- within Criminal Law, Real Estate and Construction and Strategy topic(s)

- in United Kingdom

- with readers working within the Banking & Credit industries

Key Takeaways:

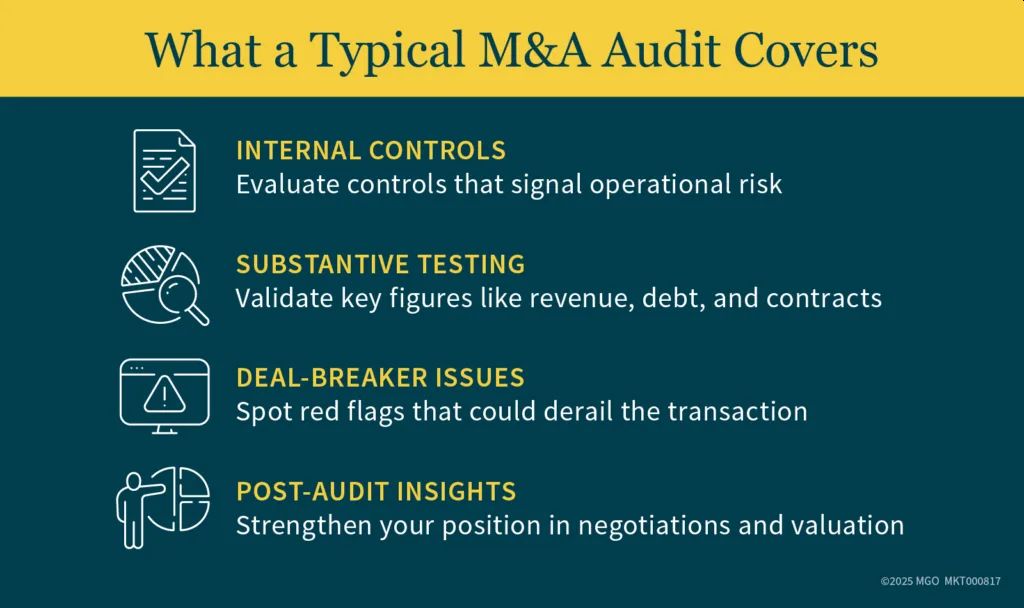

- An M&A-focused audit begins with a tailored planning process that identifies the areas most relevant to the merger or acquisition.

- Evaluating internal controls helps identify operational and financial risks that could impact negotiations or valuations.

- Insights from the audit can improve financial practices and support a smoother transition after the transaction.

When you're preparing for a merger or acquisition (M&A), every number matters. Potential buyers, investors, and lenders need clarity on your financial statements and the integrity of your entire operation. That's where an audit plays a crucial role.

A well-executed audit provides a clear, independent view of your financial health. It helps identify potential risks, discrepancies, or issues long before they come to the buyer's attention and affect valuation, negotiations, or even closing the transaction.

Inside a Well-Executed M&A Audit: 6 Key Steps

Here's a behind-the-scenes look at an M&A audit. We've broken the process down into six essential steps that can help head off surprises and keep your deal on track.

Step 1: Initial Planning and Scoping to Understand Your Business

Before any testing begins, there is a planning phase designed to understand your company's operations, industry, and the purpose of the audit. In the context of a merger or acquisition, that means focusing on what matters most to the transaction. Typically, this includes revenue, profit, assets, customer contracts, vendor agreements, debt, and contingent liabilities.

During this stage, your auditor will also request a list of documents — such as prior-year financials, trial balances, accounting policies, accounts receivable aging reports, customer lists, depreciation schedules, customer contracts, leases, and loan agreements. They will also request documentation on internal control policies and procedures.

This scoping exercise helps define higher-risk areas, set materiality thresholds, and tailor the audit plan.

Step 2: Risk Assessment and Internal Control Evaluation

During the planning phase, auditors also assess how you design and implement internal controls. This step is a part of any financial statement audit, but it's especially relevant to M&A audits because weak, inconsistent, or non-existent internal controls can signal broader financial or operational risks that could impact valuation or even derail the deal.

The audit team performs walkthroughs of key processes to understand how you recognize revenue, manage inventory, handle cash, and issue payroll and other disbursements.

If control weaknesses are identified, they are flagged so you can proactively address the issue or prepare to explain mitigating factors to the buyer before they become sticking points in negotiations.

Step 3: Detailed Substantive Testing

Substantive testing is a big part of a financial statement audit. During fieldwork, auditors thoroughly perform testing on financial data to confirm its completeness and accuracy. They'll test balances and transactions using a combination of sampling, confirmations, analytical procedures, and inspection.

In the context of an M&A deal, substantive testing might include validating:

- Accounts receivable and major customer balances

- Inventory levels and valuation methods

- Fixed asset registers and depreciation schedules

- Outstanding debts, lease obligations, and legal liabilities

- Revenue streams and contract terms

- Adjustments and accruals

Every figure tested helps you (and potential acquirers) gain a clearer picture of your financial position and operational performance. Testing can also align with the acquiring entity's due diligence needs.

Step 4: Identifying and Communicating Key Findings

As testing progresses, auditors document discrepancies and areas of uncertainty. Rather than waiting until the final report, auditors may share interim findings throughout the audit process and discuss the implications with you.

If issues arise — such as revenue booked before it's earned, misclassified liabilities, or unrecorded contingent exposures — you have an opportunity to investigate, correct, or clarify questions before the deal proceeds. Early visibility into these findings allows you to improve processes and prepare responses to questions that might arise during the due diligence process.

Step 5: Final Review and Delivering the Audit Report

Once fieldwork is complete, the audit moves into the final review phase. Auditors evaluate the completeness of documentation, tie up any loose ends, and ensure audit workpapers support conclusions before issuing the audit report.

The timing of this report may align with due diligence milestones or closing deadlines for a merger or acquisition. An unqualified opinion, also known as a "clean report", lends credibility to your financial statements and supports buyer confidence.

If the audit uncovers concerns, your management letter becomes a valuable roadmap for remediation and negotiation.

Step 6: Post-Audit Insights and Transaction Support

A thorough M&A audit often gives insight beyond the numbers in your balance sheet, income statement, and statement of cash flows.

For example, it may uncover opportunities to strengthen documentation, update internal controls, streamline reconciliations, or improve accounting policies. All of these can prepare you for a liquidity event and serve the organization well post-transaction.

Many companies use the audit findings to prepare for future reporting requirements under a new ownership structure, particularly when transitioning to public-company standards or integrating into a larger corporate environment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.