- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit and Media & Information industries

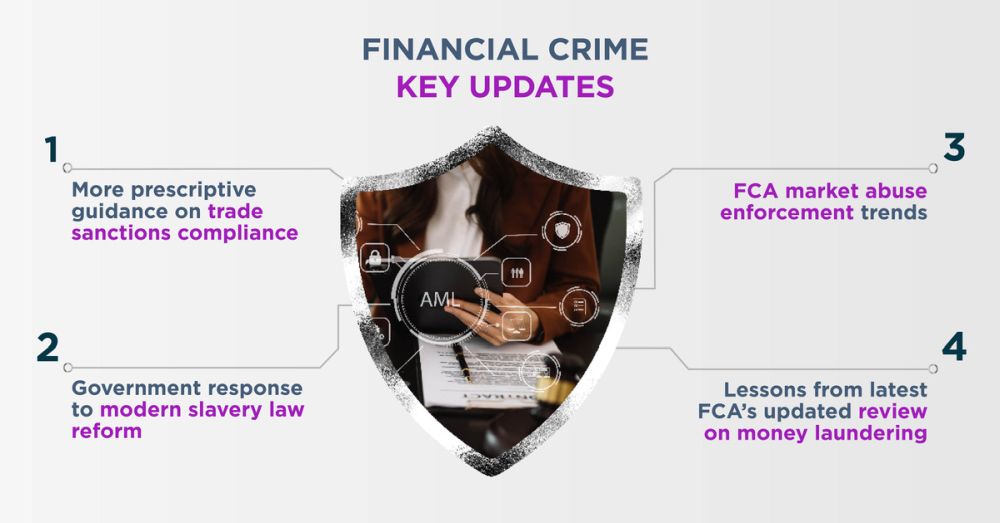

In this edition, co-edited by AG Global Investigations Partners David Pygott and Harriet Territt, we highlight four key updates in the regulation of financial crime. We start by looking at the latest developments in trade sanctions compliance, including the new OTSI guidance published on 7 January 2025, which emphasises the crucial role of non-legislative guidance in improving standards in the non-regulated sector. Next, we cover the Government response to the House of Lords Modern Slavery Act 2015 (MSA) Committee report, which highlights significant changes on the horizon, such as, standardised content requirements for modern slavery statements and strengthened penalties for non-compliance with transparency requirements. We also consider the broader impact of the Business and Trade Committee's panel inquiry 'Making Work Pay: The Employment Rights Bill' and its potential to drive further reforms in the longer term. We consider a warning from the FCA in Market Watch 80 about UK firms trading for overseas broker firms using aggregated accounts masking the ultimate client (or their ultimate beneficial owner). Finally, we provide a reminder of our latest 'AG insights' article on the FCA's updated assessment of the risks of money laundering through the markets (MLTM).

Elevating trade sanctions compliance in 2025

The rapid expansion of trade sanctions measures since 2022 has affected a wide variety of exports, particularly exports to Russia and its allies. Although UK trade sanctions are codified within legislative frameworks, they are supplemented by guidance which often sets the compliance standard for affected firms. New OTSI guidance, published on 7 January 2025, highlights the crucial role such non-legislative guidance plays in enhancing compliance standards outside of the regulated sector. In many respects, the guidance recommends that exporters who are not separately required to comply with UK anti-money laundering rules should develop systems, controls and processes akin to their regulated financial services providers. We examine the key considerations that financial institutions (FIs) should be aware of, and points they should consider addressing in light of increasing government expectations that their customers should improve their approach to trade sanctions compliance.

Click here to read more about the new UK guidance and how it differs from the G7 equivalent

Divergence from G7 guidance

Previous joint guidance by the US, EU, UK (and other G7 jurisdictions) recommended that exporters undertake necessary due diligence prior to export, with additional risk-based due diligence where red flags were identified; with the ultimate goal of ensuring that certain products did not reach Russia. Thus, due diligence standards could be tailored to each export company's specific business model. The population of financial services customers directly impacted by this was comparatively limited because the guidance was largely framed with reference to items on the Common High Priority List, which identifies items posing an increased risk of illegal diversion to Russia.

The scope of the latest UK guidance from OTSI extends beyond these items and highlights additional jurisdictions with increased risk of circumvention as well. However, perhaps the most significant point of difference is that the new guidance is much more prescriptive, presenting more detailed compliance recommendations and reducing flexibility for affected companies.

FIs should take note of the following key features of the guidance that will inevitably present challenges to customers who are UK exporters:

- a much wider list of goods and sectors now require enhanced scrutiny due to their higher risk of circumvention, in sectors which have historically been viewed as lower risk (such as automotive and heavy machinery). The implication for financial services institutions is that they will need to assess a much wider range of customers to identify whether their transactions pose specific circumvention risks;

- the new guidance prompts exporters to conduct enhanced due diligence when exporting at-risk products to a broader list of countries, including key export regions such as the UAE, China (including its Special Administrative Regions) and India. This shift will require FIs to reassess geographical risks in relation to their customers; and

- the UK guidance outlines 57 red flag indicators of sanctions evasion, categorised by 'Product', 'Customer', 'Transaction' and 'Export destination'. These due diligence indicators are codified differently to those in the G7 guidance as the UK guidance ultimately serves a different purpose, focusing specifically on the UK's regulatory environment rather than adopting a coordinated strategy to tackle Russia's circumvention tactics. Therefore, under the UK guidance, companies are required to conduct due diligence using a more detailed approach to identify specific threats. As a result, FIs must consider what their risk appetite will be, and the extent to which they will want to understand or require that their customers implement robust and effective due diligence processes to mitigate their own risk exposure.

Three key steps for financial institutions supporting export activity

- Step 1 – revisit customer due diligence/onboarding:

- FIs should consider requesting more detailed attestations or additional breakdowns from customers exporting specific items, potentially leading to increased compliance costs and administrative burdens;

- there is a need for FIs to question and engage with a wider range of customers and possibly revise their compliance frameworks to manage the increased volume of customers requiring a more in-depth review;

- FIs will need to evaluate how the updated guidance, coupled with the heightened knowledge and awareness that UK government intends for firms to have, will influence their approach to the potential sanctions risks, but also how this interacts with the UK's proceeds of crime regime;

- while the guidance documents themselves are not legally binding, failure to adhere to them increases the risk of penalties if breaches are detected by enforcement agencies. This could affect both exporters and their FIs, meaning firms will not only have increased reporting obligations but may also face enforcement risk should their customers' goods ultimately end up in Russia; and

- FIs should adjust their compliance framework and systems to ensure that such guidance, which is not legislation, is captured and reviewed as part of an ongoing process of improvement.

Step 2: assess internal compliance procedures. With customers introducing increasingly more complex compliance systems, processes, and procedures, businesses in the financial services sector also need to consider:

- how their customers' approach compliance, and how the data they are generating is developing;

- what their risk appetite is, and whether they will be satisfied providing services to customers who, as a result of this guidance being published, now may pose a greater risk; and

- if their own internal compliance framework, transaction monitoring, and due diligence efforts to deal with these changes, are fit for purpose.

Step 3: Review technology and other tools. The guidance contains a list of sanctions-oriented screening tools to support CDD checks. FIs may find it beneficial to leverage these resources in their due diligence over customers, ensuring compliance with the guidance.

Concluding comments

While these new standards remain guidance, and not a legislative requirement, it seems clear the UK government has a detailed view of what it considers to be an appropriate approach to compliance with UK trade sanctions. Companies that fail to meet this standard are therefore at greater risk of enforcement – which is a key factor FIs should be taking under consideration when dealing with their customers.

AG regularly advises a wide range of businesses on sanctions compliance. If you would like to discuss any of these matters further, please reach out to Harriet Territt or Matt Worby for more information.

Reform of modern slavery law in the short to medium term

The recent Government response to the House of Lords Modern Slavery Act 2015 (MSA) Committee report highlights the potential for significant future changes and new requirements that will impact the financial services sector, including new standardised content requirements for modern slavery statements and strengthened penalties for non-compliance with transparency requirements. Ensuring compliance and managing risks associated with modern slavery is now more critical than ever. This, combined with the ripples coming out of the Business and Trade Committee's panel inquiry 'Making Work Pay: The Employment Rights Bill', suggest significant further changes may happen longer term. However, these developments need to be weighed against the fact that similar changes have been signalled by previous governments but have not so far made it onto the UK legislative agenda.

Key messages from the MSA report

Published last October, the key message from the House of Lords MSA Committee report is that not enough is being done to effectively combat modern slavery. The criticisms highlight significant gaps in the existing legal framework, implementation, and enforcement, including:

- inconsistent and unenforced reporting requirements for companies regarding supply chain transparency. The report criticised the inconsistent quality of modern slavery statements by companies, with many failing to provide meaningful information on their efforts to tackle modern slavery. It recommended that publication of statements is widened and compliance with requirements enforced, both for companies and public bodies. It also found that there is no effective enforcement mechanism for non-compliance with reporting requirements, reducing the impact of the transparency provisions;

- insufficient support for victims due to the intersection of

immigration and modern slavery policies. The Committee found that:

- recent legislation, such as the Nationality and Borders Act 2022 and the Illegal Migration Act 2023, have conflated immigration control with victim protection; limiting the support the Act originally provided to victims and leaving victims vulnerable and facing long waiting times for decisions.

- the support provided through the National Referral Mechanism was often inadequate, with gaps in legal aid and mental health service;

- public awareness of modern slavery remains low, affecting the identification and support of victims.

It recommended the government recognises a distinction between willing migrants and trafficking victims, and develop policy accordingly;

- inadequate regulation and resourcing in the care sectors, leading to increased exploitation: The report found that exploitation was not being addressed effectively, particularly due to a lack of a single enforcement body leading to fragmented regulation and enforcement. The relaxation of visa rules without there being appropriate regulation of employers in place also exacerbated exploitation in the care sector. It called for increased resources for regulatory bodies like the Gangmasters and Labour Abuse Authority (GLAA) to tackle this;

- low prosecution rates (the proportion of prosecutions to National Referral Mechanism referrals is only 1.8%) and an underutilisation of enforcement tools. The report found that Slavery and Trafficking Prevention Orders (STPOs) and Slavery and Trafficking Risk Orders (STROs) were being underused due to lack of awareness and resources for monitoring leading to perpetrators continue to operate with impunity;

- fragmented strategic coordination and poor data sharing among agencies. There have been internal problems with a lack of prioritisation and co-ordination between the large number of agencies and departments that have responsibilities relating to modern slavery. The role of the Independent Anti-Slavery Commissioner was vacant for 18 months and the appointment process was said to have raised concerns about the independence of the role. The current incumbent, meanwhile, is facing practical difficulties due to an insufficient budget and staffing. Co-ordination across central government, local government and agencies was found to be complex and ever evolving. Poor data sharing between relevant agencies, such as the police and NHS, was found to limit the ability to identify and support victims.

The House of Lords Committee report follows the 2018 review of the Modern Slavery Act commissioned by the previous government, which made over 80 recommendations including in respect of the legal application of the Act. While the government accepted or partially accepted the majority of the recommendations in 2019, few of the proposed changes have made it onto the legislative agenda (including several outstanding items which were again raised by the House of Lords report).

Multiple elements to Government response

The Government's response outlines a multi-faceted plan to address the criticisms raised by the House of Lords Committee:

Supply chain transparency

The government said it is committed to improving the transparency of supply chains, with plans to introduce mandatory reporting requirements and a public-facing data dashboard, with standardised content requirements. It has committed to extending the statutory obligation of section 54 of the MSA to public bodies. It is also reviewing how to strengthen penalties for non-compliance with supply chain transparency requirements.

Reducing exploitation and supporting victims

The modern slavery portfolio has been moved under the Minister for Safeguarding and Violence Against Women and Girls to emphasize a victim-centred approach. The government acknowledges the need for robust data to inform policy and ensure effective interventions for victims. The budget for the Independent Anti-Slavery Commissioner has been increased, and the relationship between the Department for Business and Trade (DBT) and the Commissioner will be clarified to enhance efforts in tackling modern slavery in supply chains.

The government plans to establish the Fair Work Agency (FWA) as a single enforcement body to ensure compliance with labour rights and standards across all sectors.

There is a strong emphasis on increasing prosecutions and convictions of traffickers, with measures to improve law enforcement capabilities. The government also aims to enhance support for victims, including faster processing of cases and tailored assistance for recovery. The government will continue to review and strengthen safeguards for care workers under the Health and Care Visa scheme. The Fair Work Agency (FWA) will be established to ensure compliance with labour rights and standards across all sectors. There are also plans to increase resources for the Gangmasters and Labour Abuse Authority (GLAA) and improve collaboration with the Care Quality Commission (CQC).

Employment Rights Bill focus on modern slavery and supply chain due diligence

In December 2024, the newly re-formed Business and Trade Committee announced a call for evidence in a major new inquiry into the Government's flagship Employment Rights Bill, with a view to informing the later stages of the Bill's passage through Parliament. In other words, with a view to – as necessary – tabling additional clauses at a later stage, to address deficiencies identified through evidence received. One of the goals of the inquiry is exploring adequate protection against poor labour standards, including concerns over forced labour in international supply chains. During oral evidence sessions earlier this month, global retails leaders were questioned about this, among other things. The Committee also heard how the last quarter saw the highest number of modern slavery referrals since records began and that a fragmented labour market and under-resourced enforcement bodies have contributed to this increase as well as calls from the Independent Anti-Slavery Commissioner for mandatory human rights due diligence legislation and new legislation around transparency and supply chains.

Key takeaways

In the short to medium term, enforcement risk is increasing and the scope of those subject to mandatory reporting in the UK is likely to expand. With the passing of the Corporate Sustainability Due Diligence Act in the EU, international focus on this issue remains high from a legal, risk and reputational perspective. It is important to remain vigilant to and continually assess their exposure to modern slavery risks within your supply chains and client portfolios and to allocate resources to ensure compliance with any new regulatory requirements. The public facing modern slavery statement data dashboard will be a useful benchmarking resource. In the longer term, be prepared for new legislation aimed at enhancing supply chain transparency which could have wider implications in terms of economic crime reporting.

We can help to ensure your firm is prepared to navigate these regulatory changes. Please get in touch should you want to discuss strategies to enhance supply chain transparency and mitigate modern slavery risks.

A warning from the FCA to UK brokers that accept trades via aggregated accounts

In Market Watch 80, published by the FCA in October 2024, the FCA points out the potential for market abuse in leveraged equity products from 'aggregated' accounts administered by both FCA-regulated and overseas firms, and makes clear its expectations of FCA-regulated firms faced with this risk.

We consider the FCA's warnings to firms about manage this risk in compliance with its Handbook and MAR

Clients that had been offboarded were still able to trade

In short, the issue highlighted by the FCA arises where a client opens an account with a non-UK broker firm in a jurisdiction where the regulatory regime against market abuse may not be equivalent to that supervised by the FCA. The client trades via the non-UK broker firm which, using an 'aggregated' account, then executes with the FCA-regulated firm. The effect of the 'aggregate' account is to anonymise the trade so that the FCA-regulated firm executes it unaware of the ultimate client (or its ultimate beneficial owner), rendering that firm's usual market surveillance measures less effective.

The FCA points out that, in some such cases, working with overseas regulators, it has been able to identify the ultimate clients (or their ultimate beneficial owners), revealing in the process that some had previously held trading accounts directly with FCA-regulated firms that those firms had terminated due to suspected market abuse. FCA-regulated firms had in effect unknowingly continued to execute trades for the same ultimate clients whose accounts they had previously terminated. The FCA notes the risk of some of the ultimate clients (or their UBOs) having the characteristics of organised criminal groups.

The FCA has emphasised the need for FCA-regulated firms to take extra precautions in this area to ensure compliance with the UK regulatory framework, noting that while clients circumventing UK measures to detect and prevent suspicious activity threaten the integrity of UK markets, the FCA's own ability to intervene is limited when the accounts are administered overseas.

Article 16 of UK MAR and SYSC 6.1.1R

In Market Watch 80, the FCA reminds firms of both:

- Article 16(2) of the UK Market Abuse Regulation (UK MAR), which requires persons professionally arranging or executing transactions to "establish and maintain effective arrangements, systems and procedures aimed at preventing and detecting insider dealing, market manipulation and attempted insider dealing and market manipulation"; and

- the financial crime compliance requirements in SYSC 6.1.1R of its Handbook, which require firms to "establish, implement and maintain adequate policies and procedures sufficient to ensure compliance of the firm including its managers, employees and appointed representatives (or where applicable, tied agents) with its obligations under the regulatory system and for countering the risk that the firm might be used to further financial crime."

The FCA's reminder is accompanied by a comment that it will 'not hesitate to intervene' in circumstances where it identifies poor compliance with its Handbook provisions.

Mitigation: the FCA's expectations

A firm that has gone as far as terminating a client's account due to suspected market abuse, and faces real difficulty in identifying the relevant ultimate clients (or their ultimate UBOs), might reasonably ask what more can be expected of them in this situation.

In Market Watch 80, the FCA sets out its expectations of the additional measures FCA-regulated firms should take. These include:

- informing non-UK firms which operate such aggregated accounts that the FCA-regulated firm operates a zero-tolerance approach to market abuse, will be submitting reports of suspicious trading to regulators and maintaining dialogue with them;

- requiring non-UK firms which operate such aggregated accounts to provide detailed information about their systems and controls to prevent market abuse, including information about market surveillance techniques and information about their clients;

- asking the operators of 'aggregated' accounts to provide identifier codes for sub-accounts, in effect enabling the FCA-regulated firm to carry out more detailed surveillance than would otherwise be possible; and

- terminating relationships (including commercial ones) where trading falls outside risk tolerance.

Firms affected by this issue would be well advised to look closely at the FCA's expectations. The FCA has taken enforcement action against multiple firms for weak trading controls over the last few years. It is likely that it would use the guidance provided in Market Watch 80 in future such enforcement action, to support arguments over the application of FCA Principle 3, SYSC 6.1.1R and Article 16 of UK MAR.

We can help you stay updated with the evolving regulatory landscape and navigate the challenges posed by these accounts. Please get in touch with the authors if you would like more information.

The FCA's updated assessment of money laundering through the markets

In our latest 'AG Insights' article, we consider the FCA's recently published revised assessment of the risks of money laundering through the markets (MLTM). Given the inherent difficulties firms operating in the capital markets face identifying money laundering activity through complex transaction chains, we encourage firms to review, in particular, the case studies that the FCA has set out in its updated paper. We also encourage wholesale broker firms to review the areas where the FCA considers they may still have AML control weaknesses, summarised in our article, particularly in light of the FCA's 'Dear CEO' letter to such firms. The FCA has made it clear that broker conduct, business oversight and culture will remain priorities in its supervision work over the next two years.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.