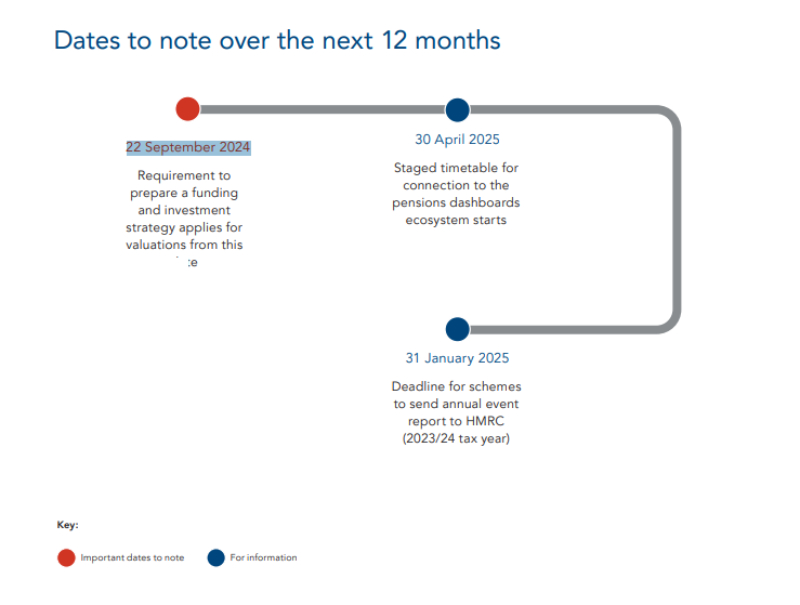

Dates to note over the next 12 months

Issues affecting all schemes

General Election – impact on pensions

The General Election resulted in a landslide victory for the Labour Party. While no pensions-related announcements have been made since the election by the new government, its election manifesto included the following pensions-related pledges:

- Adoption of reforms to ensure that workplace pension schemes take advantage of consolidation and scale to deliver better returns for UK savers and greater productive investment in the UK economy.

- A review of the pensions landscape to consider what further steps are needed to improve pension outcomes and increase investment in UK markets.

- A requirement for UK-regulated financial institutions, including pension funds, and FTSE 100 companies to develop and implement credible transition plans that align with the 1.5°C goal of the Paris Agreement.

- A review of the surplus arrangements in the Mineworkers' Pension Scheme and transfer of the Scheme's Investment Reserve Fund back to the members.

The manifesto made no mention of Labour's previously-announced plans to reinstate the lifetime allowance and, according to press reports, these plans have been dropped.

Action

Trustees and employers should monitor the new government's implementation of its manifesto pledges.

Pensions dashboards – data accuracy

The Pensions Administration Standards Association has published guidance for trustees on the importance of data accuracy for pensions dashboards. The guidance covers:

- What accurate data is.

- What trustees should do to improve their data accuracy.

- Suggested steps that trustees should take to ensure data accuracy is maintained. In addition, the Pensions Dashboards Programme (PDP) has published FAQs on "IT Health Checks". The PDP's standards require participants connecting to the pensions dashboards ecosystem to complete an IT Health Check by an independent provider with the relevant accreditation. The FAQs cover:

- What an IT Health Check is and who is required to conduct one.

- Choosing a test partner.

- When an IT Health Check must be completed by and what the implications are of not completing one.

- Which PDP standards contain information on the IT Health Check.

In addition, the Pensions Dashboards Programme (PDP) has published FAQs on "IT Health Checks". The PDP's standards require participants connecting to the pensions dashboards ecosystem to complete an IT Health Check by an independent provider with the relevant accreditation. The FAQs cover:

- What an IT Health Check is and who is required to conduct one.

- Choosing a test partner.

- When an IT Health Check must be completed by and what the implications are of not completing one.

- Which PDP standards contain information on the IT Health Check.

Action

No action required by trustees of schemes whose administrators are handling dashboards connection. Trustees of other schemes and administrators may find the guidance and FAQs helpful in their dashboards preparations.

Pensions Ombudsman – complaints and signposting

The Pensions Ombudsman (TPO) has published a blog post on its recent operating model review which confirms that going forwards, individuals will not be able to use TPO's Early Resolution Service until they have exhausted their scheme's internal dispute resolution procedure (IDRP).

TPO has also updated its factsheet on member signposting. The factsheet sets out suggested wording that schemes can use to signpost members to TPO including:

- Referral wording for inclusion in a final response, written acceptance or summary resolution communication under an IDRP or any other stakeholder resolution process.

- Short and long-form website wording.

Action

No action required, but trustees and administrators may wish to review the updated factsheet and consider whether their member communications need updating.

SG – engaging with asset managers

The Society of Pension Professionals has published a practical guide for trustees on engaging with asset managers on ESG matters. The guide covers: An outline of the various regulatory ESG disclosure requirements.

- ESG obligations for asset managers.

- A summary of the information that trustees need from their asset managers.

- A breakdown of the role of the investment consultant in ESG matters.

Action

No action required, but trustees may find the guide helpful when considering ESG matters.

To read the full article click here

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2024. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.