- within Antitrust/Competition Law topic(s)

- in United States

- with readers working within the Retail & Leisure industries

- with readers working within the Retail & Leisure industries

- within Environment, Wealth Management and Real Estate and Construction topic(s)

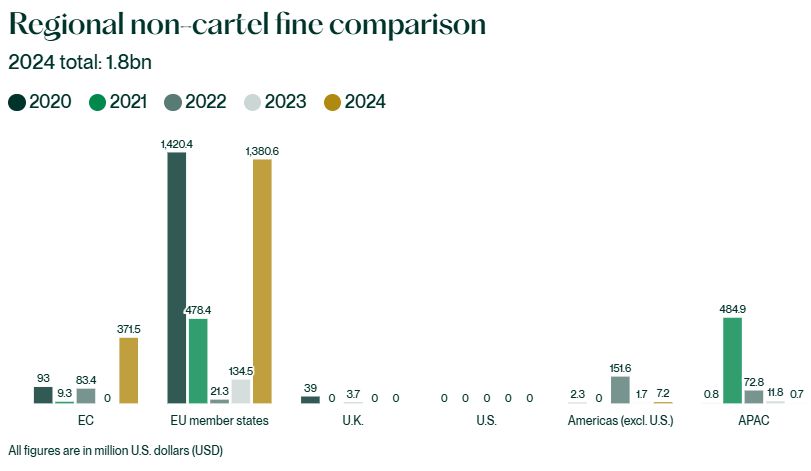

The level of fines imposed for infringements relating to vertical and other non-cartel conduct increased ten-fold in 2024, reversing a trend of decline in recent years. This rise can be attributed in part to the overall number of decisions recorded in our dataset (101) being the highest in recent years.

The uptick in fines has coincided with authorities taking a less conciliatory approach when penalizing infringements—just 38% of decisions in 2024 involved settlement or other forms of cooperation, down from 61% in 2023 and 42% in 2022.

Key statistics

The European Commission (EC) recorded its highest level of fines against vertical and other non-cartel conduct in 2024 for over four years, in stark contrast to 2023 where the EC did not record any decisions.The most significant fine, of over EUR330 million, was imposed on Mondelēz International(the producer of Oreo cookies, Cadbury's Dairy Milk, and Toblerone) for hindering the cross-border trade of chocolate, biscuits, and coffee products between EU member states. The EC found that Mondelēz limited the territories or customers to which wholesalers could resell products and prevented distributors from replying to sale requests from customers located outside their exclusive territory.

National authorities in EU member states continued to be the most active enforcers, accounting for over 78% of overall fines. The French antitrust authority was responsible for the two largest fines in any jurisdiction—a EUR611 m fine on ten manufacturers and two distributors of household appliancesand a EUR470m fine on two leading low-voltage electrical equipment manufacturers and two major distributors, both for resale price maintenance (RPM). The Polish antitrust authority was also active in 2024, with two fines of greater than EUR50m each.

Brazil's antitrust authority (CADE) issued the highest fine in the Americas—a USD6.9m fine for entities, including an industry association, after finding that they had coordinated on medical fees. This decision was initiated by a complaint to CADE, and the entities fined have announced their intention to appeal.

In contrast to other regions, APAC saw a significant decrease in the number and level of fines in 2024 compared to recent years. The Japan Fair Trade Commission (JFTC) recorded 14 decisions, but these were resolved with the imposition of remedies or the agreement of commitments rather than fines. The Korea Fair Trade Commission (KFTC) imposed three fines, all of which were under USD1m.

Non-cartel decisions by sector

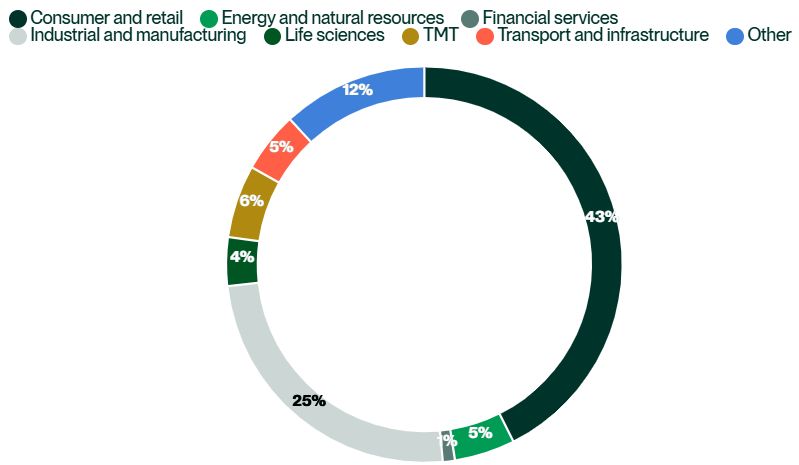

Authorities home in on the consumer and retail sector

The consumer and retail sector was the target of both the highest number of decisions (43) and the largest volume of fines (over USD1 billion) relating to vertical and other non-cartel conduct. There were three decisions which saw authorities impose fines of more than USD100m each. The investigations that led to these three decisions lasted between two and nine years—significantly longer than the median duration of investigations (one year and seven months) that concluded in 2024—indicating that authorities may take a prolonged period to build evidence in cases that incur high fines.

Authorities wield the axe on infringements in the industrial & manufacturing sector

Authorities recorded 25 decisions in the industrial and manufacturing sector, with a total fine volume of over EUR500m. RPM was responsible for over 75% of these decisions, while 28% of the decisions resulted in parties agreeing commitments with authorities. Notably, the Turkish antitrust authority recorded 17 decisions, the most significant of which was a USD10.5m fine on Nestlé's Turkey arm. Following a complaint, the Turkish antitrust authority found Nestlé liable for RPM and the imposition of regional and customer restrictions on distributors.

Forms of non-cartel conduct

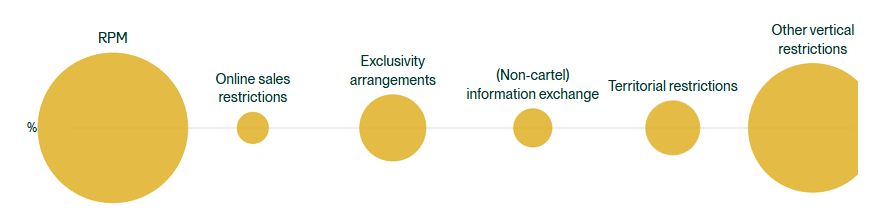

RPM maintains its predominance within forms of vertical conduct infringement

RPM accounted for 46% of vertical and other non-cartel conduct infringements. Compared to 2023, there were fewer RPM decisions, but the total fine volume increased over ten-fold. This was primarily due to two RPM fines imposed by the French antitrust authority that totaled over EUR1bn. The means by which proceedings were initiated for RPM decisions were evenly split between authorities launching investigations on their own initiative and in response to complaints.

The potential value of complaints to enforcers was demonstrated in a German case: an anonymous tip-off via the whistleblowing hotline of the German Federal Cartel Office (FCO) and further tip-offs from the marketled to an investigation and a EUR16m fine for a leading telecommunications manufacturer that had allegedly engaged in RPM.

Multiple decisions find infringements against more than one form of vertical conduct

There were seven decisions in which entities were found liable for engaging in more than one type of vertical conduct. This is a reminder of the potentially wide and evolving scope of investigations. All seven decisions involved RPM, together with simultaneous restrictions on either territories or customers. A notable example is the Turkish antitrust authority's probe of a leading battery manufacturer. In opting to settle the RPM allegations, the manufacturer's EUR230,000 administrative fine was reduced by 25%. The manufacturer also proposed commitments which successfully addressed the authority's concerns over limitations of online sales as well as territorial and customer restrictions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.