Introduction

Mergers and acquisitions, which play a critical role in the development of the economy and global trade, constitute an important agenda of competition authorities. Within the scope of the merger control regimes, the relevant transaction is brought before the competition authority before it is closed and subjected to competitive assessment over its possible effects. Considering that only in 2021 approx. 55,000 transaction with the aggregate value of 4.5 trillion USD has been closed1, the competition authorities have implemented certain criteria in order to ensure the effective functioning of the merger control regime.

Within this framework, the Article 7 of the Law No. 4054 on the Protection of Competition ("Law No. 4054") authorizes the Turkish Competition Board (the "Board") to declare the types of mergers and acquisitions which have to be notified to the Board and for which permission has to be obtained, in order for them to become legally valid. Accordingly, the Board has implemented the Communiqué No. 2010/4 Communiqué Concerning the Mergers and Acquisitions Calling for The Authorization of The Competition Board ("Communiqué No. 2010/4"), which sets the turnover thresholds determining the notification requirement of transactions.

Recently, the Turkish Competition Authority ("TCA") has published the Communiqué No. 2022/2 Amending the Communiqué No. 2010/4 ("Communiqué No. 2022/2") in the Official Gazette2, and its provisions will come into force in two months following its publication (i.e. May 4, 2022). While Communiqué No. 2022/2 increases the jurisdictional turnover thresholds, it also adopts special conditions for technology undertakings aiming to eliminate the risks arising from acquiring newly established and developing undertakings (i.e. killer acquisitions). In addition, the Communiqué No. 2022/2 brings significant changes to the notification form, which is submitted to the TCA within the scope of the merger control filings.

Accordingly, this article aims to illustrate the main changes introduced by the Communiqué No. 2022/2, in particular which relate to the amendments on (i) the definition of "technology undertakings", (ii) jurisdictional turnover thresholds, (iii) the notification form and (iv) the submission method of the notification form. We will also elaborate the economic rationale and efficiency gains in increasing the turnover thresholds.

The Definition of Technology Undertakings

Whereas the definitions that apply for the Communiqué No. 2010/4 are set forth within Article 4 of the Communiqué, the Communiqué No. 2022/2 has added a sub-paragraph defining the technology undertakings as:

"Undertakings operating in the fields of digital platforms, software and game software, financial technologies, biotechnology, pharmacology, agrochemicals and health technologies or their related assets"

Increased Turnover Thresholds

Under the Communiqué No. 2010/4, a transaction must have been notified to the Authority if one of the turnover thresholds below is triggered:

- the aggregate Turkish turnover of the transaction parties exceeds TRY 100 million (approx. USD 11.2 million/ EUR 9.6 million)3 and the Turkish turnover of at least two of the parties individually exceeds TRY 30 million (approx. USD 3.4 million/ EUR 2.9 million), OR

- in acquisitions, the Turkish turnover of the transferred assets or businesses exceeds TRY 30 million and the worldwide turnover of at least one of the other parties to the transaction exceeds TRY 500 million (approx. USD 56.2 million/ EUR 47.8 million), or (ii) in mergers, the Turkish turnover of any party exceeds TRY 30 million and the worldwide turnover of at least one of the other parties exceeds TRY 500 million.

Upon entry into force of the Communiqué No. 2022/2 the transactions must be notified to the TCA if:

- the aggregate Turkish turnover of transaction parties exceed TRY 750 million (approx. USD 84.4 million/ EUR 71.6 million) and the Turkish turnovers of at least two of transaction parties each exceed TRY 250 million (approx. USD 28.1 million/ EUR 23.9 million), OR

- in acquisitions, Turkish turnover of transferred assets or businesses exceed TRY 250 million and the global turnover of at least one of the other parties to the transaction exceed TRY 3 billion (approx. USD 337.5 million/ EUR 286.4 million); or (ii) in mergers, the Turkish turnover of any party exceeds TRY 250 million and the worldwide turnover of at least one of the other parties exceeds TRY 3 billion.

However, the TRY 250 million threshold will not be applicable to transactions concerning the acquisition of technology undertakings which (i) operate in the geographical market "Turkey" or (ii) have R&D operations or (iii) provide services to users in Turkey.

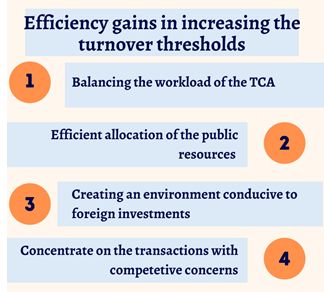

As mentioned earlier, the main purpose adopted with the turnover thresholds is to identify the transactions, which requires the approval of the TCA. The efficiency of the merger control regime depends heavily on the accuracy of the turnover thresholds. If the turnover thresholds are set lower than they should be, many transactions that do not result in a lessening of effective competition become subject to the review of the TCA, which increase the workload of the authority and extend the closing time of the transaction4. Considering factors such as developments in the economy, fluctuations in exchange rates, inflation and the decrease in purchasing power, we assess that the increase in the turnover thresholds will have a positive impact on the effective allocation of the public resources and enhancement of the merger control regime.

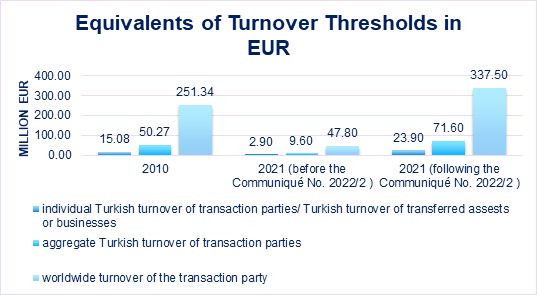

As a matter of fact, it is observed that the foreign exchange equivalent of the Turkish lira has decreased steadily since 2010, which led to a decrease in the foreign currency equivalents of the TRY 30 million, TRY 100 million and TRY 500 million turnover thresholds set out in the Communiqué No. 2010/4 as well. Whereas the average buying rate of Central Bank of the Republic of Turkey for 2011 financial year were USD 1 = TL 1.50 and EUR 1= 1.99 TL, these rates are calculated as USD 1 = TL 8.89 and EUR 1= 10.47 for the financial year of 2021. Hence, before the amendments brought by the Communiqué No. 2022/2, it may easily be assumed that the Turkish turnover of an undertaking with income in foreign currency can exceed USD 3.4 million or EUR 2.88 million, and its worldwide turnover can exceed USD 56.61 million or EUR 48 million.

On a separate note, although the turnover thresholds seem to have been raised, they have actually been equalized to their foreign currency equivalents for the year of 2010. The turnover thresholds in USD and EUR currencies for the years 2010 and 2021 (before and after the entry into force of Communiqué No. 2022/2) calculated according to the average buying rate of the Central Bank of the Republic of Turkey are presented in tables below.

Before TCA's implementations, European countries had been discussing to increase the relevant turnover thresholds in order to reduce their workload and allocate more resources to consequential transactions5. For instance, with recent amendments on the German Competition Act, the local turnover thresholds within the German merger control regime had been raised6. Furthermore, Austrian Federal Competition Authority (Bundeswettbewerbsbehörde) had introduced an additional threshold for the notifiability of the transactions, which has come into force as of January 1, 20227. Lastly, United Kingdom's Competition and Markets Authority, had opened its proposal to raise the thresholds for public opinion8.

For the last point, the Communiqué No. 2022/2 contains amendments to the turnover calculation of financial institutions (e.g. banks, leasing and factoring companies, portfolio management companies, insurance companies etc) in light of the current revisions in the relevant legislations.

Renewed Notification Form

Another most significant change introduced by the Communiqué No. 2022/2 is the amendments made in the notification form. It is seen that TCA revised the structure of the merger filing form to speed up the filing by requesting the information in the form of tables. Whereas the revised notification form restricts the definition of "affected market" with the horizontal and vertical overlaps of activities in Turkey only, it also contains sections in which the parties must provide information on affected markets in a global sense. The material changes included in the revised notification form is explained in detail below.

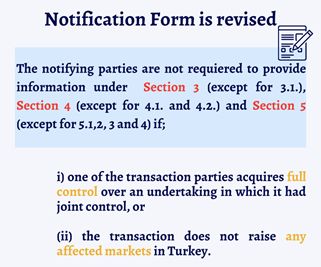

First of all, the notification form becomes relatively shorter if (i) one of the transaction parties acquires full control over an undertaking in which it had joint control, or (ii) the transaction does not raise any affected markets in Turkey. On the other hand, if one of the above-mentioned conditions are not provided, the transaction parties are required to provide the following information regardless of their market share:

- Information on sales value and sales amount data, together with the market shares, of the transaction parties for each affected market in a global scale pertaining to the past three years (Notification Form, Q. 3.5.);

- Information on the trade names and market shares of those competitors that have more than five percent market share for each affected market in a global scale pertaining to the past three years (Notification Form, Q. 3.7.);

- Information on the (estimated) total production and capacity in Turkey in the past three years in relation to the supply structure in the affected markets (Notification Form, Q. 3.9.);

- Information on the production amount and capacity, capacity utilization rates and location of the production facilities for each of the transaction parties in the past three years in relation to the supply structure in the affected markets (Notification Form, Q. 3.10.);

- (If known) Information on whether any one of the undertakings concerned or any one of their competitors have plans to expand or reduce their production or sales capacity in the near future in relation to the supply structure in the affected markets (Notification Form, Q. 3.11.);

- Information on whether the transaction parties and competitors have products that are likely to be offered to the market (i.e. which are in development) in the short or medium term (Notification Form, Q. 3.12.);

- Information on the sales and distribution channels in relation to the supply structure in the affected markets (Notification Form, Q. 3.13.);

- Information on the import conditions (if applicable, quota or tariff information or other restrictions) and whether there are import bans in relation to the affected markets (Notification Form, Q. 3.14.);

- Information on the import amounts of the undertakings concerned as well as the total import amount pertaining to the past three years in relation to the affected markets (Notification Form, Q. 3.15.);

- Information on the market entry conditions and potential competition in the affected markets (legal barriers to entry, economies of scale, network effects, restrictions arising from intellectual property rights, access to raw materials and sources of supply, production, establishment of distribution systems, etc.) (Notification Form, Q. 3.16.);

- Information on the efficiencies that are expected to arise as a result of the transaction (Notification Form, Q. 3.18.);

- Information on the consumption amounts in Turkey pertaining to the past three years to the demand structure in the affected markets (Notification Form, Q. 3.19.);

- Information on the demand structure in the affected markets (stages of the market [such as growth, maturity and decline], the estimated growth rate of demand, factors affecting the customer preferences, brand loyalty, distribution of sales between traditional channels and e-marketplaces, impact of pre and after sales services on the demand, customer groups, regional distribution of customers, exclusive distribution agreements and importance of long-term agreements (Notification Form, Q. 3.20.).

Therefore, while the renewed form currently requires the information, which had been contained under the Sections 6,7 and 8 of the notification form, it also includes some original questions (e.g. information on sales on e-marketplaces, competitors' currently developed products etc.). Lastly, notifying parties/ their representatives are expected to submit their assessment on the confidentiality by marking the relevant information in red.

E-Submission of the Notification Form

Although this method has been frequently used especially during the COVID-19 pandemic, TCA clarified that merger filings can also be submitted electronically via the e-Government (e-Devlet) portal and set the legal basis of this practice. TCA also announced that it will be possible to complete and submit the form completely electronically in the near future9.

Conclusion

Further to these amendments, TCA's announcement dated March 3, 2022 indicate that the Communiqué No. 2010/4 and the relevant secondary legislations have been updated in line with the significant impediment of effective competition test within the scope of Article 7 of the Law No. 4054. Guidelines now include the concepts of potential competition, closeness of competition analysis, and theories of harm concerning the digital and innovation-based markets.

While the changes in turnover thresholds may have a positive impact on foreign investments in Turkey and reduce the review time of notifications, the renewed notification form may, on the contrary, complicate the merger filing process and require the transaction parties to provide more detailed information on their activities, market share, distribution channels, market conditions etc. Thus, in the long view, we will be observing whether the merger control filing processes will be slowed down by creating a significant workload on notifying parties or accelerate in line with TCA's purposes.

Footnotes

1. Deloitte, Annual Turkish M&A Review 2021, January 2022 (https://www2.deloitte.com/content/dam/Deloitte/tr/Documents/mergers-acqisitions/Annual-Turkish-MA-Review-2021.pdf (last accessed on March 6, 2022)

2. Communiqué No. 2022/2 can be accessed at the following link: https://www.resmigazete.gov.tr/eskiler/2022/03/20220304-4.html (last accessed on March 6, 2022)

3. The amounts in USD and EUR 2021 financial year (i.e. 01.01.2021 - 31.12.2021) are converted using the exchange rate USD 1 = TL 8.89 and EUR 1= 10.47 TL in accordance with the applicable Central Bank of the Republic of Turkey average buying rate for 2021 financial year (i.e. 01.01.2021 - 31.12.2021).

4. For more detailed analysis on the impacts of increase in the turnover thresholds and its economic rationale, see. S. Ardiyok, A. Canbeyli, A. Tanoglu, Güncelleme Uyarisi: Birlesme ve Devralma Islemlerinde Geçerli Ciro Esiklerinin Degisen Ekonomik Kosullara Göre Yükseltilmesi, BASEAK Rekabet ve Regülasyon, January 7, 2022, https://www.rekabetregulasyon.com/guncelleme-uyarisi-birlesme-ve-devralma-islemlerinde-gecerli-ciro-esiklerinin-degisen-ekonomik-kosullara-gore-yukseltilmesi/ (last accessed on March 6, 2022)

5. See. S. Ardiyok, A. Canbeyli, A. Tanoglu, Güncelleme Uyarisi: Birlesme ve Devralma Islemlerinde Geçerli Ciro Esiklerinin Degisen Ekonomik Kosullara Göre Yükseltilmesi, Rekabet ve Regülasyon, January 7, 2022, https://www.rekabetregulasyon.com/guncelleme-uyarisi-birlesme-ve-devralma-islemlerinde-gecerli-ciro-esiklerinin-degisen-ekonomik-kosullara-gore-yukseltilmesi/ (last accessed on March 6, 2022)

6. Michael Mayr (Michael Mayr EU and Austrian Competition Law), "Austria Introduces Significant Changes to its Competition Law", Wolters Kluwer, September 20, 2021.

7. https://www.bundeskartellamt.de/EN/Mergercontrol/mergercontrol_node.html;jsessionid=2762EE6A108090EA404548868B51E638.2_cid378#doc3600240bodyText2 (last accessed on March 6, 2022)

8. https://www.traverssmith.com/knowledge/knowledge-container/uk-merger-control-and-markets-reform-where-next/ (last accessed on March 6, 2022)

9. TCA's announcement dated March 3, 2022 can be accessed at the following link: https://www.rekabet.gov.tr/tr/Guncel/rekabet-kurulundan-izin-alinmasi-gereken-82269c8a8f9bec11a21c00505685ee05 (last accessed on March 6, 2022)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.