- within Energy and Natural Resources topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Aerospace & Defence, Banking & Credit and Media & Information industries

- within Energy and Natural Resources, Tax and International Law topic(s)

Introduction: A New Paradigm in the Evolution of the Electricity Market

The Turkish electricity market1 has in recent years been reshaped not only from the perspectives of supply security and investment but also through market depth, demand-side participation, and distributed generation integration. In particular, the rapid increase in renewable energy sources (ie. RES, PV), coupled with the declining costs of battery storage technologies, necessitates a structural transformation of the market.

In this context, aggregation activity has emerged as a strategic mechanism that enables the participation of licensed and unlicensed producers, as well as flexible consumers, in the market under a single portfolio. This structure is of critical importance for increasing liquidity in the market, enabling effective participation in the balancing and ancillary services markets, and minimizing supply-demand imbalances.

Furthermore, Turkey's integration targets with the EU Clean Energy Package and the "aggregator" model render aggregation activities not only a legal requirement but also a strategic opportunity. Pursuant to the relevant regulations, aggregation activity can be carried out either by those who obtain an aggregator license or by supply license holders, provided that it is incorporated into their license from the Energy Market Regulatory Authority "(EMRA"). This article will address the technical operation, legal framework, and market impacts of aggregator license activities.

Legal Framework and Licensing Obligation

Although the general framework of aggregation activity is regulated under the Electricity Market Act2, the primary regulation on the subject is the Regulation on Aggregation Activity in the Electricity Market ("Aggregation Regulation"). In addition, the Electricity Market Licensing Regulation, the Electricity Market Balancing and Settlement Regulation, and the Electricity Market Ancillary Services Regulation also contain provisions related to aggregation activities.

Technical Operation of Aggregation

An aggregator may include generation, storage, and consumption facilities in its portfolio either separately or jointly and manage them as a single participant before the Energy Markets Operation Company ("EPİAŞ") and the system operator Turkish Electricity Transmission Corporation (TEİAŞ).

Portfolio Participants:

Portfolio Participants are limited with the following ones:

- Generators

- Consumers

- Storage facilities

However, the legislation imposes certain limitations regarding the aggregator's portfolio. Accordingly, the total capacity of licensed and unlicensed generation facilities in the portfolio must be 2,000 MW or below. Likewise, the total generation of unlicensed generation facilities within the portfolio must be 500 MW or below. Importantly, generation facilities with an installed capacity above 100 MW cannot be included in an aggregator's portfolio.

Although this restriction is criticized by market participants, it is understandable considering that the primary objective of the aggregator license is to enable more effective market participation for distributed energy sources and optimize demand-side participation.

Strategic Importance

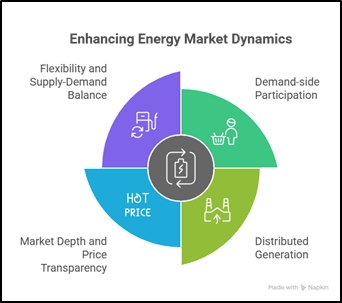

The aggregator license is a critical component of Turkey's compliance process with the EU Clean Energy Package. The strategic benefits of aggregation activity for the electricity market can be summarized as follows:

- Demand-side participation: Provides direct contributions to system reliability.

- Facilitation of distributed generation: Encourages investment in small-scale generation.

- Market depth and price transparency: Enhances flexibility in the energy market and improves price formation.

- Contributions to flexibility and supply-demand balance: Supports real-time balancing, enabling more cost-effective responses to sudden changes in demand or generation.

Demand-Side Participation

Through aggregation activity, consumption facilities approved by TEİAŞ may be included in the portfolio of aggregator license holders under demand-side participation. In this way, the participation of consumption facilities in the ancillary services and balancing power markets can be managed by aggregator license holders, who are professionals in the electricity market. However, consumption facilities participating in the balancing power market must procure their electricity supply from the aggregator license holder.

As emphasized above, demand-side participation has increasingly become a key element in the transformation of the market structure under electricity market regulations. The rapid increase in renewable energy capacity leads to unpredictability and fluctuations on the generation side, which necessitates new balancing tools for supply security and grid stability. Demand-side participation allows especially eligible consumers and aggregator license holders to respond to market signals, thereby optimizing supply-demand balance. This not only reduces TEİAŞ's balancing costs but also diversifies the revenues of market participants, moving closer to energy efficiency goals.

Critical Issues in Practice - Contract Design

With the regulation of aggregation activity as a new field in the electricity market, binding, transparent, auditable contracts that fairly regulate the rights and obligations of the aggregator and portfolio participants (grid users) must be established. These contracts will need to address capacity allocation, data sharing, payment mechanisms, and dispute resolution procedures.

Given that such contracts represent a new area of application in Turkish law, legal disputes are inevitable. Therefore, contracts must be drafted with deep expertise in the electricity market, ideally with input from technical teams. Additionally, aggregator license holders will need to sign market participation agreements with the market operator and ancillary service agreements3 with the system operator.

Since aggregation is a new activity, market participants are observed to be approaching it cautiously. As of the preparation of this article, a review of EMRA's website shows that there are currently only 23 companies holding aggregator licenses.4 Nevertheless, we believe investor interest in aggregation activities that contain significant opportunities will continue to increase in the upcoming period. Aggregator companies are also expected to provide their clients with the following services:

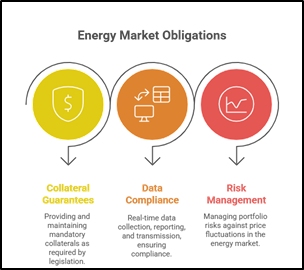

- Collateral and Financial Guarantees: Providing and maintaining mandatory collateral as required by legislation.

- Data Management and Compliance: Real-time data collection, reporting, and transmission to EPİAŞ/TEİAŞ, ensuring compliance with legal obligations.

- Portfolio Optimization and Risk Management: Managing portfolio risks against price fluctuations in the energy market.

It should be noted that, in relation to generation facilities included in the aggregator's portfolio, all market processes will treat the aggregator license holder as though it were the facility's generation license holder. In other words, all debts and receivables arising from the generation and consumption of the facility, as well as collateral, will be attributed to the aggregator license holder. Likewise, if the generation facility is within the scope of the Renewable Energy Support Mechanism ("YEKDEM"), YEKDEM payments will also be made to the aggregator.

Finally, aggregator license holders may include in their portfolios unlicensed generation facilities whose 10-year purchase guarantee period has expired, to manage their surplus electricity generation.

Conclusion: The Future of Market Participation and Strategic Recommendations

Aggregation activity can be considered as the rise of portfolio management in the Turkish electricity market. In particular, the effective integration of small-scale generation facilities and the demand side—similar to unlicensed generation—into market mechanisms not only creates commercial opportunities but also directly contributes to energy transition and sustainability objectives. In this context, certain strategic elements stand out for aggregator license holders to maximize their competitive advantage in the market:

In conclusion, aggregation activities in the Turkish electricity market emerge as a critical component enhancing both market depth and system reliability. For players seeking to obtain a license, approaching legal, technical, and financial planning holistically will be decisive for the sustainability of their activities and their market success. With our highly experienced and specialized team, we will continue to closely monitor developments5 to provide all kinds of legal services you may require on this matter.

Footnotes

1. İlker Fatih KIL: Unlocking Turkey's Energy Future: Exploring The Synergy Between Energy Storage, Electricity Generation, And Evolving Regulations - Oil, Gas & Electricity - Turkey, Mondaq Article.

2. İlker Fatih KIL, LL.M, Melih Üyer: Türkiye'de Elektriğin Depolaması ve Üretimi: Mevzuat, Uygulamalar ve Güncel Gelişmeler - Rekabet ve Regülasyon

3. For detailed information on ancillary service agreements, see: İlker Fatih Kıl, "Ancillary Services in the Electricity Market and the Legal Nature of Ancillary Service Agreements" Peer-Reviewed Article, Energy Law Journal, 2014/3, p. 111 et seq., Ankara, 2014.

4. EPDK | Enerji Piyasası Düzenleme Kurumu Access Date : 02.09.2025

5. İlker Fatih KIL, Gökçe Bilgin: Değişmeyen Tek Şey Değişim: Türkiye'nin Enerji Kanunlarında Değişiklik Yapan Kanun Yürürlükte! - Rekabet ve Regülasyon

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.