California's Assembly Bill 1207 aimed to alter the way state-licensed cannabis brands could market and package their goods. But it was vetoed. The decision brought a collective sigh of relief among industry players. Senate Bill 540 was enacted instead.

That's how the cannabis market rolls.

The legal landscape changes often, and regulations evolve. Marijuana companies must keep up or risk compliance penalties.

Read on to learn more about AB 1207, SB 540, and other cannabis industry news. We discuss the global market, legal trends in the U.S., and Europe's current marijuana laws.

California's SB 540 Replaces Vetoed AB 1207

California's Senate passed Assembly Bill 1207 on September 14, 2023. The legislation sought to clarify what could appeal to minors in terms of cannabis packaging and marketing.

But critics of the bill said the restrictive provisions would harm—rather than help—the marijuana industry. It would burden regulated businesses with increased costs and requirements. This, in turn, could allow illicit markets to flourish.

Also called the Cannabis Candy Child Safety Act, the bill had some broad restrictions. It outright banned certain imagery in cannabis advertising. Real or fictional images of fruit, vegetables, animals, or humans would be prohibited.

Non-compliant businesses would have to change their brand identities and repackage their goods. And the costs would be hefty.

With a final vote of 63-0, all AB 1207 needed was the governor's stamp of approval. But Governor Newsom vetoed Assembly Bill 1207 on October 8th, 2023.

He signed Senate Bill 540 the same day. The bill takes an evidence-based approach to regulating cannabis labeling and packaging. It allows a periodic review of the restrictions "to reflect the evolving science."

Supporters of the bill say it protects consumers, youth, and legitimate cannabis businesses.

While marijuana brands and cultivators welcomed SB 540, compliance is still paramount. Contact us if you need help implementing new legislation into your marketing strategy.

Leafly Lawsuit Fights NY Cannabis Marketing Ban

The Office of Cannabis Management (the "OCM") is the regulatory authority established under New York State's Marihuana Regulation and Taxation Act ("MRTA"). The OCM published proposed marijuana sales and marketing regulations on December 14, 2022.

The draft rules contained a provision banning third-party marketing and advertising services.

Leafly Holdings (Nasdaq: LFLY) is a third-party online cannabis marketing platform. It raised concerns over the impact of such rules. Despite this, the OCM finalized its regulations on September 12th, 2023. The third-party ban thus came into effect.

The adoption led Leafly to launch a lawsuit against the OCM at the Albany County Supreme Court.

The suit claims the OCM unfairly targets third-party platforms and restricts cannabis brands' ability to market and promote products. It was filed on September 18th, 2023.

On September 22nd, 2023, the court granted Leafly a temporary stay. The order blocks the enforcement of the regulatory ban. But the legal relief expressly applies to Leafly.

It's the only third-party platform allowed to operate in New York. at least for the time being.

Cannabis brands in New York need to review the new rules to avoid legal issues. Get in touch if you need expert cannabis compliance guidance.

New York Open for Canna-Business: License Applications Open to All

On October 4th, 2023, New York Governor Kathy Hochul launched the largest expansion of NY's cannabis market to date. Interested parties can submit license applications for the following:

- Retail

- Cultivation

- Processing

- Operating of a microbusiness

License applications are open until December 4th, 2023.

The OCM and the Cannabis Control Board ("CCB") will review applications in early 2024. Adult-use conditional cultivators and processors in operation may also apply for non-conditional licenses.

The move aims to ensure sustainable and competitive growth in New York's cannabis market. Need cannabis licensing and compliance assistance? Chat with our experts.

Fair Warning: 4 Real-World Cases of Non-Compliance in the Cannabis Industry

Regulators keep a close eye on businesses in the marijuana industry. They take compliance violations seriously. See for yourself with these four real-world cases of non-compliance:

1. California Cannabis Companies Face Charges

In September 2023, California's Attorney General Rob Bonta filed a complaint against nine cannabis companies. The lawsuit alleges the businesses illegally sold "inhalable hemp products" from their online websites.

The companies also failed to include "clear and reasonable warnings" in marketingthe said items. They face several hefty penalties. The AG further stated:

"The dangers of these products must be communicated for sale to the public, and the sale of all industrial hemp inhalable products must cease altogether."

This lawsuit amplifies the importance of playing by industry rules. It also highlights the very real risks of non-compliance.

2. $100K Fine for Messing Up the Cannabis Menu

Canada-based cannabis brand TerrAscend received a steep fine in late 2023. The infraction? The company left out adult-use items in their medicinal menu.

The omission violates a requirement by New Jersey's Cannabis Regulatory Commission (CRC). Whether the violation was intentional or not, TerrAscend took swift corrective action.

But CRC regulators still voted to fine it $100,000. That's four times more than the recommended maximum penalty. Chairwoman Houenou explained her stance. She stated the amount reflects the severe nature of the violation. She went on to say,

"The investigator, in a very thorough report, pointed out that there still seems to be a rampant issue with TerrAscend New Jersey and their staff that they are simply not offering all advertised cannabis products to medicinal patients."

This is not the first case of costly non-compliance, nor will it be the last. Even a seemingly trivial marketing choice can have far-reaching consequences.

- New Jersey's CRC issued more than 50 citations from 2020 to mid-2022.

- Colorado's State Licensing Authority issued more than 35 administrative actions for non-compliance in 2023.

- In August 2023 alone, Michigan's Cannabis Regulatory Authority (CRA) filed over 60 disciplinary actions.

The violations include packaging, advertising, non-compliant sales, and operating issues.

National or federal regulations are already strict. Butdon't discount the severity of state-specific laws. Regional authorities demand high compliance standards from cannabis brandstoo.

3. Federal Class Actions for Website Accessibility

In recent years, U.S. cannabis, hemp, and vape brands have faced a barrage of class actions. These lawsuits come under the Americans with Disabilities Act ("ADA"). They center around website accessibility challenges for the visually impaired.

Learning about product prices and making payments were some of the listed difficulties. The plaintiffs typically seek statutory damages, attorney fees, and action cost awards. That's over and above the costs of website and point-of-sale redesign.

A 2020 lawsuit against Jay-Z-backed cannabrand Caliva alleged its website failed to accommodate the visually impaired. In 2021, similar complaints were filed against Prospect Farms Hemp Sales LLC and Highline Wellness Inc.

Another such action emerged against New York company Good Guy Vapes Inc. LLC in 2022.

While not explicitly content-related, these cases highlight the risks of poor website accessibility. To avoid costly class actions, strict compliance with all legal requirements is necessary.

4. Criminal Proceedings for CBD Vapes in France

In 2020, a French company landed in hot water over its sale of CBD-containing e-cigarettes. The directors faced fines of €10,000 as well as criminal charges. Why? Well,French law prohibits the sale and marketing of cannabis and CBD products.

The company's directors appealed. This triggered the Court of Justice of the European Union (CJEU) to intervene.

Essentially, the CJEU ruled that CBD marketing remains legal, evenin EU member states where it's outlawed. More specifically, in cases where the CBD was produced lawfully in another EU country.

This controversial Kanavape case set a legal precedent for other reasons too. So it had a happy ending. The case illustrates the complexity of compliance between varying levels of governance.

It's something cannabis brands must carefully consider in their marketing efforts.

Check out our Cannabis Compliance Guide for more information or talk to us if you need expert advice.

Global Cannabis Market Trends

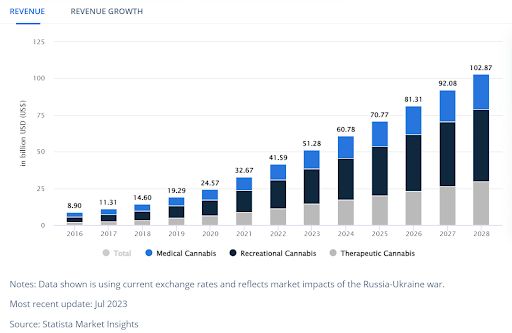

Explosive growth. Fading stigmas. New emerging markets. That's the gist of the global cannabis industry. In 2016, the legal cannabis market generated $8.9 billion in global revenue. By 2022, this figure had more than quadrupled, to $41.6 billion.

With an annual growth rate of 14.95%, market volume is projected to rise to $81.3 billion by 2026. That's almost a ten-fold increase in ten years.

Source: Statista

The legal environment and public sentiment towards cannabis vary by country and region.

This, in turn, affects market maturity.

Countries like the U.S. and Canada have well-rounded regulatory frameworks. They allow for the sale, marketing, and consumption of medicinal and recreational cannabis. Of course, their province- or state-specific legislation varies.

Other countries have legalized cannabis cultivation but still limit commercial sales. One such example is South Africa. Comparatively, Europe maintains highly restrictive marijuana laws. This, despite its progressive laws in other aspects such as sustainability and innovation.

Let's dig a little deeper into the legal, regulatory, and market trends.

Top 10 Legal Cannabis Markets

Cannabis legalization offers considerable economic growth. It contributes to increased job opportunities, tax revenue, and investment flows. Less restrictive cannabis laws correlate with high revenue growth. See the table below.

| Country | Projected Revenue in USD Millions | Legal Status of Cannabis | ||

| 2023 | 2024 | 2025 | ||

| United States | $33,880 | $39,850 | $46,250 |

Cannabis remains federally illegal in the U.S., though it's permitted in many states. State laws determine medicinal and recreational use, possession, and cultivation. |

| Canada | $3,896 | $4,701 | $5,505 |

Cannabis seeds, products, and plants are legal to purchase and use in Canada. Provinces and territories dictate sale and distribution laws.# |

| Netherlands | $1,297 | $1,528 | $1,777 |

Cannabis remains illegal in the Netherlands. But Dutch coffee shops are authorized to sell marijuana products. Personal possession of up to 5 grams is decriminalized. A pilot program for cannabis cultivation and supply commences in 2023/2024. |

| Germany | $1,063 | $1,282 | $1,501 |

German law prohibits the sale of cannabis. But consumption is decriminalized. Limited medical use is permitted under certain circumstances. In August 2023, the German cabinet endorsed a bill to legalize cannabis. It permits sale, possession, and cultivation for personal use. Parliamentary approval is pending. |

| Thailand | $1,013 | $1,220 | $1,419 | Cannabis sale, consumption, and cultivation are legally allowed in Thailand. Products with more than 0.2% of tetrahydrocannabinol (THC) remain outlawed. |

| South Africa | $845 | $1,022 | $1,193 |

Private cannabis use, consumption, and cultivation are lawful in South Africa. Medicinal CBD products are also permitted with a prescription. A draft bill tabled in 2020 is still under deliberation. It seeks to govern recreational and commercial cannabis use. |

| Spain | $818 | $988 | $1,160 | Private cannabis cultivation and consumption are permitted under Spanish case law. Commercial growing and distribution remain prohibited. |

| Malta | $679 | $825 | $966 | Malta was the first EU state to legalize personal cannabis use in 2021. Personal possession and cultivation are also permitted. |

| Switzerland | $449 | $543 | $633 |

Recreational marijuana is illegal in Switzerland. However, personal possession of up to 10 grams is tolerated. Prescribed medical cannabis use is lawful. THC products with less than 1% THC are also legal. |

| Australia | $381 | $458 | $538 |

Australia permits weed consumption, sale, and cultivation for medical purposes. The laws vary by state. Recreational cannabis is federally prohibited. The Australian Capital Territory (ACT) decriminalized private use. Other territories are less lenient. A draft bill was submitted in April 2023 for adult use and cultivation in Victoria, New South Wales, and Western Australia. |

Source: Statista

The U.S. Cannabis Market and Legal Landscape

Cannabis remains a Schedule I substance under the U.S. Controlled Substances Act of 1970 (CSA). But this hasn't stopped the industry from growing.

California became the first state to legalize medicinal marijuana use in 1996. Today, it's the world's largest cannabis market. In 2022, the Golden State generated $4.6 billion in legal cannabis sales.

That's more than every other country's 2026 forecast above.

Unsurprisingly, North America accounts for 96.8% of global marijuana revenue.

U.S. Medical Marijuana Laws

As of September 2023, 38 states have comprehensive medical marijuana laws. The same is true for the District of Columbia, Guam, Puerto Rico, and the U.S. Virgin Islands.

Ten other states allow low-THC cannabidiol (CBD) cannabis and/or CBD oil. These include Indiana, Wyoming, Wisconsin, Georgia, Texas, Iowa, Tennessee, North and South Carolina, and Kentucky.

U.S. Recreational Cannabis Laws

Adult cannabis use is legal in 23 states as of September 2023. Newcomers include Rhode Island, New York, Vermont, Maryland, Virginia, and Minnesota.

Below is a snapshot of all states where recreational use is legal, along with Washington, D.C.

Guam and the Northern Mariana Islands have also enacted adult-use marijuana laws.

Source: Reuters

U.S. States Where Cannabis Remains Illegal

As of September 2023, weed remains totally illegal in just three U.S. states.

- Nebraska lawmakers introduced Draft Bill LB 474 in 2021. It seeks to legalize the medical cannabis use for qualifying conditions. The 2023 legislative session yielded no results. Advocates are pushing for a voters' ballot in 2024.

- In Idaho, a similar draft bill was introduced but failed to advance. Cannabis advocates are thus pushing for a ballot initiative in 2024. If enacted, the state's Medical Marijuana Act would allow cannabis use for debilitating health conditions.

- Kansas lawmakers passed a medical marijuana bill in 2021. It carried over to 2022. By 2023, senate hearings were still ongoing, so SB 135t didn't proceed. 2024 presents a new opportunity for the legislation to pass.

The U.S. territory of American Samoa strictly prohibits marijuana use. The region has some of the harshest penalties. For instance, a man found in possession of a cannabis plant was sentenced to up to five years in jail.

European Cannabis Market and Legal Trends

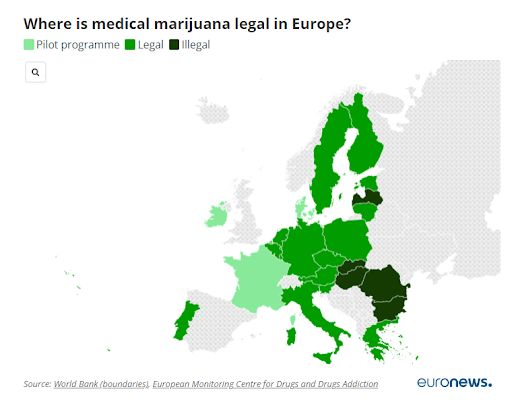

With a robust GDP and booming economies, Europe is a central hub of trading and innovation. Still, the continent's cannabis laws are much more restrictive compared to the U.S.

Marijuana is outlawed in most EU countries.

It's not all doom and gloom, though.

Several EU territories have decriminalized or legalized weed for medical use. A handful of recreational or adult-use markets have also emerged.

According to the 2023 Prohibition Partners' European Cannabis Report (Eighth Edition):

- Europe's medical cannabis market is set to reach €550 million ($587 million) in 2023. That's with forecast growth (CAGR) of 67.4% from 2021.

- CBD products have become increasingly popular across the continent. The combined market share of all CBD categories amounts to €2 billion ($2.1 billion).

- The adult-use market is slowly emerging. Malta and Luxembourg are the first EU states to legalize recreational cannabis. Four countries are currently developing similar legal frameworks. These include Switzerland, the Netherlands, Germany, and the Czech Republic.

- Europe's cannabis supply diversified throughout 2022. The largest suppliers' share (the Netherlands and Canada) is receding. Meanwhile, imports have risen to meet increased demand.

Despite industry growth, EU, national, and regional regulations remain complex and confusing. This leaves investors, businesses, and even regulators uncertain about cannabis and CBD legalities.

A Snapshot of Europe's Complex CBD Market

Europe's CBD industry is thriving. Customers have a massive selection of CBD products available to them. According to the European Monitoring Center for Drugs and Drug Addiction (EMCDDA), low-THC products are sold in most EU countries.

However, the market operates in a largely gray area. CBD legislation is fragmented in many countries. European laws lag behind industry growth.

No EU-wide regulatory framework currently exists for CBD or medicinal cannabis.

That said, regulatory progress has been made in recent years:

- CBD is not a "narcotic"

Remember the Kanavape case? It set a landmark precedent with the CJEU ruling in November 2020. It found that CBD falls outside the definition of a "narcotic drug".

This applies to synthetic or organic CBD derived from any part of the cannabis plant. Hemp leaves and flowers are thus legal to market and sell in the EU. Compliance with EU laws is still required, though.

Europe's hemp market predominantly services industrial, textile, and construction industries. However, hemp-derived CBD extracts with a THC content of 0.3% are legal under EU law.

- CBD as a cosmetic ingredient

CBD is no longer defined as a banned substance under the UN Convention on Narcotic Drugs of 1961. This, in turn, means CBD can be considered a legal substance in cosmetic products, says the EMCDDA.

CBD was also recognized in the EU's Cosmetic Ingredient Database in February 2021. It's not a legally binding document but acts as a guideline for member states. The move further legitimizes the CBD industry.

- CBD as a food ingredient

Before the CJEU ruling, CBD wasn't considered a legitimate food additive. Companies often resorted to vague labeling of CBD health supplements and dietary products. This posed major business risks of non-compliance.

However, the European Commission confirmed CBD as a possible novel food item. Its official statement, published in February 2023, reads:

"The Commission therefore, considers that cannabidiol can be considered as 'food', provided that the other conditions of Article 2 of the General Food Law are met."

These developments have helped clarify legal issues in Europe's CBD industry. Still, a significant chunk of CBD market revenue goes unreported. Trade and purchase data is also restricted, with no globally recognized trading codes.

In a June 2023 report, the EMCDDA fleshes out the intricacies of the EU's CBD and medical cannabis rules.

The wide gap between clear legislation and market practices is closing, albeit slowly.

Europe's Medical Cannabis Industry

Medical-use cannabis products are increasingly available in Europe. But the market is still in its early stages.

Most European countries have medical marijuana laws. The degree of scope and access varies, though.

Decriminalization is also growing. Here are some notable legal trends among European countries:

- Italy legalized therapeutic cannabis use in 2007. It made further legislative improvements in 2014.

- The Dutch government allows medical cannabis use with a prescription.

- Czechian lawmakers permit prescribed medicinal cannabis use for certain health conditions.

- France is piloting a medical marijuana program for specific ailments.

- Ireland launched a five-year medical cannabis pilot program in 2019. It applies to limited health uses.

- Romanian law authorizes pharmaceutical cannabis products.

- Switzerland allows medical marijuana use. A medical professional must prescribe it.

- Spain has decriminalized personal-use cannabis consumption and cultivation.

- Sweden has a zero-tolerance policy for recreational cannabis use. Medical use is permitted under certain criteria.

- Portugal allows medical cannabis use by prescription. It has also decriminalized personal use under particular circumstances.

In countries like Hungary and Poland, recreational and medical marijuana remain forbidden.

Source: Euronews

Medical cannabis laws in Europe remain largely inconsistent. The issue is compounded by the EU's lack of a state-wide legal framework. Change is on the horizon, though.

Malta: The First EU Member State to Legalize Recreational Weed

Malta's progressive marijuana laws were enacted in 2021. The legislation allows persons over 18 years old to:

- Possess up to 7 grams of weed.

- Store no more than 50 grams of dried cannabis.

- Cultivate four cannabis plants for personal use.

Maltese lawmakers also allow the formation of 'Social Cannabis Clubs.' Instead of a commercial market, consumers buy their marijuana from these non-profits.

The EU bans the establishment of adult-use marijuana markets. The social club model effectively bypasses such regulations.

Malta is expected to generate $825 million in revenue in 2025. It's the smallest EU member state. But it's also the first EU territory to legalize weed for personal use.

Luxembourg Lawmakers Follow Malta's Lead on Cannabis

The small territory of the Grand Duchy legalized personal-use cannabis in July 2023. It has permitted medical marijuana use since 2018.

Luxembourg's personal-use laws allow adults to:

- Possess up to 3 grams of marijuana.

- Grow four cannabis plants at home.

- Consume weed in private.

As an EU member, Luxembourg is taking Malta's social club approach. Lawmakers are in the process of creating a regulatory framework. According to Statista, the country's cannabis market share is forecast to reach $372 million in 2024.

The United Kingdom

Medical cannabis is legal in the U.K. The laws are restrictive, though. They allow authorized patients to use and buy cannabis-based medicine.

Marijuana may also be prescribed in specific circumstances.

The U.K. prohibits recreational cannabis use, consumption, and cultivation. As a Class B drug, illegal marijuana use attracts harsh penalties.

Stay Ahead of the Legal Cannabis Curve

Cannabis regulations dictate industry growth. From new bills to emerging markets, the landscape is always shifting. Without meticulous compliance, businesses risk steep penalties and marketing losses.

B2Bs, B2Cs, and third-party vendors must act decisively to stay compliant, competitive, and ahead of the legal cannabis curve.

Align your marketing strategies and advertising policies with the latest regulatory requirements. Contact us today to talk to a cannabis compliance expert.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.