- in United States

- with readers working within the Banking & Credit industries

Private credit has seen a rapid increase in assets under management (AUM) over the past decade, with AUM currently surpassing $1.6tn. Just as the prior growth in primary private equity AUM gave rise to a significant private equity secondaries market, the growth in private credit AUM over recent years is now producing a material private credit secondaries market.

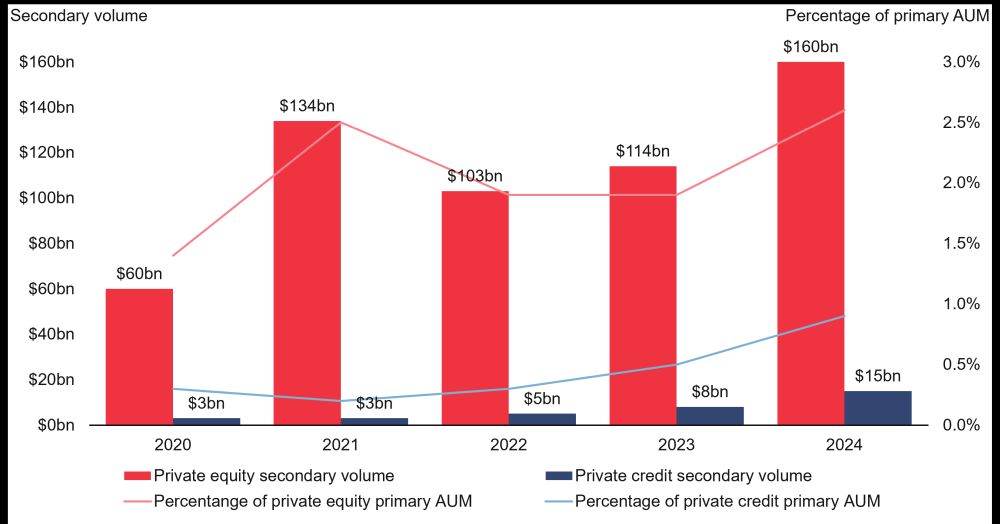

Analysing secondary volume as a proportion of primary AUM reveals how private credit secondaries have considerable room for growth – from under 1% currently to the 2%-3% seen in the more developed private equity market. As the private credit asset class expands to include more sub-strategies such as asset-based finance and investment grade private credit, the opportunity for secondaries to accompany that growth is significant. If we estimate that by 2030 private credit will reach $3tn in AUM and secondaries volumes will reach 2%, that will represent $60bn in annual secondary deal volume, an over 3x increase from current volumes.

Figure 1: Secondaries volume and proportion of primary AUM

Source: Macfarlanes analysis. Data from Preqin Ltd, Evercore H1 2024 secondary market survey and reports by Coller Capital and Apollo Global Management.

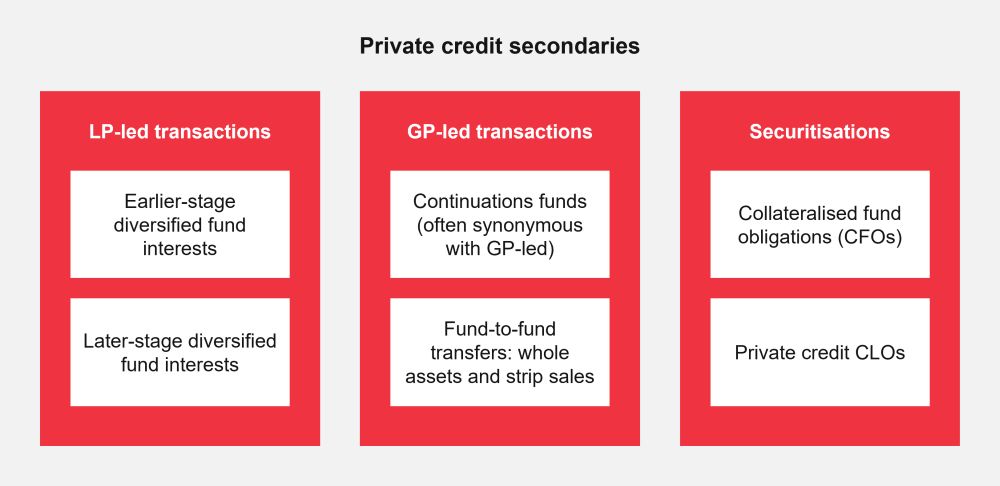

Although private credit secondaries share some similarities with private equity, they represent a more diverse set of transactions. In this article we unpack the different types of private credit secondaries as well as the common drivers behind these transactions.

Breaking down private credit secondaries

LP-led transactions

LP-led secondary transactions enable limited partners (LPs) to exit illiquid positions in private funds, providing a valuable source of liquidity. LP-led deals can be categorised based on two key factors: the stage of the fund being exited, and the concentration of the underlying portfolio being sold – factors that would usually go hand in hand.

Earlier stage diversified positions

Some LP-led transactions take place earlier in the life of the underlying when portfolios are large and diversified. In these cases, due diligence and valuations take a large-scale statistical approach and tend to be sold closer to NAV.

Late stage concentrated positions

Some secondary buyers focus specifically on end-of-life fund LP interests, where typically only a few underlying investments remain. In these cases, due diligence requires a greater emphasis on individual assets. Such LP-led transactions often trade at more substantial discounts to NAV.

Some traditional private credit managers experienced in acquiring loans in the secondary market as part of their special situations or distressed strategies, may be well-positioned to acquire late-stage LP positions, given the similarity in required due diligence expertise. However, the original GP often has control over the transfer of fund interests and may oppose sales to traditional private credit managers if perceived as competitors.

You could of course see secondary transactions involving the entire interests in SMAs or funds-of-one however these will by definition be bespoke and require individualised structuring and negotiation, unlike the more standardised processes seen with commingled fund interests. The interest sold in this transaction may not be a fund interest (which would likely require full renegotiation) and the sale may be achieved through a transaction at the portfolio, asset Holdco or LP level. These transactions will inevitably require significant GP involvement and are perhaps more akin to a GP-led transaction.

GP-led transactions

GP-led secondaries accounted for less than one third of credit secondaries deal volume in 20241, however, they are expected to rise to about 50% in the coming years tracking the evolution of private equity secondary market.

In a private equity context, the term "GP-led" is synonymous with a continuation fund with a sale of a portfolio company from one blind pool fund to a later vintage not really viewed as a secondary. However, in private credit, there is a wider range of fund products and vehicles, and in our view, some situations go beyond just continuation funds. For example, if a GP sells fund investments to a new blind pool fund it also manages - specifically to provide liquidity to LPs, rather than as part of routine portfolio management - that could reasonably be considered a secondary transaction. Transfers between related funds and accounts can raise questions around use cases and managing conflicts of interest. For more detail, read our article on this topic.

Continuation vehicles (CVs)

In a continuation vehicle, an asset or portfolio of assets is sold by a fund to a newly created vehicle managed by the same GP established specifically to acquire those assets with generally limited ability to make wholly new investments. LPs in the original fund are given the option to either receive the related distribution or reinvest it in the CV (i.e. roll over).

Single asset continuation funds, which have become increasingly popular in private equity, do not lend themselves to performing credit. For more detail, read our article on single asset continuation funds. High quality loans will typically have a natural exit within the fund's lifecycle2 and if the manager wishes to have continued exposure to the underlying company, it can do so by advancing a new loan to the same borrower from a subsequent fund. Indeed, refinancing borrowers from prior fund vintages is a key source of deals for any direct lending fund.

In private credit, continuation funds can be used in respect of a large, diversified portfolio well before the end of a fund's life, as well as to provide liquidity in respect of end-of-fund-life assets, some of which may have equity-like characteristics. In the former case, there will be a driver specific to the situation as a fund selling a fully ramped performing portfolio is not what investors would usually want. The driver may be that the assets sold represent only a sub-set of the portfolio that would benefit from being repackaged or re-levered. In the second case the driver will often be to solve a maturity mismatch between the underlying assets and the selling fund whilst providing liquidity to investors or to solve for unintended strategy drifts if the remaining loans have different risk characteristics.

There are some important differences in carrying out continuation fund transactions in private credit – including greater sensitivity to costs, closer scrutiny of termination dates and more complex execution. For more detail, read our article on private credit continuation funds.

In November 2024, it was reported3 that BlackRock was preparing a $1.3bn private credit continuation fund transferring 300 first-lien loans positions into a new fund.

In November 2024, it was reported that Vista Credit Partners had closed a $460m continuation vehicle backed by Pantheon. This vehicle provided liquidity to investors in Vista Credit Opportunities Fund II, a 2016 vintage.4

Fund-to-fund transfers

In these transactions, like with a CV, the underlying assets (which can be whole-loan sales or strip sales, i.e. partial interests) are transferred to another fund managed by the same GP, however, the key differences are that the transferee fund will not be established solely or principally for the purpose of that transaction and the acquisition will represent only a proportion of the ultimate portfolio of the transferee fund. There will be no roll option for the LPs in the selling fund. These transactions are more often driven by GP strategic decisions rather than by solving LP liquidity needs. For example, the driver of the transfer may be to seed or ramp up a new product and/or to allow diversification of the transferor fund.

In private credit, most GP-led transactions to date have had an element of securing additional primary capital for new loan origination, rather than being purely continuation funds.

In July 2024, Sumitomo Mitsui Banking Corporation announced a transaction led by Pantheon that saw a strip of performing loan investments moved off their balance sheet and into its inaugural private credit vehicle.5

Securitisations

Securitisations of a manager's existing funds or assets can also be considered secondary transactions. They can provide liquidity to existing LPs and, for new investors, they provide similar benefits of j-curve mitigation and avoidance of blind pool risk.

Both CFOs and private credit CLOs are important growth areas in private credit markets allowing access to new investor types. According to the LSTA and Bank of America, as of December 2024 the US private credit CLO market had grown by 16% since the previous year.6 However, their adoption has been slower in Europe than in the US as regulatory requirements such as Solvency II and Solvency UK reduce the incentives for insurers to invest via securitisations.

Collateralised Fund Obligations (CFOs)

CFOs are structured finance products that pool interests in several private funds and issue securities backed by the expected cash flows of those fund interests. Funds interests going into CFOs can be sourced from existing LPs, whereby the GP arranges a tender giving LPs an opportunity to sell, or it can be funded by the GP's own interests, particularly in cases where GPs have large balance sheets. The former provides liquidity to existing LPs, while the latter unlocks liquidity for the GP (and if it takes the equity in the CFO, leverages its fund investments) and a combination of both is also possible. In either case, the GP benefits from access to new investors that may benefit from the securitised structures, in particular investment grade investors such as insurance companies.

Although a CFO itself is a securitisation rather than a secondary transaction, CFOs are fundamentally built on existing, non-primary assets therefore making them a form of structured secondary transaction. Additionally, there is an increasing number of CFOs backed by secondaries funds.

In April 2025, Neuberger launched a $1.2bn CFO backed by a diversified pool of fund interests across private equity, private credit, and secondaries. The transaction was designed to unlock liquidity and broaden investor access, particularly to insurance companies.7

Private credit CLOs

When a private credit manager transfers existing loans from its funds or balance sheet into a new securitisation vehicle, such as a private credit collateralised loan obligation (CLO), this process can be considered a type of secondary transaction. By securitising existing loans, managers can return capital to investors, although that may not always be the purpose or outcome with returning capital to the fund for it to be reinvested also a potential driver.

Private credit CLOs can be used as a financing vehicle for managers. However, they require highly diversified portfolios, making them inaccessible for smaller managers. An asset-backed leverage facility could be a suitable alternative to achieve the same financing goal. For more detail, read our article on private credit CLOs in Europe.

In November 2024, Barings issued the first European private credit CLO with exposure to 61 unique obligors sourced through their European direct lending platform. Barings opted for a static CLO where the portfolio of underlying loans is fixed at the time of issuance and does not change over the life of the CLO. It is expected that Barings will have leveraged its own balance sheet and internal resources to warehouse the underlying loans prior to the CLO's issuance.

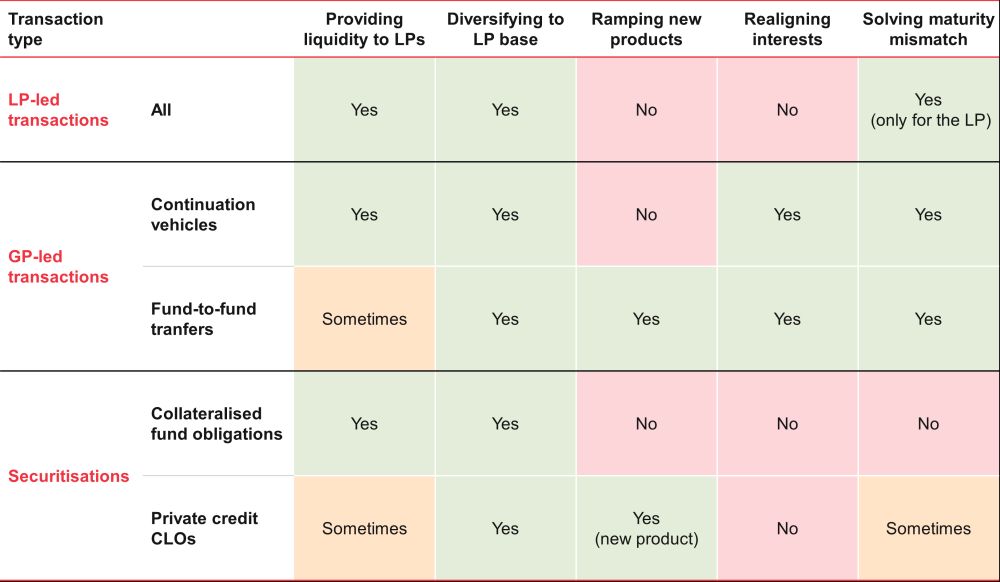

Drivers for private credit secondaries

Secondary transactions are driven by a desire to provide liquidity to LPs and/or for the GP to secure diversification of its LP base. LP diversification includes secondary investors e.g. Coller Capital, but also institutional or retail investors that want exposure to ramped up portfolios. Besides these key objectives, secondaries can achieve a series of other important benefits for managers including ramping up new products, realigning interests and solving for maturity mismatches. These are in turn driven by a combination of the maturation of private credit funds, the slowdown of M&A transactions, higher-for-longer interest rates and the increased competition in fundraising.

Providing liquidity to LPs

A key driver for secondaries (both LP-led and GP-led) is the need to provide liquidity to LPs. From 2018 to the beginning of 2024, private credit investors faced net negative capital distributions meaning capital calls exceeded distributions. This was in great part driven by the rapid growth the asset class witnessed during the time period (from AUM of circa $800bn in 2018 to over $1.6tn+ by 2024) which meant that even if distributions were healthy on a relative basis, they were outpaced by the amount of capital being put to work. Although during the first six months of 2024 distributions outpaced capital calls, most LPs are still highly focused on seeing increased distributions. Additionally, there are several idiosyncratic reasons that could lead LPs to benefit from additional liquidity.

Diversifying the LP base

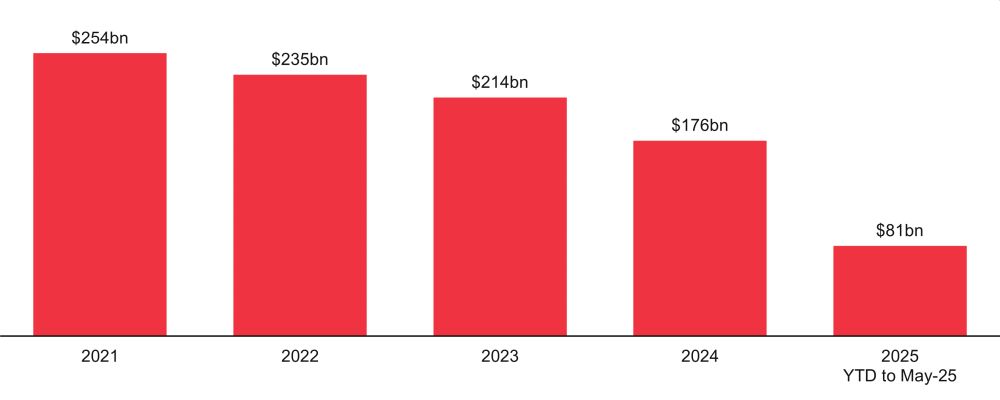

All secondary transactions mentioned throughout this article share a common attractive feature – they enable a lower-risk entry point compared to traditional blind-pool commitments. With primary fundraising markets still facing challenges – since 2021 fundraising levels have declined year-on-year – secondaries can be an important fundraising tool.

Secondary transactions can allow managers to broaden their LP base. Through private credit CLOs, for example, managers can tap into a different investor base by offering structured investment opportunities with varying risk-return profiles. Additionally, the ability to seed portfolios is also an important tool to attracting new investors as described below.

Figure 2: Private credit fundraising - aggregate capital raised

Source: Preqin Ltd.

Ramping new products

Secondary transactions, in particular fund-to-fund transfers, can be used to ramp new products. This can be particularly useful when launching evergreen strategies as showcasing a deployed portfolio can help attract investors in the early stages and the viable economics of an evergreen product for a GP can often depend on it starting and remaining ramped. Early ramping is also a key requirement of a retail product where investors fully fund their entire investment at the time of subscription and so there is a desire to invest that straight away to avoid cash drag. It is expected that as the wealth channel expands, secondaries will play an increasingly important role in facilitating faster deployment of capital and enhancing liquidity.

Realigning interests

Due to their likely limited money multiples, private credit funds with a whole of fund carried interest give rise to heavily back ended carried interest. This means that, typically, carried interest entitlements are satisfied out of the last few investments to be realised by a fund. This is illustrated in Figure 3 which shows how a direct lending fund may need to see repayments from 94% of its loans before it reaches carried interest. Consequently, it can be particularly punishing for a private credit manager in respect of its carried interest if its last investments extend. A continuation vehicle, for example, enables the existing fund to crystallise performance fees for its management team, while transferring the remaining assets to a new vehicle - thereby ensuring that the new investors and terms are aligned to the risk and return profile of the residual portfolio.

This contrasts with private equity, which has greater upside potential. For example, a private equity fund's first few realised investments could be successful enough to guarantee carry for the entire fund potentially diminishing reliance on the last few assets.

Figure 3: Percentage of loan repayment required for different waterfall stages

Note: Illustrative based Macfarlanes modelling of a direct lending fund. Modelling assumptions: £800m fund, 2% default rates, 600bps spread on base rates, four years investment period and three years holding period, 5% preferred return, 10% carried interest and 100% catchup.

Solving maturity mismatches

GPs can use secondaries to solve a maturity mismatch between the fund life and the underlying loans i.e. the loan is expected to run on past the fund life. This can happen for a variety of reasons:

- Reinvestment.

- Loan extensions.

- Repayment and refinancing slowdown.

- Non-performing loans.

Reinvestment

A key feature of direct lending funds is their ability to recycle proceeds during the investment period. With a four-year investment period, a fund may receive material prepayments towards the end of the investment period which it may redeploy in loans with terms extending beyond the life of the fund (with the expectation those will be prepaid early). This can result in a more ramped portfolio towards the end of the life of the fund than might ordinarily be expected.

Loan extensions

This could be due to the manager providing an extension directly to the underlying company or by being subject to a contractual obligation to extend the loan following an extension provided by a more senior lender.8

Over the past 2–3 years, corporate lenders have seen a sharp rise in loan maturity extensions, "amend-and-extend" deals, and Payment-in-Kind (PIK) interest features. In turn this has led to a considerable increase in the number of fund extensions.

Figure 4: Amend-and-extend transactions in leveraged loans9

Source: Pitchbook.

Repayment and refinancing slowdown

Private credit investments are self-exiting in nature through the contractual repayment of interest and principal. However, they are still impacted by M&A activity as managers often count on M&A events for loans to be refinanced. While most private loans have a maturity of five or seven years, their expected average maturity tends to be closer to three years. Unfavourable conditions for private equity sponsors can considerably prolong the expected life of loans which cannot be controlled by private credit managers due to lack of ownership.

Typical lifecycle of a direct lending fund

Given the typical lifecycle of a private credit fund, if a five or seven-year loan is issued at the end of the investment period, in the absence of a refinancing event, the loan could surpass the fund life or at least require LP-approved extensions. As noted above, because private credit funds tend to allow reinvestment there can potentially be a high volume of deals being made close to the end of the investment period increasing the chances of at least some of them being extended or not being refinanced as expected, leading to a maturity mismatch.

Non-performing loans

While the two scenarios above are related to performing loans, non-performing loans are often the cause of maturity mismatches which can lead to either the manager looking to sell the loan or to continue it under a new fund. A manager less equipped to deal with stressed or distressed assets may look to sell, while one that does have those skills may opt for a continuation vehicle which may be attractive to new investors focused on the potential upside.

Figure 5: Summary of private credit secondary transaction types and their key drivers

Key takeaways

- The private credit secondaries market is expected to experience substantial growth. If it follows the same likely path as private equity, deal volume could triple in the next five years.

- Private credit secondaries represent a more diverse set of transaction than private equity. In particular, we consider that GP-led transactions extend beyond just continuation vehicles and that other approaches - such as structured finance solutions - should also be recognized as part of the secondaries landscape.

- The key drivers of private credit secondaries include providing liquidity to LPs and diversifying and expanding the LP base. Other additional benefits include ramping up new products, realigning manager incentives, and resolving maturity mismatches caused by loan extensions, refinancing slowdowns, or non-performing loans.

Footnotes

1. According to Jefferies - Jefferies Global Secondary Market Review – January 2025.

2. Particularly considering the further extensions available at the discretion of the GP and then by LP approval.

3. According to Bloomberg - BlackRock Readies $1.3bn Private Credit Continuation Fund - Bloomberg.

4. According to Wall Street Journal. Exclusive - Vista Closes $460 Million Deal to Cash Out Credit Investors - WSJ

5. According to Alternative Credit Investor - SMBC launches €450m European middle market credit fund - Alternative Credit Investor.

6. According to LSTA - CLO Issuance Sets Annual Record, Poised for Busy 2025 - LSTA.

7. According to Bloomberg - Neuberger Pools Fund Stakes in $1.2bn Financing - Bloomberg.

8. Companies typically have staggered debt maturities. In some cases, subordinated lenders can be contractually obligated to extend to maintain the staggered profile.

9. Amend and extend transactions in leveraged loans are shown as a proxy for similar activity in private credit.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.