During 2021, the European Commission's Joint Research Centre (JRC) and the European Union Agency for Railways (ERA) published a report entitled "Insight into railway innovation through patenting trends" in which patenting trends in the railway sector within the European Union, as well as globally, were reviewed and analysed.

In this article I provide my own brief summary of the findings in some areas of particular interest.

EU patenting trends by subsystem

In the report, the authors use the Cooperative Patent Classification (CPC) system to identify patent applications relevant to railway technologies, and to split 'general' railway technology into four principal subsystems:

- Control, command and signalling (CCS) - including both trackside and onboard equipment;

- Energy (ENE) - the energy supply system, including overhead lines;

- Infrastructure (INF) - including the subcategories of rail, fastenings, sleepers, ballast, switches and crossings; and

- Rolling stock (RST) - including the subcategories of traction, bodies (e.g. passenger carriages and freight wagons), suspension, couplings and brakes.

Turning first to Figure 1 below, which shows EU patenting trends across the aforementioned subsystems, the data indicates that the ENE and INF areas have remained relatively stable in terms of patent filings, but that CCS and RST have seen significant increases in patent filings since around 2010. Of note, the "High value inventions" referred to on the Y-axis of Figure 1 represents patent families "that include patent applications filed in more than one patent office".

Figure 1- EU patenting trend by

subsystem (level 1) [Source: Figure 3 of ERA-JRC report

"Insights into railway innovation through patenting trends

2021"]

Figure 1- EU patenting trend by

subsystem (level 1) [Source: Figure 3 of ERA-JRC report

"Insights into railway innovation through patenting trends

2021"]

One observation noticeably absent from the report is that, despite relative increases in filings in some areas, the actual number of filings remains comparatively low (and very low in comparison to other transport areas such as, for example, aerospace).

EU filing trends compared to rest of world

Another metric of interest, and reviewed in the report, is the relative number of patent filings by territory. Figure 2 below breaks these patent filings down into all inventions, and high value inventions. As shown below, a marked increase in filings for 'all inventions' by Chinese applicants began in around 2013 although, and as mentioned in the report, a contributing factor to this trend may well be rooted in domestic policy. When high value inventions are considered, EU applicants are filing significantly more patent applications than those in other territories, although there is a notable rise in the number of filings from Chinese applicants in this area, too.

Figure 2 - Innovations by

country/region [Source: Figure 5 of ERA-JRC report "Insights

into railway innovation through patenting trends 2021"]

Figure 2 - Innovations by

country/region [Source: Figure 5 of ERA-JRC report "Insights

into railway innovation through patenting trends 2021"]

Green inventions

Also considered in the report is the relative number of filings directed towards 'green inventions' by applicants from different territories. The report identifies green inventions as technologies which: "mitigate the emission of greenhouse gases in the framework of the Kyoto protocol and the Paris Agreement, as well as those technologies that facilitate the adaption to the adverse effects of climate change".

As shown in Figure 2 below, EU-based applicants are filing by far the highest number of high value, green inventions across the four subsystems mentioned above. The report suggests this is based on know-how derived from the last few decades, in combination with a favourable regulatory framework in Europe.

Figure 3 - Number of high value

green inventions country/region [Source: Figure 7 of ERA-JRC report

"Insights into railway innovation through patenting trends

2021"]

Figure 3 - Number of high value

green inventions country/region [Source: Figure 7 of ERA-JRC report

"Insights into railway innovation through patenting trends

2021"]

Largest patent filers by organisation

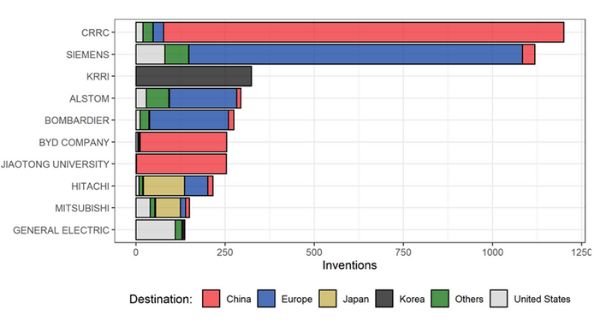

The report also considers who the most prolific filers of patent applications are, in railway technologies, around the world.

When considering the top 10 innovators for all inventions, numbers 1 and 3 on the list are CRRC and KRRI (CRRC being a Chinese state-owned, publicly traded rolling stock manufacturer, and KRRI being the Korean Railroad Institute). Also featuring in the top 5 are Siemens, Alstom and Bombardier. From the below Figure, it is observed that Siemens is by far the most prolific filer of European applications. Another interesting observation is that, unlike many other technology areas, there is far less of a US-weighting in the railway technology sphere. Put another way, it appears that Europe is a territory of greater value, for many applicants, than the US.

Figure 4 - Top 10 innovators for

all inventions, and their destinations [Source: Figure 12 of

ERA-JRC report "Insights into railway innovation through

patenting trends 2021"]

Figure 4 - Top 10 innovators for

all inventions, and their destinations [Source: Figure 12 of

ERA-JRC report "Insights into railway innovation through

patenting trends 2021"]

Turning to consider the top 10 innovators for high value inventions, Siemens now takes the top spot with a significant proportion of European-based filings. Of note, for high value inventions Siemens is significantly ahead of the competition in terms of the number of patent filings. This could, of course, be attributable to a more numbers-focussed patent filing strategy from Siemens in comparison to the other innovators included below.

Figure 5 - Top 10 innovations

for high value inventions, and their destinations [Source: Figure

13 of ERA-JRC report "Insights into railway innovation through

patenting trends 2021"]

Figure 5 - Top 10 innovations

for high value inventions, and their destinations [Source: Figure

13 of ERA-JRC report "Insights into railway innovation through

patenting trends 2021"]

As mentioned in the report, and included here for completeness, there are a number of limitations to the conclusions drawn both here and in the report. In particular, not all innovations are protected by patent applications. These statistics will therefore not take into account any non-patent innovations (e.g. trade secrets). Furthermore, patent applications are not the only type of intellectual property, and this report does not consider the filings of registered design protection, nor of trade marks.

It is clear from the report that patent filings are, for the most part, increasing in the railway technology sphere, suggesting intellectual property is playing an ever more important role in protecting railway technology innovations. Please do not hesitate to get in touch should you have any intellectual property queries falling within the railway technology sector or in any other technology area.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.