Global insurance law connect's latest research uncovers global pressure in D&O across the world, but sees opportunities for recovery in the coming year.

BLM's D&O team has worked with its insurance network colleagues from Global Insurance Law Connect to launch its first research report into global D&O markets. The report has had input from insurance lawyers in 20 countries around the globe, and its headlines are startling.

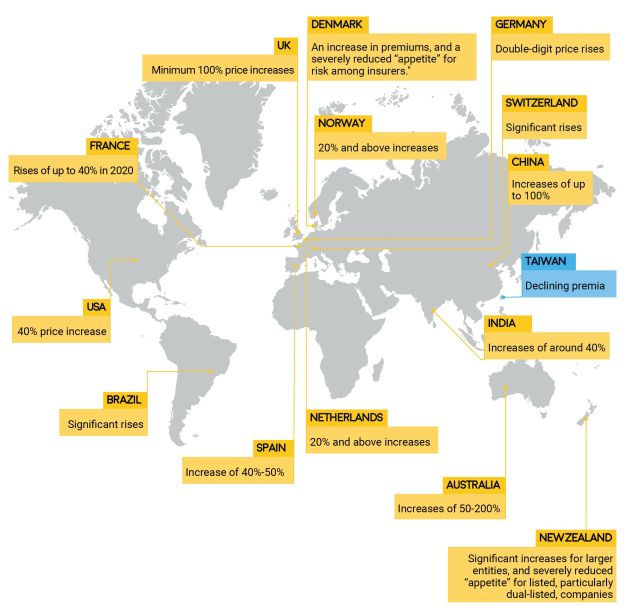

Globally, D&O pricing has risen in almost every country during 2021, with increases between 30% and 100% reported in countries worldwide. Only Taiwan, where high barriers to litigation against directors and officers make this a little-used product, has seen prices decrease.

Pricing trends

According to Professional & Financial Risks Partner Alex Traill, "COVID has been an accelerant but not the main cause for the hardening market with rising premiums in the D&O space. The real reason for rising premiums was that there was a gradual appreciation that there was a greater D&O risk in the realms of corporate mismanagement and financial misrepresentation together with a widening exposure of new risks in particular like cyber but also environmental and gender pay/employment issues."

Environmental and ESG issues

One additional problematic trend that is almost universally reported is the impact of climate change on D&O insurance. Many countries are seeing increasing attempts to hold directors and officers liable through the courts for poor environmental practices. This is also pushing D&O rates. According to Alex, "There is a trend of growth in D&O liability for environmental damage, especially given international regulations and market trends opposed to greenwash. There is a gathering momentum seen in ESG issues in the US, which is beginning to be felt in the UK." This is also true elsewhere, including Italy, where, according to Giorgio Grasso of BTG "climate change is one of the issues rising to the top of boards' risk registers; and failure to disclose climate change risks may drive litigation in the coming years."

Companies have responded with strategic shifts in insurance buying

GILC's report has uncovered some significant trends away from traditional D&O buying as a result of the global price pressure. In Denmark Jesper Ravn of Ark Law says that: "a number of publicly listed companies . have retreated from purchasing D&O insurance policies with full liability coverage. Instead, the companies self-insure D&O risks through a letter of indemnity in favour of the directors and officers."

In Switzerland, it is also reported by GBF that companies have been actively investigating the establishment of captives for their D&O risks.

Growth appetite remains

BLM believes there is still space for growth in parts of this market. Alex points out that "awareness of D&O as a product is perhaps heightened amongst publicly-listed and large privately-owned companies, as they tend to possess sophisticated in-house financial, legal and compliance functions. However, in contrast, amongst SMEs, there are still a significant minority who consider that D&O liability insurance does not apply to them at all on the basis that their board's exposure emanates from shareholders alone and is, therefore, negligible." Here is a group of companies who may now begin to see more reason to purchase D&O cover.

New entrants are also shaking up the market to the benefit of buyers. Alex reports that in the UK "there are early, tentative signs that market conditions may be beginning to soften gradually, as a number of insurers unburdened by historic claims losses have spotted an opportunity to enter the D&O marketspace, drawn to the level of premiums that they can currently command."

Conclusions

Jim Sherwood, Chairman of Global Insurance Law Connect comments on the report overall: "In many countries D&O rates are rising, and in some places those increases are extreme, but this is not the case everywhere. In a few markets the green shoots of recovery are showing, as clients reach the limits of what they are prepared to pay, and prices look set to finally stabilise."

"The changes of the past decade and recent economic shocks have led to an increased need for protection for directors and officers, in a market which lacks capacity to supply it. The impact has been a notable growth in self-insuring for this class of cover, alongside the increased use of letters of indemnity for directors and officers."

"This report again showcases the unique local market knowledge and expertise our GILC members bring to their clients across our twenty-two jurisdictions worldwide. As leading independent specialists working closely and collaborating on the major challenges facing the insurance industry, the GILC network has delivered an important update."

To download the report, click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.