- within Litigation and Mediation & Arbitration topic(s)

Business partnership agreements are the backbone of a successful partnership. These legal documents ensure everyone knows their roles, rights, and responsibilities. For entrepreneurs, having a well-structured partnership agreement is essential. It protects the interests of all parties involved and minimizes the risk of conflicts.

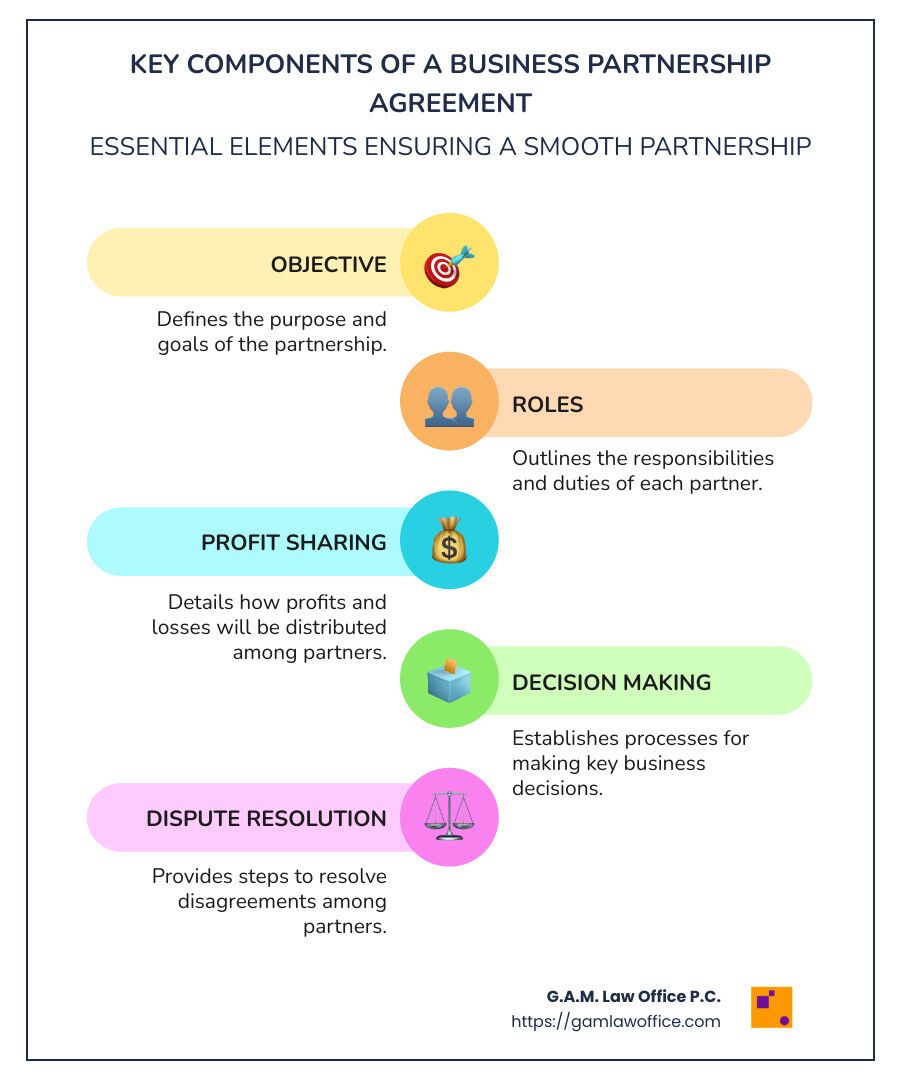

Here's a quick rundown of what business partnership agreements typically include:

- Objective: Purpose and goals of the partnership.

- Roles: Clearly defined responsibilities and duties.

- Profit Sharing: How profits and losses will be divided.

- Decision Making: Processes for making important business decisions.

- Dispute Resolution: Steps to resolve disagreements among partners.

Entrepreneurs need these agreements to iron out the nitty-gritty details and avoid misunderstandings. A strong partnership agreement not only safeguards partnerships but fuels collaborative success.

Understanding Business Partnership Agreements

Business partnership agreements are crucial documents in entrepreneurship. They act as the foundation for any partnership, outlining the terms and conditions that govern the relationship between partners. Let's break down what these agreements are all about.

Definition

A business partnership agreement is a legally binding document. It sets the framework for how a partnership will operate. Think of it as a roadmap that guides partners through their business journey. This document is similar to a contractor agreement, as it specifies each partner's rights and responsibilities, including profit-sharing and decision-making processes.

Legal Binding Nature

The legal binding nature of a partnership agreement cannot be overstated. Without it, partnerships can face complications and risks. An agreement ensures that all partners are on the same page, reducing the chance of misunderstandings. Moreover, it protects the partnership from future legal issues by clearly outlining each partner's role and obligations.

Rights and Responsibilities

A partnership agreement defines the rights and responsibilities of each partner. This includes:

- Capital Contributions: How much money or resources each partner will contribute to the business.

- Profit and Loss Sharing: The method for dividing profits and losses among partners.

- Management Roles: Who is responsible for what within the partnership. This might involve one partner handling finances while another focuses on marketing.

- Decision-Making Processes: How decisions will be made, ensuring no partner feels left out.

- Dispute Resolution: Methods for resolving conflicts, which might include mediation or arbitration.

Having these elements clearly defined helps partners work together smoothly and efficiently. It also ensures accountability, as each partner knows what is expected of them.

In summary, business partnership agreements are indispensable for entrepreneurs. They provide a clear structure, protect legal interests, and clarify roles and responsibilities, paving the way for a successful partnership.

Key Elements of a Partnership Agreement

Crafting a business partnership agreement is like building a sturdy bridge between partners. It ensures everyone knows their path and avoids potential pitfalls. Let's explore the key elements that make up this essential document.

Capital Contributions

Capital contributions are the lifeblood of any partnership. They represent what each partner brings to the table, be it cash, property, or services. These contributions often dictate the percentage of ownership each partner holds. Clear documentation of these contributions is crucial to prevent future disagreements. For instance, if one partner contributes more capital, they might expect a larger share of profits.

Profit and Loss Distribution

How profits and losses are shared can make or break a partnership. Partners can choose to split profits equally, based on their capital contributions, or by a predetermined percentage. It's vital to lay out these terms in the agreement to avoid conflicts.

Management Roles

Defining management roles is key to smooth operations. Each partner should have clear responsibilities that align with their skills. For example, one partner might handle finances while another focuses on marketing. This clarity prevents overlap and reduces confusion. Regularly revisiting these roles as the business evolves can help maintain a healthy dynamic.

Dispute Resolution

Disputes are inevitable in any partnership. Having a plan for resolving them can save time, money, and relationships. Common methods include mediation, arbitration, or informal discussions. Including these processes in the agreement ensures that partners have a roadmap for handling conflicts without resorting to litigation. This not only cuts down costs but also fosters a collaborative spirit.

Incorporating these key elements into your business partnership agreement sets the stage for a successful and harmonious partnership. It ensures that all partners are aligned, reducing the likelihood of misunderstandings and fostering a collaborative environment.

Types of Business Partnerships

When starting a business with others, understanding the different types of partnerships is crucial. Each type carries its own set of rules, liabilities, and benefits. Let's break down the main types: general partnerships, limited partnerships, and limited liability partnerships.

General Partnerships (GP)

A general partnership is the simplest form of business partnership. In this setup, all partners share equal responsibility for managing the business and they are personally liable for the business's debts. This means if the business incurs a debt, creditors can go after the personal assets of any partner.

General partnerships are easy to form and require minimal paperwork. However, the unlimited liability can be a significant downside. It's essential for partners to have a solid business partnership agreement to outline roles, responsibilities, and profit sharing to avoid conflicts.

Limited Partnerships (LP)

A limited partnership offers a bit more flexibility. It includes both general partners and limited partners. General partners manage the business and assume unlimited liability. Limited partners, on the other hand, are typically investors who do not participate in day-to-day operations and have liability limited to the amount they invested.

This structure is beneficial for those who want to invest in the business without being involved in its operations. However, limited partners must be cautious not to overstep their role, as this could affect their liability status.

Limited Liability Partnerships (LLP)

A limited liability partnership is designed to protect each partner from personal liability for certain partnership obligations. This means that partners are not responsible for the actions of other partners, safeguarding their personal assets. LLPs are especially popular among professionals like lawyers, accountants, and architects.

This structure provides a balance between flexibility and protection, allowing partners to manage the business while enjoying limited liability. The availability and regulations of LLPs can vary by state.

Understanding these partnership types helps entrepreneurs choose the right structure for their business goals and risk tolerance. A well-drafted business partnership agreement can further clarify roles and protect partners' interests in any partnership type.

How to Create a Partnership Agreement

Creating a business partnership agreement is a critical step in forming a successful partnership. It sets the foundation for how your business will operate and helps prevent future conflicts. Here's how you can craft one effectively:

Consult an Attorney

While you might be tempted to draft a partnership agreement on your own, consulting an attorney can be invaluable. A legal expert ensures that your agreement complies with all relevant laws and regulations. This is crucial because each state may have different requirements for partnerships.

An attorney can help tailor the agreement to your specific needs, offering strategic advice on potential issues like dispute resolution and partner withdrawal. This personalized guidance can save you headaches down the line.

Use Customizable Templates

For those looking to save time and resources, customizable templates can be a great starting point. These templates are available from various sources, such as the Small Business Administration or legal service providers. They offer a structured format that covers the basics like capital contributions, profit sharing, and management roles.

However, while templates provide a useful framework, they should not replace legal advice. It's essential to adapt them to fit your unique business situation. Adjusting a template with the help of an attorney can ensure it addresses specific concerns relevant to your partnership.

The Drafting Process

When drafting your partnership agreement, clarity is key. Start by defining key elements such as:

- Capital Contributions: Clearly state what each partner will contribute, whether it's money, property, or services. This affects ownership percentages and profit sharing.

- Profit and Loss Distribution: Decide how profits and losses will be divided. This can be based on capital contributions or another agreed-upon method.

- Management Roles: Define who will handle what aspects of the business. This prevents overlap and confusion in decision-making.

- Dispute Resolution: Outline how conflicts will be resolved, whether through mediation, arbitration, or another method. This can prevent costly legal battles.

Throughout the drafting process, communication with your partners is crucial. Discuss each element thoroughly to ensure everyone is on the same page. This collaborative approach not only strengthens the agreement but also fosters a spirit of teamwork and trust.

By following these steps, you can create a robust partnership agreement that protects your interests and sets your business up for success.

Advantages and Disadvantages of Partnerships

Advantages

Easy to Establish

One of the most appealing aspects of a partnership is how simple it is to set up. Unlike corporations or LLCs, you don't have to file extensive federal paperwork. You can just focus on drafting a business partnership agreement that outlines your terms. All partners need to agree and sign, and you're ready to go.

You'll only need to handle a few local filings, like a trade name application, and you're in business. This ease of setup allows entrepreneurs to quickly pool resources and start operations without the usual bureaucratic delays.

Carries Less of a Financial Burden

Starting a business can be financially daunting, but a partnership can ease that burden. With a partner, you can share the costs of starting and running the business. This means you might avoid taking on heavy debts, or you could invest more upfront to help your business grow.

For instance, if you're looking to launch a tech startup, sharing the cost of expensive equipment or software can make it more manageable. Plus, having a partner means you can split the financial risk, which can be a relief for many entrepreneurs.

Disadvantages

Mutual Liability

While partnerships are easy to start, they come with the downside of mutual liability. In a partnership, you are not just responsible for your actions but also for your partner's. If your partner makes a mistake or incurs a debt, you are equally liable. This can put your personal assets at risk, as there's no legal separation between you and the business.

This mutual liability can sometimes strain relationships, especially if one partner feels they're shouldering more of the burden. It's crucial to have a clear business partnership agreement that outlines responsibilities to mitigate potential conflicts.

Provides Less Independence

Having a partner means sharing decisions. While collaboration can be beneficial, it also means you have less independence. Every significant business decision requires agreement from all partners, which can sometimes lead to disagreements or delays.

For example, if you want to expand the business but your partner prefers to maintain the status quo, it could lead to a stalemate. This lack of autonomy might not suit everyone, especially those who prefer to have full control over business decisions.

Obligated to Split Profits

While sharing costs is an advantage, sharing profits might not always feel as beneficial. In a partnership, profits are divided among partners, which could mean a smaller share than if you were running the business alone. If you have multiple partners, your profit margin could shrink significantly.

This aspect requires careful consideration, especially if one partner feels they contribute more but receive an equal share. Your business partnership agreement should clearly outline profit distribution to ensure fairness and transparency.

In summary, partnerships offer a quick and less burdensome way to start a business, but they also come with shared responsibilities and liabilities. Understanding these pros and cons can help you decide if a partnership is the right structure for your venture.

Frequently Asked Questions about Business Partnership Agreements

What is a business partnership agreement?

A business partnership agreement is a legal document that lays out the rules and guidelines for a business relationship between partners. This agreement defines each partner's rights and responsibilities, ensuring everyone knows their role. It covers key aspects like ownership stakes, decision-making strategies, and how profits or losses are shared.

Think of it as a roadmap that helps partners steer the business journey while minimizing misunderstandings or disputes. Without such an agreement, partners might find themselves in tricky situations with no clear path forward.

Can I make my own partnership agreement?

Yes, you can make your own partnership agreement, but it's often wise to consult an attorney. While there are customizable templates available online that can guide you through the process, having a legal expert review your agreement ensures it's comprehensive and compliant with local laws.

An attorney can help tailor the agreement to your specific needs, addressing unique circumstances that generic templates might overlook. This professional touch can save you from potential legal troubles down the road.

What are the main considerations in a partnership agreement?

When drafting a partnership agreement, several important elements must be considered:

- Capital Contributions: Clearly define what each partner will contribute to the business. This could be in the form of cash, property, or services. The agreement should also outline what happens if the business needs more capital in the future.

- Ownership Stakes: Determine how much of the business each partner owns. This is usually based on their initial contributions and impacts how profits and losses are distributed.

- Decision-Making Strategies: Establish how decisions will be made. Will all decisions require unanimous consent, or can some be made by majority vote? Clearly defining this process helps prevent conflicts and ensures smooth operations.

- Dispute Resolution: Address how disputes between partners will be handled. Options like mediation or arbitration can be included to avoid costly legal battles. This part of the agreement acts as a safety net, providing a path to resolve disagreements amicably.

By considering these elements, you set a strong foundation for your partnership, paving the way for a successful and harmonious business relationship.

Conclusion

Navigating the complexities of a business partnership agreement can seem daunting, but with the right guidance, it becomes a powerful tool for success. At G.A.M. Law Office P.C., we recognize the importance of crafting agreements that not only protect your interests but also foster collaboration and growth.

Our approach is centered on offering custom legal counsel custom to your unique needs. We understand that every business is different, and a one-size-fits-all agreement simply won't do. That's why we take the time to understand your goals, challenges, and vision, ensuring that your partnership agreement is as unique as your business.

Strategic advice is at the heart of what we do. Whether you're just starting out or looking to restructure an existing partnership, our team provides insights that help you make informed decisions. We focus on clear communication and transparency, so you always know where you stand and what steps to take next.

By partnering with us, you're not just getting a legal document; you're gaining a strategic ally committed to your success. Let us help you build a solid foundation for your partnership, one that minimizes risks and maximizes potential.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.