- within Corporate/Commercial Law topic(s)

- in United States

- within Transport, Environment and Antitrust/Competition Law topic(s)

In November 2025, there were three Rule 2.7 announcements made across the UK public M&A market and eight further possible offers announced.

Firm Offers announced this month:

- Recommended cash offer by Permira Advisers LLP for JTC plc – £2.3 billion – public to private

- Recommended cash offer by Phillip Brokerage Pte Ltd for Walker Crips Group plc – £5.96 million

- Recommended share offer by Team plc for WH Ireland Group plc – £12.7 million

Possible Offers announced this month:

- Formal sale process announced by Kore Potash Plc

- Strategic review including a formal sale process announced by Bluefield Solar Income Fund Limited

- Possible offer by Team plc for WH Ireland Group plc – share consideration (firm offer subsequently announced)

- Strategic review including formal sale process announced by PPHE Hotel Group Limited

- Formal sale process announced by Management Consulting Group PLC

- Possible offer by ACG Metals Limited for Anglo Asian Mining plc

- Possible offer by Mark Furness for essensys plc – £12.95 million – cash consideration

- Possible offer bya Jiangxi Copper Company Limited for SolGold plc – £780.7 million – cash consideration

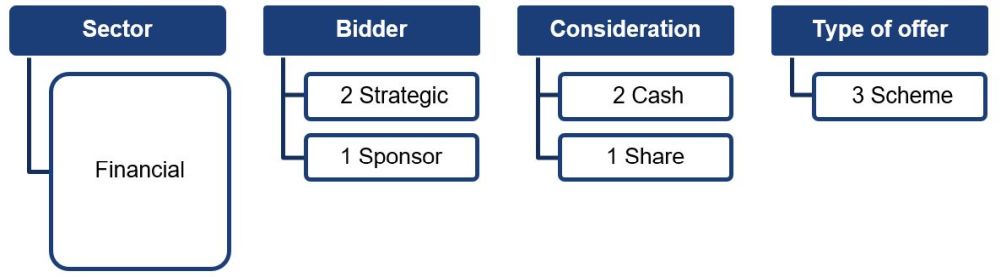

Firm Offers breakdown this month:

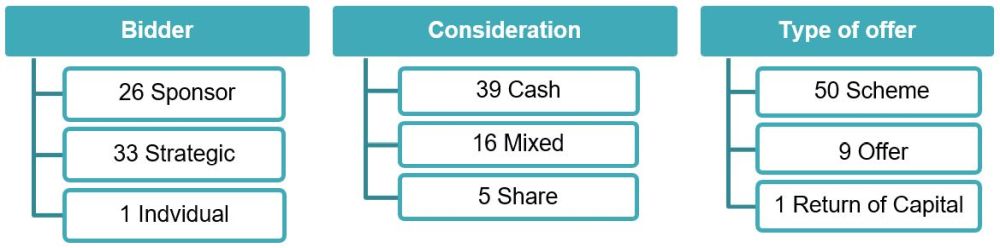

Year to date breakdown:

November 2025 Updates:

CMA finalises changes to its merger control guidance on

jurisdiction and procedure

The Competition and Markets Authority (CMA) has published its

updated guidance on jurisdiction and procedure (CMA2)

and updated Merger Notice template.

In June 2025 the CMA launched a consultation on a number of

proposed changes to its merger control guidance in order to reflect

the 4P's framework – pace, predictability, process and

proportionality – embedded in the CMA's new Mergers

Charter. The changes have been made in response to the

Government's Strategic Steer, which called for the CMA to

contribute to its overriding national priority of economic growth,

prioritise pro-growth/pro-investment interventions and minimise

uncertainty.

The updated guidance:

- clarifies the CMA's approach to the 'material influence' and 'share of supply' tests;

- includes more detail on when the CMA will exercise its discretion to take into account merger control proceedings in other jurisdictions (when deciding whether to call in a transaction for investigation on its own initiative); and

- contains changes to the pre-notification and phase 1 merger process, and to the Merger Notice template.

You can read more about the changes to CMA2 in our competition notes blog here.

The CMA is also currently consulting on its guidance to merger remedies (see our blog here for further details). The consultation is open until 13 November 2025, and the final remedies guidance is expected to be published by the end of the year.

November 2025 Insights:

November has seen activity that is fairly consistent with the same period across the previous five years. There has been a slight increase in the number of possible offers, up from six to eight, making 2025 the year with the highest number of possible offers in the last five years. The number of firm offers in November 2025 matched those announced during the same period in 2024. By sector, finance was particularly active, accounting for three firm offers and one possible offer.

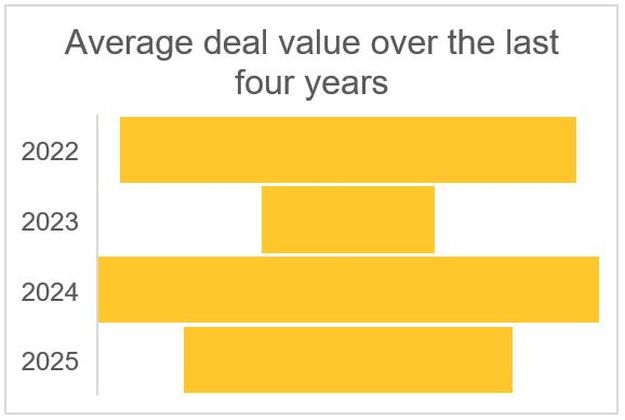

2025 has been an active year for UK public M&A, but it has not quite matched the highs of 2024 in terms of value. While deal volumes remain similar, the average deal value so far in 2025 is lagging behind last year's impressive figures. So far, 2025 has recorded eleven transactions valued at over £1 billion, whereas 2024 saw seventeen deals surpass that milestone. It will be interesting to see whether December activity closes the gap and how the year ultimately wraps up.

Useful links

- Herbert Smith Freehills Takeovers Portal.

- Herbert Smith Freehills Public M&A Podcast Series.

- The Takeover Code.

- The Takeover Panel's Disclosure Table (detailing offeree companies and offerors currently in an offer period).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.