- within Corporate/Commercial Law topic(s)

- within Antitrust/Competition Law, Intellectual Property and Real Estate and Construction topic(s)

- with readers working within the Retail & Leisure industries

This article was originally published in the 2026 IPEM Allocation and Fundraising Trend Report. Find out more about our knowledge partnership with IPEM.

The last time we met to take stock of the private market investor landscape, the view appeared much as it does today: exits are still difficult, tough competition for funding, and liquidity solutions continuing to evolve. In this context, the focus on value creation has further sharpened, with growing scrutiny on how GPs address and execute expected value creation.

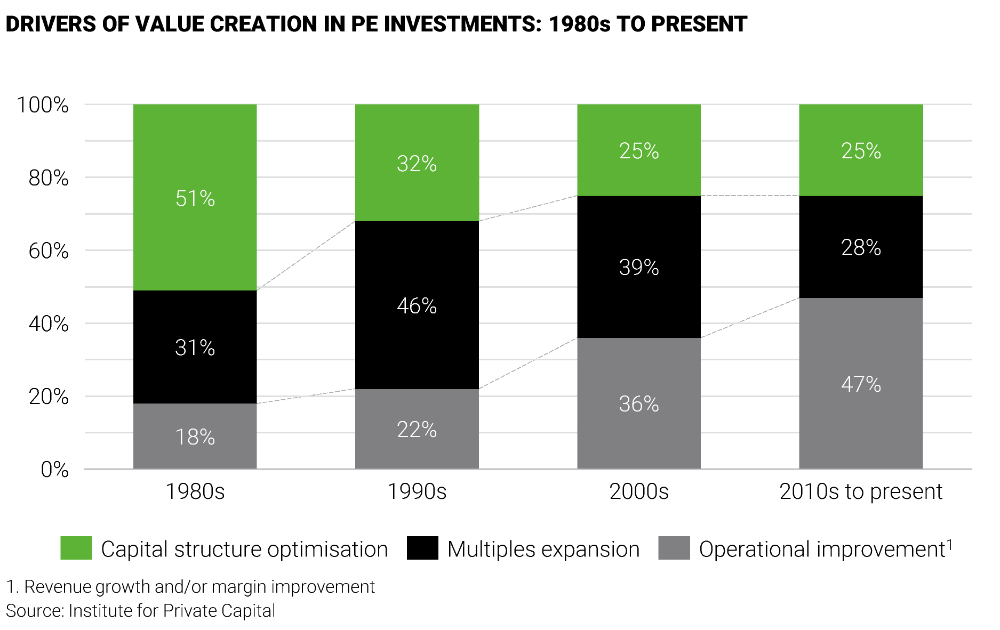

Across all private equity strategies, LPs show a clear preference for making new funding commitments over reinvesting in existing holdings. Their search for investment opportunities is driven by consistent returns and absolute performance. Since 2023, the importance of a fund's value creation approach has grown year-on-year. As LPs prioritize this, value creation has become a key source of fund performance, while leverage has diminished as a performance lever.

Growth and margin improvement through operational improvement now represent nearly half of all PE value creation, a 2.5-fold increase over the last three decades. Consequently, value creation levers are instrumental at every stage of the investment cycle. For that, GPs need a robust equity story backed by a clear value creation thesis, which increasingly comprises a sizeable operational dimension. The ability to execute these complex, operationally focused plans has now become pivotal.

Buy-side scrutiny

A sizeable mismatch persists in the private capital market between seller valuation expectations and the price buyers are willing to pay. This gap intensifies the challenge of demonstrating where value creation is coming from, especially as market disruption strongly increases uncertainty within business plans. To meet these valuation challenges, a robust operational value creation plan is critical to help the business face today's level of uncertainty and increase resilience. AI tools are increasingly used in the diligence phase to accelerate and deepen scrutiny, while focusing on the analysis of potential value creation levers.

Portfolio performance

When a PE firm delays a planned exit by a year or more, the focus shifts to which value creation levers remain available. Everything is back on the table, from maximizing digital strategy to improving sales operations. In this environment, firms may have overlooked real opportunities to drive value. Take value chain optimization: by proactively making it more flexible and resilient, firms can better withstand disruptions and uncover new growth avenues.

This intense focus on value creation is also critical in the secondaries market, which continues to grow across PE, VC, and Private Debt due to demand for liquidity solutions and limited exit opportunities. For both LP-led and GP-led secondaries, a clear, convincing value creation plan is essential. In GP-led deals, the value creation story must be reset with a clear path forward.

Getting closer to a portco's actual operations during the holding period can mitigate issues or prevent misguided strategies. A singular focus on EBITDA, for example, can distract from improving a business's true health in other areas, such as free cash flow.

AI offers a significant opportunity to accelerate this value creation. It now tops the list of technology interests for LPs and has become a key skill for GPs. By harnessing AI, firms can unlock new services, introduce innovative product features, enhance performance, optimize processes, and reduce decision times. This enables business agility and faster transformation, strengthening both the value creation thesis and the equity story.

AI can also help PE firms monitor portco performance more closely and identify where value can be generated. However, effective AI deployment requires a cohesive strategy across portfolio companies; its implementation often lacks direction. This allows smaller, nimbler companies to make better use of the proliferation of AI tools.

Selling into headwinds

With valuations under pressure and limited M&A activity, PE firms must clearly demonstrate how a portco's valuation thesis has played out, with a robust rationale ready for market interrogation. The nature of dealmaking has also changed, often involving complex capital structures with more risk-averse investors, which catalyzes intense due diligence.

Persistent bid-ask spreads are putting pressure on portco projections. The story about future company performance needs to show what is possible and how, not simply tell the market what to expect.

As LPs scrutinize PE firm value creation more closely than ever, GPs have an opportunity to devise new value creation plans. They can show the market not only how value is being generated throughout the investment lifecycle, but also how they are mastering its execution.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.