- in Middle East

- within Criminal Law, Strategy and Family and Matrimonial topic(s)

- with Finance and Tax Executives

Key Takeaways:

- Strategic leadership succession planning helps your family business prepare for generational transitions while reducing risk and preserving long-term unity.

- Defining roles, responsibilities, and qualifications for family and non-family successors creates clarity and supports effective business continuity.

- Governance, compensation models, and contingency planning are essential tools to maintain control and drive long-term performance across generations.

—

Introduction

A smooth leadership transition is essential for preserving the values and operational stability of a family business. While ownership succession is often top-of-mind, transitioning management and leadership roles requires just as much attention—and proactive planning. Without it, even well-established family enterprises can lose direction or unity.

Why Succession Planning Matters for Your Business

Leadership succession will happen—it's a matter of when, not if. Research shows that while over 30% of family-owned businesses transition successfully to the second generation, only 12% survive to the third, and just 3% make it to the fourth. Strategic succession planning can help your organization defy those odds by developing leaders prepared to maintain long-term success.

Planning for Leadership and Management Succession

Succession in leadership requires a different approach than ownership transition. The roles are often filled by different individuals, and each comes with unique interpersonal and professional demands. Planning must identify clear expectations, qualifications, and paths for development across all leadership functions within the business and family office.

What to Look for in Future Leaders

The most effective succession plans evaluate candidates based on interpersonal traits—such as accountability, emotional intelligence, and integrity—as well as technical skills and experience. Leadership roles should be clearly defined with input from current role holders, and performance should be assessed regularly. Assessment tools, including those that measure instinctive strengths, can help provide objective guidance.

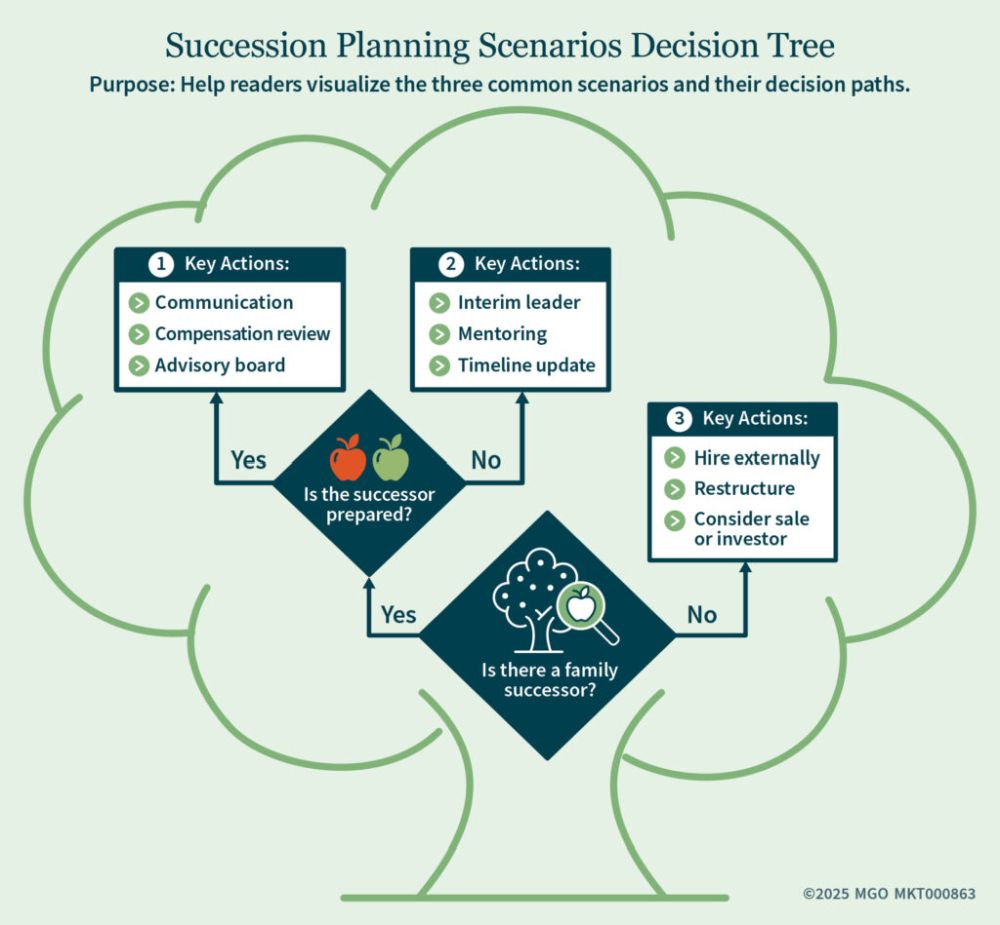

Three Common Succession Scenarios

Each succession path presents unique challenges. Here are the most common ones:

Scenario 1: A Family Member Is Ready

When a family member has received proper training, mentoring, and experience, the transition can proceed smoothly. Still, clear communication with key stakeholders is vital. Define responsibilities, confirm readiness, and establish an advisory structure—perhaps including older-generation members—to support the transition.

Scenario 2: A Family Member Needs More Time

If your chosen successor isn't quite ready, an interim leader—internal or external—may be the solution. Interim roles should be governed by a timeline, mentorship responsibilities, and alignment with family values. Phantom stock or other non-equity compensation models can align incentives without relinquishing ownership. In some cases, senior family members may remain longer to bridge the gap.

Scenario 3: No Family Member Is Available

Sometimes, the right person isn't in the family. If a non-family leader is needed, treat the process like a business hire—set expectations, vet candidates thoroughly, and ensure they build trust with the family. If continuity can't be preserved internally, consider options like external investors or even selling the business, if aligned with long-term goals.

Key Governance and Communication Considerations

Strong governance is the foundation of successful leadership transitions. Clearly defining the roles and responsibilities across the family, family office, and business arms creates accountability and prevents confusion. Succession planning should include documented processes for decision-making, conflict resolution, and long-term goal setting.

Apply the "three Cs" of governance—consensus, communication, and consistency—to guide the organization through change. Regular governance meetings, reporting protocols, and succession readiness assessments can help ensure that all parties remain aligned and committed to the shared vision. A governance charter or family constitution can further support continuity by documenting values and expectations.

Don't Overlook Non-Family Advisors

Non-family advisors often bring the outside perspective needed to make objective decisions. Trusted executives, legal and financial advisors, or board members familiar with your family's history and goals can help evaluate succession candidates, assess readiness, and guide communication strategies.

Including these individuals in the planning process can build credibility, reduce emotional bias, and give reassurance to both internal and external stakeholders. Their insights can also help resolve conflicts, identify blind spots, and provide continuity during leadership transitions, especially when transitioning to non-family leadership or navigating complex dynamics.

Adaptability Is Essential

No matter how well-designed your succession plan is, the future is unpredictable. Market disruptions, regulatory changes, health issues, or shifting family dynamics can all upend even the best-laid plans.

To stay on track, your succession strategy must include built-in flexibility. Revisit your plan regularly—ideally on an annual basis—and update timelines, contingency scenarios, and leadership development goals based on current circumstances. Incorporate "trigger events" that prompt reevaluation, such as business milestones, economic downturns, or changes in family structure.

By staying agile, your family business can remain resilient, aligned, and ready for whatever the future brings.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.