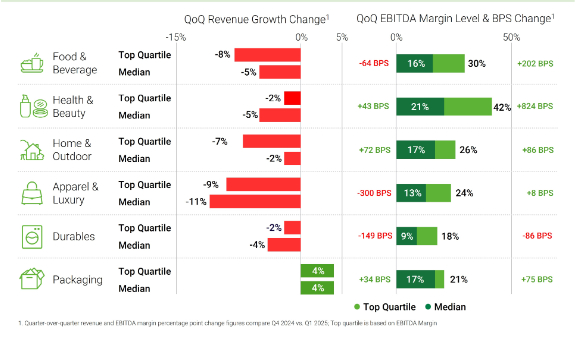

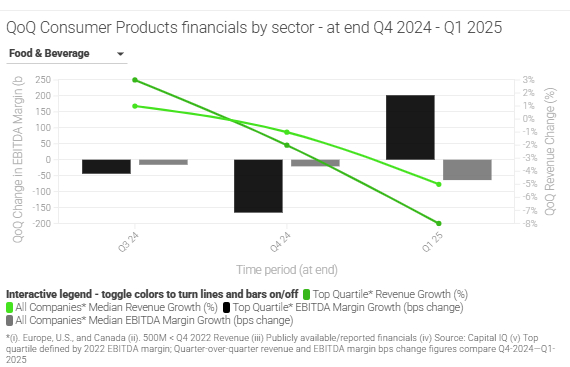

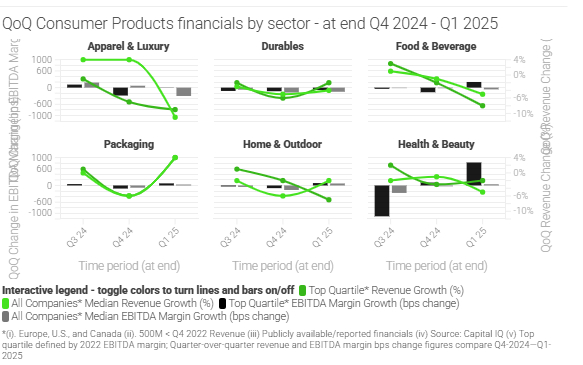

In the first quarter of 2025, revenue for consumer goods companies declined across all sectors except packaging, following the end of the holiday season. The most significant drop was seen in the Apparel and Luxury category, as consumers held back on spending during uncertain times. EBITDA margins also decreased due to rising input costs and an inflationary environment driven by tariff uncertainties. With signs of improvement on the tariff landscape and new trade deals on the horizon, will this help consumer goods companies rebalance costs and gain greater stability?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.