of outcome doesn't happen by accident—it requires precise timing, deep experience with both Chinese and U.S. legal systems, and a strategy tailored to your specific facts. I am not aware of any lawyers or law firm that has handled more than one Sinosure case. We've handled more than one hundred. If Sinosure is putting the survival of your company at risk, you really ought to call us.

Frequently Asked Questions About Sinosure Debt Collection

Understanding Sinosure's Powers

Q: Can Sinosure really seize my trademarks or block my shipments?

A: Yes, Sinosure is the Chinese government—and it wields extraordinary power. It can easily coordinate with Chinese customs and IP authorities, and we've seen it freeze trademarks, seize payments to Chinese suppliers, and block shipments within days of launching a collection effort. Keep in mind: Sinosure isn't just another creditor. As an arm of the Chinese government, it has access to nearly everything on a computer inside China, including the internal systems of your suppliers. It knows every move you make in China.

Q: What specific assets can Sinosure target?

A: Sinosure can potentially seize :

- Your China IP registrations–trademarks, patents and copyrights.

- Your bank accounts, payments to China, and receivables in China

- Your inventory in China

- Your shipments about to leave China

- Future credit arrangements with Chinese suppliers

Sinosure Payment and Settlement Issues

Q: If I pay my Chinese supplier directly, will that stop Sinosure?

A: Usually not. If Sinosure already paid your supplier, your payment to the supplier likely won't release Sinosure's claims—and you could end up paying twice. You need a China-specific, enforceable settlement agreement with all relevant parties to be free of all claims.

Q: What if I really do owe what Sinosure says I owe?

A: Even with valid debts, your manufacturer or Sinosure will often tack on excessive or invented interest, penalties, and fees. Even if you're going to pay, you shouldn't overpay. See Fighting Back Against Fake (and Real) Sinosure Claims: A Primer

Q: Can I negotiate with Sinosure myself?

We strongly advise against it. In our experience, nine times out of ten, when someone tries to resolve a China-related problem on their own, they make it worse. And with Sinosure, the odds are even higher. Anything you say—no matter how well-intentioned—can be used to establish liability. Our lawyers have seen countless self-negotiation attempts backfire, often with serious consequences.

Sinosure Timing and Response Issues

Q: How long do I have to respond to Sinosure demands?

A: There's no official deadline, but we've seen Sinosure seize assets and block the ability to buy from China on credit before the debtor company even knew they were involved. Other times, they move slowly—or not at all. Like most Chinese bureaucracies, Sinosure operates opaquely and sometimes irrationally. It will mostly depend on the specific of your case and who is handling your case for Sinosure, both in the United States and in China.

Q: What should I do immediately if I receive a Sinosure demand?

A: Do not respond directly to Sinosure or their collection agents. Contact experienced counsel immediately before taking any action or making any statements. Feel free to contact us.

Sinosure's Unpredictability

Q: Why is it so hard to predict what Sinosure will do?

A: There isn't just one Sinosure. There are many regional Sinosures, each with different people, and their behavior varies. The same goes for their U.S.-based law firms and collection agencies.

Q: How quickly does Sinosure typically act?

A: This varies dramatically. Some companies face immediate asset freezes, while others deal with prolonged collection efforts spanning months or years. Nearly everything we know about their timing comes from our direct experience handling Sinosure cases.

Our Final Thoughts on Sinosure

We don't share our detailed legal strategies for a reason. Sinosure and its lawyers might be read these posts too. This is a specialized area with serious cross-border risks, and one misstep can dramatically increase your exposure. Our goal is to help our American clients, not the Chinese Government.

Your Next Move Matters

If you've been contacted by Sinosure—or even if you suspect your Chinese supplier has filed a claim—now is the time to act. Reach out to the international dispute resolution team at Harris Sliwoski. Our lawyers have helped more than 100 companies protect their assets, defeat unjustified claims, and continue sourcing from China without disruption.

Let us help you achieve the same outcome—before your leverage runs out and your options narrow.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.