- within Environment topic(s)

Since our last briefing, there have been a number of important tax developments which affect the real estate sector.

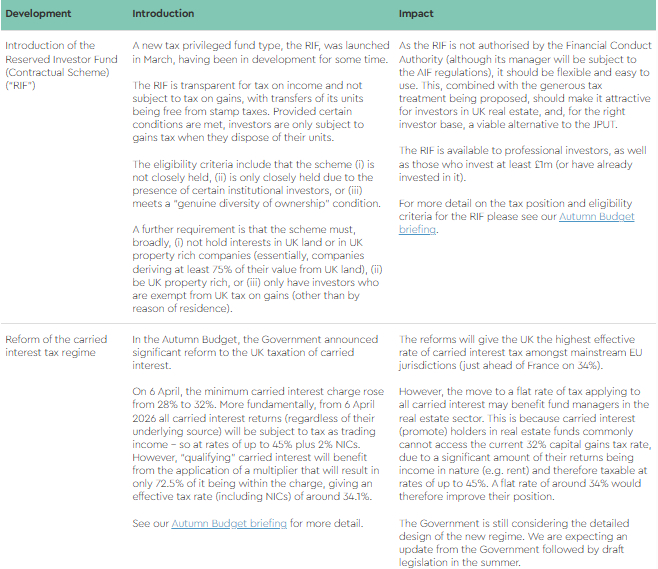

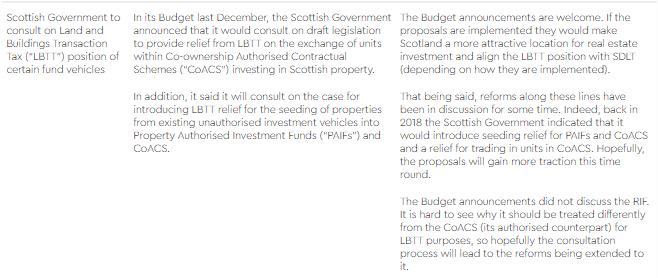

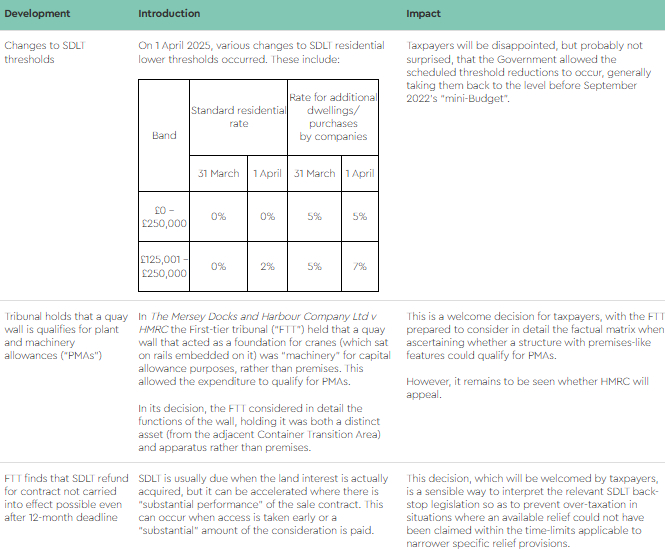

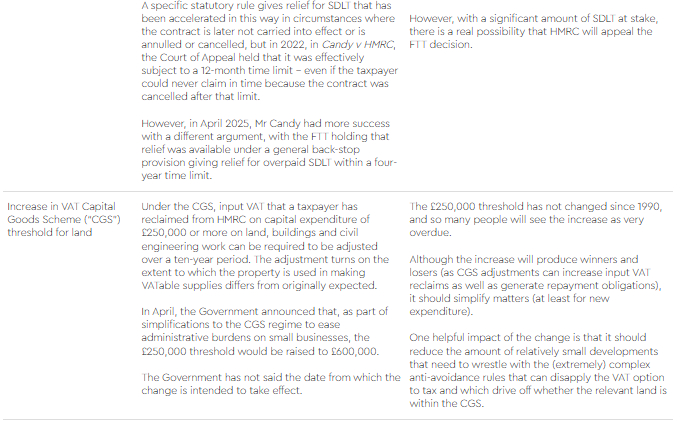

The standout item is the recent introduction of the Reserved Investor Fund, a new type of investment fund expected to be of particular interest to commercial real estate strategies. Continuing the funds theme, we are still waiting for more detail as the Government considers the design of its fundamental reforms to the UK taxation of carried interest scheduled for April 2026 (which may actually improve the position of managers who currently cannot access capital treatment on carried interest returns). From a "bricks and mortar" perspective, we have seen the announcement of an increase in the VAT capital goods scheme threshold for property expenditure and two recent victories for the taxpayer against HMRC in the Tax Tribunal. All these issues and more are discussed in this briefing, which provides a checklist of the key tax developments that those in the real estate sector should be aware of.

1. Real estate vehicle tax

2. Bricks and mortar tax

Read the PDF of this publication below. Alternatively you can download to print, to save for later or for a different experience.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.