On 7 November 2022, the French and Luxembourg governments signed an amendment to paragraph 3 of the protocol to the existing treaty between the two countries for the avoidance of double taxation and for the prevention of income and wealth tax avoidance and evasion (the "Double Tax Treaty"). Ratification procedures must now be completed in each country in order for this measure to enter into force. The teleworking limit was increased from 29 to 34 days for the purposes of Article 14 of the Double Tax Treaty, which pertains to employment income and how it is taxed.

The new limit will apply to French cross-border workers from 1 January 2023 (provided that the ratification procedures are finalised).

As a reminder, French residents who exceed the limit may incur risks, including tax risks, for their Luxembourg employers; for example, the risk of creating a permanent establishment in the teleworker's country of residence. Above all, they may trigger a number of administrative obligations for the employer with the French tax authorities, although these should theoretically be reduced from January 2023. A newsflash on the newly relaxed rules will be released once the measure is enacted.

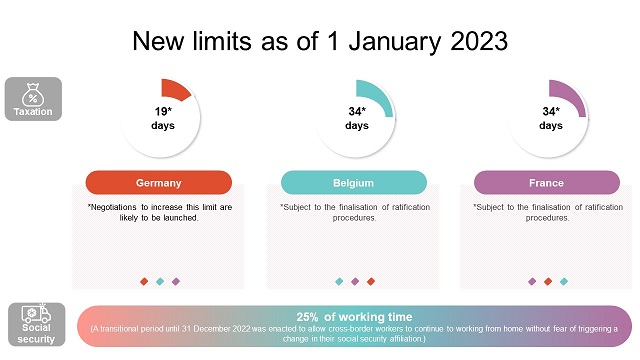

Below you will find a chart showing the applicable limit for each country for tax and social security purposes.

For more information, you can also visit our dedicated page Towards a new model, which is updated regularly.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.