- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

This digest recaps the first four articles in our series on Managing for Value, an approach that helps companies consistently outperform peers in the long term by building a powerful reinvestment advantage. In the next phase of this series, we'll explore how grocers can use this framework to tackle some of their most critical opportunities, from private brand to fleet optimization to digital transformation.

A grocer with a generic, one-size-fits-all value proposition won't survive long in the modern landscape. It's no secret that customers are splitting their grocery budgets not only between supermarkets but across mass merchandisers, discounters, club stores and others. As a result, every grocer must aggressively cultivate points of differentiation — some customer-facing, some behind the scenes.

The ways in which grocers can achieve this much-needed specialization are infinite, but it's easy for companies to get stuck on the questions of which opportunities to chase and how to fund them.

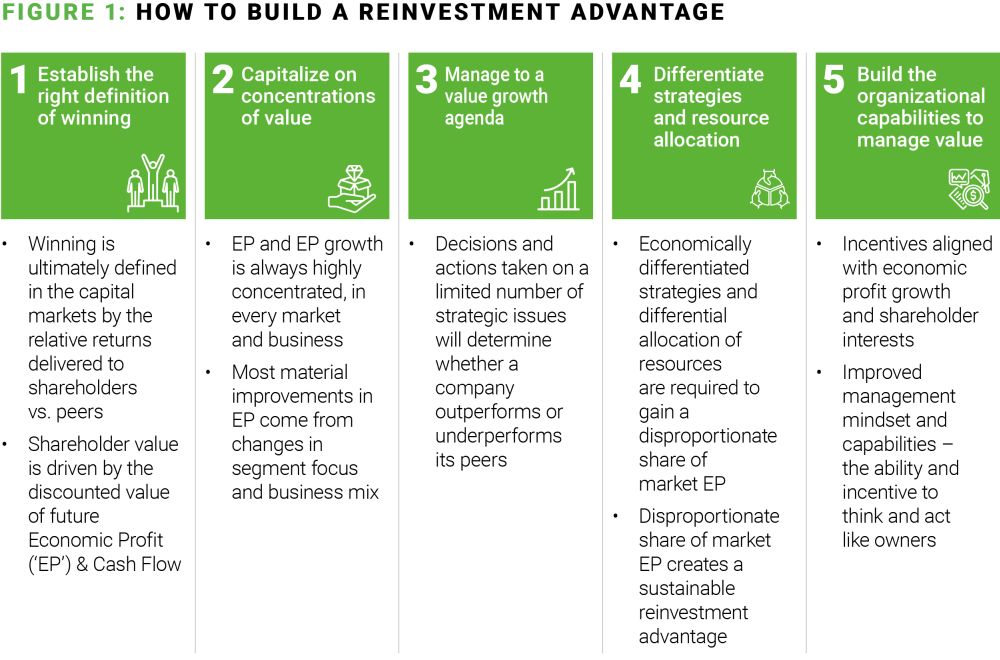

Enter an approach known as managing for value. The process involves five steps: aligning on a single measure of success; identifying internal and external concentrations of value; establishing management's key priorities; creating differentiated strategies and resource allocation; and building a culture of ownership.

We've seen successful companies of all sizes, across industries, use the principles of managing for value to create a sustainable competitive advantage. For example, many public companies have used this approach to deliver shareholder returns in excess of 50% above their peers. For both public and private organizations, managing for value creates a virtuous cycle that enables heavy reinvestment to build even more value for their customers.

1. Establish the right definition of winning

It all starts with adopting the right definition of success, which is maximizing total shareholder returns. Whether a company is publicly held or privately held, maximizing "shareholder" value also requires maximizing value to both customers and employees.

What's necessary to win in the customer marketplace is the same as what's necessary to win in the capital markets: a grocer has to capture a greater share of the market profit pool by serving customers better than the competition. Gaining loyal — and profitable — customers means that these consumers perceive greater benefits for the price than they can find elsewhere, and when a company achieves this, they create value for those customers.

We have found the most consistent measure of customer value and driver of shareholder value, regardless of company, to be long-term economic profit (EP) growth.

Increasing economic profit growth faster than competitors creates a reinvestment advantage, which can be used to fund signature programs, remodel stores, upgrade systems, train employees, and more. Maximizing EP creates a "flywheel effect," with every investment driving increased competitive advantage and additional profit growth — all of which ultimately benefits all stakeholders (customers, employees, communities, shareholders, etc.).

2. Capitalize on concentrations of value

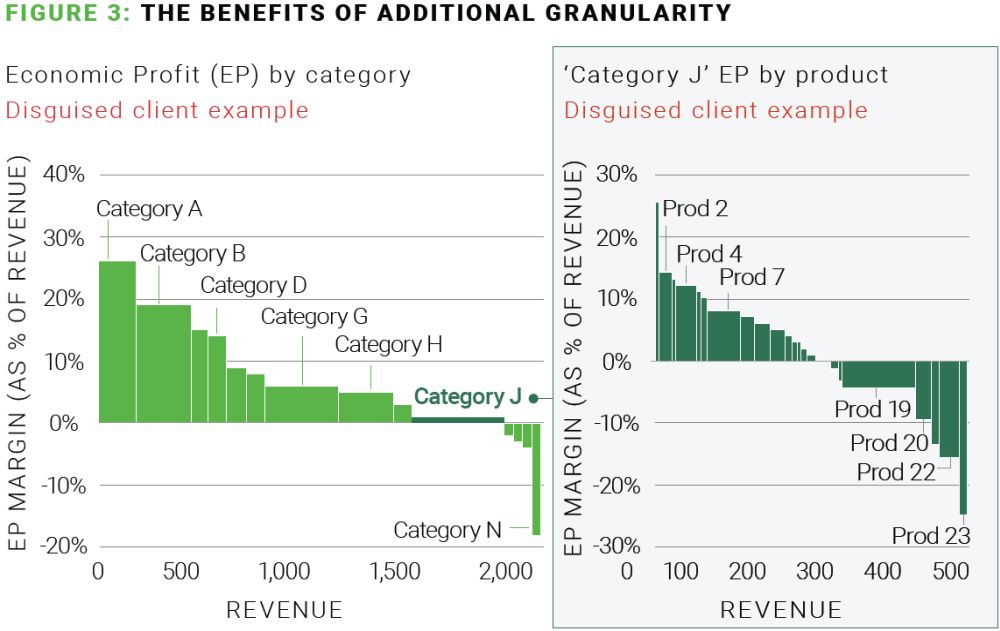

While the average profit margins in grocery are only 2%, that average hides what top performers know: that value creation and value destruction are always highly concentrated.

For U.S. grocery overall, profits are concentrated in mass players (e.g., Target, Walmart) despite revenues being concentrated in chain grocers. These companies capitalized on customers looking for a "one-stop-shop" during the pandemic and invested resulting earnings into improving the customer experience. While supermarkets can't go head-to-head with these companies in every area, they need to examine them closely; the fact that mass players are capturing an outsized share of profits means they are serving shoppers in differentiated ways, and it is important for every grocer to understand what is driving their success.

Within companies, value is concentrated by customer, product, category, department, store, banner and region. It is not unusual to see 20% of shelf space generating 80% of economic profit, and it is critical for management to know which products these are, who buys them, and why.

In addition to "atomizing" the business in this way, companies should ensure they have multiple lenses on profitability in each of those segments. Most grocery competitors focus on gross margin for individual products — and sometimes operating income for categories. Along with those traditional metrics, we have found tremendous value can be unlocked by understanding a "fully burdened" view of economics that includes an allocation of the capital required to generate that profitability (working capital, share of store fixed capital, etc.). This is where EP comes into play.

Similarly, many companies prioritize revenue growth above all, assuming that sales will drive profit. In reality, there is both "good" revenue and "bad" revenue, along with "good" costs and "bad" costs — where good and bad are defined by whether they create or destroy value over time. The general rule of thumb that all growth is good misses a key consideration: some segments inherently have better economics than others, so not all revenues grow value to the same extent.

3. Manage to a value growth agenda

Once they understand where value is concentrated, management teams must pursue a short list of initiatives that offer the greatest potential for value creation. The difference between the executive team engaging in 10 activities at 80% and attacking five at 100% is the difference between status quo performance and actually moving the needle on the business. This agenda should be prioritized by value creation potential (i.e., the sum of discounted future economic profit, since a dollar today is worth more than a dollar several years from now).

Having a value growth agenda that is appropriately crafted and treated as the North Star for the organization provides clarity in several critical ways. It creates a consistent and unbiased method for executives to evaluate what is most important, as using EP removes the guesswork from decisions — for example, whether to invest in a marketing push expected to grow revenue by $300M versus a supply chain refinement expected to save $100M in cost. It also mitigates the role of politics in deciding where time is spent because executive attention is guided by value, not existing relationships.

In addition, following a value growth agenda allows for easy distinctions between the urgent and the important; if those boundaries aren't clear, pursuit of "timely" initiatives can keep companies from making progress on long-term projects of real impact. Finally, committing to prioritize the opportunities of the value growth agenda reduces the distraction that otherwise occurs when organizations feel pressure to chase every fleeting fad.

This agenda will not be one-size-fits-all. Executives should first consider what will be most impactful to their company and customers. For example, one would expect a discounter's agenda to look very different from that of a natural grocer. For a more traditional grocer, an agenda for the highest value growth items might look like the below.

The agenda should be dynamic, sustained and regularly updated to drive decisions and actions over time. As agenda items are completed, management adapts the plan to tackle the next set of priorities.

4. Differentiate strategies and resource allocation

It might be tempting for grocers to hew to "best practices," but we have observed that it's actually very risky to only ever take the paths that are obvious. Benchmarking to best practices limits a company to what's already been tried — and ignores the reality that sometimes even the best solutions in use still aren't particularly effective. Less conventional or unique tactics are also harder for competitors to imitate and therefore unlock more value.

Many companies also fall into the trap of improving line items or components of the business in isolation rather than pursuing integrated strategic change.

For example, matching the assortment of a successful competitor may drive a small boost in sales, but it's unlikely to convert enough new customers to dramatically impact the top or bottom lines. On the other hand, designing promotions to drive traffic towards the most profitable products —perhaps by discounting price-elastic items frequently purchased in the same basket — has the potential to simultaneously increase sales and margins through mix improvement.

As a grocer evaluates how best to pursue each of the opportunities on their agenda, they may discover that some have straightforward solutions, but the issues with the greatest value at stake are often more complex. Grocers should evaluate a full suite of alternatives to see whether solutions beyond the obvious could drive greater differentiation and more profit.

The chosen alternatives should not be siloed; they all need to fit together. The right combination will produce a differentiated strategy that serves customer needs better than competitors and captures a greater share of market profits.

Agenda items will need to be funded, and that means reallocating existing resources or taking out debt. While capital often isn't completely constrained, it certainly is expensive, so surgically shifting it toward the chosen alternatives (and away from unprofitable areas of the business) will greatly accelerate value growth.

5. Build the organizational capabilities to manage value

This "managing for value" mindset, which requires management dedicating focus to a short list of big-ticket opportunities and setting aside others, has to extend from executives to employees throughout the company. While delivering on agenda items is critical, companies that only manage initiative by initiative generally don't sustain outperformance over time. Instilling a philosophy of prioritizing activities based on profit potential enables value-driving decisions to be made independently every day — most without the involvement of senior leadership.

Just as executives need to reserve their attention for the most significant opportunities of the overall company, employees throughout the organization need to prioritize their own projects based on the value they can deliver.

To enable and encourage this, EP should be made visible at all levels of the organization, and it should be directly tied to senior leaders' compensation. Strong decision rights must be created to combat perverse incentives. From executives down, managers should then train their direct reports on what managing for value means for their function and day-to-day responsibilities, and value growth should be a recurring theme in their conversations with team members collectively and individually.

Such alignment doesn't happen overnight, but once "managing for value" is ingrained in the culture, it delivers superior results that persist over the long term.

Check out the previous articles in this series at the links below, and stay tuned for deep dives on how the managing for value framework can be applied to opportunities like private brand; fleet optimization; digital transformation and role of the store; and more.

Managing for Value, Part 1: A new way to think about winning in grocery

Managing for Value, Part 2: What grocers gain from a closer look at profitability

Managing for Value, Part 3: Prioritizing an agenda for profitable growth

Managing for Value, Part 4: How grocers can drive sustainable profitable growth

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.