- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

Downward economic pressure is not abating: weak demand and falling revenue is feeding into multiple sectors across the major economies.

The Bank of England's Agents' Q3 summary of business conditions found that "economic activity remained subdued, and there were growing concerns about the outlook" in both B2C and B2B sectors. At the ECB, September indicators were pointing towards stagnation into the end of 2023, while in the US, where third quarter growth remained strong, the Federal Reserve said tight financial and credit conditions were expected to weigh on economic activity in November.

In these conditions, it is tough to win new business, and companies are understandably reviewing salesforce effectiveness to generate more revenue.

Work in this area often focuses on better allocation of sales resources to target sales opportunities adequately. This involves looking at a range of well-known factors and levers such as the areas, accounts, and quotas assigned to individual salespeople, the mix of hunter and farmer roles, and incentive structures. While these are critical sales strategy actions, this approach can still miss a key aspect of sales performance that is often obscured by poor visibility: the outsized effect of discounting on salesforce behaviours.

The profit discount

Having visibility of where the money is going between gross and net revenue often reveals real opportunity areas. Gross-to-net waterfall modelling shows how the final sale price for a product translates in net revenue, after discounts are applied.

From software sales to construction material suppliers, discounting on list pricing is a fundamental part of day-to-day sales in many industries, particularly faster-moving goods and services in B2B transactions. Taking a closer look at its effect can yield profound profit impacts.

In the software industry, a combination of regular customer, promotional, and discretionary sales discounts can swallow up 20-30% of gross revenue. In the construction sector, the P&L can be hit from discounting when margins are already squeezed by cost of sold goods, labour, and asset costs. We've seen 30-40% of a full list price lost on discounts.

The profit impact of these reduction is magnified, a 5% discount from the full sales price could reduce profits by 50%, making it vital to see discounts not as a "knock-down" on the RRP but as a mark down on profit.

Too often we see that companies do not have visibility on how much they are discounting, and they cannot establish a clear line of sight between the use of discounts and the effectiveness of sales behaviours. This means they miss opportunities that lie in less typical areas.

Changing selling behaviour

Discounting is tied to selling behaviours, which is both a qualitative and quantitative data challenge. Data-driven clarity on how discounts operate can be linked to how a salesforce sells.

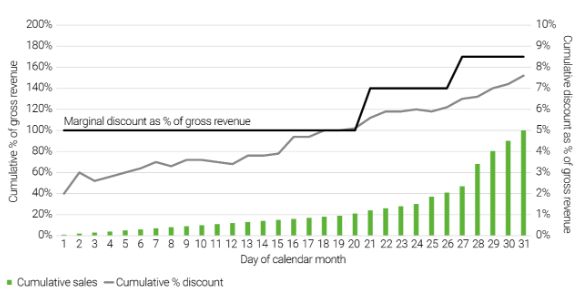

In one sales context – selling through local channels

– a monthly sales target led to a huge volume spike in the

second half of the month as the channels knew discounts would rise

by 50% or more as the product salesforce rallied to hit their

monthlytargets.

Clarity on the link between discounting and sales behaviours allowed for better targeted intervention: incentives and targets could be reset – assessing month-on-month at the 15th day or up-weighting sales in the first part of the month, for example – to remove a calendar-driven cycle of rising discounts and fallingprofits.

Simplifying the pricing model

In another situation, sales behaviours were very inconsistent, as the salesforce wrestled with a dizzying array of discounts applied to a vast product range. This resulted in significant margin leakage that policing the generic guidelines in place could not avoid. However, linking discounting and sales patterns allowed the company to adopt a simpler, more data-driven pricing strategy with fewer price points for products less exposed to competitive pressures.

The actions above create space for negotiation and selling to take place above a floor cost and can transform sales conversations so that more time can be spent discussing value-add benefits, not just price. At the same time, it helps the customer-facing salesforce sharpen their focus on discounting in certain hyper-competitive areas.

Tight, competitive sales conditions can worsen the revenue impact of sales strategies that rely on discounts to close deals. In fast-moving, people-led transactions, across different industries, discount levels and sales behaviours can exacerbate revenue pressures, eating up profit margins under the radar.

Greater visibility on where and how discounts affect sales performance and behaviours will ultimately reveal where and how change is required to achieve sustainable salesforce effectiveness.This can be typically summarised as a combination of the elements below:

- No set strategy / clarity in setting "list

prices".For example,many tech companies grow through

acquisitions, particularly in newer markets and legacy "list

prices" for those products are never rationalised after the

acquisition. The sales team therefore needs to discount at a

certain level to stay competitive in the market.

- Coaching sales reps to sell on value vs.

price. This can be a fundamental mindset and capability

shift for the salesforce. How can the salesforce engage with the

customer earlier in the sales process to fully explore needs and

qualify associated product value, minimising the importance of

price at the point of final decision making?

- Poor pricing governance.Many businesses

struggle to find the right balance between giving too much discount

authority to the salesforce (at the risk of margin leakage) vs.

giving too little pricing authority to sales (at the risk of

spending too much time in securing approval for every single deal

at the expense of selling).

- Misaligned incentive structures.Without careful consideration to tying incentives to deal margins across all levels of a sales function, it can be difficult to drive the right selling and discounting behaviours throughout the business unit.

While discounting is the symptom that needs to be fixed, a full understanding of the underlying root causes that drive this behaviour is key to improve sales performance. Ultimately, management need a clear line-of-sight to both: does your business have what it takes?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.