- within Corporate/Commercial Law topic(s)

- in United States

- within Consumer Protection, Insolvency/Bankruptcy/Re-Structuring and Insurance topic(s)

Introduction

The continued growth and diversification of the regional economies, coupled with significant advancements in the legal frameworks, have made the United Arab Emirates and the Kingdom of Saudi Arabia increasingly attractive destinations for private credit providers looking to deploy capital. Despite this growing interest, compared to the United States and Europe, the Middle East remains a relatively untapped market and offers significant opportunities for private credit providers

Careful navigation of the modernized legal frameworks can deliver robust financing structures and help overcome risk considerations which in the past may have acted as a barrier to entry for certain private credit providers. In this context, understanding the different legal frameworks, and the interplay between them, is key for designing optimum funding structures.

This guide provides a high-level overview of some of the key considerations for private credit providers looking to deploy capital in the UAE (both onshore and in the two financial free zones, DIFC and ADGM) or KSA.

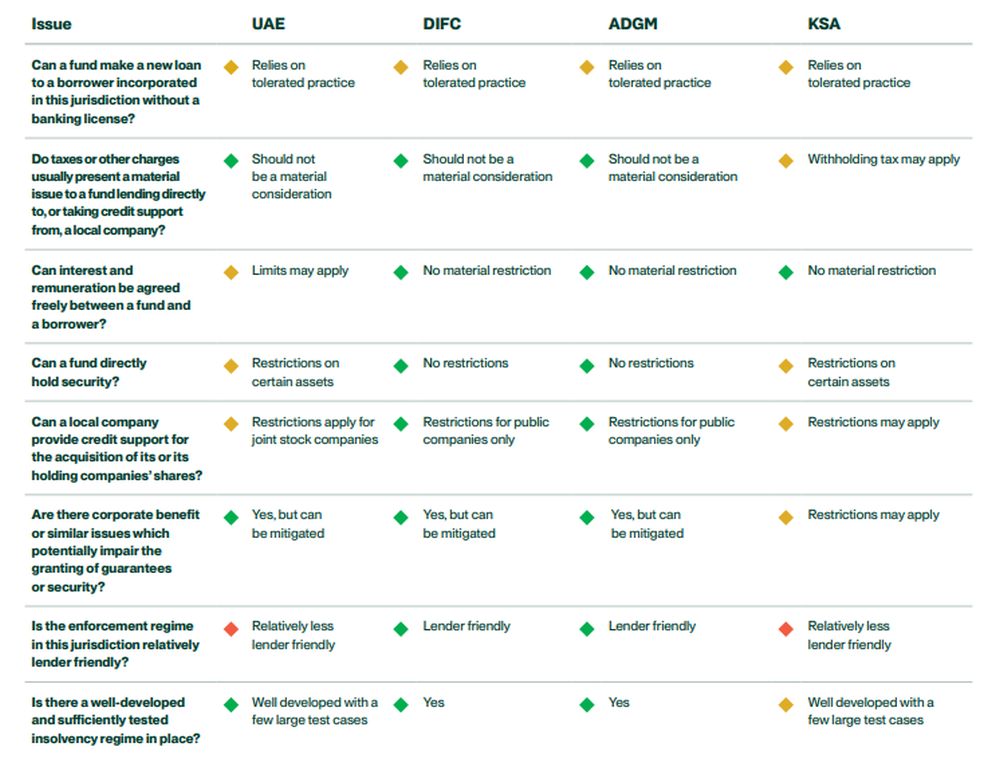

Comparative overview of key considerations

"Onshore" UAE

| Can a fund make a new loan to a borrower incorporated in this jurisdiction without a banking license? |

|

| Do taxes or other charges usually present a material issue to a fund lending directly to, or taking credit support from, a local company? |

|

| Can interest and remuneration be agreed freely between a fund and a borrower? |

|

| Can a fund directly hold security? |

|

| Can a local company provide credit support for the acquisition of its or its holding companies' shares? |

|

| Are there corporate benefit or similar issues which potentially impair the granting of guarantees or security? |

|

| Is the enforcement regime relatively lender friendly? |

|

| Is there a well-developed and sufficiently tested insolvency regime in place? |

|

Dubai International Financial Centre (DIFC)

| Can a fund make a new loan to a borrower incorporated in this jurisdiction without a banking license? |

|

| Do taxes or other charges usually present a material issue to a fund lending directly to, or taking credit support from, a local company? |

|

| Can interest and remuneration be agreed freely between a fund and a borrower? |

|

| Can a fund directly hold security? |

|

| Can a local company provide credit support for the acquisition of its or its holding companies' shares? |

|

| Are there corporate benefit or similar issues which potentially impair the granting of guarantees or security? |

|

| Is the enforcement regime relatively lender friendly? |

|

| Is there a well-developed and sufficiently tested insolvency regime in place? |

|

Abu Dhabi Global Markets (ADGM)

| Can a fund make a new loan to a borrower incorporated in this jurisdiction without a banking license? |

|

| Do taxes or other charges usually present a material issue to a fund lending directly to, or taking credit support from, a local company? |

|

| Can interest and remuneration be agreed freely between a fund and a borrower? |

|

| Can a fund directly hold security? |

|

| Can a local company provide credit support for the acquisition of its or its holding companies' shares? |

|

| Are there corporate benefit or similar issues which potentially impair the granting of guarantees or security? |

|

| Is the enforcement regime relatively lender friendly? |

|

| Is there a well-developed and sufficiently tested insolvency regime in place? |

|

Kingdom of Saudi Arabia (KSA)

| Can a fund make a new loan to a borrower incorporated in this jurisdiction without a banking license? |

|

| Do taxes or other charges usually present a material issue to a fund lending directly to, or taking credit support from, a local company? |

|

| Can interest and remuneration be agreed freely between a fund and a borrower? |

|

| Can a fund directly hold security? |

|

| Can a local company provide credit support for the acquisition of its or its holding companies' shares? |

|

| Are there corporate benefit or similar issues which potentially impair the granting of guarantees or security? |

|

| Is the enforcement regime relatively lender friendly? |

|

| Is there a well-developed and sufficiently tested insolvency regime in place? |

|

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.