- within Litigation and Mediation & Arbitration topic(s)

- in European Union

On October 25, the International Centre for Settlement of Investment Disputes (ICSID) released its 2024 Annual Report, which highlights significant trends and statistics in ICSID's cases during the fiscal year ending on June 30, 2024 (FY2024). ICSID administered 341 cases in that period (which was just five short of 346 cases in FY2022), marking the second-highest caseload in its history — a testament to its pivotal role in global investment dispute resolution.

Read ICSID's 2024 Annual Report here.

Key Statistics and Developments

Case Distribution

During the past fiscal year, 58 new cases were registered. Out of the registered disputes, 53 cases (91%) were arbitrations under the ICSID Convention, four cases were based on the Additional Facility Rules, and one was a conciliation based on the ICSID Convention.

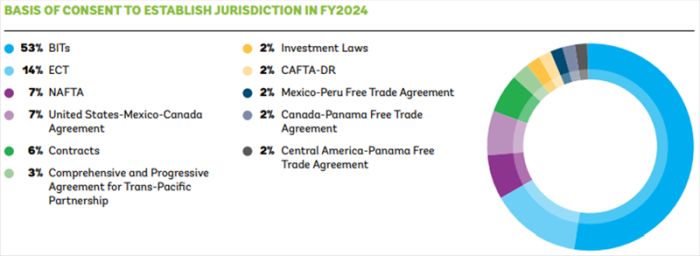

BITs Dominate the Disputes

In FY2024, 53% of the registered cases were brought under Bilateral Investment Treaties (BITs). The second most common instrument was the Energy Charter Treaty (ECT), representing 14% of the disputes, followed by the North American Free Trade Agreement (NAFTA) at 7% and the US-Mexico-Canada Agreement at 7% of the total registered cases. Other treaties invoked include the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, the Dominican Republic-Central America FTA (CAFTA-DR), the Mexico-Peru Free Trade Agreement, the Canada-Panama Free Trade Agreement, and the Central America-Panama Free Trade Agreement. Contracts and investment laws accounted for the remaining cases at 6% and 2%, respectively.

Membership Expansion

The Republic of Equatorial Guinea's accession to the ICSID Convention brought the total number of signatories to 166, with 158 having ratified the Convention. This expansion reflects a growing international commitment to structured dispute resolution mechanisms.

Outcome Between States and Investors

In FY2024, 88 cases were concluded. Out of this number, 65 were original arbitrations, and the remaining were post-award proceedings. Of the original arbitrations, 46 (71%) were subject to a decision by an arbitration tribunal, and 19 (29%) were settled or otherwise discontinued. Regarding the 23 post-award proceedings, 14 were based on annulment applications, four on applications for rectification of an award, and the remainder consisted of an application for a supplementary decision, an application for both rectification and supplementary decision, an application for revision of an award, an application for interpretation, and a resubmission of an arbitration.

Of the disputes decided by a tribunal, 52% of the awards upheld investors' claims — either in part or in full (24 out of 46 cases), 37% rejected the investors' claims on the merits (17 out of 46 cases), and 11% of the awards were based on the tribunal declining jurisdiction (5 out of 46 cases). See our previous alert on statistics on enforcement and compliance of ICSID awards over a longer period.

Geographical Reach

The cases involving the Americas accounted for almost 50% of the total registered cases in FY2024. Out of the total cases, South America, Central America, and the Caribbean represented 31% of the disputes. Latin America occupies the highest rank among the regions.

Economic Sectors Insights

Oil, gas, mining, and electricity (and other energy) accounted for 45% of disputes. Transportation and construction accounted for 33% of disputes. These trends highlight ongoing challenges and complexities in these critical industries and align with the statistics reported in ICSID's 2023 Report. Seeour previousalert on ICSID's 2023 figures.

ArentFox Schiff has extensive experience in advising and representing parties in the Americas and Africa, ranging from negotiating settlements of investment disputes to appearing before ICSID tribunals and addressing the enforcement of awards.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.