Introduction

Credit risk certainly stands as a cornerstone of the banking system. Concerns that counterparties will default on their repayment obligations has become a growing concern over years. In the past, reality sometimes superseded the most pessimistic scenarios that were prevailing. Since then, lessons have been learnt: there is, today, no such thing as any form of qualitative insurance as to the creditworthiness of a private individual, an institution or even a financial system.

In this context, risk management virtues are obvious, in its capacity to restore confidence and transparency as well as to protect the banking sector. Credit institutions have subsequently been actively looking for innovative solutions in risk mitigation. In particular, credit risk can be moderated by enhancing the loan structure. Either at loan inception or throughout the credit's life, banks may require the counterparts to provide mitigants such as collateral, guarantees or pledging relationships. Simultaneously, use of credit derivatives or subscriptions to insurance contracts have constantly increased.

The Basel committee has also steadily recognised the foundations of risk mitigation techniques: collateral, on-balance sheet netting, guarantees and credit derivatives, to quote. Collateral is certainly the most common form of credit risk mitigation. It refers to the process of pledging, hypothecating or giving assets to a credit institution, by the borrower or a third party on behalf of the borrower. In technical terms, collateral gives the possibility to transform, at least partly, credit risk into other forms of risks, namely the ones proper to the collateral (e.g. market risk or liquidity risk). When enforceability of the collateral is ensured through appropriate legal documents, banks can act proactively in monitoring the creditworthiness of the portfolio by means of specific controls at collateral level.

Use of collateral also ultimately impacts the very fundamentals of banks' resiliency: reduction of capital requirement, together with the enhancement of the large exposure risk reporting.

Recognition of financial collateral: Capital requirements reductions

Capital requirements reductions

Under Basel II regulation, Pillar I, when certain conditions are fulfilled, institutions are given the possibility to mitigate their credit risk exposures. To reflect the real risks held in portfolio, collateralised credit exposures may have a risk-weighted exposure lower than the same credit exposure without credit protection, as a defined range of credit protections can be taken into account for reducing capital requirements.

According to the Capital Requirement Directive (Directive 2006/48/CE or 'CRD', amended by Directive 2009/83/EC, and transposed into Luxembourg National Law with the CSSF Circular 06/273, wich has recently been amended by CSSF Circular 10/475 to consider the modifications at European level) there are two approaches to Credit Risk Mitigation ('CRM'): a simple approach, easy to use and a Financial Collateral Comprehensive Method (FCCM).

The simple approach is a substitution method. The risk weight of the collateral is substituted for the risk weight of the counterparty. This method may only be used under the standardised approach for non-trading book credit risk.

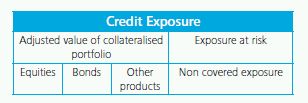

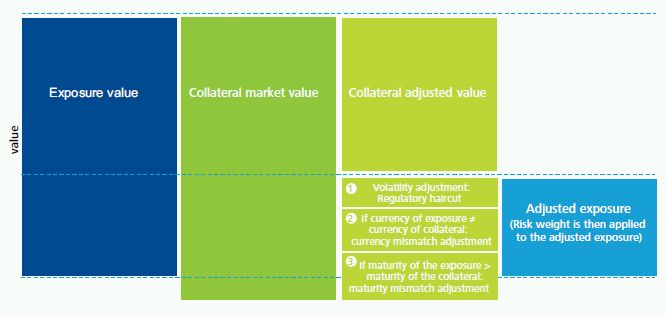

Under the comprehensive approach, the collateral adjusted value is deducted from the risk exposure (before assigning the risk weight). Collateral value adjustments ('haircuts') are applied because collaterals are submitted to risk, which could reduce the realisation value of the collateral when liquidated.

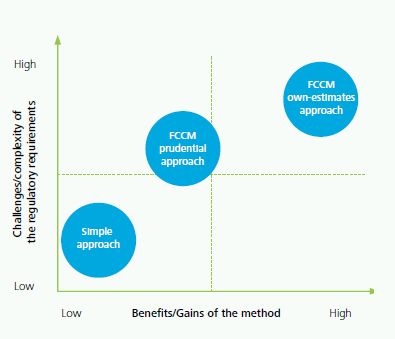

Credit institutions can use haircuts pre-defined by the regulator ('prudential' approach) or estimated by the credit institution itself (own-estimates methodology).

A new large exposure regime

New opportunities to consider financial collaterals

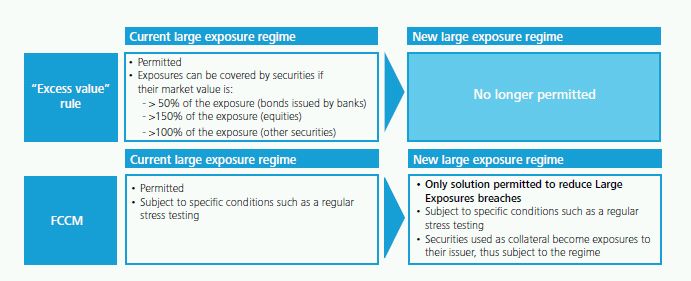

In the aftermath of the 2007-2008 market turmoil and the subsequent work by the European Commission to address shortcomings revealed by the financial crisis, the CRD, translating Basel II into European legislation, has been amended in November 2009 with regards to: banks affiliated to central institutions, certain own funds items, large exposures, supervisory arrangements, and crisis management (Directive 2009/111/EC).

The amendments contained in the new CRD are to be transposed and enforced in national law by the end of 2010 (CSSF Circular 10/450 and 10/475).

With the forthcoming new regime, the 'excess value' rule is no longer permitted:

How to treat financial collateral under FCCM?

Regulatory requirements

Under the comprehensive approach, haircuts are applied because the realisation value of the collateral may be reduced when liquidated. An accurate collateral valuation is thus important from the agreement to the end of the contract.

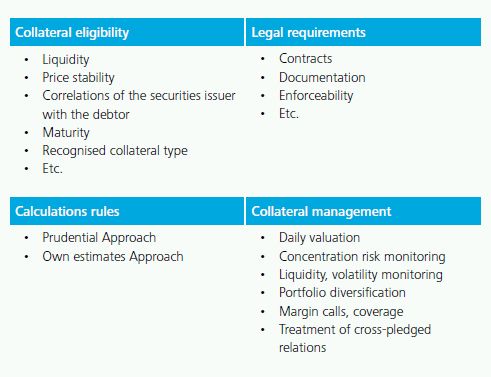

However, the level of loss protection is not only a function of the assets value and liquidity. Collaterals are submitted to a wider range of risk drivers, such as relevant risk management policy, contracts enforceability and collateral portfolio diversification. The CRD has consequently stated rules to include collateral into the capital requirements calculations for each collateral, but also at the portfolio level:

Methodology

Comprehensive prudential approach The risk weight of the exposure remains the same but the exposure is reduced by the collateral value, which has been decreased by applying 3 haircuts:

Volatility haircuts are pre-determined by the regulator depending on the collateral type, the issuer's creditworthiness, the maturity, etc.

The prudential approach could be seen as a good trade-off between the heavy requirements of the own estimates approach and the benefits in the capital requirements calculations (which are however dependent on the portfolio's composition).

Its implementation requires yet resources, adequate tools, as well as definition of policies and procedures. Its use is submitted to an agreement by the regulator.

Own estimates methodology

The effect of collateral as a risk-mitigant under the own estimates method operates through the Loss Given Default risk parameter. This means that under this method, the risk reducing effect of collateral will be reflected in the bank's own estimates of Loss Given Default, and needs to be done consistently. This approach produces more accurate results, fitting your portfolio at best but includes developing internal models, which requires resources, tools and relevant methodologies.

Our assistance

Our approach aims at accompanying you towards an effective management of credit risk, encompassing but superseding regulatory requirements. To remain pragmatic, and ensure a proportional and scalable service offer, we declined it into a spectrum of independent modules hereby listed:

Module I: knowledge transfer

Deloitte can assist you in enhancing your understanding of the regulatory requirements related to the use and implementation of FCCM methodology. The objective is to give you the opportunity to benefit from our experience to let you know each criteria on the basis which the regulator grants the agreement for financial collateral inclusion into Basel II capital charge calculations.

Moreover, we offer specific training sessions, allowing you to leverage on our privileged position towards regulatory authorities and to let you anticipate the forthcoming regulatory changes in credit risk matters. Amendments of the CSSF Circular 06/273 and new large exposures regime are typical examples of topics which might be of interest for you.

Module II: situation assessment

Deloitte can assist you in determining which method will bring the greatest advantage to your institution in making a diagnostic of your credit and collateral portfolios, of your risk management processes and tools, and thus assessing the costs/benefits of migrating towards more-advanced approaches.

Indeed, the success of the project in terms of ratio 'benefits vs costs' will depend on the choice of the appropriate method for your business, based on the analysis of the following factors:

1. Risk management: monitoring functions, client acceptance process, effective controls, etc.

2. Stability of the business_: stability of clients'risk profile, stability of collateral portfolio, dynamic controls/improvement of the processes

3. Operational infrastructure: risk governance, reliable data/IT systems, staff knowledge, etc.

4. Nature of clients: risk profile, concentration, correlations to collateral, etc.

5. Nature of collateral: portfolio composition, concentration, volatility, etc.

Module III: target setting

We can assist you in the development of an implementation planning:

1. Definition of the resources, tools, processes and methodologies to implement in order to meet regulator's requirements

2. Pragmatic diagnostic of the currently used resources, tools, processes and methodologies

3. List of actions to be carried out by theme, business and entity

4. Description, documentation, prioritisation and schedule of each action

Module IV: risk reporting-outsourcing or internally implemented solution

We can assist you in effectively implementing a collateral risk management system. An internal model approach or an outsourcing solution where we would be given the responsibility to perform the risk reporting can equally be contemplated. Irrespective of the chosen vehicle, the following features shall be found:

1. Collateral adjusted values/capital requirements calculations: development of appropriate data, systems and calculations methodology under the regulatory requirements

2. Operational collateral management: development of a solution for breaches control, automation of margin calls, monitoring of securities values, simulation of liquidation strategies of portfolios, etc.

3. Risk reporting/quantitative analyses: production of a range of risk reporting for collateral portfolio, including the dimensions of market, liquidity correlations and concentrations. Probabilities of default, credit VaR and Loss-Given-Default approaches, together with the construction of dynamic credit scores, are proposed

4. Stress test program: systematic simulations of adverse conditions, analogous to ' what-if' scenarios, can be proposed, such as a drop in the market value, a liquidity crisis, a tightening of correlations between the issuer of securities and the debtor, etc.

Module V: follow-up

We can assist you to ensure the efficiency of the CRM techniques implementation and use by performing testing of the models and calculations, gap analysis of systems, data,tools and methodologies with regulatory requirements, etc.

Conclusion

In a constant effort, the European Commission has been steadily promoting an alignment of regulatory requirements more closely with real exposures to underlying risks. This has been achieved by means of increasing the risk sensitivity and adapting the regulatory capital calculations to evolving market practices and products, hence reducing the gap between regulatory capital and economic capital.

The role played by risk mitigation techniques in this endeavour turns out to be fundamental; in particular, this holds true in the context of regulatory capital calculations and new large exposures regime, promoting the comprehensive method.

While the foundations of this method are clear, its implementaiton is, in general, not. Resources, tools, methodologies and processes are needed along the way. A broad variety of benefits nonetheless makes the way worth being taken:

- Implementation of a stronger risk management

- Reduction of the number of large exposure breaches, especially in the context of a tighter regulatory framework

- Capturing real risks

- Reduction of the regulatory capital requirements related to credit risk (Pillar I)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.