The attempt to find a single lease accounting model based on recognition of a right-of-use asset has faltered. In this article, two professionals in Grant Thornton LLP's National Professional Standards Group suggest a control-based model as an alternative.

The FASB and IASB (the Boards) are preparing to issue a second exposure draft on lease accounting later this year or early next year. This exposure draft is expected to include a second lease accounting model in addition to the original model based on recognition of a right-of-use asset. The right-of-use asset itself isn't being rethought.

Some may attribute the addition of a second model to political pressure or resistance to change on the part of preparers. Others have noted a lack of consistency between the right-of-use asset model and the control-based model for revenue recognition, despite similarities in the economic substance of the transactions. We fall into the latter group.

Regardless of the reasons for the new exposure draft, we are concerned that the current models are complex, conceptually challenged, and unlikely to provide financial statement users with decision-useful information. In our view, the problems that the Boards are encountering in the lease accounting project are largely due to conceptual shortcomings inherent in the right-of-use asset.

The current state of affairs

Under existing GAAP, leasehold rights are considered to be executory contracts unless the lease transfers substantially all of the risks and rewards of ownership to the lessee. In a bold attempt to resolve issues with that model, the Boards issued a blanket assertion in their original discussion paper, Leases: Preliminary views, issued in March 2009.1 In a decision meant to clear the way for a single leasing model, the Boards decided that in a simple lease, the lessee obtains a right to use the leased item — a right that meets the definition of an asset. The Boards did not provide further clarification as to whether the right-of-use asset is considered to be a tangible or intangible asset.

Since then, the single lease accounting model based on the right-of-use asset has failed to gain general acceptance, in part because of concerns about measurement of the asset and obligation and, more recently, concerns about the income statements. A major concern of both lessors and lessees is that the accounting for rights of use would lead to earlier recognition of both revenue and expenses than would be the case under current operating lease accounting requirements.

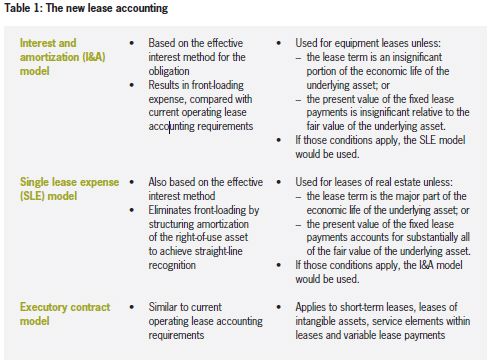

In July 2012, the Boards decided to propose two models in a forthcoming exposure draft:

- The interest and amortization (I&A) model, which is based on the right-of-use asset approach

- The single lease expense (SLE) model, which is designed to achieve straight-line recognition of rental expenses on the income statement

Short-term leases and non-lease elements within a lease would continue to be accounted for as executory contracts.

In order to decide which model to use, both the lessor and the lessee would have to look at the significance of the lease term and the lease payments relative to the economic life and fair value of the underlying asset. The decision criteria would be applied differently, depending on the nature of the underlying assets (real estate or equipment), as described in Table 1.

We are not convinced that this overall approach would improve the quality or understandability of financial reporting.

A control-based model

We propose an alternative approach that calls for two types of lease contracts, with classification contingent on whether the contract transfers control of the underlying asset to the lessee. Our model is based on our belief that:

- the accounting model for leases should be conceptually consistent with the accounting for economically similar transactions — especially those that involve revenue recognition — and should produce comparable financial statement outcomes;

- the model should improve the quality of information for users of the financial statements;

- the financial statements should be understandable; and

- the financial statements should make a clear distinction between tangible assets that are controlled by the reporting entity and contractual assets that are rights of use.

The principle for distinguishing between the types of leases is the transfer of control — the same principle used for revenue recognition. Our model differs from the current FASB and IASB leasing proposals in that it looks to control of

the underlying asset — a concept deeply embedded in existing accounting guidance, as well as within U.S. tax and bankruptcy laws — rather than control of the right-of-use asset.

In our model, contracts that transfer control of the underlying asset to the lessee would be accounted for as sales and financing arrangements. Contracts that do not transfer control of the underlying asset to the lessee would be operating leases. Under an operating lease, the assets and liabilities are contract assets and performance obligations, respectively.

While our approach is not perfect, we believe that a model based on control of the underlying asset would be a significant improvement compared to current lease accounting. The remainder of this article describes how such an approach would work.

Leases that transfer control of an asset: Lessor

Our proposal for accounting for financing leases is based on guidance in the forthcoming revenue recognition standard and is substantially identical to the receivable and recognition model proposed by the Boards. A lease would be a sale when it is a permanent, or non-temporary, transfer of control of an underlying tangible asset from the seller/lessor to the buyer/lessee. Other elements of the leasing contract, such as services, would be accounted for separately.

On execution of the lease, the seller/lessor would recognize one or more contract assets and performance obligations. On transfer of control, the seller/lessor would derecognize the underlying asset and recognize revenue (or a gain or loss). The lease would be accounted for as a sale and financing transaction, with derecognition of the underlying asset and recognition of a receivable and, if appropriate, a residual asset.

In subsequent periods, the lessor would recognize revenue from other performance obligations when satisfied. The receivable would be recognized or remeasured (impaired) consistent with the accounting for any other receivable.

Leases that transfer control of an asset: Lessee

The lessee would account for an acquisition of the entire underlying asset as a purchase at the normal selling price of the asset and recognize an obligation to make payments and, if appropriate, an obligation to return the residual asset at the end of the lease term. We believe that this provides a better measure of obligations, assets deployed and financing costs than a model that is based on discounting minimum lease payments using the lessee's incremental borrowing rate.

In our model, the interest rate would be determined based on the entry value of the asset and the total obligation, theoretically approximating the rate used by lessors to price leases that transfer control of the underlying asset. In subsequent periods, the asset would be depreciated or remeasured if impaired but not to an amount less than the amount of any recognized obligation to return the residual asset.

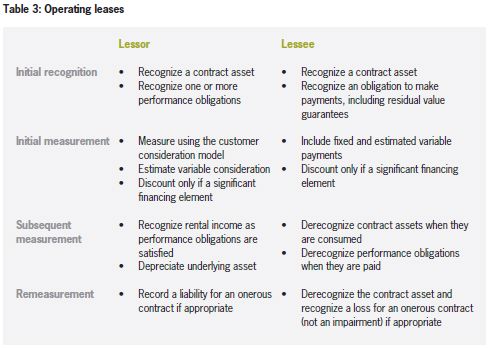

Operating leases: Lessor

We believe that the lessor should evaluate a lease that does not transfer control of the underlying asset similar to a service, using the criteria in the pending revenue recognition standard to recognize a contract asset and one or more performance obligations. The amounts would be discounted only if there is a significant financing element (i.e., a timing difference between when payment is made and the contract asset is used). In subsequent periods, revenue would be recognized as the performance obligations are satisfied: Revenue associated with the obligation to permit the use of the underlying asset would be recognized over time, and revenue associated with the obligation to perform other services would be recognized as those services are performed. A contract asset would not be tested for impairment, but there could conceivably be a liability for an onerous contract.

Operating leases: Lessee

When the contract does not transfer control of the underlying asset, the lessee would recognize a contract asset and a performance obligation for payments to be made under the lease. Those amounts would be discounted only if there is a significant financing element within the lease. In subsequent periods, the contract asset would be eliminated and recognized as an expense over time, and the performance obligation would be relieved as payment is made. The contract asset would not be subject to impairment, but would be reduced in the event that the contract asset ceases to have value because, for example, the lessee ceases to use the property but still has an obligation to pay.

The accounting by the lessee will require that the Boards address the accounting for contract assets and performance obligations by the customer. The Boards would need to discuss whether the amounts would be recognized as net or gross and whether to account for only the lease element or to include services.

Defining control

There are still many issues to be worked out, particularly with respect to the definition of control. We believe that the definition should align with the one stipulated in the FASB and IASB revenue recognition project, aside from certain indicators that may be unique to leases. According to the Boards' revenue recognition proposal, the following conditions must be met for a transfer of control to occur:

- The seller must have the right to receive payment.

- The customer must have the legal title.

- The seller must have transferred physical possession.

- The customer must have assumed the significant risks and rewards of ownership.

- The customer must have accepted the asset.

We would add that the transfer of control must be non-temporary. In the case of finite-lived assets, the ratio of the lease term, including renewal option periods, to the useful life of the asset would be a factor in determining whether the customer has assumed the significant risks and rewards of ownership. Residual value guarantees by the lessee and the amount of residual risk retained by the lessor would also be determining factors.

Why control of the underlying asset is a better measure

In our estimation, public comments and subsequent Board redeliberations indicate that the concept of the right-of-use asset is not yet sufficiently developed to be workable in practice. In the discussion paper, Leases: Preliminary views,2 the Boards included a provision to account for leases that transfer control of the underlying asset at the end of the lease term as a sale. In our model, we build on that concept, but we record sales-type leases as sales only if they transfer control of the underlying asset as of the beginning of the lease term. In doing so, we have changed the unit of account from the right-of-use asset to the underlying asset. This simplifies many issues surrounding initial measurement and remeasurement, the calculation of discount rates, the recording of impairment, and the recognition of revenue and expense.

Other advantages to our approach include enhanced financial reporting comparability between entities that purchase assets and those that lease them; symmetry in the accounting between the lessor and the lessee; and consistency with the accounting proposed in the Boards' revenue recognition project. A control-based model is more consistent with current legal and tax-related distinctions between types of leases. It also helps reduce complexity because practitioners need not familiarize themselves with a different accounting model that applies only to leases. The most important advantage is better and more understandable information for users of the financial statements.

Conclusion

Despite the difficulties inherent in rebooting the project, we believe that it is essential to get lease accounting right. Public comments and subsequent redeliberations indicate that the right-of-use model has not gained support from the majority of either users or preparers of financial statements. There are also legal and tax considerations that should be taken into account. Finally, it's useful to bear in mind that the method used to account for operating leases is bound to serve as a precedent for the future accounting for other executory contracts. In that regard, we encourage the Boards to rethink how entities should present contract assets and performance obligations in financial statements, whether on the balance sheet, in the notes, or in a separate schedule of executory contracts.

A new approach is needed. We believe a control-based model could be a start.

Footnotes

1. Financial Accounting Standards Board. "Leases: Preliminary views." Financial Accounting Series, Number 1680-100, March 19, 2009. Available at www.fasb.org/DP_Leases.pdf.

2. Financial Accounting Standards Board. "Leases: Preliminary views." Financial Accounting Series, Number 1680-100, March 19, 2009. Available at www.fasb.org/DP_Leases.pdf.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.