- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

To say ESG - Environmental, Social, Governance - is a fast-evolving field is an understatement. It's a landscape presenting a whole new context for operations in all sectors - which takes different forms in different regions.

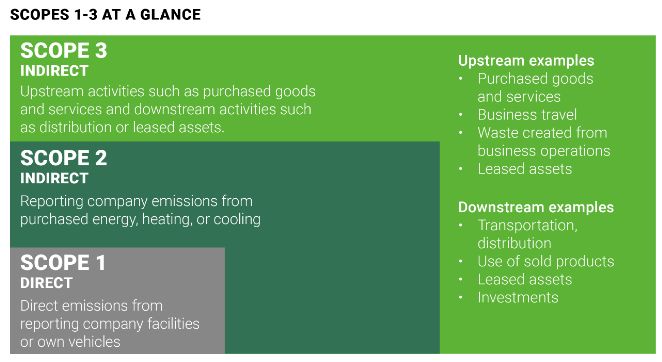

For many companies, recent sustainability action has focused on environmental impact, specifically decarbonisation and emissions reduction in the most controllable areas: Scope 1 (e.g., direct emissions from company facilities or own vehicles) and Scope 2 (e.g., emissions from purchased energy, heating, or cooling).

Especially given the accelerating regulatory change, the corporate sustainability challenge has broadened beyond simply the emissions within the four walls of a company and its own operations: now companies are being held accountable for Scope 3 emissions (e.g., downstream activities such as distribution or leased assets and upstream activities such as purchased goods and services) as well as areas of biodiversity, water efficiency, and waste.

Furthermore, social (such as human rights violations and worker safety) and governance (e.g., accountability and anti-competitiveness practices) considerations are commanding greater attention, bringing them more on par with environmental considerations.

Take the European Corporate Sustainability Reporting Directive (CSRD) framework, for example, which places greater emphasis on transparency and comparability of Environmental, Social and Governance reporting. For the first time it is "putting sustainability reporting on an equal footing with financial reporting", as Commissioner Mairead McGuinness remarked during a European Parliament debate in November 2022.

Tomorrow today

When it comes to operational strategy, it may sound cliché, but the "tomorrow today" adage has never been truer. Regulations banning sales of new internal combustion engine cars from 2035 (or even 2025 in Norway) cannot wait for the operational transformations also required.

As the example indicates, perhaps the biggest change is the holistic, enterprise-wide transformation that this new context demands - creating a correlated sequence of organisational change across divisions and workstreams. However, there is also a huge operational opportunity: realising thefinancial value that these changes can create - or the potential risk that you can avoid.

Opportunities and Risks

In many ways, regulation is playing catch-up to the paradigm shift that has happened among consumers. There is far greater interest in the ESG credentials of a product than ever before, albeit perhaps under other names.

If your business falls behind perceptions and shopfloor buying trends that are increasingly influenced by ESG considerations, you will risk missing out on revenue opportunities. CSRD also greatly expands on these areas, placing greater emphasis on biodiversity, an increased focus on circularity, plus the key changes relating to the social aspect of company transparency across operational activity.

The directive establishes greater social reporting requirements outside an organisation's own workforce or its customers' privacy: now companies are required to report on, for example, the health and safety and freedom of expression of their value chain workers and affected communities, too. It is not the exception anymore that companies are claiming active reporting on social standards in their RFPs (requests for proposals). Many businesses are now catching up in their understanding of the financial materiality of ESG - those that don't run the risk of business losses.

Financing ESG

Part of the operational shift required involves securing board and investor backing for the financing and activities needed to implement ESG changes.

One aspect is investment for change, which needs to be seen as not just reactive but proactive pursuit of business opportunities. Goldman Sachs has made much of the idea of Green Capex as the prime driver of infrastructure investment today and tomorrow. This capital spending is described as "a powerful secular growth theme for investors as greater capital is required to meet net zero, clean water and infrastructure mandates."

Creating the case for such investments is a key operational challenge in a context where the case is now being made on profit, loss, and ESG. And these positive business cases are not the exception. Operational changes set in train by ESG levers have proven to be value creators as well: when Walmart re-sized its carboard packaging already years ago, it realised millions of dollars savings while reducing packaging waste by thousands of tons (and with that a similar amount of CO2e).

ESG and value creation can and should go hand in hand, reflected in how CDP (formerly the Carbon Disclosure Project) puts together every sustainability action with monetary savings and payback periods.

The challenge is that the whole movement is not holistic or homogenous. For example, the change in ESG regulation in Europe isn't mirrored across all regions. For global operations, the patchwork of expectations from US states to European countries creates governance challenges, as well as questions on what operational steps to take and when.

A 360-degree view

ESG cross-cutting reporting comes with whole-of-operation implications that extend throughout the supply chain: companies are now required to expand the extent of their accountability beyond their comfort zone of Scope 1 and 2 for emission reduction, as well as take care of social breaches upstream in the supply chain.

These actions, however, are operational changes with multiple knock-on effects to other workstreams and parties in the supply chain. And they have often been avoided, as elements that are easier to control and change have taken priority. To be fully in command (or at the very least have full transparency) of E, S and G conditions across a company's entire ecosystem - from raw material sourcing through to end of life - organisations need to rethink the governance pillar of ESG for systematic and effective monitoring and reporting.

The new context for operational ESG action is being drawn. And as new reporting and regulatory changes come into effect in the coming years, the need to act on some of the most complex sustainability challenges companies face will only increase, exponentially.

In this upcoming series of articles, we take a closer look at some of the key elements within the three sustainability pillars of ESG, affecting operations across multiple sectors:

- Going circular to address Scope 3 emissions

- Social solutions lie in supply chains

- Re-engineering Governance for sustainable ESG action

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.